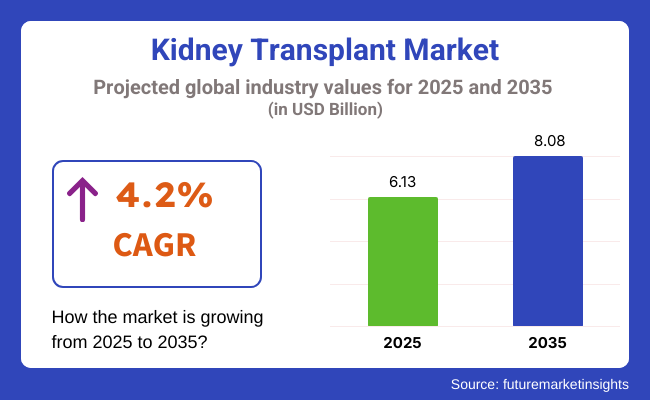

The Kidney transplant industry is projected to be valued at USD 6.13 billion in 2025. As per FMI's analysis, the kidney transplant industry will grow at a CAGR of 4.2% and reach USD 8.08 billion by 2035. The worldwide kidney transplant industry is anticipated to see consistent growth on account of advances in transplant technology, a rising incidence of CKD, and growing awareness of organ donation.

The growth of the kidney transplant industry was supported by the rising organ donation rates, advancements in transplant techniques, and improved post-transplant care in 2024. A major advancement was the development of machine perfusion technologies that kept donor kidneys alive longer and helped reduce organ wastage and improve transplant outcomes.

The increasing need for kidney transplantation is driven by the increasing incidence of diabetes and hypertension, which are major causes of CKD. Moreover, advancements in technology in the form of better immunosuppressive therapy, organ preservation methods, and xenotransplantation advancements are increasing transplant success rates. Nevertheless, the sector is hindered by issues like organ scarcity, the expense of transplants, and complications following transplantation.

The kidney transplant industry is on a consistent growth path, fueled by increasing chronic kidney disease (CKD) cases, organ preservation and transplant technology advancements, and heightened organ donation awareness.

Biotechnology companies, medical device manufacturers, and transplant facilities will gain from developments such as machine perfusion, artificial intelligence-based organ matching, and xenotransplantation, while patients in low-income areas will be disadvantaged by exorbitant costs and organ shortages. As governments and healthcare systems continue to invest in enhancing access to transplants, the industry will keep growing, with the Asia-Pacific region becoming a major growth area.

Budget for Advanced Organ Preservation and Transplant Technologies

Treatment modalities like machine perfusion technology, Artificial Intelligence based organ matching, and 3D bioprinting can help boost organ transplant success rate and reduce wastage. Collaborating with biotech companies and healthcare institutions can speed up research & segment expansion.

Drive Accessibility& Affordability in Emerging Sectors

To not only help improve transplant affordability, especially in the Asia-Pacific and Latin America regions, where CKD is reaching epidemic levels, companies should align with healthcare policies and healthcare reimbursement models. Cost reduction and sector coverage can best be achieved through public-private partnerships and local manufacturing.

Enhance Supply Chain & Strategic Partnerships

To combat organ shortages and speed up distribution, stakeholders need to work with organ donation networks, create blockchain-based donor registries and explore xenotransplantation advances. Mergers, acquisitions, and cross-industrypartnerships with AI developers and biotech firms can lead to competitive advantages in the fast-evolving transplant landscape.

| Risk | Probability & Impact |

|---|---|

| Organ Shortages & Unequal Access | High Probability, High Impact |

| Regulatory & Ethical Challenges | Medium Probability, High Impact |

| High Transplant Costs & Insurance Barriers | High Probability, Medium Impact |

| Priority | Immediate Action |

|---|---|

| Adopt Advanced Organ Preservation | Invest in machine perfusion and AI-driven organ matching to improve transplant success rates. |

| Expand Industry Accessibility | Develop affordable transplant solutions and reimbursement models, focusing on emerging sectors . |

| Strengthen Strategic Partnerships | Form alliances with biotech firms, organ donation networks, and AI developers to drive innovation. |

As the kidney transplant industry continues to change, the next step in the discussion is to innovate quickly, become more accessible, and form key partnerships. Unique strategic projects, such as machine perfusion, AI-organ matching, and xenotransplantation, will set segment leaders apart while positively impacting patient outcomes. Simultaneously, globalization through local manufacturing and public-private partnerships in emerging sectors enables new revenues. Overcoming regulatory hurdles and affordability barriers will be key to long-term success.

