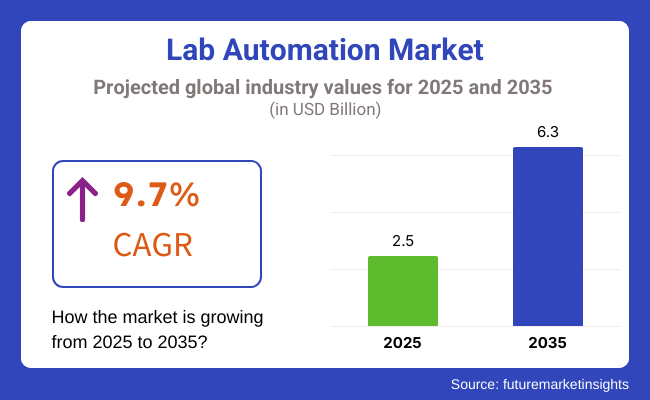

The market for laboratory automation is expected to grow significantly from 2025 to 2035, as it will be worth about USD 2.5 billion in 2025, increase to over USD 6.3 billion at a 9.7% annual growth rate by 2035. High-throughput screening, microplate readers, and liquid-handling robots are all being favoured in the marketplace with the drive toward automated, miniaturized labs.

The rise in high-throughput screening along with other laboratory devices offers a great opportunity for companies who specialize in stage-specific continuous operation management solutions to grow their business. Help is also coming from laboratory information management systems and laboratory execution systems that greatly increase work efficiency and meet quality requirements.

The second important driving force comes from the increased requirement for personalized medicine and the growing prevalence of chronic diseases. Lab automation platforms make it possible to identify biomarkers more quickly, reduce the time it takes to get drugs onto the market, and move the entire process closer to patient outcomes. Besides, plans to reconstruct research labs and elevate lab achievements are providing new opportunities for lab automation providers.

Explore FMI!

Book a free demo

North America stands at the forefront of laboratory automation due to robust infrastructure in pharmaceutical manufacturing, clinical diagnostics, and biomedical research. The United States and Canada are at the forefront of adopting workflow automation solutions, robot systems that are integrated, as well as AI-driven analyzers to cope with rising levels of samples and prevent human errors.

Government funding of biomedical research and interdisciplinary collaboration between the academia, research institutes, and industry leaders are propelling the installation of highly advanced laboratory automation systems. Robotic platforms are being used to automate drug discovery in prominent USA research institutions for efficiency and standard output.

Furthermore, North America's strict regulatory landscape-focusing on data integrity, patient protection, and laboratory efficiency-favours investment in automation as well. Modules of audit trails for traceability and compliance and automatic data monitoring are being added by laboratories.

Europe is a robust laboratory automation market since it boasts highly developed pharmaceutical and biotechnology sectors, especially in the UK, Germany, and Switzerland. The region's keen emphasis on precision medicine and next-generation molecular diagnostics, as well as the need for high-throughput diagnostic devices, is making laboratories in Europe implement automation.

European Medicines Agency (EMA) and similar authorities are urging tighter controls over the precision of data, traceability, and best practices within laboratory environments

Laboratories are being spurred on to include automated sample preparation systems, robotic arms for repeated tasks, and computerized lab management systems through these regulations.

Europe's emphasis on sustainability has promoted the development of energy-saving lab automation equipment and the use of recyclable materials to make equipment. Pharma firms and biotech institutions are also partnering with technology suppliers to incorporate next-generation automation solutions that simplify drug development pipelines and meet new regulatory frameworks.

Asia-Pacific will witness the highest growth rate in lab automation market due to increased production of biopharmaceuticals, clinical diagnostic labs, and CROs. China, Japan, India, and South Korea are heavily investing in the modernization of laboratory infrastructure, with the installation of automated systems growing.

China's fast-expanding pharma industry and investments in healthcare R&D have led to the mass adoption of robotic liquid handlers, automated storage systems, and AI-based data analysis platforms. Likewise, India's initiatives to develop its biotechnology and diagnostics industries are leading to collaborations with international automation technology suppliers.

Japan's emphasis on technology advancements and South Korea's biosimilar prominence are similarly stimulating demand for high-end laboratory automation solutions. With laboratories managing rising numbers of samples, automated platforms are in turn becoming more essential to elevate throughput and keep data integrity in place.

In addition, rising emphasis on lab standardization, international standards compliance, and increasing collaborative research activities among nations of the Asia-Pacific region is propelling lab automation growth. The trend is not only maximizing operational efficiency but also rendering laboratories competitive in the global research and diagnostics market.

Integration Complexity and High Initial Investment in Lab Automation

The Complexity of Integration: Integrating automated systems into existing laboratory workflows can be complex and time-consuming, which can be a challenge for the Lab Automation Market. Interoperability between the automated equipment, legacy software, and data management platforms remains a challenge for laboratories which can lead to inefficient and error-prone data handling.

Moreover, the extensive upfront cost involved in acquiring, deploying, and maintaining complex automation systems is a substantial constraint to adoption, especially among small and mid-sized laboratories. In addition, limited technical expertise and resistance to change compound the problem.

Overcoming these challenges will require companies to develop modular, cost-effective automation solutions that can be easily integrated into our current laboratory systems.

They will be essential to aid with these obstacles while still allowing for automation technology to be embraced and used effectively through standardised protocols, AI-powered systems/optimisation and scaled support services. Greater investment in workforce training and providing automated solutions that are customizable will drive wider adoption across labs of all sizes.

Market Growth Driven by Advances in AI and Robotics

The increasing adoption of AI (artificial intelligence), robotics, and high-throughput screening technologies offers significant opportunities for the Lab Automation Market. Trained on data until October 2023, AI analyses data to return faster, more accurate results and minimizes human errors, allowing researchers to concentrate on solving important problems.

Automation, in the form of robotic systems, improves sample handling, drug discovery, and diagnostics-foster productivity, operational efficiency, and reproducibility of experimental results. Fully automated laboratories are in high demand, driven by the need for high precision, reproducibility, and minimal manual intervention during research and clinical applications.

Other drivers with respect to the need for smart automation solutions is the push for remote laboratory operations and cloud-based data sharing. Those organizations that leverage smart automation, cloud-based laboratory management, and machine learning algorithms will give themselves a clear competitive opportunity in this rapidly evolving economy.

Automated predictive analytics for AI-powered workflows will allow us to optimize lab operations, thereby leading to massive increases in research throughput.

Between 2020 and 2024, the rising demand for high-throughput analysis, precise diagnostics, and expedited research workflows became key drivers for the Lab automation market. Automation in laboratories was also in high demand, resulting in new automated liquid handling systems, robotic workstations, and AI-enabled diagnostic tools, dramatically increasing production and decreasing error rates.

Cloud Computing and Data Analytics were critical in improving data management, real-time lab monitoring and collaborative research on a global scale. The automation in the laboratories also contributed significantly in improving workflow as well as with sample processing, which led to less turnaround times.

Increasing investment in biotechnology and pharmaceutical research further propelled market growth, with companies utilizing automation to improve drug discovery and development processes. Still, barriers related to high implementation costs and interoperability between different automation systems remained, causing slower adoption rates for selected laboratory settings.

By 2025 to 2035, the market is anticipated to have matured even further towards AI integration with the focus resting on laboratory connectedness and highly advanced levels of robotic applications. Fully automated workflows in laboratories will be integrated, with systems leveraging AI-driven decision-making, predictive analytics, and real-time monitoring to require minimal human involvement in complex processes.

The continuing extension of decentralized and remote laboratories will increase the need for portable automation systems and IoT-enabled lab devices, to form increased flexibility in different research operations. Sustainability, therefore, will be a major focus as companies will develop energy-efficient automation technologies and implement eco-friendly lab practices capable of minimizing waste, operational costs, and environmental impact.

As personalized medicine and precision diagnostics takes centre stage, the need for highly automated and data-driven laboratory environments will only grow, evidenced by the growing role of automation enabling innovation in genomics, proteomics, and drug development.

Moreover, AI-powered autonomous lab assistants will streamline the management of data, processing of samples, and design of experiments, leading to new levels of efficiency and precision. These growing trends are going to customize the Lab Automation Market, reshaping research, diagnostics, and the pharmaceutical industry.

Adopting advanced automation technologies is imperative for laboratories, research institutions, and healthcare providers to improve efficiency, cut operational expenses, and reduce errors.

