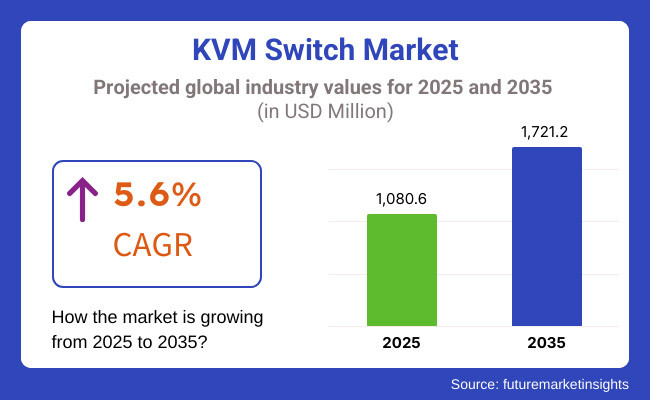

The global KVM Switch market is projected to grow significantly, from USD 1,080.6 Million in 2025 to USD 1,721.2 Million by 2035 an it is reflecting a strong CAGR of 5.6%.

The KVM Switch Market is witnessing growth in the recent years as the organizations from different verticals including BFSI, healthcare, IT & telecom are inclined to effective management of their IT infrastructure. To manage hundreds of servers remotely, organizations are turning to KVM switches for streamlining remote access, which in return will rise the need for improving efficiency and security for the overall performance of the operating systems & devices.

With the growing complexity of IT environments, enterprises are looking for the leading edge of performance in KVM-IP switches to support secure low-latency access to critical systems. Need for real-time, high-resolution KVM solutions to process data-intensive applications such as media & entertainment & government will further, increase the market growth.

Growing use of cloud-based infrastructure and rise in remote working models is propelling demand for multi-user KVM switches that allow servers to be accessed securely from various locations. For businesses, there is a need for a scalable and cost-effective IT management solution to run smooth operations without any compromises on security.

As cybersecurity threats continue to increase, organizations are also turning to secure KVM switches to limit unauthorized access and safeguard sensitive data. These provide enterprises with increased security features that allow them to avoid risk from the perspective of server management and data control.

Due to an advanced it infrastructure, a strong center presence, as well as strict security regulations, North America emerged as a key market. In India and Australia, the segment is gaining momentum due to businesses expanding their digital operations, as KVM switches facilitate enhanced IT efficiency, thus leading to further growth of the market.

Explore FMI!

Book a free demo

| Company | Vertiv Holdings Co. |

|---|---|

| Contract/Development Details | Secured a contract with a major data center operator to supply high-performance KVM switches, enabling efficient management of server infrastructure and reducing operational complexities. |

| Date | February 2024 |

| Contract Value (USD Million) | Approximately USD 15 |

| Renewal Period | 3 years |

| Company | ATEN International Co., Ltd. |

|---|---|

| Contract/Development Details | Partnered with a multinational corporation to deploy KVM over IP solutions across multiple office locations, enhancing remote management capabilities and IT support efficiency. |

| Date | August 2024 |

| Contract Value (USD Million) | Approximately USD 12 |

| Renewal Period | 4 years |

Increasing adoption of multi-user KVM switches for enhanced server accessibility

Increased complexity of IT infrastructure and the need for seamless server management are fuelling the proliferation of multi-user KVM switches to manage IT infrastructure across verticals. These switches allow multiple users to locally control multiple servers at the same time, which enhances operational efficiency in large enterprises, data centers, and cloud environments.

With businesses pushing further into IT territory, real-time access to critical systems is something that needs to be made available, making multi-user KVMs a cornerstone investment. The IT & telecom industry vertical is particularly experiencing rapid adoption as remote servers need to be centralized control in cases of multi-located setups.

This is only putting upward pressure on the need for IT management solutions that are both in demand, but also provide a higher level of security and performance as governments around the world secure their digital infrastructure. One example is a recent government IT modernization effort that reportedly set aside more than USD 5 billion to enhance remote server accessibility and bolster cybersecurity across public sector organizations.

Such initiatives are leading enterprises to leverage multi-user KVM switches for greater network operational efficiency and security As the cloud computing market grows further, demand for high-performance KVM solutions providing highly secure and real-time access will also increase ensuring uninterrupted service availabilities in mission-critical networks.

Increasing adoption of high-performance KVM switches in media & entertainment

The media & entertainment sector is also one of the key growth markets for high-performance KVM switches due to the demand for real-time video editing and post-production and for live broadcasting. These switches enable professionals to swap between high-resolution workstation PCs to guarantee high-quality production.

Traditional IT infrastructure cannot keep up with data transfer needs with the growing 4K and 8K content. Performance KVM switches provide low-latency, high-bandwidth connection which are vital n high-end production environments.

The growing demand for sophisticated KVM solutions is also being driven by investment in digital media and broadcasting technologies from governments. A national broadcasting upgrade initiative was funded with USD2.8 billion to enhance remote media production capabilities and ensure real-time data transmission.

There is also the implementation of high-performance KVM switches to share content creation and distribution across many platforms. Furthermore, with the increasing adoption of cloud-based media workflows, the use of KVM-over-IP solutions is being increasingly integrated by studios and production houses to enable the remote collaboration of workforces.

Growing global demand for streaming services, esports, and virtual production continues to drive the need for high-performance KVM solutions, guaranteeing high-quality and uninterrupted content delivery.

Expanding digital transformation and remote work models driving market demand

KVM switches are policies to transform businesses digitally and remotely work with IT infrastructure from any location. With organizations moving towards hybrid work environments, IT teams require secure and seamless access to their remote servers, making KVM-over-IP solutions a vital investment.

But in order to ensure business continuity and productivity, enterprises are adopting next-gen server management to minimize downtime. A growing trend of this can be seen in industries such as healthcare, BFSI, and government, where the need for secure remote access to critical systems is unavoidable.

In turn, governments across the globe are taking steps to ensure remote work infrastructure is funded. For example, a new government-financed USD 3.6B IT resilience program was recently initiated to improve secured remote access solutions for enterprises and public institutions.

The project involves secure KVM switches to maintain data security and provide a stable network for employees WORKING FROM home. Moreover, as remote work culture increases, so do the cyber breaches, as many offices are now adopting KVM for secure and performance-oriented remote access.

The increasing focus on cloud-based IT infrastructure, automation, and real-time monitoring of systems only adds to the demand for advanced KVM switch technology, positioning them as an indispensable element in the modern digital workspace.

Rising Adoption of Virtualization reducing the need for physical KVM switches

As organizations continue to adopt virtualization technologies, the need for physical KVM switches in managing IT infrastructure is becoming less common. Using virtualization allows the hosts in an organization to run multiple virtual machines (VMs) on the same physical hardware server, resulting in less single hardware-based KVM switches for each physical server in order to access the server and control.

As there are software-based tools to allow IT administrators to remotely manage virtual environments, there is no need for physical KVM-based solutions. This trend is most apparent in data centers, cloud environments, and enterprise IT networks, where companies demand cost effectiveness, scalability, and flexibility in their infrastructure.

The software defined remote access solution emerge out to help companies Cascading virtualization through various different virtualized environments. I know hypervisors and virtual management platforms enable administrators to log into several servers via a single interface, reducing reliance on dedicated hardware switches.

They are even less utilized with the rise of containerization technologies such as Kubernetes and Docker, which directly deploy and manage applications-skipping the hardware-based control interfaces provided by KVM altogether.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Secure access to multiple computing devices became a compliance requirement. |

| Remote Work & IT Infrastructure | Increase in remote work accelerated demand for multi-device management. |

| Integration with Virtualization | KVM switches optimized for cloud-based virtual desktop environments. |

| Security & Data Protection | Advanced encryption protocols enhanced KVM switch security. |

| Market Growth Drivers | Rising complexity of IT infrastructure increased demand for efficient KVM solutions. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-enhanced KVM solutions ensure automated threat detection and secure access control. |

| Remote Work & IT Infrastructure | AI-driven virtual KVM systems reduce dependency on physical hardware. |

| Integration with Virtualization | AI-powered KVM technology enables predictive resource allocation in multi-cloud environments. |

| Security & Data Protection | Quantum encryption secures data transfers between multiple systems using KVM. |

| Market Growth Drivers | Growth in AI-driven automation and smart data centers drives adoption of intelligent KVM technology. |

The global KVM switch market is characterized by its segmented structure, segmented across three tiers on the basis of vendor strength, market presence, and technological advancement. So many Tier 1 vendors including Avocent (Vertiv), Aten International, Raritan (Legrand), has high market share due to their well-defined product portfolio, broad global distribution network and novel investment into KVM technology.

Data centers and mission-critical applications are targeted for the high-performance and scalable KVM solutions these vendors provide. Established brand recognition, large investments in R&D, and long term contracts with big industries such as IT, BFSI, and telecommunications reinforce their dominance.

