The Japan wireless telecommunication services industry will reach a market value of USD 1,61,586.9 million in 2025 and grow steadily at a CAGR of 6.7%, reaching USD 3,10,516.7 million by 2035.

| Attributes | Values |

|---|---|

| Estimated Japan Industry Size in 2025 | USD 1,61,586.9 million |

| Projected Japan Industry Size in 2035 | USD 3,10,516.7 million |

| Value-based CAGR from 2025 to 2035 | 6.7% |

Growing internet traffic due to the need for high-speed internet, expansion of the wireless telecommunication services market in Japan. The infrastructure, which is so critical to health operations of businesses and individuals and those of day-to-day life, it can only be expanded in so far.

Importance of 5G Technology for Demand Solution One of the applicable solutions to settle this request is 5G Technology, as it gives another few highlights of ultra-low latency, higher bandwidth, and better network. When businesses and consumers migrate to 5G networks, they use complex applications such as employed smart homes, autonomous vehicles, and real-time data analytical devices.

Internet of Things (IoT) The accelerated growth of the Internet of Things (IoT) is empowering disruptive industries and driving more opportunities for growth in this market. Increasing connected devices like healthcare monitoring and industrial sensors leads to actuated demand for strong wireless infrastructure. The IoT can be an integral part of industries like manufacturing, healthcare, logistics, and agriculture, where it increases efficiency, tracks in real-time, and supports data-driven decisions.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

The following table presents the compound annual growth rate (CAGR) for the Japan market over six-month intervals, allowing industry stakeholders to track precise trends for strategic decision-making.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 6.2% |

| H2, 2024 | 6.4% |

| H1, 2025 | 6.5% |

| H2, 2025 | 6.8% |

H1 signifies January to June, while July to December analysis is signified through H2

The steady increase in 5G rollouts, cloud-based telecom services, and IoT-driven industries reflects market momentum. The Japan wireless telecom market is projected to grow from 6.2% CAGR in H1 2024 to 6.8% in H2 2025, demonstrating consistent expansion.

| Date | Development/M&A Activity & Details |

|---|---|

| Jan-25 | NTT Docomo are focused on expanding its 5G network to cover 90% of urban areas in Japan. |

| Oct-24 | SoftBank partnered with Microsoft Azure to develop AI-driven cloud solutions. |

| Mar-24 | KDDI launched "Telecom CloudPro," a dedicated service for BFSI and healthcare sectors. |

| Sep-24 | Rakuten Mobile acquired a regional telecom provider for enhancing rural connectivity. |

| Dec-23 | Japan MIC (Ministry of Internal Affairs and Communications) introduced new spectrum auction policies to support small businesses in 5G adoption. |

Japanese telecom providers are searching for strategic partnerships and invest to provide the market and remain competitive, with the integration with cloud, ai-based services, and applications on the IoT. With 5G adoption, telecom companies are broadening service portfolios to provide improved connectivity for both enterprises and consumers.

5G Revolutionizes Connectivity

Japan's 5G technology deployments are led by NTT Docomo, SoftBank, and KDDI, which plan to offer ultra-fast speeds, low latency, and enhanced connectivity across the country's largest cities. These trends drive the mass shipment of autonomous driving, AR/VR scenarios, and industrial automation. The 5G transformation is redefining Japan’s digital economy, improving user experience through uninterrupted streaming, speedy downloads and numerous smart device connections.

Cloud Services Dominate the Market

Cloud-based telecom solutions streamline enterprise operations, strengthen cybersecurity, and facilitate remote work. Rising demand for secure data access and transaction processing in industries like BFSI and healthcare is making investments in cloud-managed telecom services more elaborate. Japan-based telecom sector is also expected to grow on cloud adoption at 8.2% CAGR, where ironically the growth of traditional telecom services is also dominated.

IoT and Smart Cities Expand Opportunities

Japan leading the way reshaping urban landscapes with smart city initiatives and IoT technology Industrial automation powered by IoT, connected vehicles, and AI-based traffic management systems are among the potential use cases driving demand for such wireless connectivity. Real-time monitoring, energy-efficient public services, and automated industrial processes heavily depend on telecommunication providers.

Investments in Rural Connectivity Increase

A major investment to expand rural broadband is aimed at closing Japan's digital divide. A government and telecom giants are working hand in hand to roll out high-speed networks to remote regions, enabling e-learning, telemedicine, and digital commerce. Better connectivity should boost economic inclusion and provide new revenue streams for telecom providers.

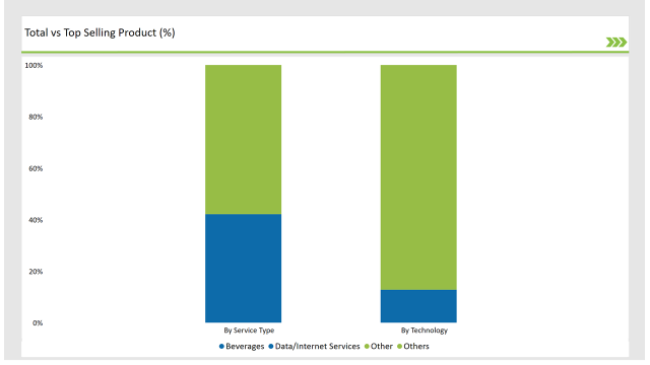

| Service Type | Market Share (2025) |

|---|---|

| Data/Internet Services | 42.1% |

| Fixed Voice Services & Messaging | 20.5% |

| Telecom Managed Services | 19.6% |

| Cloud Services | 17.8% |

Data and internet services sit above all else, a reflection of our growing reliance on fast broadband on both work and play, as well as conducting business. Rapid Adoption of telecom managed services and cloud services across industries.

| Technology | Market Share (2025) |

|---|---|

| 3G | 12.8% |

| 4G | 50.3% |

| 5G | 36.7% |

Although 4G is still the prevalent technology, 5G penetration is increasing rapidly, alongside telecom providers upgrading their infrastructure to meet modern connectivity requirements.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

Japan’s wireless telecom market is fiercely competitive, headed by NTT Docomo, SoftBank and KDDI. Revolutionizing Telecoms - Rakuten Mobile and Regional Telecom Providers Drive Competition with Innovative Services.

| Vendors | Market Share (2025) |

|---|---|

| NTT Docomo | 29.3% |

| SoftBank | 25.8% |

| KDDI | 22.1% |

| Rakuten Mobile | 10.5% |

| Others | 12.3% |

Data/internet services, fixed voice services & messaging, telecom-managed services, and cloud services dominate.

The market includes 3G, 4G, and 5G technologies, with 5G adoption accelerating significantly.

BFSI, healthcare, retail & eCommerce, IT & telecom, travel & hospitality, and government are key industries.

The Japan wireless telecom market will grow at a CAGR of 6.7% from 2025 to 2035.

By 2035, the industry will reach USD 3,10,516.7 million.

Key drivers include 5G adoption, cloud computing, and IoT applications.

Tokyo and Osaka lead in wireless service adoption due to urbanization and high-tech infrastructure.

Leading players include NTT Docomo, SoftBank, KDDI, and Rakuten Mobile.

Explore Telecommunication Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.