Market Shifts: A comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with laboratory safety and data integrity standards |

| Technological Advancements | Adoption of robotic liquid handling, AI-based data analysis |

| Lab Connectivity | Increasing use of cloud computing and IoT for data sharing |

| Automation in Drug Discovery | Growth in high-throughput screening for pharmaceutical R&D |

| Workforce and Skill Adaptation | Need for specialized training to operate automated systems |

| Market Competition | Expansion of automation providers offering specialized solutions |

| Supply Chain Dynamics | Demand fluctuations due to supply chain disruptions |

| Market Growth Drivers | Rising demand for high-throughput research and clinical diagnostics |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Enhanced global regulatory frameworks for AI-integrated and autonomous lab systems with increased oversight on automation reliability. |

| Technological Advancements | Expansion of fully autonomous laboratories, real-time AI-driven diagnostics, and self-learning automation systems. |

| Lab Connectivity | Seamless integration of IoT-enabled lab equipment, block chain-secured data transactions, and AI-driven lab network optimization. |

| Automation in Drug Discovery | Advanced AI-driven drug discovery models, virtual laboratory simulations, and enhanced automation in molecular diagnostics. |

| Workforce and Skill Adaptation | Rise of AI-assisted lab management, workforce reskilling for automation integration, and increased demand for data science expertise in labs. |

| Market Competition | Emergence of AI-focused lab automation start-ups, driving market disruption and fostering competition among established industry leaders. |

| Supply Chain Dynamics | Streamlined supply chain logistics with predictive AI-based inventory management, ensuring efficient lab automation equipment distribution. |

| Market Growth Drivers | AI-powered decision-making, sustainability initiatives, decentralized laboratory models, and automation-driven advancements in personalized medicine. |

The USA laboratory automation market is expanding rapidly with more R&D investment, a strong biotech and pharma sector, and rising demand for precision medicine. Pharma multinationals, independent biotechs, and the NIH are in big time as they are investing heavily in automated laboratory systems that accelerate the research pace quicker and lead the way on drug discovery.

Clinical laboratory automation is also a leading influence, as diagnostic laboratories and hospitals try to optimize workflow, reduce turnaround time, and enhance the reproducibility of testing procedures. The outbreak of chronic and infectious diseases is also driving demand for automated sample handling, liquid handling, and high-throughput screening platforms.

The USA leads the market for AI lab automation solutions with robot-driven lab processes and cloud-based laboratory management systems leading the way in growing demand. Government initiatives towards life science research and presence of market giants like PerkinElmer, Thermo Fisher Scientific, and Agilent Technologies are driving the growth of the market.

With lab management growing more data-driven and next-generation sequencing (NGS) automation being a continually growing priority, the USA lab automation market will experience strong growth in the next decade.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 10.3% |

The United Kingdom lab automation market is expanding on the basis of expansion in genomics, government spending on life sciences, and increasing demand for precision medicine. Genomics England initiative, UK Biobank, and various research initiatives are implementing automated lab solutions to enhance workflows and maintain increased accuracy in data.

UK's strong pharmaceuticals and biotech industries, encompassing the existence of companies such as AstraZeneca and GlaxoSmithKline (GSK), are placing high investment in robotic lab systems and AI-enabled automation for drug discovery and development. Applications involving liquid handling robots, automated mass spectrometry, and machine learning-based analytics in the laboratory are growing at a rapid rate.

In addition, clinical diagnostics labs and hospitals are adopting automation to deal with increasing volumes of patient testing, particularly in pathology and microbiology labs. The UK's highly regulated environment (MHRA, GDPR compliance) is also pushing labs to invest in automated and secure data management systems for compliance and efficiency.

With continued R&D spending and rising adoption of AI-based lab automation, the UK lab automation market is expected to grow at a consistent rate.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 9.4% |

The European Union market for laboratory automation is expanding tremendously with the pressures of harsh regulatory compliances, increasing research collaborations, and increased demand for automation-based diagnostics. Germany, France, and the Netherlands are big catalysts for adopting AI-driven automation for life science, pharmaceutical research and development, and medical diagnostics.

Germany, the hub of major biotech and pharma players like Bayer, BioNTech, and Merck, is investing in robotic lab systems, high-throughput screening, and AI-based drug discovery platforms. The EU focus on personalized medicine and cell & gene therapy R&D is also fueling automated bioprocessing and sample prep solution demand.

