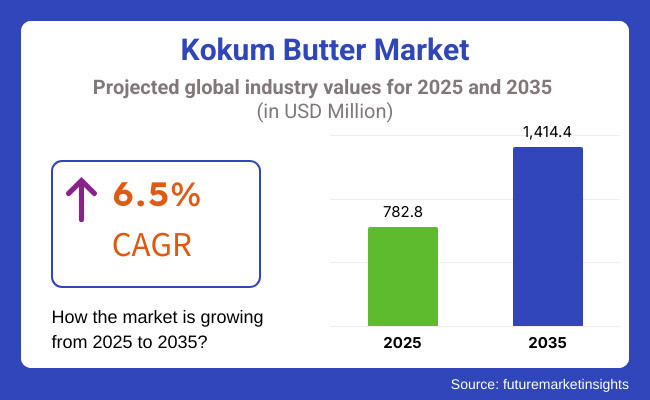

The global kokum butter market is set to reach USD 782.8 million in 2025. The industry is expected to grow at 6.5% CAGR from 2025 to 2035 and depict USD 1,414.4 million by 2035.

Kokum butter is an emollient, vegetable fat from the seeds of Garcinia indica, that grows in India. Famous for its light, non-greasy texture, kokum butter is rich with essential fatty acids and antioxidants, making it an active ingredient in hair and skincare formulations. It adds deep moisture, improves skin elasticity and aids dry skin; thus it is widely used in lotions, balms and creams. As a natural and skin-friendly alternative to synthetic moisturizers, kokum butter is a popular ingredient in cosmetics, pharmaceuticals, and toiletries owing to its intrinsic healing characteristics.

The industry is mainly driven by increasing consumer demand for plant-based and natural ingredients, especially in cosmetics, personal care and food industry. This trend by manufacturers is positively impacting the industry as manufacturers are expanding production capacities or launching new product variants to meet changing consumer preferences.

Industry-leading companies have established large-scale manufacturing plants, which can improve the efficiency of supply and meet the demand of global users. A number of manufacturers are targeting the environmentally-conscious consumers by offering organic and sustainably sourced kokum butter. This evolution has motivated the growth of fair-trade-accredited and environmentally conscious products, which has further solidified their industry power.

Skincare formulations use kokum butter increasingly owing to its non-comedogenic and deep moisturizing properties. This has led companies to expand the product line by incorporating kokum butter in creams, lotions, lip balms, and hair care products. Furthermore, it is increasingly utilized in the food industry as a cocoa butter substitute, thus propelling its overall demand.

Another major factor fueling industry growth is the use of natural and chemical-free ingredients. Consumers are searching for plant-based, non-GMO, and preservative-free products, and now manufacturers are working to focus on transparency in sourcing and processing as well.

Explore FMI!

Book a free demo

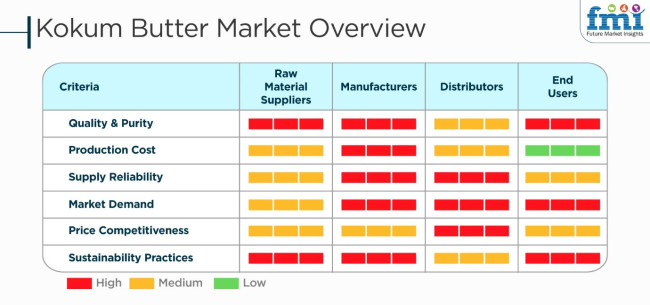

The kokum butter business has different stakeholders, including raw material suppliers, manufacturers, distributors, and end users. Raw material suppliers care about quality, purity, and sustainability in order to provide high-quality kokum seeds for butter extraction. Manufacturers care about production cost, supply reliability, and quality in order to provide premium-grade butter to be used in cosmetics, skincare, and pharmaceuticals.

Distributors focus on price competitiveness and industry demand to provide perpetual supply chains and effectively service consumers. End consumers, such as cosmetic companies, food processors, and pharmaceutical firms, focus on quality, sustainability, and affordability to keep up with the increasing demand for plant-based, natural ingredients.