There are also Tier 2 players like Belkin, Dell Technologies and Hewlett Packard Enterprise (HPE) that have a more market presence by providing competitive solutions designed for low to mid-sized enterprise and specialized industry requirements. Although not as dominant as Tier 1 players, they exploit brand reputation, compatibility with wider IT infrastructure, and strong customer relationships.

KVM switches from Avocent are designed to deliver affordability and performance with ease of deployment, preferred in business-critical environments. Other Tier 2 vendors cater to more specialized applications like industrial control rooms and government.

Tier 3 vendors like Rose Electronics, Adder Technology, and G&D (Guntermann & Drunck) target specialized markets for custom KVM capabilities. These trades on high-performance IP-based KVM switches, secure data transmission, and industry-specific applications such as broadcasting, military and medical environments.

Although their market share is lower, they serve a niche for specialized customer needs that the larger vendors may not be focused on. Most market is concentrated into Tier 1 vendors, while Tier 2 and Tier 3 provide innovation and diversity in vendor offerings.

The section highlights the CAGRs of countries experiencing growth in the KVM Switch market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 7.8% |

| China | 6.4% |

| Germany | 3.5% |

| Japan | 5.1% |

| United States | 4.2% |

The industrial automation sector in China is increasingly dynamic, propelled by smart manufacturing, robotics and digital transformation initiatives. Industry adoption of IP-based KVM switches is increasing as industries pursue seamless remote access,current control and centralized management of industrial systems.

These switches allow engineers and operators to monitor numerous machines from one workstation, making it far more efficient and lowering operational downtime. The integration of Industrial IoT (IIoT) and AI-driven automation in Chinese industries contributes to the industry-wide growing demand for the scalable, high-bandwidth KVM solutions.

On October 16, the MIIT of China announced its "Intelligent Manufacturing" plan as part of a roadmap to deepen industry digitalization. In 2025, it emphasizes that China should have 70% of the key manufacturers equipped with advanced automation technologies. This paradigm shift is propelling investments in IP-based KVM solutions ensuring secure remote managements and seamless connectivity across industrial facilities.

The deployment of smart control systems driven by government initiatives like "Made in China 2025" also gives rise to a demand for more sophisticated KVM switches. As China’s industrial output surpasses the USD 4 trillion mark, there are continued efforts to drive automation-based efficiency which continues to grow the need for high-performance, IP-based KVM switches. China is anticipated to see substantial growth at a CAGR 6.4% from 2025 to 2035 in the KVM Switch market.

The surge in digital adoption by India’s small and mid-sized enterprises (SME)s are resulting in increased need for there to be cost-effective multi-user KVM switches. As businesses scale IT infrastructure, multi-user KVM switches allow efficient access to multiple servers, resulting in reduced hardware costs and improved space utilization.

Cloud service providers, IT outsourcing, and business process automation require cost-efficient and scalable solutions, and this is fuelling demand for KVM products. Multi-User: These switches helps multiple users control and manage IT assets and can be helpful in co-working spaces, newly established companies and expanding enterprises in India.

IT modernization and better digital infrastructure have been on the cards for the Indian government for some time via programs like "Digital India" and "Make in India." In April, the Ministry of Electronics and Information Technology (MeitY) dedicated USD 1.2 billion towards promoting IT adoption in SMEs.

According to reports, more than 50% of SMEs in India are gradually moving towards a cloud-based infrastructure which is going to drive demand for economical KVM solutions. The need for cost-effective IT management tools are essential for sustaining growth; especially with India’s SME sector accounting for nearly 30% of GDP. India's KVM Switch market is growing at a CAGR of 7.8% during the forecast period.

Hyperscale data centers in the US are growing at a staggering pace, with the increase in demand for cloud computing, use of AI workloads, and adoption of new workloads, combined with increasing data consumption. Such large-scale facilities require high-performance KVM switches to manage thousands of servers.

As Amazon Web Services (AWS), Microsoft Azure and Google Cloud scale their operations, demand for secure, high-bandwidth KVM solutions remains. In this paper, you will learn how these switches provide real-time access to and control over extremely large server infrastructures with minimal downtime and a consolidated view of IT for easy management.

Recently, the USA government approved a USD 65 billion investment plan for digital infrastructure, including data center modernization. Moreover, the National Institute of Standards and Technology (NIST) has issued new cybersecurity guidelines for hyperscale facilities, mandating secure remote access and multi-layered authentication-it are among the factors directly contributing to the upsurge in demand for high-performance KVM solutions.