Regional Variance:

High Variance:

Convergent and Divergent Perspectives on ROI:

Consensus:

Variance:

Shared Challenges:

Regional Differences:

Hospitals & Transplant Centers:

Medical Device Manufacturers:

Patients & Donors:

Alignment:

Divergence:

USA:

Western Europe:

Japan/South Korea:

High Consensus:

Key Variances:

Strategic Insight:

| Country/Region | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States |

|

| Western Europe |

|

| United Kingdom |

|

| Germany |

|

| Japan |

|

| South Korea |

|

| China |

|

| India |

|

The USA will grow at a rate of 3.2% CAGR during 2025 to 2035, is expected to lead key growth segments, due to favorable government support, increasing technological advancements and high organ transplant rates. There is a well-regulated organ allocation process through UNOS (the United Network for Organ Sharing) and the OPTN (Organ Procurement and Transplantation Network) which makes the organ allocation system efficient.

With AI-driven algorithms for organ matching, machine perfusion technologies and xenotransplantation research, the USA is at the forefront. The National Organ Transplant Act (NOTA) prohibits the sale of human organs, but facilitates paired kidney exchanges to increase transplantation accessibility. The expansion of private insurance coverage and state level incentives will further drive segment growth.

The UK kidney transplant segment is poised to increase at a CAGR of 2.9% from 2025 to 2035, bolstered by NHS blood and transplant (NHSBT) initiatives and the controversial, organ procurement process in place of Max and Keira's Law. Such a policy has expanded the pool of available deceased donor organs, and decreased wait times.

The UK has been at the forefront of adopting minimally invasive transplant techniques and hypothermic machine perfusion (HMP) technology behind enhanced transplant success rates. The MHRA is independent but is obliged to register its recommendations on transplant drugs and medical devices under EU MDR. High costs required for transplant, an underfunded NHS budget, and ongoing regulatory changes as a result of Brexit, which has put pressure on imports of medical devices.

France’s kidney transplant sector will expand at a compound annual growth rate (CAGR) of 2.7% between 2025 and 2035; it has seen an increase in organ availability as a result of the country's opt-out donation law. Recent advances in organ preservation technology and hypothermic machine perfusion (HMP) were accompanied in France by leadership in their implementation, to the extent that transplant centers use such technologies as a standard.

Public-private collaborations supported by the government are driving innovation in bioprinting and artificial organs. France also grapples with regional inequalities in transplant access, where rural hospitals lack the high-tech infrastructure to perform kidney transplants. The industry will be fueled by AI-enabled transplant matching and the evolution of minimally invasive surgery in the future.

The German kidney transplant segment is expected to grow at a compound annual growth rate (CAGR) of 2.4% in the 2025 to 2035 period, attributable to robust public healthcare financing and advanced transplant research. Germany still has one of the lowest donor rates in western Europe, which in turn limits organ transplants.

Germany is pioneer in robotic kidney transplant surgery and AI-based donor-recipient matching, essential to profile the best donor-recipient according to compatibility, thus reducing risks and complications and improving outcomes. Transplant analytics could be among the first fields affected, but EU legislation on medical devices (EU MDR) and data protection (GDPR) are also hindering the adoption of AI.Cost remains a significant barrier, as the high average cost of a kidney transplant has led to increased demand for cross-border transplants in the EU.

Italy’s kidney transplant segment is expected to sustain a CAGR of 2.6% from 2025 to 2035, buoyed by a well-established national organ donation network. Transplant legislation is supervised by the Centro Nazionale Trapianti (CNT), which is responsible for equitable organ distribution. Italy boasts one of the highest rates of living-donor kidney transplant in Europe, and a significant use of robotic-assisted transplant surgeries.

Italy faces challenges such as unequal healthcare access across regions and the slow adoption of AI-based organ allocation systems. Funding for regenerative medicine and organ preservation technology is also growing, highlighted by large investments in xenotransplantation and stem-cell therapies. Economic instability and high medical device import costs may constrain short-term growth.

South Korea kidney transplant landscape is poised to grow at a CAGR of 2.8% from 2025 to 2035, owing to the rapid adoption of medical technologies, a strong universal healthcare system and government-supported insurance coverage for transplant patients. It has one of the highest per capita healthcare costs in Asia, and the government strongly supports organ transplantation.

The Korean network for organ sharing (KONOS) is responsible for allocation and transplant policies in South Korea, in accordance with principles of fairness and ethics. Robot-assisted kidney transplantation (RAKT) is gaining popularity led by hospitals like Seoul National University Hospital and Asan Medical Center augmenting real-time AI-powered donor-recipient matching algorithm to increase the success rates of transplant operations.

Japan's kidney transplant segment is forecast to grow at a CAGR of 2.3% between the years 2025 to 2035, lower than the worldwide average owing to cultural and regulatory challenges. It has one of the lowest deceased organ donation rates among developed nations, partly because of cultural beliefs that relate to death and organ removal. The law on organ transplants (OTL), which requires consent from family members to perform organ retrieval, adds further obstacles.