Furthermore, the EU's compliance with MDR and GDPR regulations is accelerating the adoption of automated data management systems for secure laboratory workflows. Growing demand for digital pathology and laboratory diagnostics through AI in European clinics and hospitals is also fueling the market.

As ongoing investment is being made in laboratory automation facilities, the European market will continue to increase gradually in the following ten years.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 9.8% |

The Japanese laboratory automation market is expanding because the nation has a well-developed biotech industry with a high focus on AI-based automation and significant investment in precision medicine. It also boasts a well-developed robotics industry that makes it a world leader in automated lab equipment, liquid handling robots, and intelligent lab management systems.

Japan's growing population of elderly is fueling demand for automated clinical diagnosis, especially in pathology labs and hospitals. Japan's premier research universities and institutions are also making investments in next-generation sequencing (NGS) and artificial intelligence lab analytics for advanced biomedical research.

Moreover, Japanese pharmaceutical firms such as Takeda and Astellas are implementing high-throughput robotic lab systems to facilitate the rapid development of drugs as well as research on personalized therapy.

With increasing investments in lab automation, robotics, and artificial intelligence, the Japanese market for laboratory automation will grow manifold over the next two years.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 9.6% |

The South Korean lab automation market is growing rapidly with the country's strong biotech industry, government incentives for AI-based research, and high adoption of digital healthcare technology.

South Korea is becoming a hotspot for biomedical research and pharma innovation, and firms such as Samsung Biologics and Celltrion are investing in drug discovery and biopharmaceutical manufacturing through lab automation technology.

South Korea's smart hospital projects are also propelling the demand for robot-based clinical diagnosis and robot-assisted laboratory procedures. The semiconductor and electronics sector in South Korea is fueling the development of smart lab devices and IoT-enabled laboratory management systems.

Moreover, AI-powered automation of proteomics and genomics research is picking up steam, with funding from the government to drive research in precision medicine and personalized care. With constant investments in digitization of laboratories and AI-driven automation, South Korean laboratory automation will witness monumental growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.7% |

Biochemistry Devices and Molecular Devices Drive Market Growth as Demand for High-Throughput Laboratory Processes Expands

The biochemistry instruments and molecular instruments segments also share a large proportion of the lab automation market, as research laboratories, pharmaceutical firms, and clinical diagnostic labs increasingly rely on automation to save time, minimize human error, and promote scientific breakthroughs.

These instruments are central in providing high-throughput analysis, enhanced reproducibility, and improved integration into the workflow, and lab automation becomes indispensable in biomedical research, drug development, and clinical diagnosis.

Biochemistry devices have developed as one of the generally utilized robotized research center instruments, offering high-speed examination, diminished manual intercession, and enhanced exactness in biochemical testing.

Not at all like conventional research center strategies, robotized biochemistry gadgets enhance example dealing with, reagent administration, and investigative procedures, guaranteeing quicker turnaround times and steady test comes about.

The developing interest for biochemistry mechanization in clinical diagnostics, pharmaceutical exploration, and metabolic contemplates has energized appropriation of high-throughput biochemistry examiners, as research centers look to improve testing proficiency and information exactness while diminishing operational expenses.

Concentrates show that computerized biochemistry gadgets upgrade assay affectability, ensure reproducibility, and streamline reagent utilization, driving cost investment funds and better patient results.

The growth in biochemistry automation of drug metabolism research, incorporating automated enzyme kinetics analysis, biochemical profiling in real time, and integrated lab-on-a-chip technology, has consolidated market demand, guaranteeing wider adoption for pharmacokinetic studies and personal medicine.

AI-based biochemistry analysers’ integration, encompassing machine learning-based data interpretation, automated quality control, and predictive diagnostic insights, has yet again increased adoption, guaranteeing improved decision-making in clinical as well as research uses.

Evolution of next-generation biochemistry analysers, incorporating microfluidic-based automation, reaction chamber miniaturization, and cloud-accessible remote monitoring, has streamlined market growth for quicker, more accurate biochemical analysis across various sample types.

Application of biochemistry automation in the study of infectious diseases and biomarker identification, with high-throughput screening of metabolic disorders, viral infections, and inflammatory conditions, has fortified market growth for improved diagnostics and focused therapeutic development.

