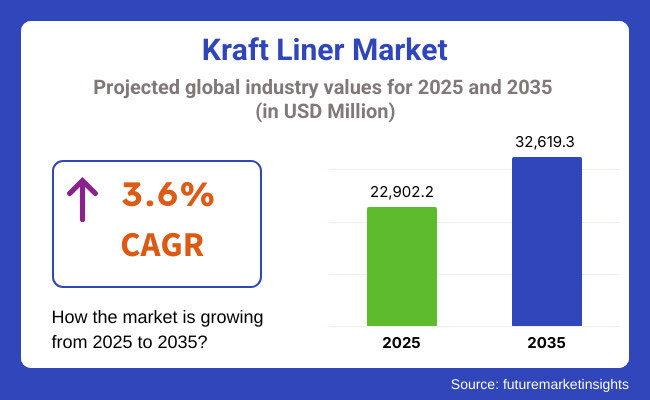

The global kraft liner market is projected to expand steadily from USD 22,902.2 million in 2025 to USD 32,619.3 million by 2035. A compound annual growth rate of 3.6% is expected through this period. The market generated USD 22,106.4 million in revenue in 2024, showing consistent growth driven by evolving packaging needs.

Sustainability has become the key driver for growth. Demand for eco-friendly and recyclable packaging materials has increased amid tightening environmental regulations and heightened consumer awareness. Unbleached kraft liners have emerged as preferred materials due to their mechanical strength and lower chemical processing. Their natural brown color appeals strongly to brands focusing on environmentally conscious packaging, especially in e-commerce, food & beverage, and industrial sectors.

Manufacturers are improving fiber sourcing and reducing chemical treatments to enhance biodegradability and cost efficiency. Reuters reported in early 2025 that brands worldwide are prioritizing packaging solutions that reduce plastic use and carbon footprints. This shift is expected to sustain long-term demand for kraft liners.

Mid-weight kraft liners with basis weights of 200-400 GSM dominate due to their optimal balance between durability and affordability. They provide strength and resistance necessary for safe product transit without excessive shipping costs. This feature attracts consumer goods and electronics industries seeking to protect products while enhancing sustainability profiles.

“Packaging must evolve to support both product protection and sustainability goals,” said Sarah Mitchell, Chief Sustainability Officer at Smurfit Kappa. She added that unbleached kraft liners are vital to delivering this balance in the modern supply chain. Investments in innovation, sustainable fiber sourcing, and strategic partnerships continue to strengthen market prospects. The Kraft Liner market is set for stable growth aligned with global sustainability priorities and expanding end-user sectors.

The below table presents the expected CAGR for the global kraft liner market over several semi-annual periods spanning from 2024 to 2034.

| Particular | Value CAGR |

|---|---|

| H1 | 3.7% (2024 to 2034) |

| H2 | 3.5% (2024 to 2034) |

| H1 | 4.2% (2025 to 2035) |

| H2 | 3.0% (2025 to 2035) |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 3.7%, followed by a slightly higher growth rate of 3.5% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 4.2% in the first half and remain relatively moderate at 3% in the second half. In the first half (H1) the market witnessed a decrease of 50 BPS while in the second half (H2), the market witnessed an increase of 50 BPS.

Unbleached kraft liner dominated the material type segment with a 48% share in 2025, driven by its eco-friendly profile and strength. In basis weight, the 200-400 GSM segment accounted for 56% share, preferred for its balance of durability and cost-efficiency in corrugated packaging.

Unbleached kraft liner accounted for a 48% share of the global kraft liner market in 2025, emerging as the preferred material for sustainable packaging solutions. Produced using virgin wood fibers with minimal chemical processing, this liner offers superior mechanical strength and moisture resistance, ideal for demanding applications in the eCommerce, food & beverage, and industrial sectors.

The natural brown appearance enhances its acceptance among brands promoting eco-friendly and recyclable packaging, supporting global plastic reduction initiatives. Packaging World reported in 2024 that sustainability policies and rising consumer awareness have significantly driven the demand for unbleached kraft liners.