As of 2023, the USA surpassed 600 hyperscale data centers, solidifying its position as the largest hyperscale center in the world. USA is anticipated to see substantial growth in the KVM Switch market significantly holds dominant share of 74.6% in 2025.

The section contains information about the leading segments in the industry. By Product, the KVM High Performance Switch segment is estimated to grow quickly from the period 2025 to 2035. Additionally, by Industry, IT & telecom segment holds dominant share in 2025.

| Type | CAGR (2025 to 2035) |

|---|---|

| High-Performance KVM Switches | 7.2% |

High-Performance KVM Switches segment is expected to grow at a CAGR of 7.2% from the period 2025 to 2035. As IT infrastructure and data center operations continue to become more complex, demand for high-performance KVM switches has risen. Trained on data until October 2023, UX290-RE Urban Wear: You’ll want a lot of Urban Wear. Ultra-fast KVM solutions are required by organizations managing cloud computing, AI-driven analytics, and financial transactions to evoke seamless operations without delays. This has led to a shift by businesses toward IP-based, multi-user KVM solutions that deliver high-speed data transmission and centralized/server control over a number of different locations.

The worldwide investments by governments are expanding data center infrastructure and modernizing digital infrastructure, which is driving the adoption of the high performance KVM switches. A USD 50 billion investment in next-generation cloud data centers and high-performance computing facilities, announced recently, aims to build out digital infrastructure. In turn, this growing demand for bandwidth KVM solutions is amplified by a 40% increase in hyperscale data center deployments cumulating AI-centric applications. With organizations scaling their IT operations further, high-performance KVM switches will most likely play an important role in providing the ability to rapidly and securely access servers, making them a crucial part in future-proofing digital enterprises.

| Industry | Value Share (2025) |

|---|---|

| IT & Telecom | 24.5% |

The IT & Telecom industry is poised to capture share 24.5% in 2025. The rapid digitalization, cloud computing, and growing demand for high-speed data transmission, the KVM switch market is dominated by the IT & Telecom sector. Data up to October 2019 · Telecom Operators & IT Service Providers need secure, high-bandwidth KVM switches to efficiently manage large-scale network infrastructure.

As 5G technology, edge computing, and AI-driven telecom operations continue to emerge, enterprises are seeking advanced KVM solutions to enhance server performance and remote management capabilities. The IT & Telecom industry has emerged as the leading adopter of KVM switch technology due to the as rapidly increasing demand for secure data centers, network monitoring, and IT administration.

Recently the government established a 75 billion telecom modernization fund to expand 5G, develop cloud infrastructures, and upgrade data centers. Let us scrutinize which KVM switches are likely to have wide adoption and why. In addition to this, more than 80% of global telecom providers have reported an increase in their demand for remote access solutions, which further supports the need for KVM switches in network operations.

IT & Telecom is expected to contribute a large portion of KVM switch used by them, due to growing demand for high speed internet and cloud based services, which require uninterrupted connectivity and high level of infrastructure management.

KVM Switch Market is growing with the significant growth rate of 2021 to 2027. The vendors concentrate on innovative ideas to facilitate integrating IP-based and also high-resolution assistance into the last product to engage the latest IT facilities.

With the growth of cloud computing, remote work and opening data centers, market forces are setting your data in motion. Businesses stand out with enhanced security features, family-friendly access and integration into the modern corporate suite.

Recent Industry Developments in KVM Switch Market

The Global KVM Switch industry is projected to witness CAGR of 5.6% between 2025 and 2035.

The Global KVM Switch industry stood at USD 1,080.6 million in 2025.

The Global KVM Switch industry is anticipated to reach USD 1,721.2 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 6.9% in the assessment period.

The key players operating in the Global KVM Switch Industry ATEN International, Black Box Corporation, Vertiv Group Corp., Belkin International, StarTech.com, Raritan (A Brand of Legrand), Adder Technology, IOGEAR (Kramer Electronics), Guntermann & Drunck GmbH, SmartAVI, Inc.

In terms of product, the segment is segregated into KVM Desktop Switch, KVM-IP Switch, KVM Secure Switch, KVM High Performance Switch and Others.

In terms of Organization Size, the segment is segregated into Small Organization & Mid-sized Organization and Large Organization.

In terms of Industry, it is distributed into BFSI, Healthcare, Industrial, IT & Telecom, Media & Entertainment, Government and Others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.