The rising awareness of the product’s benefits, including its deeply moisturizing and non-greasy properties, has fueled its industry growth in the skincare and wellness industries. Ensuring consistent quality, sustainability, and effective distribution strategies will be crucial for the continued expansion of this industry.

The accelerated half-yearly growth rate of the global industry in terms of (CAGR) during the current year (2025), and the expected forecast period (2024 to 2034) is outlined in the table below. The analysis shows changes in the patterns of growth, and also provides useful data about revenue realization trends and overall industry direction. H1 or first half of the year is January to June, and H2 or second half is July to December.

| Particular | Value CAGR |

|---|---|

| 2024 to 2034 (H1) | 6.0% |

| 2024 to 2034 (H2) | 6.4% |

| 2025 to 2035 (H1) | 6.2% |

| 2025 to 2035 (H2) | 6.6% |

Throughout H1 of the decade 2025 to 2035, the industry is projected to see a growth of 6.0% CAGR, in H2 of the same decade, the growth observed is likely to be better at 6.4%. The next period, H1 2025 to H2 2035, sees the CAGR climb, to 6.2% in the first half and then accelerate once again to 6.6% in the second half. The industry growth for H1 was 20 BPS and same 20 BPS for H2.

Rise of Functional and Therapeutic Butter Applications

The product is increasingly being used for its therapeutic benefits, beyond just skincare and cosmetics. It is now being incorporated into specialized pharmaceutical and nutraceutical formulations due to its high concentration of stearic acid and antioxidant properties. The industry is witnessing a surge in demand from consumers seeking products that offer both nourishment and medicinal benefits, particularly for skin repair, anti-inflammatory treatments, and wound healing.

Manufacturers are catering to this trend by developing kokum butter-based functional skincare solutions, including medicated balms and therapeutic lotions for eczema and psoriasis relief. The increasing use of the product in Ayurvedic and traditional medicine formulations is also boosting its appeal. Companies are investing in clinical research and product development to highlight the medicinal potential of the product, creating new avenues for industry expansion and differentiation.

Supply Chain Realignment to Overcome Seasonal Limitations

The product production is highly dependent on seasonal fruit availability, which has historically caused fluctuations in supply and pricing. To counteract these challenges, manufacturers are focusing on supply chain realignment by establishing long-term partnerships with kokum cultivators and implementing controlled storage solutions.

Investments in processing technologies, such as cold pressing and extended shelf-life preservation methods, are helping reduce raw material wastage and improve year-round availability. Additionally, contract farming initiatives and co-operative models in India, where kokum is primarily cultivated, are ensuring a steady and sustainable supply chain.

Manufacturers are also looking at alternative sourcing regions and diversifying procurement strategies to mitigate the risk of shortages. This shift is improving price stability, enhancing product availability for global buyers, and ensuring a steady industry expansion despite seasonal supply constraints.

Increasing Use in Clean-Label and Minimal-Ingredient Formulations

With the growing consumer preference for minimal and chemical-free formulations, the product is gaining traction in the personal care and food industries as a key ingredient in clean-label products. Manufacturers are promoting its purity, emphasizing the absence of synthetic stabilizers, preservatives, or artificial fragrances.

This trend is particularly impacting premium skincare brands, which are developing formulations with only a few core ingredients, using the product as a base due to its natural emollient and preservative properties. The food industry is also leveraging this trend by incorporating the product as a natural fat replacement in dairy-free chocolates and confectionery.

Companies are investing in transparent sourcing, third-party certifications, and product labeling that highlights its single-ingredient purity. The push for ultra-clean formulations is making the product a preferred choice among health-conscious consumers looking for natural alternatives in both skincare and food products.