Javier Morales, Vice President of Product Development at WestRock, stated, “Unbleached kraft liner is integral to reducing packaging’s environmental impact,” underscoring its growing role in environmentally responsible packaging strategies. The segment’s demand is expected to remain steady, supported by the packaging industry’s transition toward biodegradable and compostable materials in both developed and emerging markets globally.

The 200-400 GSM basis weight segment captured a 56% share of the kraft liner market in 2025, becoming the most widely used weight class owing to its excellent balance between strength and cost-efficiency. These liners are suitable for manufacturing corrugated boxes and containerboards that require resistance to impact, compression, and stacking loads during storage and transportation.

Industries such as food, beverage, consumer goods, and electronics prefer this weight range to ensure product safety while optimizing shipping weight and cost. Bloomberg highlighted in 2025 that mid-weight kraft liners have expanded market presence due to their dual advantage of protection and sustainability, making them ideal for modern packaging needs.

Anika Gupta, Global Packaging Director at Mondi Group, commented, “Mid-weight kraft liners are a practical choice for brands balancing protection with green goals,” reaffirming the segment’s relevance. Growth in circular economy practices and increasing demand for lightweight yet durable packaging will further sustain this segment’s market leadership.

Increasing Demand for Environmentally Friendly and Recyclable Packaging

The Kraft Liner Industry is being spurred by the shift globally towards biodegradable and recyclable packaging. Many industries, such as food & beverage, logistics, or e-commerce, use green pulp to reduce their carbon footprint and remain compliant with many environmental legislations. Kraft liner, made from virgin or recycled pulp, is recyclable and biodegradable, and hence an ideal alternative to plastic packaging.

International governments have imposed stringent policies to control plastic waste, thus compelling firms to abandon paper packaging. Furthermore, customers are more environmentally aware, thus compelling more demand for green packaging options.

Kraft Liner Industry is also increasing on the back of other drivers, like leading firms like Apple, which are embracing Kraft liner-based cartons and boxes. Circular economy initiatives are also a major driving force for manufacturers to invest in high-quality recyclable kraft liners that allow for sustainable manufacturing and waste control.

Expansion of the E-Commerce and Retail Industries

One of the main drivers of the Kraft Liner Market is the growth in retailing and e-commerce. Lightweight, tough, and affordable packaging materials are increasingly demanded due to internet purchases in order to protect the products during transportation.

In an effort to provide corrugated boxes and shipping boxes with strength, flexural properties, and sustainability when they are packing heavy and fragile items, kraft liner is extensively employed. Kraft liner packaging is being adopted by large e-commerce players such as Amazon, Alibaba, and Walmart to achieve sustainability objectives and cut down on the use of plastic. There is also a growing demand for sustainable and safe packaging, with home delivery options increasing.

Unpredictable Nature of Raw Material Prices

That is the most severe among all of the concerns in the Kraft Liner Market: raw material price volatility, and they are recycled paper fibers and wood pulp. All Kraft liner manufacturers are based on forest products, and any advantages from the forest protection laws, climate change, or a shortage in the supply would only drive up the prices.

Besides, increased demand for recycled paper products overburdens recycling plants and, at times, results in a scarcity of quality recycled fibers. Increasing the cost of energy and transport affects the cost of production and thus raises the high cost of kraft liner to manufacturers and consumers. These fluctuations in costs render it almost impossible for firms to sustain prices, to the disadvantage of profit margins. In an attempt to bypass this issue, firms invest in substitute raw materials and improved recycling technology, yet cost fluctuations are still a great disincentive to market growth.

Tier 1 companies comprise market leaders capturing significant market share in global market. These market leaders are characterized by high production capacity and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of services, including recycling and manufacturing, utilizing the latest technology and meeting the regulatory standards, providing the highest quality. Prominent companies within tier 1 include International Paper Company, WestRock Company, Georgia-Pacific LLC, Packaging Corporation of America (PCA), and Billerud Americas Corporation.