In spite of its benefits of accuracy, scalability, and high efficiency, biochemistry automation is challenged by factors such as high capital expenditure requirements, software integration difficulties, and poor mobility for small laboratory applications.

But new developments in AI-driven laboratory workflow optimization, cloud-based analytics platforms, and future-generation lab automation hardware are enhancing cost-effectiveness, user flexibility, and analytical throughput, sustaining future market growth for biochemistry automation.

Molecular devices have seen robust market uptake, especially in genomics research, molecular diagnostics, and precision medicine, as laboratories increasingly adopt automation to streamline sample preparation, DNA/RNA sequencing, and gene expression analysis.

Automated molecular devices differ from conventional molecular testing techniques in that they offer better accuracy, quicker processing, and greater scalability, making them invaluable in high-throughput research and clinical testing.

Increased need for molecular automation in genetic testing, cancer diagnosis, and infectious disease screening has fueled adoption of completely automated molecular testing platforms, as clinicians and researchers are looking for high-speed, reproducible, and error-free molecular analysis.

Studies indicate that molecular automation enhances workflow efficiency, reduces contamination risks, and minimizes human errors in PCR-based, next-generation sequencing (NGS), and microarray-based diagnostics.

Expansion in laboratory automation in liquid biopsy and targeted oncology through automated cell-free DNA (cfDNA) extraction, circulating tumor cell (CTC) analysis, and multiplexed biomarker discovery has furthered market demand, ensuring greater adoption for the early diagnosis of cancer and personalized treatment methodologies.

The inclusion of AI-driven molecular automation, with deep learning algorithms for genome annotation, automated variant calling, and predictive analytics for disease prognosis, has also accelerated adoption further, with enhanced diagnostic accuracy and reproducibility in research.

The creation of integrated molecular workstations, with robotic liquid handling, cloud-based genomic data management, and real-time PCR automation, has maximized market growth to provide scalable, high-throughput molecular testing in research and clinical laboratories.

Though it has the strengths of scalability, precision, and cost-effectiveness, molecular automation is confronted by limitations of high capital expenditure, complicated regulation, and shortage of talent in advanced genomic data analysis.

Yet, the new innovations involving AI-aided molecular workflow automation, cloud-stored genomic data, and next-gen portable molecular analyzers are enhancing availability, pricing, and diagnostic capability, paving the way for sustained market expansion for molecular automation.

The drug discovery and life sciences R&D are two principal drivers of the market, with research organizations and pharmaceutical firms increasingly utilizing automated lab solutions to expedite scientific advances, enhance the precision of experiments, and streamline high-throughput screening.

Life sciences R&D has become one of the biggest users of lab automation, with scientists increasingly combining robotic automation, AI-based analytics, and intelligent data processing tools to enhance research efficiency and reproducibility. In contrast to manual laboratory operations, automated research laboratories increase experimental precision, reduce variability, and speed up data analysis, yielding improved scientific results.

The increasing need for research automation with AI, including automated microscopy, image analysis, and real-time assay monitoring, has spurred adoption of lab automation solutions as researchers aim for high-throughput experimentation platforms that produce trusted, reproducible data.

The growth in cloud-based lab automation, with remote-access scientific workflows, shared data analysis, and AI-assisted experiment replication, has tightened market demand, with more usage in global research collaborations and multi-institutional studies.

Although it has research accuracy and efficiency advantages, lab automation in life sciences is challenged by high expense, complicated protocol standardization, and limited interpretability of AI models.

Nevertheless, new developments in robotic-assisted laboratory workflows, cloud-based research data management, and AI-aided scientific discovery platforms are enhancing scalability, reproducibility, and experimental precision, guaranteeing sustained market growth for automated life sciences R&D.

Automated drug screening expedites pharmaceutical research, prominently facilitating biologic and small molecule analyses. As big pharma increasingly leverages robotics to optimize lead selection, target validation, and preclinical testing, computerization streamlines workflows.

Unlike traditional methodology relying solely on human effort, automated platforms shrink timelines, refine data integrity, and refine candidate choice, guaranteeing swifter, thriftier discovery.

The proliferating demand for AI-aided, high-volume screening-featuring self-governing fluid conducting, robotic readers, and deep learning-based hit forecasting-has driven robotics adoption in pharmaceutical R&D as companies pursue statistics-steered progress.

Miniaturized testing also utilizes microfluidic automation incorporating lab-on-a-sliver analysis, organ-on-chip modeling, and AI-assisted pharmacokinetics simulation, strengthening marketplace want to ensure broader application in customized medicine and precision treatment.

Despite facilitating acceleration, lab computerization in pharma faces hindrances such as regulatory constraints, massive initial investments, and integration intricacies. However, emerging advances in AI-aided virtual screening, robot-aided workflows, and quantum calculating aiding modeling are improving efficiency, accuracy and scalability, guaranteeing ongoing sector growth for automated discovery.

Growing adoption of robotic process automation is driving the growth of the lab automation market. Automated liquid handling, AI-driven data analysis and robotic lab workflows are among the areas companies are targeting to improve efficiency, accuracy and reproducibility in clinical, pharmaceutical, and research laboratories.

Healthcare technology providers operating worldwide as well as specialist automation companies, every business contributing to greener technology in automated sample preparation, robotic lab assistants, and cloud-based lab data management

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Thermo Fisher Scientific, Inc. | 15-20% |

| Beckman Coulter (Danaher Corporation) | 12-16% |

| Siemens Healthineers AG | 10-14% |

| PerkinElmer, Inc. | 8-12% |

| Agilent Technologies, Inc. | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Thermo Fisher Scientific, Inc. | Develops robotic liquid handling systems, AI-powered lab automation platforms, and automated sample processing solutions. |

| Beckman Coulter (Danaher Corporation) | Specializes in high-speed robotic sample handling, automated clinical diagnostics, and AI-integrated laboratory systems. |

| Siemens Healthineers AG | Manufactures automated clinical lab solutions, robotic diagnostic workflows, and AI-driven laboratory information systems (LIS). |

| PerkinElmer, Inc. | Provides high-throughput screening, automated imaging, and AI-powered bioanalysis systems for research and clinical applications. |

| Agilent Technologies, Inc. | Offers precision liquid handling robotics, automated chromatography solutions, and lab workflow optimization technologies. |

Key Company Insights

Thermo Fisher Scientific, Inc. (15-20%)

The company specializes in lab automation market for bringing automation to lab robotics and cloud-based lab data integration and automated high-throughput screening solutions with AI-based-enhanced services within it.

Beckman Coulter (Danaher Corporation) (12-16%)

Beckman Coulter works in clinical lab automation, robotic sample processing and AI draw diagnostics to streamline the lab processes to make them faster and more accurate.

Siemens Healthineers AG (10-14%)

Automated clinical diagnostics, digital pathology integration, and AI and lab workflow optimization are drafted by Siemens Healthineers.

PerkinElmer, Inc. (8-12%)

Biotechnologies are also powered by PerkinElmer, which specializes in high-throughput automation of drug discovery, bioanalysis, and genetic screening for high-speed, high-accuracy operation of labs.

Agilent Technologies, Inc. (5-9%)

Agilent provides robotic liquid handling, lab workflow analytics, and AI-driven chromatography automation, allowing users to efficiently process samples and analyze data.

Next generation AI powered laboratory automation laboratory robotic systems cloud-linked lab management are some of the contributor lab automation companies. These include:

The overall market size for Lab Automation Market was USD 2.5 Billion in 2025.

The Lab Automation Market is expected to reach USD 6.3 Billion in 2035.

The demand for the Lab Automation Market will be driven by the need for increased efficiency, accuracy, and productivity in laboratories. Technological advancements, growing research activities, and the rising demand for personalized medicine will further fuel market growth.

The top 5 countries which drives the development of Lab Automation Market are USA, UK, Europe Union, Japan and South Korea.

Biochemistry Devices and Molecular Devices Drive Market to command significant share over the assessment period.

Specialty Medical Chairs Market Trends - Size, Growth & Forecast 2025 to 2035

Surgical Drapes Market Overview - Growth, Demand & Forecast 2025 to 2035

Super Resolution Microscope Market Insights - Size, Share & Forecast 2025 to 2035

Portal Hypertension Management Market Trends - Size, Growth & Forecast 2025 to 2035

Precocious Puberty Treatment Market Overview – Growth, Trends & Demand Forecast 2025 to 2035

Pleural Diseases Therapeutics Market – Drug Trends & Future Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.