Growing Influence of Premiumization in the Industry

The global kokum butter market is witnessing a strong push toward premiumization, as high-end beauty and personal care brands position kokum butter-based products in the luxury skincare segment. This trend is driven by the rising disposable income of consumers seeking superior-quality, exotic ingredients with unique properties. Manufacturers are targeting this industry by refining the product extraction processes to maintain maximum purity, enhancing its texture and absorption capabilities.

Premium product lines featuring the product are being marketed with high-end packaging, branding, and exclusivity, appealing to consumers willing to pay a premium for superior results. Additionally, the luxury chocolate and gourmet food industry is increasingly using the product as a high-end cocoa butter substitute, further solidifying its place in the premium product segment. This shift is encouraging manufacturers to emphasize sourcing transparency, ethical harvesting, and quality differentiation to maintain a competitive edge.

In the period between 2020 and 2024, global sales of the product owe to consumer demand for plant-based, non-comedogenic moisturizers. Demand for chemical-free cosmetics and natural skincare solutions positions the product as a premium ingredient for lotions, balms, and creams. In response to meeting demand, producers have increased production and initiated sustainable practices of procurement to ensure continued supply of the ethically sourced product.

The growing popularity of organic and Ayurvedic beauty care products, wherein the product is appreciated due to its nutrient-rich nature, will drive the industry growth through 2035. Clean-label formulation and animal-free cosmetics shall further drive uptake among high-end personal care firms. The industry for functional food will see high adoption of the product by plant-based as well as health-regulated offerings. As sustainability and best practice in sourcing continue to grow in popularity, the product dominance will also grow.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growth in usage of the product in cosmetics and personal care products driven by its emollient and anti-aging benefits. | AI-based development of the product-based skincare products with improved bioavailability and multi-beneficial effects. |

| More usage in pharmaceuticals and nutraceuticals for antioxidant and anti-inflammatory properties. | Expansion into personalized wellness products, bio-enhanced supplements, and targeted therapeutic applications. |

| Growth in organic and sustainably sourced product driven by clean-label and ethical consumer preferences. | Blockchain-backed traceability, carbon-neutral extraction, and regenerative farming practices will dominate sourcing. |

| Food industry adopted the product as a plant-based alternative to cocoa butter in chocolates and confectionery. | Precision fermentation and blend fat formulations will bring texture, taste, and nutrition content for non-traditional foods at a good level. |

| There were challenges in keeping up with supply chain efficiency and raw material sourcing. This affected availability and pricing. | Supply chain optimization using AI and automated processing will improve industry stability. |

| Limited awareness outside regional markets restricted global expansion. | Increased international adoption through digital marketing, influencer-driven campaigns, and sustainability branding. |

The threat in the business is climate dependency and agricultural changes. Kokum (Garcinia indica) is largely cultivated in India, particularly in the Western Ghats. Through a series of conditions, such as weather, deforestation, and soil degradation, the yield and availability which in turn leads to supply deficits can be influenced, thus leading to an increase in the cost of raw materials.

The process of extracting the product involves the multi-step that is carried out on kokum seeds, which requires careful handling; thus, it is a bit complicated. Any problems like poor infrastructure, labor shortages, or export restrictions in harvesting, processing, or delivering which can affect industry stability will lead to disruptions.

Regulatory compliance and quality assurance are the two main factors contributing to the industry. Because it is often used in cosmetics, personal care, and food applications, it has to meet international safety standards such as that of the FDA (USA), EFSA (Europe), and BIS (India). Problems as in the case of microbial contamination, inadequate extraction methods, or non-conformance to organic and fair-trade certifications can result in regulatory confrontations and reputation hazards.

The need for plant-based butters is higher, thus adulteration risks and industry competition among suppliers are climbing up. Low-quality or mixture kokum butter is offered by certain vendors, which in turn affects the trust of the consumers and the effectiveness of the product. Therefore, to be in the industry, suppliers need to maintain high-quality products, have proper permits, and organize third-party inspections that are essential to continue being competitive.

The creams segment growth is being driven by the increasing consumer preference for plant-based, chemical-free skincare. This deep nourishing, non comedogenic and fast absorbing butter can be superior alternative to shea and cocoa butter. Touted as a healer of dry, sensitive and mature skin, it has become a signature ingredient in high-end moisturizing creams.

Harnessing those anti-inflammatory and antioxidant properties, manufacturers are including the product into clean-label, dermatologist-approved formulations. Brands like Kiehl’s, Forest Essentials and L’Occitane are formulating organic, preservative-free options as fears grow over synthetic emulsifiers and petrochemical-based moisturizers.

The health-conscious population has dramatically increased their purchase of organic skin care, cruelty-free products, and sustainable alternatives in the beauty segment have positively complemented to the mass adoption of the product in the formulation of personal care and beauty products. Now, its deep hydration, non-comedogenic property and anti-aging benefits have put the product in the limelight as an alternative to shea and cocoa butter in moisturizers, body butters, and hair-care products.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 22.6% |

| China | 10.4% |

| Germany | 6.2% |

The USA industry growth is due to the fact that the demand for organic and natural personal care products is very high, and people tend to use plant-based products more and more. The USA industry also experienced growth in the application of the product in skincare products with its moisturizing and emollient characteristics. The product is also used in the food industry as a cocoa butter replacement in confectionery items, targeting health-oriented consumers.

The established distribution channels of the country and the presence of prominent manufacturers of cosmetics also add to the expansion of the industry. USA kokum butter industry is set to maintain its growth, fueled by persistent trends in natural product adoption and innovation in areas of application. FMI believes that the USA industry will grow at 22.6% CAGR during the study period.

USA Growth Drivers

| Critical Drivers | Details |

|---|---|

| Natural Product Demand | Growing consumer preference for plant-based personal care and skincare products. |

| Food Industry Applications | Use of the product as a healthier alternative to cocoa butter in chocolates. |

| Established Distribution | Strong retail and e-commerce networks supporting industry growth. |

| Presence of Major Manufacturers | Leading cosmetic firms incorporating the product in skincare products. |

The Chinese industry is growing at a fast pace with an estimated CAGR of 10.4% during 2025 to 2035, cites FMI. This strong growth is driven by the growing middle class and higher consumer awareness for natural and organic personal care products.

Chinese consumers are increasingly becoming health-conscious, and hence, there is growing demand for skin care products that have natural ingredients such as the product. The local cosmetics sector is reacting to this by infusing the product into the different formulations like lotions, creams, and lip balms. Additionally, the government push for sustainable and green products tracks with the expanding consumer demand for natural ingredients and thus drives growth in the industry further.

Drivers of Growth in China

| Top Drivers | Information |

|---|---|

| Rising Middle Class | Increased disposable incomes driving demand for premium skincare. |

| Move to Natural Ingredients | Greater consumer preference for organic and plant-based products. |

| Growth in Domestic Cosmetics | Local brands incorporating the product into creams, lip balms, and lotions. |

| Government Support for Sustainability | Policies promoting eco-friendly and naturally sourced cosmetic ingredients. |

In Japan, the industry is on an upward trend owing to the rising demand for high-quality, multifunctional ingredients in the skincare and beauty industries. Japanese consumers have traditionally valued skin health and are shifting more toward products that are both effective and delicate, qualities that the product embodies. Its dense concentration of antioxidants and essential fatty acids makes the ingredient a valuable addition to routines, especially those for dry and sensitive skin products.

Growth Drivers in Japan

| Top Drivers | Information |

|---|---|

| Focus on High-Quality Skincare | Japanese consumers prioritize premium skincare products with safe, effective ingredients, leading to increased interest in the product. |

| Preference for Natural Ingredients | A growing demand for skincare products made with natural, plant-based ingredients like kokum butter, which is gentle on the skin. |

The German industry growth is fueled by a well-developed cosmetics sector and a consumer demographic that places emphasis on high-quality, natural skin care products. German producers have a reputation for strict quality standards, and the addition of the product to product lines demonstrates the dedication to fulfilling consumer requirements for effective, natural ingredients.

The trend of sustainable and ethically sourced materials is also good for the industry, with the product being one that meets these standards. The move by the European Union to encourage the use of safe and natural cosmetics also favors including kokum butter in products. FMI believes that the German industry is expected to grow at 6.2% CAGR throughout the study period.

Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| Strong Cosmetics Industry | Presence of well-established skincare and personal care brands. |

| High Consumer Standards | Preference for high-quality, effective natural skincare ingredients. |

| Sustainable Product Demand | Growth in ethically sourced and environmentally friendly ingredients. |

| EU Regulations on Natural Cosmetics | Policies favoring the use of safe, plant-based ingredients in products. |

The expansion of the industry in the UK is due to a growing consumer interest in natural and sustainable skincare ingredients. As consumers are becoming more eco-friendly, they are looking for products that are in line with their values of sustainability and ethical sourcing.

The product, which has moisturizing and skin-healing benefits, is becoming popular as a substitute for synthetic chemicals in personal care products. Moreover, the increasing popularity of plant-based skincare products, coupled with the movement toward cruelty-free and vegan formulations, is boosting the demand for the product.

Growth Drivers in UK

| Key Drivers | Details |

|---|---|

| Health and Wellness Trends | Growing consumer focus on overall well-being, including using natural and nourishing ingredients in skincare. |

| Rising Demand for Organic Products | Increasing preference for organic and chemical-free products as consumers become more health-conscious. |

With a significant push for sustainable and non-chemical products, the major players are increasing their production capacities while investing in R&D for the development of high-quality, value-added formulations.

The industry is now becoming even more competitive with the entrance of new manufacturers dealing with organic and ethically sourced kokum butter. Industrial players are thereby focusing on product innovation, sustainability, and strategic collaboration to widen their industry share.

Companies with a strong supply chain, efficient sourcing, and compliance with internationally recognized quality standards, are gaining a competitive edge. In addition to this growth strategy, companies could choose to establish business in strikingly new markets and approach specifically strong segments within their markets, clean beauty and functional foods being cases in point.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| AAK | 14-18% |

| Bunge Loders Croklaan | 10-14% |

| Wilmar International | 9-13% |

| Fuji Oil | 8-12% |

| Olam International | 6-10% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| AAK | Specializes in sustainable and high-quality kokum butter for cosmetics and food industries, focusing on eco-friendly sourcing. |

| Bunge Loders Croklaan | Provides high-quality plant-based butter substitutes, such as the product, for confectionery and skincare use. |

| Wilmar International | Manufactures the product for industrial and consumer markets with strict quality compliance and sustainable practices. |

| Fuji Oil | Innovates with kokum butter-based products for chocolate, bakery, and personal care applications. |

| Olam International | A major supplier of ethically sourced butter, catering to food and cosmetic manufacturers globally. |

Key Company Insights

AAK (14-18%)

Leading producer of plant oils and butter investing in sustainable production of the product for food and cosmetic applications.

Bunge Loders Croklaan (10-14%)

Specializes in plant-based alternatives to butter, such as the product, for the confectionery and personal care industries.

Wilmar International (9-13%)

Consolidates its position through vertically integrated supply chains to produce high-quality product.

Fuji Oil (8-12%)

Spiviers product growth in the confectionery and bakery sectors with the use of kokum butter as a product driver.

Olam International (6-10%)

Placed high emphasis on ethical practices and sustainability for the global food and personal care markets.

Other Key Players (35-45% Combined)

The industry is set to reach USD 782.8 million in 2025.

The market is projected to reach USD 1,414.4 million by 2035.

Who are the major kokum butter companies?

The USA, set to depict 22.6% CAGR during the study period, is poised for fastest growth.

They are widely used in creams.

The industry is segmented into creams, skin lotions, balms, shaving creams, conditioners, lipsticks, body butters, moisturizing creams, hair care products, soaps, toiletries, confectionery, and bakery products.

The industry caters to the pharmaceutical industry, cosmetic industry, and other end uses.

The industry spans North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.