The global kitchen hood market is expected to grow at a CAGR of between 2025 and 2035, driven by factors such as increased consumer demand for active ventilation solutions, growing penetration of smart kitchen appliances, and advanced air purification technologies.

Kitchen hoods, also known as exhaust hoods, are commonly installed in residential and commercial kitchens to capture smoke, odors, and grease arising from cooking, thus promoting better air quality and a more pleasant cooking experience.

The next-generation market is driven by hoods that are energy-efficient and noise-reducing, as well as sensor-based and self-cleaning kitchen hood systems. Further, growing trend of modular kitchens, rising investments in IoT-enabled appliances, and increasing regulatory emphasis on improving indoor air quality standards are also some of the factors that lead to steady evolution of the industry.

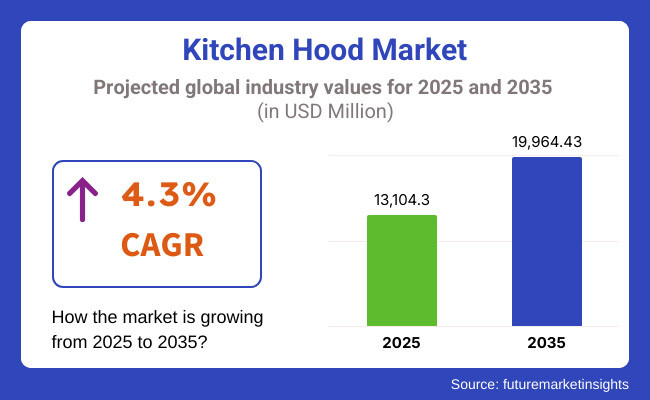

In 2025, the kitchen hood market was valued at approximately USD 13,104.30 million. By 2035, it is projected to reach USD 19,964.43 million, reflecting a compound annual growth rate (CAGR) of 4.3%. The growth of this market is attributed to increasing adoption of ductless and energy-efficient kitchen hoods, rising consumer preference for sleek and smart designs, and expanding investments in next-generation ventilation systems.

The integration of AI-driven air purification, enhanced filtration technologies, and cost-effective manufacturing techniques is further supporting market expansion. Additionally, the development of eco-friendly, touchless, and voice-controlled kitchen hoods is playing a crucial role in market penetration and industry adoption.

North America is the largest regional market for kitchen hoods due to high demand for luxury kitchen appliances, a growing number of home residential kitchen renovations undertaken and significant investment in smart home technologies. Touchless and IoT-integrated and AI-powered ventilation systems include next-generation kitchen hoods that are becoming the development and commercialization goal in North America including countries like the United States and Canada.

The rising demand for energy-efficient and low-noise kitchen appliances, increasing emphasis on improving indoor air quality, and increasing usage of smart home automation are driving the market growth. Moreover, increasing renovations of luxury kitchens and surging demand for kitchen hood designs that can be customized are further pushing product innovation and acceptance.

Demand for stylish yet sustainable kitchen ventilation solutions in Europe is rising, and government policies to promote energy efficiency and advanced high-performance filtration technologies are also part of the growth drivers in this region. Germany, France and the UK are emphasized to manufacture high-quality, green electric kitchen hoods for domestic and restaurant solutions.

The increasing focus on carbon footprint reduction, rising uptake in modular and open kitchen designs, and R D in advanced odor-clearing filters are further driving market uptake. Moreover, growing applications in high-end hospitality kitchens, luxury home industrial appearances, and smart ventilation control systems present more opportunities for manufacturers and major suppliers.

The kitchen hood market in the Asia-Pacific region is the fastest growing, attributed to rapid urbanization, higher disposable incomes, and growing proliferation of modern kitchen appliances. China, India and Japan are making significant investments in R&D of cost-effective, high-efficiency kitchen hoods for mass-market and premium segments.

Factors such as the growing need for smart and space-efficient kitchen applications, the swift progression of urban residential projects, and the changing regulatory structure, in tandem with government measures to endorse energy-efficient appliances, are accelerating the growth of the regional market.

Moreover, growing kitchen hygiene awareness and the introduction of ductless and noiseless exhaust hood designs are propelling the HVAC exhaust hood market penetration. The market is also growing due to the presence of domestic kitchen appliance manufacturers and collaborations with global brands.

As technology in kitchen rendering continues to evolve, along with the integration of smart appliances and sustainable production processes, the kitchen hood market is projected to grow steadily throughout the next decade. Functional, appealing, and long-lasting, companies are channeling their innovations into ventless and ductless, and AI-enabled ventilation, advanced grease and odor removal features, and next-gen, touch-less control features.

Moreover, the growing consumer preference for smart and stylish kitchen devices, digital integration in smart home automation, and changing regulatory scenario are all key themes driving the future of this market. AI-based air quality monitoring, next-gen eco-friendly filters, and connected home ventilation solutions are optimizing kitchen performance, and ensuring superior kitchen hood solutions across the globe.

Challenge

High Installation and Maintenance Costs

The high installation, maintenance, and energy consumption costs make it difficult for the Kitchen hood market. These advanced hoods utilize high-efficiency motors, smart sensors and air purification technologies, leading to increased consumer upfront costs due to skilled installation need. Moreover, routine upkeep such as cleaning and changing filters also increases costs in the longer run. There will need to be a major emphasis on cost-effective production and modular construction for installation, combined with self-cleaning technologies to make it affordable and convenient.

Noise Levels and Energy Efficiency Concerns

Kitchen hoods remain a hard sell for many consumers, though, who worry about their noise and energy inefficiency. High-speed exhaust fans typically produce a lot of noise, which can be a turn-off for users in open-plan kitchens. In addition, energy-hogging kitchen hoods add to electricity costs too, leading to worries over sustainability. To remedy these issues, manufacturers will have to invest in quieter motor technology, variable-speed exhaust systems, and energy-efficient filtration solutions to make their products more appealing.

Opportunity

Rising Demand for Smart and IoT-Enabled Kitchen Appliances

The growing popularity of smart home technology is propelling demand for IoT-enabled kitchen hoods that provide automated ventilation, air quality monitoring, and voice-activated controls. The integration of artificial intelligence with smart information and computer technology helps to optimize range hoods airflow for different cooking intensity, increases user convenience, and improves air quality in the home. With the proliferation of smart kitchen appliances, companies that offer connectivity features, remote monitoring, and AI-driven automation will be well positioned to succeed.

Growing Focus on Sustainability and Eco-Friendly Designs

With increasing environmental awareness, consumers are looking for energy-efficient and green kitchen ventilation options. This transition to sustainable materials, energy-saving motors, and carbon-neutral manufacturing represents an enormous growth opportunity for the market.

Filters that can be recycled, grease-collection systems and low-emission ventilation technology are among the innovations gaining ground. Organizations that invest in green certifications, environmentally-friendly product innovations, and sustainable branding will establish a competitive advantage in the marketplace.

The kitchen hood market grew at a steady pace between 2020 and 2024, driven by increased consumer awareness towards indoor air quality, the growing adoption of smart home appliances, and advancements in filtration technology. As per the initial forecast, challenges such as high installation costs, noise issues, and supply chain disruptions adversely impacted the market expansion. Companies responded by rolling out quiet, energy-efficient models, refining filter durability, and making them available in more online sales channels, making them more accessible on shelves.

Future market outlook: 2025 to 2035: The new and emerging markets for kitchen air purification are projected to have a substantial impact, particularly in creative technologies such as AI-based air purification, self-cleaning filter systems and sustainable kitchen ventilation, within the time frame of 2025 to 2035.

Industry standards will be redefined through the incorporation of sophisticated sensors capable of detecting smoke, grease, and humidity along with novel machine learning algorithms that implement adaptive airflow control. Another major trend is the switch to recyclable and biodegradable materials in kitchen hood manufacturing, which will push eco-friendly customers to make purchasing decisions. The next stage of market growth will be dominated by the innovation and digitization of products and services at progressive companies that prioritize both sustainability and corporate responsibility.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with indoor air quality and energy efficiency regulations |

| Technological Advancements | Growth in noise reduction and multi-speed fan control |

| Industry Adoption | Increased use in residential and commercial kitchens |

| Supply Chain and Sourcing | Dependence on traditional exhaust fan manufacturers |

| Market Competition | Dominance of established appliance brands |

| Market Growth Drivers | Demand for enhanced indoor air quality and kitchen safety |

| Sustainability and Energy Efficiency | Initial focus on improving exhaust efficiency and reducing noise levels |

| Integration of Smart Monitoring | Limited tracking of air quality and filter maintenance |

