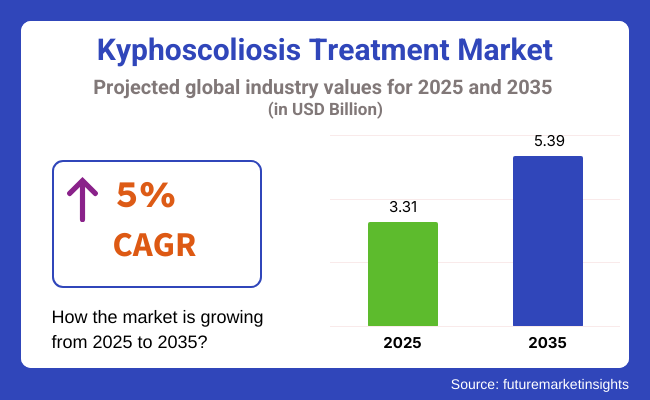

The Kyphoscoliosis Treatment Market is valued at USD 3.31 billion in 2025. As per FMI's analysis, the Kyphoscoliosis Treatment Industry will grow at a CAGR of 5% and reach USD 5.39 billion by 2035.

In 2024, the industry witnessed steady growth driven by increased diagnosis rates and the rising adoption of minimally invasive surgical procedures. Key advancements in spinal deformity management, including novel bracing systems and non-surgical therapies, contributed to the expansion of treatment options. Additionally, increasing awareness campaigns in developed regions led to early diagnosis, particularly among adolescents.

Pharmaceutical companies introduced improved biologics and pain management drugs, which saw significant demand. Emerging economies in Asia and Latin America expanded their healthcare infrastructure, further facilitating industry growth. Partnerships between healthcare providers and technology companies also brought AI-assisted diagnostic tools into mainstream use, enhancing early detection rates.

Looking ahead to 2025 and beyond, the industry is expected to benefit from continuous technological innovations and enhanced reimbursement policies. Additionally, growing investments in R&D will likely result in the introduction of more effective therapies. With the prevalence of kyphoscoliosis increasing among the aging population, the demand for personalized treatment solutions and telehealth consultations is set to rise, ensuring sustained industry growth over the next decade.

The industry is on a steady growth trajectory, driven by advancements in minimally invasive procedures, increased diagnostic rates, and rising healthcare infrastructure in emerging economies. Pharmaceutical companies, medical device manufacturers, and telehealth providers are well-positioned to benefit from this growth. However, regions with limited access to specialized healthcare may face challenges in adopting advanced treatment solutions.

Invest in Technological Advancements

Executives should allocate resources toward developing minimally invasive procedures, AI-assisted diagnostics, and advanced bracing systems. Partnering with medical device manufacturers and investing in R&D will enhance treatment outcomes and expand industry share.

Expand Access in Emerging Industry

Companies should collaborate with governments and healthcare providers to improve access to kyphoscoliosis treatments in developing regions. Establishing local partnerships and offering cost-effective solutions will drive adoption and revenue growth.

Strengthen Distribution Networks and Partnerships

Developing robust distribution channels and forming alliances with telehealth providers will improve patient reach and service delivery. Strategic acquisitions of regional players can also accelerate industry entry and expand geographical presence.

| Risk | Details |

|---|---|

| Regulatory Changes | Medium Probability, High Impact |

| Limited Access to Healthcare | High Probability, Medium Impact |

| Technological Failures | Low Probability, High Impact |

| Priority | Immediate Action |

|---|---|

| Enhance Technological Capabilities | Invest in R&D for AI-assisted diagnostics and minimally invasive procedures |

| Expand Industry Access | Form partnerships with healthcare providers in emerging industry s |

| Strengthen Supply Chain | Establish reliable supplier networks and monitor regulatory changes |

To stay ahead, companies must prioritize investments in AI-driven diagnostics and minimally invasive treatment technologies while expanding partnerships in emerging industry s to increase patient access. Establishing a resilient supply chain, monitoring regulatory developments, and forming strategic alliances will ensure competitive advantage.

Additionally, fostering innovation through R&D and engaging with telehealth platforms will accelerate industry presence and enhance patient outcomes. By executing these strategies, companies can capture industry growth and drive long-term profitability.

(Surveyed Q4 2024, n=450 stakeholder participants evenly distributed across hospitals, clinics, medical device manufacturers, and insurers in the USA, Western Europe, Japan, and South Korea)

Regional Variance:

High Variance:

Convergent and Divergent Perspectives on ROI:

Consensus:

Variance:

Shared Challenges:

Regional Differences:

Hospitals and Clinics:

Medical Device Manufacturers:

Alignment:

Divergence:

USA:

Western Europe:

Japan/South Korea:

High Consensus:

Key Variances:

Strategic Insight:

| Countries | Policy and Regulatory Impact |

|---|---|

| The USA | FDA regulations for medical devices, requiring clinical trials and post- industry surveillance . CMS reimbursement policies influence pricing. |

| UK | MHRA approval necessary for device commercialization, with strict compliance on safety and performance. |

| France | ANSM mandates device registration and monitoring; compliance with EU MDR regulations essential. |

| Germany | Barfm oversees medical device approvals, with additional regulatory checks under the EU MDR. |

| Italy | AIFA and Ministry of Health regulate product safety, with detailed documentation required for industry entry. |

| South Korea | MFDS approval mandatory; devices need to meet specific labelling and performance standards. |

| Japan | PMDA regulates through rigorous clinical trial data, focusing on safety and effectiveness. |

| China | NMPA approval involves extensive product testing and quality inspections. Local clinical trials may be required. |

| Australia-NZ | TGA approval in Australia and Medsafe in New Zealand require compliance with stringent medical standards. |

By type, the industry is expected to experience steady growth, with a projected CAGR of 4.8% from 2025 to 2035. Surgical treatments will continue to dominate, driven by advancements in minimally invasive techniques, robotic-assisted surgeries, and improved recovery times. Non-surgical options, such as physical therapy, bracing, and other conservative measures, are increasingly favored for early-stage cases, contributing to the segment's expansion.

Furthermore, the adoption of advanced spinal implants, orthotic devices, and innovative treatment modalities is expected to drive industry growth. The rise in the aging population and the increasing prevalence of spinal deformities, particularly in older individuals, will continue to fuel demand for both surgical and non-surgical treatment options throughout the forecast period.

The treatment segment is projected to witness a CAGR of 5.1% during the forecast period, driven by continuous advancements in medical technology. Surgical treatments remain the dominant option, fueled by innovations in spinal implants, 3D imaging, and intraoperative navigation systems, improving precision and patient outcomes. Popular surgical procedures, such as spinal fusion and vertebral body tethering, are known for their high success rates, offering long-term relief to patients.

Non-surgical treatments, including physiotherapy, pain management, and orthotic devices, are gaining traction, particularly in regions with better healthcare access and awareness. Additionally, the integration of comprehensive post-surgery rehabilitation programs, along with advancements in patient care, is expected to significantly enhance recovery rates, making the treatment segment highly favorable in the coming years.

Hospitals and specialty clinics are the primary end users contributing to the significant growth of the industry, with a projected CAGR of 5.0%. Hospitals continue to dominate due to their advanced surgical infrastructure, access to cutting-edge technologies, and specialized spine care units, offering comprehensive treatment options. Specialty clinics are experiencing rapid growth, driven by personalized care plans and rehabilitation services tailored to individual patient needs.

Ambulatory surgical centers (ASCs) are becoming increasingly popular due to the growing preference for outpatient procedures, shorter recovery times, and lower costs compared to traditional hospital settings. Additionally, increased investments in healthcare infrastructure, along with the rise of telehealth platforms for remote monitoring and post-surgery care, are further enhancing the industry's growth, improving patient access and treatment outcomes.

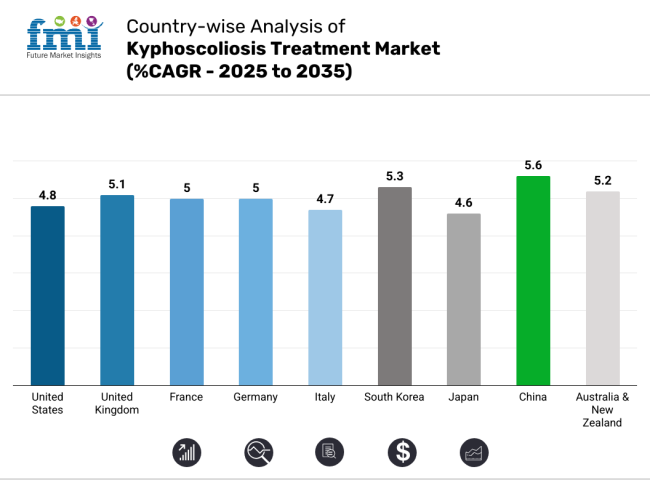

The industry is expected to set to grow at a steady pace of 4.8% during the forecast period due to advanced medical technologies and growing elderly population. The USA industry benefits from an aging population, growing kyphoscoliosis awareness, and advances in minimally invasive surgeries.

In addition, government supportive initiatives for healthcare reforms and adequate insurance coverage are likely to aid the industry expansion. Technological advancements in spinal implants and increasing investments in R&D are expected to offer growth opportunity. Nonetheless, the barriers of high treatment costs and complex regulatory challenges remain barrier.

The UK chronic pulmonary hypertension treatment industry is expected to grow at a 5.1% CAGR, driven by a strong healthcare infrastructure and government-supported initiatives. These policies not only make the industry profitable but also encourage early diagnosis and treatment through awareness campaigns and patient support programs. The presence of major industry players, along with cooperative research and development efforts, further boosts technological advancements in treatment options.

Additionally, the increasing demand for personalized medicine, including patient-specific implants and targeted therapies, is creating new growth opportunities. Enhanced access to healthcare, coupled with advancements in medical technologies, will support continued industry expansion and improved patient outcomes.

France’s chronic pulmonary hypertension treatment industry is anticipated to grow at a 5% CAGR, driven by robust government initiatives and rising healthcare spending. The country’s strong healthcare system, coupled with supportive policies for spinal disorder treatments, fosters industry growth. Advancements in diagnostic tools, along with a higher number of spinal surgeries, further contribute to increased demand for effective treatments.

Additionally, the growing establishment of specialized orthopedic professionals and dedicated spine centers across the region is accelerating the adoption of innovative treatment options. These factors combined are expected to continue fueling industry expansion, improving patient care, and broadening access to necessary treatments.

Germany’s chronic pulmonary hypertension treatment industry is expected to grow at a 5.0% CAGR, bolstered by strong government support and rising healthcare spending. The demand for spinal disorder treatments is further fueled by the increasing availability of advanced diagnostic tools and a rise in spinal surgeries.

As the number of orthopedic specialists and dedicated spine centers continues to grow, the country is witnessing more targeted and personalized treatment approaches. The focus on enhancing healthcare infrastructure, coupled with innovations in surgical techniques and patient care, positions Germany as a key player in the industry, driving both the adoption of advanced treatments and improved patient outcomes.

Italy industry is expected to grow with the CAGR of 4.7% driven by an aging population and expanding healthcare access. However, the increasing cases of kyphoscoliosis owing to the geriatric population and sedentary lifestyle factors contributing to the kyphoscoliosis are driving the industry. The industry is additionally supported by the government striving to provide everyone a healthcare facility and technology improving treatment options. Economic issues and healthcare expenditure budget cuts could restrict growth.

The chronic pulmonary hypertension treatment industry in South Korea is projected to expand rapidly at a 5.3% CAGR, driven by significant technological advancements and robust government support. South Korea benefits from its strong healthcare infrastructure and a focus on integrating cutting-edge medical technologies, such as AI-driven diagnostics and robotic-assisted surgeries.

FMI further opines that increasing investments in research and development, coupled with a rising demand for minimally invasive procedures, contribute to the industry’s growth. High patient awareness, along with favorable reimbursement policies, is further fueling the adoption of advanced treatments, improving patient outcomes and driving the overall expansion in the region.

The sales industry in Japan are forecasted to grow at a 4.6% CAGR, driven by advancements in robotics and AI. The aging population remains a key driver, as the demand for effective treatments for spinal deformities continues to rise. Robotics and AI integration in surgical procedures enables greater precision, improving patient outcomes and reducing recovery times.

According to FMI, Japan’s government actively supports the development and adoption of innovative medical devices, fostering an environment conducive to industry growth. Positive collaborations with global companies also accelerate the adoption of cutting-edge treatments, further expanding the potential in the country.

China’s revenue is projected to grow at a 5.6% CAGR from 2023 to 2030, making it one of the most vital growth landscape globally. The industry benefits from a large patient population and significant government initiatives aimed at boosting healthcare infrastructure. Rising healthcare spending, along with policies that promote the growth of domestic medical technology, further supports the industry’s expansion.

Local manufacturers are increasingly providing cost-effective solutions, increasing industry accessibility. Long-term growth is expected to be driven by continuous improvements in healthcare infrastructure, the adoption of advanced treatments, and the rising demand for specialized spinal care across the country.

Australia and New Zealand are projected to experience a 5.2% CAGR in the kyphoscoliosis treatment industry, driven by high healthcare standards and government initiatives. Both countries benefit from robust support for medical advancements, enabling continuous development in treatment options. A strong emphasis on patient-centric care ensures that the needs of individuals are prioritized, with advancements in minimally invasive procedures playing a significant role in improving patient outcomes.

Furthermore, ongoing collaborations between universities, research institutions, and medical device manufacturers foster innovation, leading to the adoption of cutting-edge technologies. This collaborative environment enhances the availability of effective, modern treatments for kyphoscoliosis.

Leading companies in the kyphoscoliosis treatment industry include Johnson & Johnson Services Inc., Medtronic PLC, Stryker Corporation, and Zimmer Biomet Holdings Inc. Specific industry share percentages are not readily available. Recent developments include Globus Medical Inc.'s introduction of the MARVEL Growing Rod System, designed for children with early-onset scoliosis. The growing adoption of telemedicine has also improved access to specialized care, while advancements in regenerative medicine and genetic research are contributing to more personalized and effective treatments.

Medtronic

Johnson & Johnson (DePuySynthes)

Stryker Corporation

Zimmer Biomet (Not listed but a major player)

Orthofix Holdings, Inc.

Integra LifeSciences

B. Braun Melsungen AG

Teva Pharmaceuticals USA, Inc.

Amneal Pharmaceuticals LLC / Aurobindo Pharma / Perrigo Company

the industry is segmented in postural kyphosis, scheuermann’skyphosis, congenital kyphosis.

the landscape is bifurcated into medications and surgery and bracing.

the industry is divided into hospital, clinics, ambulatory surgical centres.

themarket is studied across North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa.

The growth is driven by advancements in surgical techniques, increasing adoption of minimally invasive procedures, and a rising aging population.

The industry is expected to grow steadily, fueled by technological innovations, improved patient outcomes, and rising demand for personalized treatment options.

Key players include Johnson & Johnson Services Inc., Medtronic PLC, Stryker Corporation, Zimmer Biomet Holdings Inc., Globus Medical Inc., NuVasive Inc., Orthofix Medical Inc., Spineart SA, B. Braun Melsungen AG, Seaspine Holdings Corporation, Amneal Pharmaceuticals LLC, Aurobindo Pharma Limited, Integra LifeSciences, MicroPort Scientific Corporation, Perrigo Company, Teva Pharmaceuticals USA, Inc.

Surgical treatments, including spinal fusion and vertebral body tethering, are the most common for addressing kyphoscoliosis.

The industry is projected to reach USD 5.39 billion by 2035.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 17: Global Market Attractiveness by Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Treatment, 2023 to 2033

Figure 19: Global Market Attractiveness by End User, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 37: North America Market Attractiveness by Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Treatment, 2023 to 2033

Figure 39: North America Market Attractiveness by End User, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Treatment, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 77: Europe Market Attractiveness by Type, 2023 to 2033

Figure 78: Europe Market Attractiveness by Treatment, 2023 to 2033

Figure 79: Europe Market Attractiveness by End User, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 97: South Asia Market Attractiveness by Type, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Treatment, 2023 to 2033

Figure 99: South Asia Market Attractiveness by End User, 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Treatment, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 137: Oceania Market Attractiveness by Type, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Treatment, 2023 to 2033

Figure 139: Oceania Market Attractiveness by End User, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 157: MEA Market Attractiveness by Type, 2023 to 2033

Figure 158: MEA Market Attractiveness by Treatment, 2023 to 2033

Figure 159: MEA Market Attractiveness by End User, 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Algae Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Water Treatment Polymers Market Growth & Demand 2025 to 2035

Water Treatment System Market Growth - Trends & Forecast 2025 to 2035

Water Treatment Chemical Market Growth – Trends & Forecast 2024-2034

Asthma Treatment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA