The Japan TMA market is poised for a period of significant growth in the next decade, fueled by the accelerated rollout of 5G networks, surging demand for improved wireless connection, and investment in telecom infrastructure. By 2025, the market is expected to reach USD 732.4 million and is projected to expand with a CAGR of 5.9% to USD 1,302.8 million in 2035.

Market Attributes and Growth Projections

| Attributes | Values |

|---|---|

| Estimated Japan Market Size in 2025 | USD 732.4 Million |

| Projected Japan Market Size in 2035 | USD 1,302.8 Million |

| Value-based CAGR from 2025 to 2035 | 5.9% |

Explore FMI!

Book a free demo

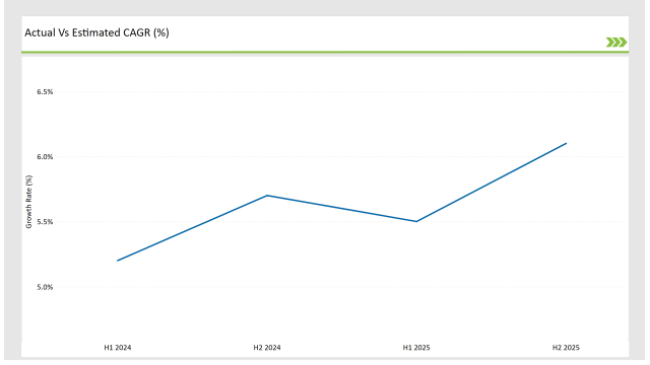

The table below outlines the semi-annual growth rate of the market, providing insights into industry trends.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 5.2% (2024 to 2034) |

| H2 2024 | 5.7% (2024 to 2034) |

| H1 2025 | 5.5% (2025 to 2035) |

| H2 2025 | 6.1% (2025 to 2035) |

The CAGR variation denotes the changes in the market, with a consistent growth period in 2024, then a small decline at the beginning of 2025. But the robust 60 BPS H2 2025 rise shows the return of demand and go-go enthusiasm for the sector as telcos step up 5G rollouts.

| Date | Development / M&A Activity & Details |

|---|---|

| Jan-25 | Sumitomo Electric expands production capacity for 5G-compatible TMAs. |

| Oct-24 | Murata Manufacturing acquires a domestic TMA manufacturer to strengthen market presence. |

| Mar-24 | Hitachi High-Tech partners with SoftBank to deploy low-noise amplifiers in urban networks. |

| Sep-24 | NEC Corporation launches multi-band TMAs to improve network efficiency. |

| Dec-23 | Japan’s Ministry of Internal Affairs and Communications announces new spectrum allocations, driving TMA demand. |

Strong 5G Deployment Driving TMA Integration

Telecom majors NTT Docomo, KDDI and SoftBank's biggest demand for TMAs is driven by Japan's rapid 5G rollout. The densified network deployments such as small cells and macro base stations the TMF have an important role to play in reducing losses and improving uplink performance.

Because of Japan’s urban density and high data traffic, operators are deploying advanced TMAs with low-noise amplification to increase network reliability. Also, the 2023 Government-sponsored 5G acceleration scheme has bolstered TMA rollout in rural areas to address the urban-rural digital divide and enable nationwide 5G coverage.

Surge in Open RAN and Multi-Vendor Compatibility

As O-RAN continues to be adopted, Japan is leading the way with Rakuten Mobile and others deploying multi-vendor networks. It's this trend that requires flexible and interoperable TMAs capable of working across varying telecom infrastructure configurations. Because Open RAN is disaggregated, operators can deploy cost-efficient components from various suppliers.

As TMAs now need to be able to service more varied base stations and antennas, manufacturers are concentrating on advancing softwaredefined amplifiers and adaptive filtering technologies to improve network performance. Japan’s TMA ecosystem is experiencing innovation catalyzation by the shift towards vendor-neutral architectures.

High Investment in Energy-Efficient and Low-Power TMAs

Japan’s strong commitment to carbon neutrality by 2050 has accelerated incorporation of energy-saving elements in the network - a move by telecom service providers to strengthen low-power TMAs as well. Compared to existing silicon-based amplifiers, the newer GaN (Gallium Nitride)-based TMAs boasts of better efficiency, lower heat dissipation, and lower power consumption and they are gaining traction among operators.

NTT Docomo and SoftBank, meanwhile, are also trialling green base station tech, including the use of solar-powered TMAs to reduce energy costs. As telecom networks are responsible for a large share of electricity consumption, the need for lightweight, passive-cooled TMAs that minimize environmental impact and maximize 5G performance is gaining momentum.

Rising Adoption of mmWave TMAs for Urban Network Densification

As a leading mmWave 5G market Japan's telecom operators continue to invest heavily in spectrum bands above 28 GHz to improve connectivity in urban areas. TMAs with a high frequency (HF) for mmWave- which boost the same signal strength while suppressing noise more than broad-band TMAs deployed for LTE- are being deployed to prevent the shorter transmission range of mmWave.

KDDI and Rakuten Mobile have been prioritizing the development of compact and lightweight TMAs that support high-band spectrum and low latency for real-time applications. There is an increasingly demand for mmWave-compatible TMAs, especially in urban areas such as Tokyo and Osaka, where ultra-high speed 5G connectivity is critical.

Growing Demand for TMAs in Smart City and IoT Applications

The growth of TMA market is mainly supported by Japan's smart city initiatives and IoT based industries. Telecom networks need Ultra-Reliable Low Latency Communication for connected infrastructure projects like smart traffic systems, autonomous transport, and remote healthcare. TMAs are required to increase network coverage and optimize 5G-based IoT deployments. As an example, the growth in industrial IoT across sectors such as manufacturing and logistics is driving the integration of TMA into private 5G networks.

With Japan striving to bring about 5G -supported automation and AI- driven services that can demand much of their networks, reliability enhancements offered by next-generation TMAs are emerging as a leading investment focus for both operators and enterprises.

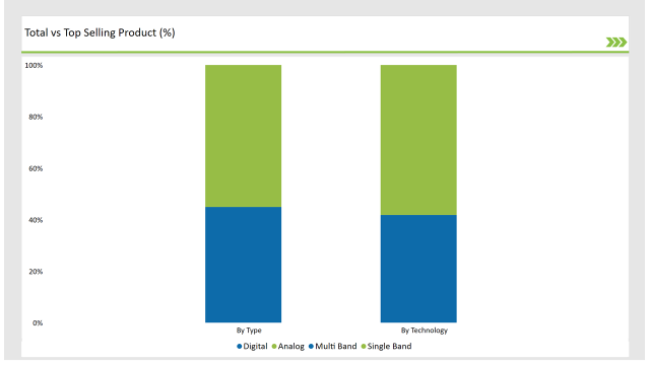

| Type | Market Share (2025) |

|---|---|

| Single Band | 55.1% |

| Multi Band | 44.9% |

| Technology | Market Share (2025) |

|---|---|

| Analog | 58.2% |

| Digital | 41.8% |

The Japan tower mounted amplifier market is highly competitive, with several domestic players leading innovation and expansion.

| Vendors | Market Share (2025) |

|---|---|

| Sumitomo Electric | 30.5% |

| Murata Manufacturing | 24.1% |

| NEC Corporation | 19.8% |

| Hitachi High-Tech | 11.4% |

| Others | 14.2% |

The market will grow at a CAGR of 5.9% from 2025 to 2035.

The industry will reach USD 1,302.8 million by 2035.

The major players include Sumitomo Electric, Murata Manufacturing, NEC Corporation, and Hitachi High-Tech.

Single-band and multi-band TMAs cater to diverse network needs.

Analog TMAs maintain dominance, but digital TMAs are growing rapidly.

Network operators lead, but infrastructure providers play a crucial role in expansion.

Electric Switches Market Insights – Growth & Forecast 2025 to 2035

Electrical Bushings Market Trends – Growth & Forecast 2025 to 2035

Edge Server Market Trends – Growth & Forecast 2025 to 2035

Eddy Current Testing Market Growth – Size, Demand & Forecast 2025 to 2035

3D Motion Capture Market by System, Component, Application & Region Forecast till 2035

IP PBX Market Analysis by Type and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.