Tier 2 companies include mid-size players having a presence in specific regions and highly influencing the local market. These are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance, but may not have advanced technology and a wide global reach. Prominent companies in tier 2 include Twin Rivers Paper Company, Monadnock Paper Mills, Inc., Cascades Inc., Green Bay Packaging Inc., DS Smith Plc, Klabin S.A., Visy Industries, Paper Australia Pty Ltd, OJI Fibre Solutions, Nine Dragons Paper Holdings Ltd, Lee & Man Paper Manufacturing Ltd, Shandong Bohui Paper Industry Co., Ltd, Dongguan Jianhui Paper Co., Ltd, Zhejiang Jingxing Paper Joint Stock Co., Ltd, Oji Holdings Corporation.

Tier 3 includes the majority of small-scale companies operating at the local level and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment. They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The section below covers the future forecast for the Kraft liner market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia, the Pacific, Western Europe, Eastern Europe and MEA is provided.The USA is expected to account for a CAGR of 2.5% through 2035. In Europe, Spain is projected to witness a CAGR of 3.2% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 2.5% |

| Germany | 2.1% |

| China | 4.5% |

| UK | 2.0% |

| Spain | 3.2% |

| India | 4.7% |

| Canada | 2.3% |

Stricter government policies on green packaging in the USA, it is also expected to drive the demand for kraft liner products. As part of the increased efforts by the USA Environmental Protection Agency (EPA) and state agencies to encourage the use of biodegradable and recyclable packaging materials, California, New York, and Washington states have banned the use of single-use plastic packaging materials and plastic bags, and together boost kraft liner-based solution demand.

Many companies have also started focusing on eco-friendly packaging material because of the support for the growth of the e-commerce sector, such as Walmart, McDonald's and Coca-Cola. It has also created another push for the Kraft liner market in America. That, along with further attempts to go zero-waste by companies, predicts an increase in the use of kraft liner-based corrugated boxes and shipping materials.

The industrial and automotive packaging sectors have been on dynamic expansion in Germany and have significant influence in the kraft liner market. Kraft liner is another widely applied corrugated packaging material that is very famous due to its strength, durability, and green applications for exporting and transporting heavy commodities. In addition, huge importance given to sustainability and clearly defined recycling regulations such as the Packaging Act (VerpackG) has highly driven the German manufacturers to adopt high-grade recyclable kraft liner material.

In addition, expansion of logistics and machinery industry sectors has been another force driving Kraft liner based cartons and protective packaging. As Germany is at the forefront of green industrial packaging, demand for kraft liner-based packaging material for the packaging of automotive, machinery, and electronics should continue to rise.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 22.90 billion |

| Projected Market Size (2035) | USD 32.61 billion |

| CAGR (2025 to 2035) | 3.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand tons for volume |

| Product Type (Segment 1) | Bleached Kraft Liner, Unbleached Kraft Liner |

| Basis Weight (Segment 2) | Up to 200 GSM, 200 to 400 GSM, Above 400 GSM |

| Application (Segment 3) | Corrugated Sheets, Corrugated Boxes, Container Board or Solid Board |

| End Use (Segment 4) | Food, E-commerce Companies, Food and Beverage, Logistics Providers, Industrial Applications |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Germany, France, United Kingdom, Italy, Russia, China, Japan, South Korea, India, GCC Countries, South Africa |

| Key Players influencing the Kraft Liner Market | International Paper Company, WestRock Company, Georgia-Pacific LLC, Packaging Corporation of America (PCA), Billerud Americas Corporation, Twin Rivers Paper Company, Monadnock Paper Mills, Inc., Cascades Inc., Green Bay Packaging Inc., DS Smith Plc |

| Additional Attributes | Dollar sales, share by unbleached kraft liner, Higher demand from corrugated box production, Growth in e-commerce packaging, Rising use in logistics and containerboard manufacturing, Market shifting towards sustainable and lightweight kraft liner materials, Asia Pacific and Latin America projected as fast-growing regions for food and industrial packaging applications, Companies focusing on recyclable and eco-friendly kraft liner production for circular economy practices. |

The market is categorized into bleached and unbleached kraft liner.

The segmentation includes kraft liners with a basis weight of up to 200 GSM, 200 to 400 GSM, and above 400 GSM.

The market covers applications such as corrugated sheets, corrugated boxes, and container board or solid board.

The market serves multiple industries, including food, which is further divided into E-commerce companies, food and beverage, logistics providers and industrial applications.

Key Countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East & Africa are covered.

Table 01: Global Market Value (US$ Million) and Volume (‘000 Tonnes) Analysis by Product, 2014H-2033F

Table 02: Global Market Value (US$ Million) and Volume (‘000 Tonnes) Analysis by Basis Weight, 2014H-2033F

Table 03: Global Market Value (US$ Million) and Volume (‘000 Tonnes) Analysis by Application, 2014H-2033F

Table 04: Global Market Value (US$ Million) Analysis by End Use, 2014H-2033F

Table 05: Global Market Volume (‘000 Tonnes) Analysis by End Use, 2014H-2033F

Table 06: Global Market Value (US$ Million) and Volume (‘000 Tonnes) Analysis by Region, 2014H-2033F

Table 07: North America Market Value (US$ Million) Analysis by Taxonomy, 2014H-2033F

Table 08: North America Market Volume (‘000 Tonnes) Analysis by Taxonomy, 2014H-2033F

Table 09: North America Market Value (US$ Million) Analysis by End Use, 2014H-2033F

Table 10: North America Market Volume (‘000 Tonnes), Analysis by End Use, 2014H-2033F

Table 11: Latin America Market Value (US$ Million) Analysis by Taxonomy, 2014H-2033F

Table 12: Latin America Market Volume (‘000 Tonnes) Analysis by Taxonomy, 2014H-2033F

Table 13: Latin America Market Value (US$ Million) Analysis by End Use, 2014H-2033F

Table 14: Latin America Market Volume (‘000 Tonnes), Analysis by End Use, 2014H-2033F

Table 15: East Asia Market Value (US$ Million) Analysis by Taxonomy, 2014H-2033F

Table 16: East Asia Market Volume (‘000 Tonnes) Analysis by Taxonomy, 2014H-2033F

Table 17: East Asia Market Value (US$ Million) Analysis by End Use, 2014H-2033F

Table 18: East Asia Market Volume (‘000 Tonnes), Analysis by End Use, 2014H-2033F

Table 19: South Asia & Pacific Market Value (US$ Million) Analysis by Taxonomy, 2014H-2033F

Table 20: South Asia & Pacific Market Volume (‘000 Tonnes) Analysis by Taxonomy, 2014H-2033F

Table 21: South Asia & Pacific Market Value (US$ Million) Analysis by End Use, 2014H-2033F

Table 22: South Asia & Pacific Market Volume (‘000 Tonnes), Analysis by End Use, 2014H-2033F

Table 23: Western Europe Market Value (US$ Million) Analysis by Taxonomy, 2014H-2033F

Table 24: Western Europe Market Volume (‘000 Tonnes) Analysis by Taxonomy, 2014H-2033F

Table 25: Western Europe Market Value (US$ Million) Analysis by Country, 2014H-2033F

Table 26: Western Europe Market Value (‘000 Tonnes) Analysis by Country, 2014H-2033F

Table 27: Western Europe Market Value (US$ Million) Analysis by End Use, 2014H-2033F

Table 28: Western Europe Market Volume (‘000 Tonnes) Analysis by End Use, 2014H-2033F

Table 29: Eastern Europe Market Value (US$ Million) Analysis by Taxonomy, 2014H-2033F

Table 30: Eastern Europe Market Volume (‘000 Tonnes) Analysis by Taxonomy, 2014H-2033F

Table 31: Eastern Europe Market Value (US$ Million) Analysis by Country, 2014H-2033F

Table 32: Eastern Europe Market Value (‘000 Tonnes) Analysis by Country, 2014H-2033F

Table 33: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2014H-2033F

Table 34: Eastern Europe Market Volume (‘000 Tonnes) Analysis by End Use, 2014H-2033F

Table 35: Central Asia Market Value (US$ Million) Analysis by Taxonomy, 2014H-2033F

Table 36: Central Asia Market Volume (‘000 Tonnes) Analysis by Taxonomy, 2014H-2033F

Table 37: Central Asia Market Value (US$ Million) Analysis by End Use, 2014H-2033F

Table 38: Central Asia Market Volume (‘000 Tonnes) Analysis by End Use, 2014H-2033F

Table 39: Russia & Belarus Market Value (US$ Million) Analysis by Taxonomy, 2014H-2033F

Table 40: Russia & Belarus Market Volume (‘000 Tonnes) Analysis by Taxonomy, 2014H-2033F

Table 41: Russia & Belarus Market Value (US$ Million) Analysis by End Use, 2014H-2033F

Table 42: Russia & Belarus Market Volume (‘000 Tonnes) Analysis by End Use, 2014H-2033F

Table 43: Balkan & Baltic Countries Market Value (US$ Million) Analysis by Taxonomy, 2014H-2033F

Table 44: Balkan & Baltic Countries Market Volume (‘000 Tonnes) Analysis by Taxonomy, 2014H-2033F

Table 45: Balkan & Baltic Countries Market Value (US$ Million) Analysis by End Use, 2014H-2033F

Table 46: Balkan & Baltic Countries Market Volume (‘000 Tonnes) Analysis by End Use, 2014H-2033F

Table 47: MEA Market Value (US$ Million) Analysis by Taxonomy, 2014H-2033F

Table 48: MEA Market Volume (‘000 Tonnes) Analysis by Taxonomy, 2014H-2033F

Table 49: MEA Market Value (US$ Million) Analysis by End Use, 2014H-2033F

Table 50: MEA Market Volume (‘000 Tonnes) Analysis by End Use, 2014H-2033F

Figure 01: Global Market Share Analysis by Product, 2014H, 2023E & 2033F

Figure 02: Global Market Attractiveness Analysis by Product, 2023E-2033F

Figure 03: Global Market Share Analysis by Basis Weight, 2014H,2023E& 2033F

Figure 04: Global Market Attractiveness Analysis by Basis Weight, 2023E-2033F

Figure 05: Global Market Share Analysis by Application, 2014H,2023E& 2033F

Figure 06: Global Market Attractiveness Analysis by Application, 2023E-2033F

Figure 07: Global Market Share Analysis by End Use, 2014H,2023E& 2033F

Figure 08: Global Market Attractiveness Analysis by End Use, 2023E-2033F

Figure 09: Global Market Share Analysis by Region, 2014H,2023E& 2033F

Figure 10: Global Market Attractiveness Analysis by Region, 2023E-2033F

Figure 11: North America Market Share Analysis by Country (2022A & 2033F)

Figure 12: North America Market Share Analysis by Basis Weight (2022A & 2033F)

Figure 13: North America Market Share Analysis by Product (2022A & 2033F)

Figure 14: North America Market Share Analysis by Application (2022A & 2033F)

Figure 15: North America Market Share Analysis by End Use, 2022A

Figure 16: Latin America Market Share Analysis by Country (2022A & 2033F)

Figure 17: Latin America Market Share Analysis by Basis Weight (2022A & 2033F)

Figure 18: Latin America Market Share Analysis by Product (2022A & 2033F)

Figure 19: Latin America Market Share Analysis by Application (2022A & 2033F)

Figure 20: Latin America Market Share Analysis by End Use, 2022A

Figure 21: East Asia Market Share Analysis by Country (2022A & 2033F)

Figure 22: East Asia Market Share Analysis by Basis Weight (2022A & 2033F)

Figure 23: East Asia Market Share Analysis by Product (2022A & 2033F)

Figure 24: East Asia Market Share Analysis by Application (2022A & 2033F)

Figure 25: East Asia Market Share Analysis by End Use, 2022A

Figure 26: South Asia & Pacific Market Share Analysis by Country (2022A & 2033F)

Figure 27: South Asia & Pacific Market Share Analysis by Basis Weight (2022A & 2033F)

Figure 28: South Asia & Pacific Market Share Analysis by Product (2022A & 2033F)

Figure 29: South Asia & Pacific Market Share Analysis by Application (2022A & 2033F)

Figure 30: South Asia & Pacific Market Share Analysis by End Use, 2022A

Figure 31: Western Europe Market Share Analysis by Country (2022A)

Figure 32: Western Europe Market Share Analysis by Basis Weight (2022A & 2033F)

Figure 33: Western Europe Market Share Analysis by Product (2023A & 2033F)

Figure 34: Western Europe Market Share Analysis by Application (2022A & 2033F)

Figure 35: Western Europe Market Share Analysis by End Use, 2022A

Figure 36: Eastern Europe Market Share Analysis by Country (2022A)

Figure 37: Eastern Europe Market Share Analysis by Basis Weight (2022A & 2033F)

Figure 38: Eastern Europe Market Share Analysis by Product (2023A & 2033F)

Figure 39: Eastern Europe Market Share Analysis by Application (2022A & 2033F)

Figure 40: Eastern Europe Market Share Analysis by End Use, 2022A

Figure 41: Central Asia Market Share Analysis by Country (2022A & 2033F)

Figure 42: Central Asia Market Share Analysis by Basis Weight (2022A & 2033F)

Figure 43: Central Asia Market Share Analysis by Product (2022A & 2033F)

Figure 44: Central Asia Market Share Analysis by Application (2022A & 2033F)

Figure 45: Central Asia Market Share Analysis by End Use, 2022A

Figure 46: Russia & Belarus Market Share Analysis by Country (2022A & 2033F)

Figure 47: Russia & Belarus Market Share Analysis by Basis Weight (2022A & 2033F)

Figure 48: Russia & Belarus Market Share Analysis by Product (2022A & 2033F)

Figure 49: Russia & Belarus Market Share Analysis by Application (2022A & 2033F)

Figure 50: Russia & Belarus Market Share Analysis by End Use, 2022A

Figure 51: Balkan & Baltic Countries Market Share Analysis by Country (2022A & 2033F)

Figure 52: Balkan & Baltic Countries Market Share Analysis by Basis Weight (2022A & 2033F)

Figure 53: Balkan & Baltic Countries Market Share Analysis by Product (2022A & 2033F)

Figure 54: Balkan & Baltic Countries Market Share Analysis by Application (2022A & 2033F)

Figure 55: Balkan & Baltic Countries Market Share Analysis by End Use, 2022A

Figure 56: MEA Market Share Analysis by Country (2022A & 2033F)

Figure 57: MEA Market Share Analysis by Basis Weight (2022A & 2033F)

Figure 58: MEA Market Share Analysis by Product (2022A & 2033F)

Figure 59: MEA Market Share Analysis by Application (2022A & 2033F)

Figure 60: MEA Market Share Analysis by End Use, 2022A

The global kraft liner industry is projected to witness CAGR of 3.6% between 2025 and 2035.

The global kraft liner industry stood at USD 22,902.2 million in 2025.

Global kraft liner industry is anticipated to reach USD 32,619.3 million by 2035 end.

East Asia is set to record a CAGR of 4.7% in assessment period.

The key players operating in the global kraft liner industry include International Paper Company, WestRock Company, Georgia-Pacific LLC, Packaging Corporation of America (PCA), Billerud Americas Corporation.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.