| Advancements in Product Innovation | Development of touchless and voice-controlled kitchen hoods |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI-driven compliance tracking, stricter eco-certifications, and smart ventilation mandates |

| Technological Advancements | Expansion of AI-driven airflow optimization, self-cleaning filters, and smart sensor integration |

| Industry Adoption | Widespread adoption in smart kitchens, automated ventilation systems, and eco-friendly restaurant designs |

| Supply Chain and Sourcing | Shift toward sustainable materials, local sourcing, and energy-efficient production techniques |

| Market Competition | Rise of smart kitchen startups, AI-driven air quality firms, and modular kitchen ventilation solutions |

| Market Growth Drivers | Growth in self-regulating ventilation systems, AI-powered grease control, and eco-conscious consumer preferences |

| Sustainability and Energy Efficiency | Large-scale implementation of carbon-neutral ventilation, recyclable filter systems, and solar-powered kitchen hoods |

| Integration of Smart Monitoring | AI-powered real-time air monitoring, IoT-enabled maintenance alerts, and predictive filter replacement systems |

| Advancements in Product Innovation | Introduction of biodegradable filters, adaptive airflow technology, and energy-harvesting ventilation systems |

Growing consumer demand for energy-efficient ventilation solutions, increasing adoption of modular kitchens, and significantly growing residential and commercial real-estate sector in the country, are some of the key factors for leading market position of the United States in the global kitchen hood market. Continued focus on indoor air quality and the aesthetics of kitchen spaces is fueling further market growth.

Moreover, increasing investments in advanced kitchen appliances, as well as the development of intelligent noise reduction and auto-cleaning filters and IoT-enabled range hoods, aids to drive the market growth. Also, the integration of energy-efficient motors, grease-trapping technology and touchless controls is improving product appeal.

Companies are also working on making stylish, space-saving and high-suction kitchen hoods in line with changing consumer demands. Moreover, an ever-growing trend of using ductless and wall-mounted kitchen hoods in residential households as well as restaurant kitchens is fuelling demand in the USA market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.5% |

One of the major consumers in kitchen hoods market is the United Kingdom, due to increased renovations of residential structures, and demand for sophisticated range of ventilation systems and innovative designs that cater to consumer preferences for modern and minimalistic kitchens. Growing awareness about energy efficiency and air purification is also driving the market. Also, government policies encourage the use of eco-friendly and low-noise kitchen appliances, the development of multi-speed extraction, activation in carbon filters, and integration of LED lighting, which also boost the expansion of the market.

In addition, newer technologies like convertible range hoods and sensor-based air quality control and aesthetic customizations are trending. To meet contemporary design tastes, firms are also investing in premium-grade stainless steel, glass-finished and concealed kitchen hoods. In addition, the growing need for space-compliant, less-maintained, and smart kitchen hoods within apartments, commercial kitchens, and open-plan layouts is acting as a growth factor for the country market adoption. The move toward low-carbon and sustainable appliance manufacturing is also racing up demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.1% |

The European kitchen hood market is dominated by Germany, France and Italy owing to the strong home appliance manufacturing in these countries and increasing adoption towards smart home technology along with extensive regulatory support and investment in energy efficient kitchen ventilation. Gradual growth of the market is induced by the European Union's emphasis on enhancing air quality indoors, in addition to investments in sustainable kitchen appliances. Furthermore, the growing popularity of ultra-quiet, high-suction, and motion-sensing kitchen hoods are contributing to product efficiency.

Market growth is additionally propelled due to increasing demands for modular kitchen solutions, integrated vent systems, and premium ventilation technology. The extension of the rigid EU energy labeling regulations combined with rising innovations in grease separation and self-cleaning technology is also adding to the adoption throughout the EU. Additionally, the growing demand for high profile island range hoods and downdraft ventilation systems is driving innovation in kitchen hood market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.2% |

Rise in Compact, High-Tech Home Appliances, Growth in Energy-Efficient Kitchen Ventilation Solutions, and Inclination towards Space-Saving Designs to Fuel Japan Kitchen Hoods Market Expansion Rising demand for odor removal and grease filtration is propelling the market for advanced kitchens.

The country’s focus on smart home integration along with the newest advances in ultra-slim, automated and voice-controlled kitchen hoods is driving innovation. In addition, stringent government regulations regarding noise reduction along with rising investments in AI-enabled ventilation systems is driving companies to develop high-efficient products.

The increasing need for wall-mounted, under-cabinet, and retractable range hoods in urban apartments, open kitchens, and commercial food service facilities is also driving the growth of the home appliance industry in Japan. Moreover, Japan is contributing to the modern kitchen hoods by investing in modular cooking solutions and sustainable kitchen ventilation technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.4% |

South Korea has also emerged as an important Map sensor market, supported by the proliferating need for premium kitchen solutions, the expanding acceptance of built-in-ventilation solutions integrated in kitchen designs, and government support for energy-efficient technologies at home. Tight environmental regulations for kitchen air quality, as well as rising investment in smart filtration and touchless sensor technology, fuels the market growth. Increased competitiveness is being aided by the country’s effort to boost durability, reduce noise, and increase oil-trapping efficiency via advanced filter materials and aerodynamic hood designs.

This, along with the increasing popularity of visually-pleasing, multi-functional, and AI-enabled kitchen hoods in luxury residences, restaurants, and smart homes, is also driving the market's acceptance. This requires an investment in high-performance suction technology, air purification systems, and IoT-integrated smart ventilation solutions. Demand for new and innovative kitchen hoods is growing in South Korea as luxury home upgrades and high-tech kitchen renovations become the norm.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

Compact, space-saving and economical in design, under-cabinet kitchen hoods remain an especially popular option. These hoods easily install below kitchen cabinets, which is ideal for small residential kitchens and apartment use. Under-cabinet models are popular with consumers for their ease of installation, effective smoke extraction, and lower price range. More recently, manufacturers have started adding smart filtration technology, quiet motor functions and energy-efficient LED lighting to increase the efficiency of modern under-cabinet kitchen hoods.

Particularly in the high-end kitchen or commercial spaces they have become very popular and they work particularly well in modern open-space kitchens. They do have better exhaust capability, aesthetics, and suction capacity than other hoods.

The growing desire for numerous kitchen design amenities, such as sleek stainless steel finishes, high-end kitchen appliances, and adjustable ventilation options is contributing to the boom in demand for wall-mounted hoods. Moreover, with touchless operation, IoT-enabled monitoring, and grease-trapping technology, the wall-mounted kitchen hood will only become better over time.

Homeowners comprise a large portion of the segment as they look towards providing efficient air purification, smoke removal and odour elimination in the kitchen. The growing trend of modular kitchens, smart home automation and high-efficiency ventilation solutions are driving demand for aesthetic and technologically-advanced kitchen hoods. The rise of smart homes, integrated air quality sensors, and AI-centric ventilation has aided innovations in residential kitchen hood design.

Commercial establishments like restaurants, hotels, and catering services, lean on high-powered kitchen hoods for air quality, safety regulations, and also kitchen hygiene. It is also despite the demand for industrial-grade, heavy-duty ventilation systems, which can handle multi-speed airflow control and heat resistant materials.

In addition, strict regulations for meeting commercial kitchen exhaust standards, fire suppression system standards as well as grease management solutions have bolstered the demand for advanced, sturdy kitchen hoods, thereby auguring well for the growth of the commercial segment.

Specialty stores continue to play a significant role in the distribution of high-end and high-performance kitchen hoods, as customers can receive expert advice, demonstrations, and personalized suggestions. These businesses are popular among customers for their exclusive collections, element solutions, and direct-to-manufacturer partnerships. The increasing requirement for energy-efficient, low-noise and sensor-based kitchen hood models, along with this growth in kitchen hood and kitchen appliance trends, has aided specialty retailers in enhancing their offerings and wide-ranging smart ventilation technologies and luxury kitchen solutions.

Online retailing has become increasingly popular, accessible, and beneficial for consumers, with vast selections of kitchen hoods generally lower prices and delivery right to the door. In addition, e-commerce platforms have changed the game in terms of purchase decisions with comprehensive product comparisons, customer reviews and AI-type recommendations. Long been considered an un-sexy category for online shopping, manufacturers have begun tapping into direct-to-consumer (DTC) models, virtual reality showroom experiences, and augmented reality (AR) products, to bring appliances into the kitchen.

The kitchen hood industry is driven by increasing demand for effective kitchen ventilation solutions in both residential and commercial settings, as well as technological advancements in smart and energy-efficient kitchen appliances. Leading in smart connectivity, noise reduction, and high-performance filtration systems, are all a focus for companies to enhance both user experience and air quality.

One of the key trends in the global range hoods market is IoT-enabled range hoods, ductless and recirculating range hoods, and the use of sustainable materials for energy-efficient range hoods.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| BSH Home Appliances | 18-22% |

| Whirlpool Corporation | 14-18% |

| Elica S.p.A. | 11-15% |

| Faber S.p.A. | 8-12% |

| Miele & Cie. KG | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| BSH Home Appliances | Leading provider of smart, energy-efficient kitchen hoods with advanced filtration and noise control. |

| Whirlpool Corporation | Specializes in high-performance ducted and ductless range hoods with modern design features. |

| Elica S.p.A. | Develops IoT-enabled kitchen hoods with innovative air purification and smart connectivity. |

| Faber S.p.A. | Offers premium kitchen hoods with advanced grease and odor filtration systems. |

| Miele & Cie. KG | Focuses on high-end, ultra-quiet kitchen ventilation systems with sustainable materials. |

Key Company Insights

BSH Home Appliances (18-22%)

BSH Home Appliances dominates the kitchen hood market with a robust portfolio of smart, energy-efficient appliances that include range hoods. The company combines advanced air purification, noise reduction and IoT features for improved kitchen ventilation. BSH is a global company setting the international standard with continuous innovation.

Whirlpool Corporation (14-18%)

The brand offers high-performance kitchen hoods with sleek designs for residential and commercial markets alike. They focus on user-friendly interfaces, powerful ventilation systems and ease of installation. Whirlpool has a reputation for making durable appliances, which bolsters its strong market position.

Elica S.p.A. (11-15%)

Elica helps brands innovate connected high-end kitchen hoods that use both air quality monitoring and stylish looks. It focuses on advanced filtration machine technology, like charcoal, HEPA, and more, for better indoor air quality. Elica's research and design investment boosts its competitive edge.

Faber S.p.A. (8-12%)

Faber is the leading name in its category and specializes in delivering the most efficient grease and odor filtration system from their premium kitchen hoods. They, in turn, are focused on optimizing airflow dynamics and bringing noise-reducing technology. It helps the market growth of Faber as they have a strong partnership with kitchen appliance brands.

Miele & Cie. KG (6-10%)

Miele's premium kitchen ventilation comes equipped with sustainably sourced materials, precision engineering and ultra-quiet operation. The company builds in smart technologies, like automated air-sensing adjustments, to drive energy efficiency. It supports a steady expansion on its home market, a premium position.

Other Key Players (30-40% Combined)

The kitchen hood market is comprised of several global and regional manufacturers, with an emphasis on innovation, efficiency, and design attractiveness. Key players include:

The overall market size for kitchen hood market was USD 13,104.30 million in 2025.

The kitchen hood market expected to reach USD 19,964.43 million in 2035.

The demand for the kitchen hood market will be driven by increasing urbanization and residential construction, rising consumer awareness of indoor air quality, growing demand for modular kitchens, advancements in energy-efficient and smart kitchen ventilation systems, and expanding adoption in commercial food service establishments.

The top 5 countries which drives the development of kitchen hood market are USA, UK, Europe Union, Japan and South Korea.

Under cabinet and wall-mounted kitchen hoods dominate market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Kitchen Hood System Market Size and Share Forecast Outlook 2025 to 2035

Kitchen/ Toilet Roll Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Kitchen Tools and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Kitchen Trailers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Kitchen Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Kitchen Islands and Carts Market

Kitchen Storage Market

Kitchen & Dining Furniture Market

Toy Kitchens and Play Food Market Size and Share Forecast Outlook 2025 to 2035

MEA Kitchen Storage Market Growth – Trends & Forecast 2025 to 2035

Smart Kitchen Appliances Market Size and Share Forecast Outlook 2025 to 2035

Cloud Kitchen Market Trends – Size, Demand & Forecast 2025-2035

Small Kitchen Appliances Market Growth – Demand & Trends to 2033

Outdoor Kitchen Appliances Market Size and Share Forecast Outlook 2025 to 2035

Modular Kitchen Baskets Market Size and Share Forecast Outlook 2025 to 2035

Built-In Kitchen Appliance Market Outlook – Size, Share & Innovations 2025 to 2035

Household Kitchen Appliances Market Size and Share Forecast Outlook 2025 to 2035

Table and Kitchen Linen Market Size and Share Forecast Outlook 2025 to 2035

Commercial Kitchen Ventilation System Market Growth - Trends & Forecast 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA