The increasing penetration of smartphones and IP-based voice communication technologies like Voice Over LTE and Voice Over Wi-Fi in Japan are expected to experience large growth in demand over the next 10 years. The shift towards to withdraw 3G telecommunications networks, VoLTE is gaining as the primary voice technology such as high-definition, voice quality, reduced call setup times and increased reliability.

The stage of VoWiFi is undergoing a rapid-growth phase propel due to the demand for indoor connectivity solutions, as well as seamless handovers between networks. The funnel of Wi-Fi 6 and Private 5 G networks is also empowering VoWiFi offerings to ensure decreasing price, high-quality voice calls. The market is expected to exceed USD 1,456.7 million by 2025, with a CAGR of 25.1%, exceeding USD 13,675.9 million by 2035.

Market Attributes and Growth Projections

| Attributes | Values (USD Million) |

|---|---|

| Estimated Market Size in 2025 | USD 1,456.7 Million |

| Projected Market Size in 2035 | USD 13,675.9 Million |

| Value-based CAGR from 2025 to 2035 | 25.1% |

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

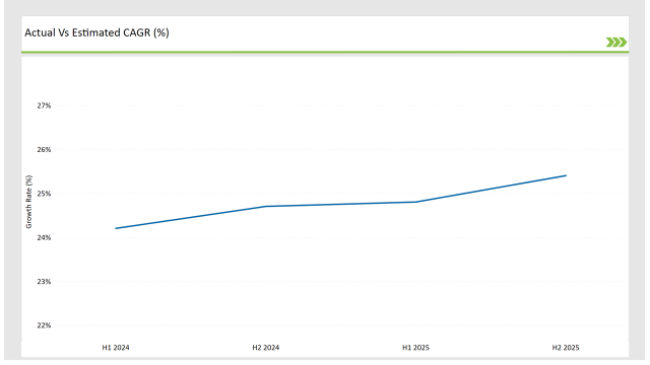

The table below outlines the semi-annual growth rate of the market, offering insights into industry trends.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 24.2% |

| H2 2024 | 24.7% |

| H1 2025 | 24.8% |

| H2 2025 | 25.4% |

The market in Japan for voice over long-term evolution (VoLTE) and voice over wireless fidelity (VoWi-Fi) services is expanding. H2 2024 data was then based on higher enterprise adoption of VoWiFi solutions, helping spur growth from H1 2024 (24.2%) to H2 2024 (24.7%). This pattern remained in H1 2025 (24.8%). and H2 2025 (25.4%), promting advanced network infrastructure, and integration in 5G.

| Date | Development / M&A Activity & Details |

|---|---|

| Jan-25 | NTT Docomo expands VoLTE and VoWi-Fi capabilities to enhance indoor call quality. |

| Oct-24 | SoftBank partners with cloud VoIP providers to improve enterprise VoWi-Fi solutions. |

| Mar-24 | KDDI launches AI-powered call optimization for VoLTE and VoWi-Fi services. |

| Sep-24 | Sony integrates advanced VoWi-Fi features in its latest smartphone lineup, boosting call reliability. |

| Dec-23 | Japan’s MIC allocates new spectrum to support rising VoWi-Fi adoption in urban and rural areas. |

Increasing Adoption of 5G-Enabled VoLTE Services

The rising installation of 5G network is the key element that is propelling the growth for global voice over LTE market due to telecom operators are putting effort on 5G Network infrastructure. The rollout of 5G has also surpassed the 2G and 3G networks, which mobile operators are phasing out as a way to pave the way for 4G and 5G VoLTE, which will enable VoNR (Voice over New Radio) and real-time video calling.

Meanwhile, VoLTE adoption is accelerating in countries like Japan, South Korea, and China as 5G coverage expands in the regions. New cloud-native IMS (IP Multimedia Subsystem) solutions continue to innovate on VoLTE scalability, operational cost optimization, and service reliability.

Expansion of Wi-Fi Calling for Indoor Connectivity

VoWiFi is becoming an essential solution for voice calls indoors, especially with the rise of Wi-Fi 6 and private 5G networks. Operators then are incorporating Wi-Fi calling to help cover low-signal areas, like office buildings, underground metro stations, and rural places.

Voice over Wi-Fi, also commonly known as VoWiFi, allows your mobile device to transmit its voice calls over a Wi-Fi network, meaning you no longer need a cellular signal to make a voice call. Carrier-grade WiFi solutions are also essentially utilized by enterprises, offering a cost-effective mode of communication between internal departments, as well those employed to boost the overall user experiences.

Rising Demand for High-Quality Voice Communication

HD voice calling and an improved call quality is being demanded by consumers and businesses resulting in an increasing demand for VoLTE and VoWiFi solutions. Traditional circuit switched network have poor clarity, latency and call drop.

VoLTE and VoWiFi, which are based on packet switched technology, offer low-latency, high-definition audio and less background noise as compared to earlier generations of networks. VoWiFi also acts like a cheap international roaming plan, letting users call a local number while travelling (again, at local rates) and avoiding expensive international calls.

Expansion of IoT and Smart Devices with Voice Capabilities

Smartphones, wearables, IoT-enabled devices and smart assistants are shifting the demand for VoLTE and VoWiFi connectivity. Telecom providers are focused on developing a VoLTE-supported IoT ecosystem to meet consumer demand for voice integration across multiple devices. VoLTE and VoWiFi obtain substantial significance in real-time processing and low power consumption for such applications such as connected cars, smart assistants and industrial automation where voice communication will be highly reliable.

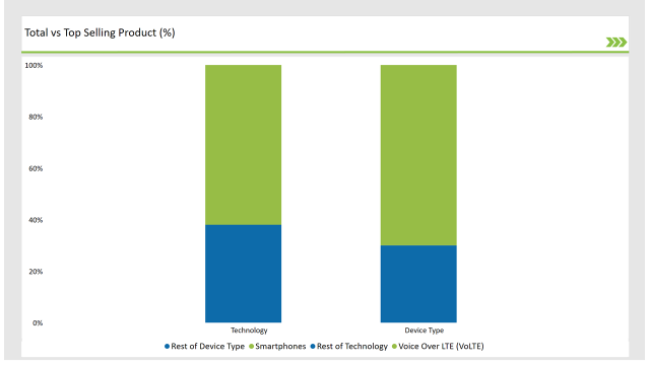

| Technology | Market Share (2025) |

|---|---|

| Voice over LTE (VoLTE) | 62.0% |

| Others | 38.0% |

The expansion of 5G networks, upgrades of existing networks, and the phased-out era of 3G, VoLTE is dominating. Telecom companies prioritize VoLTE interface for incredibly high voice quality, zero latency calls, and video calling.

| Device Type | Market Share (2025) |

|---|---|

| Smartphones | 70.0% |

| Others | 30.0% |

Smartphones are dominating the market due to the growing adoption of 5G, the availability of better VoLTE-enabled devices and the increasing need for HD voice services.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

-and-voice-over-wi-fi-(vowi-fi)-market-revenue-share-by-country-2025.png)

The Japanese VoLTE and VoWi-Fi market is highly competitive with the leading giants of telecom operators and technology firms are propelling the innovation.

| Vendors | Market Share (2025) |

|---|---|

| NTT Docomo | 35.0% |

| Soft Bank | 28.0% |

| KDDI | 22.0% |

| Sony | 7.0% |

| Others | 8.0% |

The market will grow at a CAGR of 25.1% from 2025 to 2035.

The industry will reach USD 13,675.9 Mn by 2035.

Increasing smartphone penetration, rising IP-based communication adoption, and the demand for high-quality voice services.

NTT Docomo, SoftBank, KDDI, and Sony.

Explore Telecommunication Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.