As a result, Japan is deeply dependent on living donors, who make up almost 85 percent of all kidney transplants. This has resulted in long waiting lists to receive a deceased donor transplant, often over 10 years at major hospitals. Japan is now heavily investing in artificial kidney development, stem-cell therapies and 3D bioprinting to address the organ shortage. Among those leading this research into regenerative medicine for kidney failure are JCR Pharmaceuticals and Kyoto university’s iPS cell research institute.

The China kidney transplant industry is expected to grow at a CAGR of about 3.1% between 2025 and 2035 mainly due to the health care reform supported by the central government, an increasing voluntary donor registry, and substantial investments in transplant research. China performs one of the largest volumes of kidney transplants in the world, with more than sixteen thousand transplants conducted.

Transplant-related medical devices and pharmaceuticals are overseen and regulated for compliance with Good Manufacturing Practices (GMP) by the National Medical Products Administration (NMPA). The Chinese National Organ Donation and Transplantation Committee (CNODTC) played a key role in moving from unethical sourcing practices to an incentivized, voluntary system that aims to minimize harm and increase voluntary organ donations ethically.

The kidney transplant sector of New Zealand and Australia are projected to grow with a CAGR of 2.7% during the period from 2025 to 2035, bolstered by high organ donation rates, a universal healthcare system, and substantial government funding for transplant programs. With donor awareness campaigns launched by the Australian Organ and Tissue Authority (OTA), Australia has one of the highest deceased donor rates in the Asia-Pacific region.

Australia and New Zealand were among the early adopters of AI-based transplant matching and robotic-assisted kidney transplant surgeries, leading to better efficiency of transplantations. It includes research institutes like Monash University and the University of Sydney, which are also pursuing stem-cell-based kidney regeneration and organ bio engineering. Other issues include regional differences in transplant availability and access, especially in rural and indigenous areas with limited hospital infrastructure.

India is anticipated to be the fastest-growing kidney transplant segment during the period 2025 to 2035 with a CAGR of 3.3% driven by the increasing cases of chronic kidney disease (CKD), growing private healthcare sector and medical tourism. While the National Organ & Tissue Transplant Organisation (NOTTO) is responsible for organ allocation, the country faces considerable common challenges including an illegal organ segment, insufficient deceased donors and substantial out-of-pocket transplant costs.

Leading hospitals, like the Apollo Hospitals Group and AIIMS, have begun incorporating robotic-assisted kidney transplant procedures into their offerings as well as AI-powered transplant logistics to streamline processes. India serves as a global destination for organ transplants to patients from the Middle East, Africa, and Southeast Asia because of much cheaper transplant procedures.

The global transplant segment and grow at a CAGR of 4.2% between 2025 and 2035. Deceased-donor kidney transplants had the largest market share among transplant types, fueled by increasing market awareness regarding organ donation along with technological developments in organ preservation.

Living-donor kidney transplants are the most rapidly expanding segment because of higher rates of success, shorter wait times, and improved minimally invasive donor nephrectomy surgeries. In many countries, there are public awareness campaigns and government incentives that are helping to promote living donation as the best option for donation in terms of utilitarianism.

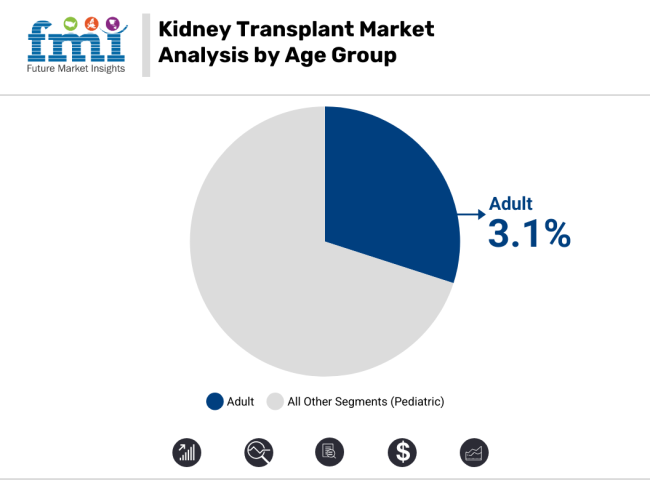

The industry is expected to expand at a CAGR of 3.1% during this period, with varying growth rates across different segments. A breakdown by age group reveals that adult kidney transplants account for the vast majority of the segment, with approximately 92% of the total share in 2025.

This is mainly due to the increasing rates of chronic diseases, such as diabetes and hypertension in adults, which increases the demand for transplants. Even though the pediatric segment is smaller, it is also experiencing steady growth as surgical techniques and post-operative care improve, leading to higher survival rates among young patients.

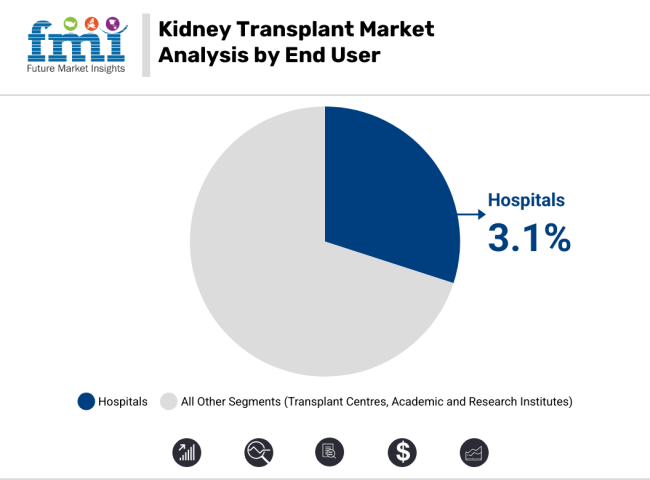

The kidney transplant industry is projected to grow at a CAGR of 3.1% from 2025 to 2035. By end user, hospitals have steadfastly been the leading segment globally with over half of all kidney transplants taking place in this setting. They are dominant because of their infrastructure, access to complete databases of patients, and higher-risk procedures.

On the other hand, transplant centers are turning into specialized institutes providing focused care, thus boosting the sector. Awareness of the importance of cross-organ collaboration is relatively young, but academic and research institutes are a major driver of innovation in these individual areas (transplant techniques, immunosuppressive drugs, and regenerative medicine), although they usually do not directly perform procedures.

Pricing strategies, technological innovations, strategic partnerships, and geographical expansion are some of the key areas where the leading companies in the kidney transplant sector are focusing their efforts to gain an edge over their competitors. As healthcare costs climb, businesses are prioritizing cost-efficient transplant solutions, such as minimally invasive surgical methods and new organ preservation technologies, to make it more accessible.

Companies are partnering with organ procurement organizations (OPOs), transplant centers, and biotech companies to increase organ availability. With the increasing CKD cases and investment in healthcare, expansion into emerging sectors, especially in India, China, and South-East Asia, is a major focus. Firms also work with government agencies and regulators to create policies that promote organ donation and transplantation.

Deceased-Donor Kidney Transplant, Living-Donor Kidney Transplant (Direct Donation Kidney Transplant, Non-directed Donation Kidney Transplant, and Paired exchange Kidney Transplant)

Adult and Pediatric

Transplant Centres, Hospitals, and Academic and Research Institutes

North America, Latin America, Europe, South Asia, East Asia, Oceania, and The Middle East and Africa (MEA)

More people are getting chronic kidney disease (CKD). Diseases like diabetes and high blood pressure are becoming more common. These health problems, combined with advances in transplant technology and better organ donation programs, mean more people need kidney transplants.

New technologies are making transplants work better. For example, AI helps match organs to people more efficiently, robotic surgeries make operations more precise, improved medicines help the body accept new organs, and better preservation techniques keep organs healthy longer.

There are several challenges, first, there aren't enough organs available for everyone who needs them. The procedures are also very expensive, and patients often have to wait a long time. Another issue is the risk of the body rejecting the new organ. Additionally, strict regulations need to be followed, which can complicate the process.

Countries like India and China are experiencing rapid growth in kidney transplants. This growth is due to increased investment in healthcare, more cases of kidney disease, and government programs that encourage organ donation and transplantation.

Government rules have a big impact and these rules cover everything from how organs are donated and collected to insurance coverage, government subsidies, and patient out-of-pocket costs and how transplant centers are accredited. They greatly influence how easy or difficult it is to perform kidney transplants in different regions.

Table 01: Global Market Analysis 2017 to 2022 and Forecast 2023 to 2033, By Transplant Type

Table 02: Global Market Analysis 2017 to 2022 and Forecast 2023 to 2033, By Age Group

Table 03: Global Market Analysis 2017 to 2022 and Forecast 2023 to 2033, By End User

Table 04: Global Market Analysis 2017 to 2022 and Forecast 2023 to 2033, By Region

Table 05: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 06: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Transplant Type

Table 07: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Age Group

Table 08: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By End User

Table 09: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 10: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Transplant Type

Table 11: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Age Group

Table 12: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By End User

Table 13: Europe Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 14: Europe Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Transplant Type

Table 15: Europe Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Age Group

Table 16: Europe Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By End User

Table 17: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 18: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Transplant Type

Table 19: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Age Group

Table 20: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By End User

Table 21: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 22: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Transplant Type

Table 23: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Age Group

Table 24: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By End User

Table 25: Oceania Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 26: Oceania Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Transplant Type

Table 27: Oceania Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Age Group

Table 28: Oceania Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By End User

Table 29: Middle East and Africa Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Country

Table 30: Middle East and Africa Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Transplant Type

Table 31: Middle East and Africa Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By Age Group

Table 32: Middle East and Africa Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, By End User

Figure 01: Global Market Value Analysis, 2017 to 2022

Figure 02: Global Market Forecast & Y-o-Y Growth, 2023 to 2033

Figure 03: Global Market Incremental $ Opportunity, 2022 to 2033

Figure 04: Global Market Value Share (%) Analysis 2023 and 2033, By Transplant Type

Figure 05: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, By Transplant Type

Figure 06: Global Market Attractiveness Analysis 2023 to 2033, By Transplant Type

Figure 07: Global Market Value Share (%) Analysis 2023 and 2033, By Age Group

Figure 08: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, By Age Group

Figure 09: Global Market Attractiveness Analysis 2023 to 2033, By Age Group

Figure 10: Global Market Value Share (%) Analysis 2023 and 2033, By End User

Figure 11: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, By End User

Figure 12: Global Market Attractiveness Analysis 2023 to 2033, By End User

Figure 13: Global Market Value Share (%) Analysis 2023 and 2033, By Region

Figure 14: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, By Region

Figure 15: Global Market Attractiveness Analysis 2023 to 2033, By Region

Figure 16: North America Market Value Analysis, 2017 to 2022

Figure 17: North America Market Forecast & Y-o-Y growth, 2023 to 2033

Figure 18: North America Market Value Share By Transplant Type 2023 (E)

Figure 19: North America Market Value Share by Age Group 2023 (E)

Figure 20: North America Market Value Share By End User 2023 (E)

Figure 21: North America Market Value Share By Country 2023 (E)

Figure 22: North America Market Attractiveness Analysis, By Transplant Type

Figure 23: North America Market Attractiveness Analysis, By Age Group

Figure 24: North America Market Attractiveness Analysis, By End User

Figure 25: North America Market Attractiveness Analysis, By Country

Figure 26: USA Market Value Proportion Analysis, 2022

Figure 27: Global Vs USA Y-o-Y Growth Comparison, 2022 to 2033

Figure 28: USA Market Share Analysis (%) By Transplant Type, 2022 & 2033

Figure 29: USA Market Share Analysis (%) By Age Group, 2022 & 2033

Figure 30: USA Market Share Analysis (%) By End User, 2022 & 2033

Figure 31: Canada Market Value Proportion Analysis, 2022

Figure 32: Global Vs Canada Y-o-Y Growth Comparison, 2022 to 2033

Figure 33: Canada Market Share Analysis (%) By Transplant Type, 2022 & 2033

Figure 34: Canada Market Share Analysis (%) By Age Group, 2022 & 2033

Figure 35: Canada Market Share Analysis (%) By End User, 2022 & 2033

Figure 36: Latin America Market Value Analysis, 2017 to 2022

Figure 37: Latin America Market Forecast & Y-o-Y growth, 2023 to 2033

Figure 38: Latin America Market Value Share By Transplant Type 2023 (E)

Figure 39: Latin America Market Value Share by Age Group 2023 (E)

Figure 40: Latin America Market Value Share By End User 2023 (E)

Figure 41: Latin America Market Value Share By Country 2023 (E)

Figure 42: Latin America Market Attractiveness Analysis, By Transplant Type

Figure 43: Latin America Market Attractiveness Analysis, By Age Group

Figure 44: Latin America Market Attractiveness Analysis, By End User

Figure 45: Latin America Market Attractiveness Analysis, By Country

Figure 46: Brazil Market Value Proportion Analysis, 2022

Figure 47: Global Vs Brazil Y-o-Y Growth Comparison, 2022 to 2033

Figure 48: Brazil Market Share Analysis (%) By Transplant Type, 2022 & 2033

Figure 49: Brazil Market Share Analysis (%) By Age Group, 2022 & 2033

Figure 50: Brazil Market Share Analysis (%) By End User, 2022 & 2033

Figure 51: Mexico Market Value Proportion Analysis, 2022

Figure 52: Global Vs Mexico Y-o-Y Growth Comparison, 2022 to 2033

Figure 53: Mexico Market Share Analysis (%) By Transplant Type, 2022 & 2033

Figure 54: Mexico Market Share Analysis (%) By Age Group, 2022 & 2033

Figure 55: Mexico Market Share Analysis (%) By End User, 2022 & 2033

Figure 56: Argentina Market Value Proportion Analysis, 2022

Figure 57: Global Vs Argentina Y-o-Y Growth Comparison, 2022 to 2033

Figure 58: Argentina Market Share Analysis (%) By Transplant Type, 2022 & 2033

Figure 59: Argentina Market Share Analysis (%) By Age Group, 2022 & 2033

Figure 60: Argentina Market Share Analysis (%) By End User, 2022 & 2033

Figure 61: Europe Market Value Analysis, 2017 to 2022

Figure 62: Europe Market Forecast & Y-o-Y growth, 2023 to 2033

Figure 63: Europe Market Value Share By Transplant Type 2023 (E)

Figure 64: Europe Market Value Share by Age Group 2023 (E)

Figure 65: Europe Market Value Share By End User 2023 (E)

Figure 66: Europe Market Value Share By Country 2023 (E)

Figure 67: Europe Market Attractiveness Analysis, By Transplant Type

Figure 68: Europe Market Attractiveness Analysis, By Age Group

Figure 69: Europe Market Attractiveness Analysis, By End User

Figure 70: Europe Market Attractiveness Analysis, By Country

Figure 71: Germany Market Value Proportion Analysis, 2022

Figure 72: Global Vs Germany Y-o-Y Growth Comparison, 2022 to 2033

Figure 73: Germany Market Share Analysis (%) By Transplant Type, 2022 & 2033

Figure 74: Germany Market Share Analysis (%) By Age Group, 2022 & 2033

Figure 75: Germany Market Share Analysis (%) By End User, 2022 & 2033

Figure 76: Italy Market Value Proportion Analysis, 2022

Figure 77: Global Vs Italy Y-o-Y Growth Comparison, 2022 to 2033

Figure 78: Italy Market Share Analysis (%) By Transplant Type, 2022 & 2033

Figure 79: Italy Market Share Analysis (%) By Age Group, 2022 & 2033

Figure 80: Italy Market Share Analysis (%) By End User, 2022 & 2033

Figure 81: France Market Value Proportion Analysis, 2022

Figure 82: Global Vs France Y-o-Y Growth Comparison, 2022 to 2033

Figure 83: France Market Share Analysis (%) By Transplant Type, 2022 & 2033

Figure 84: France Market Share Analysis (%) By Age Group, 2022 & 2033

Figure 85: France Market Share Analysis (%) By End User, 2022 & 2033

Figure 86: U.K Market Value Proportion Analysis, 2022

Figure 87: Global Vs U.K Y-o-Y Growth Comparison, 2022 to 2033

Figure 88: U.K Market Share Analysis (%) By Transplant Type, 2022 & 2033

Figure 89: U.K Market Share Analysis (%) By Age Group, 2022 & 2033

Figure 90: U.K Market Share Analysis (%) By End User, 2022 & 2033

Figure 91: Spain Market Value Proportion Analysis, 2022

Figure 92: Global Vs Spain Y-o-Y Growth Comparison, 2022 to 2033

Figure 93: Spain Market Share Analysis (%) By Transplant Type, 2022 & 2033

Figure 94: Spain Market Share Analysis (%) By Age Group, 2022 & 2033

Figure 95: Spain Market Share Analysis (%) By End User, 2022 & 2033

Figure 96: BENELUX Market Value Proportion Analysis, 2022

Figure 97: Global Vs BENELUX Y-o-Y Growth Comparison, 2022 to 2033

Figure 98: BENELUX Market Share Analysis (%) By Transplant Type, 2022 & 2033

Figure 99: BENELUX Market Share Analysis (%) By Age Group, 2022 & 2033

Figure 100: BENELUX Market Share Analysis (%) By End User, 2022 & 2033

Figure 101: Nordic Countries Market Value Proportion Analysis, 2022

Figure 102: Global Vs Nordic Countries Y-o-Y Growth Comparison, 2022 to 2033

Figure 103: Nordic Countries Market Share Analysis (%) By Transplant Type, 2022 & 2033

Figure 104: Nordic Countries Market Share Analysis (%) By Age Group, 2022 & 2033

Figure 105: Nordic Countries Market Share Analysis (%) By End User, 2022 & 2033

Figure 106: Russia Market Value Proportion Analysis, 2022

Figure 107: Global Vs Russia Y-o-Y Growth Comparison, 2022 to 2033

Figure 108: Russia Market Share Analysis (%) By Transplant Type, 2022 & 2033

Figure 109: Russia Market Share Analysis (%) By Age Group, 2022 & 2033

Figure 110: Russia Market Share Analysis (%) By End User, 2022 & 2033

Figure 111: East Asia Market Value Analysis, 2017 to 2022

Figure 112: East Asia Market Forecast & Y-o-Y growth, 2023 to 2033

Figure 113: East Asia Market Value Share By Transplant Type 2023 (E)

Figure 114: East Asia Market Value Share by Age Group 2023 (E)

Figure 115: East Asia Market Value Share By End User 2023 (E)

Figure 116: East Asia Market Value Share By Country 2023 (E)

Figure 117: East Asia Market Attractiveness Analysis, By Transplant Type

Figure 118: East Asia Market Attractiveness Analysis, By Age Group

Figure 119: East Asia Market Attractiveness Analysis, By End User

Figure 120: East Asia Market Attractiveness Analysis, By Country

Figure 121: China Market Value Proportion Analysis, 2022

Figure 122: Global Vs China Y-o-Y Growth Comparison, 2022 to 2033

Figure 123: China Market Share Analysis (%) By Transplant Type, 2022 & 2033

Figure 124: China Market Share Analysis (%) By Age Group, 2022 & 2033

Figure 125: China Market Share Analysis (%) By End User, 2022 & 2033

Figure 126: Japan Market Value Proportion Analysis, 2022

Figure 127: Global Vs Japan Y-o-Y Growth Comparison, 2022 to 2033

Figure 128: Japan Market Share Analysis (%) By Transplant Type, 2022 & 2033

Figure 129: Japan Market Share Analysis (%) By Age Group, 2022 & 2033

Figure 130: Japan Market Share Analysis (%) By End User, 2022 & 2033

Figure 131: South Korea Market Value Proportion Analysis, 2022

Figure 132: Global Vs South Korea Y-o-Y Growth Comparison, 2022 to 2033

Figure 133: South Korea Market Share Analysis (%) By Transplant Type, 2022 & 2033

Figure 134: South Korea Market Share Analysis (%) By Age Group, 2022 & 2033

Figure 135: South Korea Market Share Analysis (%) By End User, 2022 & 2033

Figure 136: South Asia Market Value Analysis, 2017 to 2022

Figure 137: South Asia Market Forecast & Y-o-Y growth, 2023 to 2033

Figure 138: South Asia Market Value Share By Transplant Type 2023 (E)

Figure 139: South Asia Market Value Share by Age Group 2023 (E)

Figure 140: South Asia Market Value Share By End User 2023 (E)

Figure 141: South Asia Market Value Share By Country 2023 (E)

Figure 142: South Asia Market Attractiveness Analysis, By Transplant Type

Figure 143: South Asia Market Attractiveness Analysis, By Age Group

Figure 144: South Asia Market Attractiveness Analysis, By End User

Figure 145: South Asia Market Attractiveness Analysis, By Country

Figure 146: India Market Value Proportion Analysis, 2022

Figure 147: Global Vs India Y-o-Y Growth Comparison, 2022 to 2033

Figure 148: India Market Share Analysis (%) By Transplant Type, 2022 & 2033

Figure 149: India Market Share Analysis (%) By Age Group, 2022 & 2033

Figure 150: India Market Share Analysis (%) By End User, 2022 & 2033

Figure 151: Thailand Market Value Proportion Analysis, 2022

Figure 152: Global Vs Thailand Y-o-Y Growth Comparison, 2022 to 2033

Figure 153: Thailand Market Share Analysis (%) By Transplant Type, 2022 & 2033

Figure 154: Thailand Market Share Analysis (%) By Age Group, 2022 & 2033

Figure 155: Thailand Market Share Analysis (%) By End User, 2022 & 2033

Figure 156: Indonesia Market Value Proportion Analysis, 2022

Figure 157: Global Vs Indonesia Y-o-Y Growth Comparison, 2022 to 2033

Figure 158: Indonesia Market Share Analysis (%) By Transplant Type, 2022 & 2033

Figure 159: Indonesia Market Share Analysis (%) By Age Group, 2022 & 2033

Figure 160: Indonesia Market Share Analysis (%) By End User, 2022 & 2033

Figure 161: Malaysia Market Value Proportion Analysis, 2022

Figure 162: Global Vs Malaysia Y-o-Y Growth Comparison, 2022 to 2033

Figure 163: Malaysia Market Share Analysis (%) By Transplant Type, 2022 & 2033

Figure 164: Malaysia Market Share Analysis (%) By Age Group, 2022 & 2033

Figure 165: Malaysia Market Share Analysis (%) By End User, 2022 & 2033

Figure 166: Oceania Market Value Analysis, 2017 to 2022

Figure 167: Oceania Market Forecast & Y-o-Y growth, 2023 to 2033

Figure 168: Oceania Market Value Share By Transplant Type 2023 (E)

Figure 169: Oceania Market Value Share by Age Group 2023 (E)

Figure 170: Oceania Market Value Share By End User 2023 (E)

Figure 171: Oceania Market Value Share By Country 2023 (E)

Figure 172: Oceania Market Attractiveness Analysis, By Transplant Type

Figure 173: Oceania Market Attractiveness Analysis, By Age Group

Figure 174: Oceania Market Attractiveness Analysis, By End User

Figure 175: Oceania Market Attractiveness Analysis, By Country

Figure 176: Australia Market Value Proportion Analysis, 2022

Figure 177: Global Vs Australia Y-o-Y Growth Comparison, 2022 to 2033

Figure 178: Australia Market Share Analysis (%) By Transplant Type, 2022 & 2033

Figure 179: Australia Market Share Analysis (%) By Age Group, 2022 & 2033

Figure 180: Australia Market Share Analysis (%) By End User, 2022 & 2033

Figure 181: New Zealand Market Value Proportion Analysis, 2022

Figure 182: Global Vs New Zealand Y-o-Y Growth Comparison, 2022 to 2033

Figure 183: New Zealand Market Share Analysis (%) By Transplant Type, 2022 & 2033

Figure 184: New Zealand Market Share Analysis (%) By Age Group, 2022 & 2033

Figure 185: New Zealand Market Share Analysis (%) By End User, 2022 & 2033

Figure 186: Middle East and Africa Market Value Analysis, 2017 to 2022

Figure 187: Middle East and Africa Market Forecast & Y-o-Y growth, 2023 to 2033

Figure 188: Middle East and Africa Market Value Share By Transplant Type 2023 (E)

Figure 189: Middle East and Africa Market Value Share by Age Group 2023 (E)

Figure 190: Middle East and Africa Market Value Share By End User 2023 (E)

Figure 191: Middle East and Africa Market Value Share By Country 2023 (E)

Figure 192: Middle East and Africa Market Attractiveness Analysis, By Transplant Type

Figure 193: Middle East and Africa Market Attractiveness Analysis, By Age Group

Figure 194: Middle East and Africa Market Attractiveness Analysis, By End User

Figure 195: Middle East and Africa Market Attractiveness Analysis, By Country

Figure 196: GCC Countries Market Value Proportion Analysis, 2022

Figure 197: Global Vs GCC Countries Y-o-Y Growth Comparison, 2022 to 2033

Figure 198: GCC Countries Market Share Analysis (%) By Transplant Type, 2022 & 2033

Figure 199: GCC Countries Market Share Analysis (%) By Age Group, 2022 & 2033

Figure 200: GCC Countries Market Share Analysis (%) By End User, 2022 & 2033

Figure 201: Türkiye Market Value Proportion Analysis, 2022

Figure 202: Global Vs Türkiye Y-o-Y Growth Comparison, 2022 to 2033

Figure 203: Türkiye Market Share Analysis (%) By Transplant Type, 2022 & 2033

Figure 204: Türkiye Market Share Analysis (%) By Age Group 2022 & 2033

Figure 205: Türkiye Market Share Analysis (%) By End User, 2022 & 2033

Figure 206: South Africa Market Value Proportion Analysis, 2022

Figure 207: Global Vs South Africa Y-o-Y Growth Comparison, 2022 to 2033

Figure 208: South Africa Market Share Analysis (%) By Transplant Type, 2022 & 2033

Figure 209: South Africa Market Share Analysis (%) By Age Group, 2022 & 2033

Figure 210: South Africa Market Share Analysis (%) By End User, 2022 & 2033

Figure 211: North Africa Market Value Proportion Analysis, 2022

Figure 212: Global Vs North Africa Y-o-Y Growth Comparison, 2022 to 2033

Figure 213: North Africa Market Share Analysis (%) By Transplant Type, 2022 & 2033

Figure 214: North Africa Market Share Analysis (%) By Age Group, 2022 & 2033

Figure 215: North Africa Market Share Analysis (%) By End User, 2022 & 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Kidney Stone Extraction Balloon Market Size and Share Forecast Outlook 2025 to 2035

Acute Kidney Injury Treatment Market Growth - Trends & Forecast 2025 to 2035

APOL1 Mediated Kidney Disease Market - Demand, Growth & Forecast 2025 to 2035

Late Stage Chronic Kidney Disease Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

ICU-acquired Acute Kidney Treatment Market

Autosomal Dominant Polycystic Kidney Disease Treatment Market Overview - Growth & Forecast 2025 to 2035

Transplant Monitoring Kits Market - Growth & Forecast 2025 to 2035

Global Transplant Diagnostics Market Insights – Size, Trends & Forecast 2024-2034

The Liver Transplantation Market is segmented by Treatment type and End User from 2025 to 2035

Bone Marrow Transplant Market is segmented by transplant type, disease indication, and end user from 2025 to 2035

3D Bioprinted Organ Transplants Market Size and Share Forecast Outlook 2025 to 2035

Global Cross-species Organ Transplantation Market Analysis – Size, Share & Forecast 2024-2034

Hematopoietic Stem Cell Transplantation Market - Trends & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA