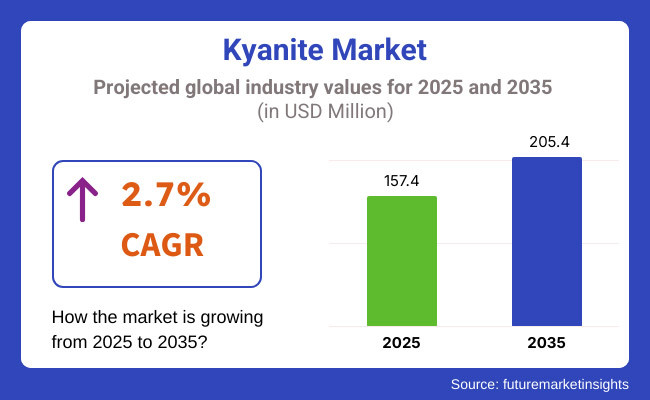

The market is projected to reach USD 157.4 Million in 2025 and is expected to grow to USD 205.4 Million by 2035, registering a CAGR of 2.7% over the forecast period. The growth of the steel and glass industries, increasing infrastructure projects, and rising demand for heat-resistant materials are shaping the industry’s future. Additionally, advancements in mineral processing techniques and increasing exploration activities are expected to drive further market growth.

The kyanite market will grow steadily from 2025 to 2035. This is because more industries need it. The material is useful in areas like metallurgy and foundries. kyanite is special due to its high performance. It is an aluminosilicate mineral. People use it to make kiln linings, furnace bricks, and molds. It resists high heat and stays stable under intense heat. It also does not expand much when heated.

These qualities make it important. Industries such as iron & steel, glass making, and cement production want materials that can resist high temperatures. This need is pushing the use of kyanite-based products. On top of that, there is a global move for processes that save energy and are sustainable. Industries want long-lasting solutions. This is helping increase the demand for kyanite. All these factors together are making the kyanite market grow.

Beyond refractories, kyanite is in demand in ceramics, car parts, planes, and electronics. Its market is growing fast. Electric cars, light plane parts, and chip making are giving kyanite more uses in strong materials that handle heat. New tech in material science is also making kyanite better fit for future needs. Yet, issues like changing raw material supply and mining rules can slow growth. But new building projects, industry growth, and new strong materials help keep kyanite needed. It stays important in building and new tech uses over the next ten years.

North America is set to lead the kyanite market. Strong need from steel, airplane, and tech fields will drive this. The USA and Canada are on top due to big refractory production, large kyanite mining, and more use in top ceramics.

The rise of steel making, more use of kyanite in new tech, and growth in building projects that need heat-proof stuff push market demand. Plus, help from the government for local mineral work and more money in metal study boost market growth.

Europe has a big part in the kyanite market. Countries like Germany, the UK, France, and Italy lead in making items like refractories, ceramics, and parts for planes. The European Union cares about green mining and needs more strong industrial materials, which guide market trends.

The rise in green energy, need for better insulation, and growth of car and glass industries drive kyanite use. Also, more research in minerals and green refractory products help boost the market more.

The Asia-Pacific area will see the highest growth rate in the kyanite market. This is thanks to fast factory growth, rise in steel making, and more need for heat-resistant items. China, India, Japan, and South Korea are top users and makers of kyanite.

China leads in steel making. More money goes into high heat factories there, and more big building projects help the market grow. India’s building sector is booming, and more advanced ceramics and heat-resistant items are needed. Japan and South Korea are big in high-tech gadgets and new material studies, which helps the market grow in the area.

Challenges

Fluctuating Raw Material Prices and Mining Regulations

The kyanite market faces big challenges. Raw material costs go up and down, which affects how much it costs to make and how much it sells for. Rules about mining can make it harder to get and move the raw materials.

Processing kyanite needs lots of energy, which is another issue. There is also competition from man-made options, making it harder for the market to grow.

Opportunities

Growth in Refractory and High-Performance Materials, and Sustainable Mining Innovations

Although there are challenges, the kyanite market has many chances to grow. More use of strong materials for making steel, cement, and glass is causing more need for kyanite.

New, green ways to mine and process kyanite will make it easier to get and be good for the planet. Also, more money is going into finding new uses for kyanite in high-tech items like advanced ceramics, airplane parts, and electronics, bringing more money to makers and sellers.

The rise of electric cars and clean energy is also likely to increase the need for materials that can take high heat, pushing up kyanite use further.

From 2020 to 2024, the kyanite market grew steadily. People wanted more high-temperature materials. This was needed for ceramics and metal work. Kyanite expanded when heated, making it perfect for steel, glass, and other hot industries. More infrastructure, energy-heavy industries, and better refractory tech helped the market grow too.

From 2025 to 2035, big changes are coming to the kyanite market. Advanced AI will help find new minerals. Refractory materials will be bio-engineered. Blockchain will make supply chains clearer. Nanotechnology will improve ceramics. Coatings will heal themselves. 3D printing will make strong materials. These changes will reshape industrial uses, make things greener and save money.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with environmental regulations and mining standards to ensure sustainable extraction practices. |

| Technological Advancements | Improvements in extraction and processing technologies enhancing the quality and yield of kyanite products. |

| Industry Applications | Predominantly used in refractories, ceramics, and metallurgy. |

| Adoption of Smart Equipment | Limited integration of smart technologies in mining and processing operations. |

| Sustainability & Cost Efficiency | Growing emphasis on sustainable mining practices and cost-effective processing methods. |

| Data Analytics & Predictive Modeling | Emerging use of data analytics for resource estimation and process optimization. |

| Production & Supply Chain Dynamics | Fluctuations in production volumes due to variable demand and operational challenges. |

| Market Growth Drivers | Demand driven by traditional industrial applications and infrastructure development. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter environmental policies and sustainability standards influencing mining operations and supply chain practices. |

| Technological Advancements | Adoption of advanced mining technologies and automation to increase efficiency and reduce environmental impact. |

| Industry Applications | Expanded applications in electronics, automotive, and aerospace industries due to kyanite's thermal and mechanical properties. |

| Adoption of Smart Equipment | Increased use of IoT and AI in mining operations for real-time monitoring and optimization. |

| Sustainability & Cost Efficiency | Implementation of circular economy principles, including recycling and waste reduction strategies, to enhance sustainability and cost efficiency. |

| Data Analytics & Predictive Modeling | Widespread adoption of predictive modeling and big data analytics to improve exploration efficiency and operational decision-making. |

| Production & Supply Chain Dynamics | Stabilized production with diversified supply chains to mitigate risks and meet growing global demand. |

| Market Growth Drivers | Growth propelled by technological advancements, new applications in emerging industries, and increased focus on sustainable materials. |

The kyanite market in the USA is growing. Demand comes from refractories, ceramics, cars, and high-heat insulation materials. Both USGS and EPA oversee mining and processing of kyanite to protect the environment.

Use of kyanite in foundry molds, better ceramic composites, and more steel and glass manufacturing boost the market. Investments in local mineral resources and green projects shape industry trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 2.9% |

The UK kyanite market is growing fast. More money is being put into new ceramics. The need for materials that can handle high heat in planes and military is going up. There’s also a push for finding minerals in eco-friendly ways.

In the UK, the Environment Agency and BGS keep an eye on how kyanite is mined and used in factories. The automotive and electronics industries want lighter and tougher materials. This need is helping the kyanite market grow. New ways to make synthetic kyanite are coming up. More kyanite is being brought in from other countries, changing how supply is managed.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.5% |

The kyanite market in Europe is growing because there's more need for better heat-resistant materials. More studies on advanced ceramics and rules for eco-friendly mining help. Plans by the European Union push for recycling and smart use of top minerals.

Germany, France, and Italy use kyanite in big ovens, glass-making, and ceramics. New tech in processing minerals and using fake kyanite for special uses are helping the market grow.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 2.7% |

The kyanite market in Japan is growing. There is more need for strong ovens, car and tech parts, and new materials. Japan's Ministry of Economy, Trade, and Industry supports new ideas in ceramic and mineral insulation.

Japanese firms are working on making pure kyanite for tech bits, better ways to use it, and adding it to heat-proof mixes. Also, the call for lasting, tough industry stuff is pushing market changes.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.8% |

The kyanite market in South Korea is seeing good growth. Steel production is growing, there's more need for heat-resistant ceramics, and more money is going into top-notch materials for tech parts and new energy. The Trade, Industry, and Energy Ministry (MOTIE) of South Korea controls mineral imports and backs new ceramic tech.

Smart manufacturing is on the rise, research in tiny ceramics is increasing, and the desire for aluminosilicate-based materials in EV battery production is helping to shape market movements. Plus, South Korea is pushing to be more independent in key minerals, and this affects money put into both local and global kyanite sources.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.0% |

The kyanite market is growing fast. This is because more people want refractory stuff, use is going up in ceramics, and it's needed for hot industrial jobs. Blue and cyan kyanite are big in the market. They are strong, stay stable under heat, and last long in tough industrial uses.

Blue kyanite is loved for its high alumina, great heat resistance, and ability to handle high temperatures. It is key for refractories, ceramics, and strong industrial uses. This kyanite often goes into kiln linings, furnace bricks, and foundry molds because it doesn’t stretch much with heat and is very strong.

The rise in using blue kyanite in refractories comes from the growing need in steel, glass, and cement businesses, where heat-proof stuff is vital. Also, better ways to extract it, make it synthetically, and process it are boosting quality and steadiness in performance.

Even with its good points, issues like few high-quality spots, tough mining, and changing costs of raw stuff remain. But new tricks in mineral handling, greener mining ways, and other aluminosilicate options might help make supply chains stronger and spur market growth.

Cyan kyanite is gaining fame due to its wide range of uses in factories, its beauty in gem sales, and growing role in ceramic mixes. This stone has medium alumina, resists heat well, and has a special tint, which makes it good for décor, castables, and heat shields.

The rising need for cyan kyanite in factory and art uses comes from its use in fireproof high-grade materials, more interest in gemstones, and progress in composite material making. Also, green mineral extraction, better grinding tools, and improved processing ways are boosting the stone's purity and range of uses.

Still, there are hurdles like it being less common than blue kyanite, changes in mineral makeup, and scarce awareness in small groups. New refining tricks, fake gem creating, and custom-made factory mixes are seen to boost its use and broaden its market.

The need for kyanite comes mainly from factories and high-tech uses. It is mostly used for making ceramics and casts because it stands up to heat and is strong.

Kyanite is used often in making ceramics. It is good for strong and heat-resistant ceramics. These ceramics need low heat growth, high heat tolerance, and strong build. It is found in kiln parts, electrical insulators, and heat tiles. These need to work well with heat.

More people are using kyanite for ceramics due to growing needs for home and industry use. It is used more in new ceramic coatings, aerospace pieces, and electronic parts. Also, very fine kyanite powders, mixed ceramic styles, and better heat-making methods are making products last longer and be more eco-friendly.

Yet, there are issues like breaking of material, tricky heat-making steps, and costs going up because of mining limits. New fake ceramic options, smart computer-guided ceramic making, and better sourcing will help in making it more widely used and efficient.

Kyanite is becoming more popular in casting work. It's used for high-heat molds, sands, and linings for casting metals. It helps keep heat stable, stops misshaping, and makes molds last longer. This makes it vital for casting iron, steel, and other metals.

More people want kyanite for casting because foundries are growing worldwide. The need for precise metal pieces is rising, and new coatings for molds are improving. Also, pure kyanite refractories, new casting materials, and AI in mold design help make things more accurate.

But, there are problems like supply chain issues, high energy use for processing, and not enough good kyanite ores. Advances in recycled materials, better coatings to resist heat shocks, and smart grading tools are likely to boost casting and widen its market.

The kyanite market grows because many want better heat-resisting stuff. The spreading need comes from making ceramics and metals. Steel making goes up, new ceramic methods are made, and more heat-proof materials are needed for industry uses and metal works. Businesses aim for pure kyanite, baked kyanite (mullite), and fake choices to boost heat checks, strong grip, and chemical fight. Big rock miners, heat-proof part sellers, and ceramic makers work together. Each offers new clean methods, green mining ways, and more uses for kyanite in gadgets and space fields.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Kyanite Mining Corporation | 18-22% |

| Imerys Refractory Minerals | 12-16% |

| Great Wall Mineral | 10-14% |

| Anand Talc | 8-12% |

| Henan Tongbaishan Refractory | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Kyanite Mining Corporation | Develops high-purity kyanite and mullite for refractories, ceramics, and foundry applications. |

| Imerys Refractory Minerals | Specializes in synthetic and natural kyanite for steel, glass, and high-temperature ceramics. |

| Great Wall Mineral | Manufactures calcined kyanite for use in refractory linings, kilns, and furnace insulation. |

| Anand Talc | Provides kyanite-based raw materials for industrial applications, including paints, coatings, and ceramics. |

| Henan Tongbaishan Refractory | Focuses on crushed and powdered kyanite for metallurgy, ironmaking, and precision casting. |

Key Company Insights

Kyanite Mining Corporation (18-22%)

Kyanite Mining Corporation leads the kyanite market, offering high-purity raw kyanite and mullite for refractory and industrial applications.

Imerys Refractory Minerals (12-16%)

Imerys specializes in synthetic kyanite-based products, ensuring enhanced heat resistance for steel and ceramics industries.

Great Wall Mineral (10-14%)

Great Wall Mineral provides calcined kyanite solutions, optimizing thermal shock resistance in industrial applications.

Anand Talc (8-12%)

Anand Talc focuses on fine-grade kyanite powders, catering to paint, coatings, and chemical industries.

Henan Tongbaishan Refractory (6-10%)

Henan Tongbaishan supplies kyanite-rich refractory materials, supporting metallurgical and foundry processes.

Other Key Players (30-40% Combined)

Several mining companies, refractory suppliers, and mineral processing firms contribute to advancements in high-purity extraction, alternative material development, and sustainability efforts in the kyanite industry. These include:

The overall market size for the kyanite market was USD 157.4 Million in 2025.

The kyanite market is expected to reach USD 205.4 Million in 2035.

Increasing demand for refractory materials in high-temperature industries, growing use in ceramics and metallurgy, and rising adoption in automotive and aerospace applications will drive market growth.

The USA, China, India, Brazil, and Germany are key contributors.

Blue and Cyan kyanite is expected to lead in the Kyanite Market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA