The Japan Supplier Quality Management (SQM) Applications Market is expected to grow from USD 1,515.0 million in 2025 to USD 3,737.3 million in 2035, at a CAGR of 9.5% from the period 2025 to 2035. The market is growing due to the rising regulatory compliance requirements, increasing adoption of cloud-based supplier quality management solutions and increasing complexity of supply chain ecosystem across all industries including automotive, aerospace & defence, electronics and healthcare.

| Attributes | Values |

|---|---|

| Estimated Japan Industry Size 2025 | USD 1,515.0 million |

| Projected Japan Industry Size 2035 | USD 3,737.3 million |

| Value-based CAGR from 2025 to 2035 | 9.5% |

The emergence of strict Japan Industrial Standards (JIS) and ISO compliance requirements and increasing pressure to manage extensive supplier risk assessment and quality control are fuelling the growth of Supplier Quality Management (SQM) solutions.

AI, automation, and blockchain technologies are increasingly being embraced by diverse industries (particularly automotive, electronics, and aerospace) to help monitor suppliers, improve compliance tracking and facilitate data-driven decision-making. AI systems streamline supplier evaluations and reduce mistakes, improve compliance no matter how complex and automation speeds up reporting and audits.

Blockchain allows for dispensation of tamper-proof records and ensures the integrity of supplier data allowing identification to work as a point of reference. This evolution is revolutionising SQM processes and enabling businesses to fulfil regulatory requirements, reduce risk and optimise supplier performance across multi-layered supply chains.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

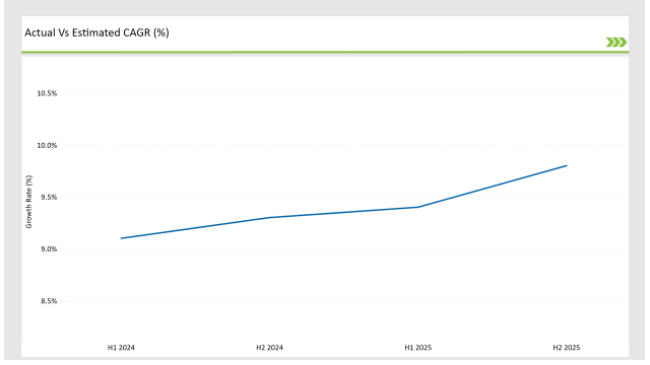

The table below illustrates the compound annual growth rate (CAGR) of the Japan SQM market over six-month intervals, reflecting the evolution of regulatory mandates, cloud adoption, and digital transformation in supplier quality management.

| Period | Value CAGR |

|---|---|

| H1, 2024 | 9.1% |

| H2, 2024 | 9.3% |

| H1, 2025 | 9.4% |

| H2, 2025 | 9.8% |

(H1: January to June; H2: July to December)

The increase in CAGR from 9.1% in H1 2024 to 9.8% in H2 2025 reflects rapid digitalization in supplier quality management, increased investments in cloud solutions, and heightened supplier risk assessment needs across Japanese industries.

| Date | Development/M&A Activity & Details |

|---|---|

| Jan-2025 | Dassault Systems launched an AI-powered supplier quality analytics tool for automotive manufacturers. |

| Oct-2024 | SAP acquired a Japanese compliance software company to enhance SQM functionalities. |

| Mar-2024 | Japan Ministry of Economy, Trade and Industry (METI) introduced new supplier audit guidelines help for emphasizing real-time quality reporting. |

| Sep-2024 | Siemens Digital Industries Software partnered with semiconductor manufacturers for end-to-end supplier quality automation. |

| Dec-2023 | NEC Corporation developed a blockchain-based supplier quality tracking system for electronics manufacturers. |

Major regulatory bodies and software vendors in Japan are investing in AI-driven automation, blockchain-based supplier tracking, and cloud-based supplier quality platforms to enhance compliance and operational efficiency.

Automation Enhances Supplier Quality Compliance

The automotive and aerospace sectors in Japan are tilting towards adopting AI and machine learning technologies for improvements in Supplier Quality Management (SQM). These technological innovations are revolutionizing supplier quality audits, reducing errors from the manual process, and streamlining compliance monitoring. AI-powered systems provide better insights into supplier risk, allowing logistics managers to analyze vendors more accurately and with less risk of human error.

Automation helps collective intelligence complement humans By automating tedious tasks like inputting data, identifying anomalies, and reporting, businesses can spend their time where it matters most - high-value decision-making.

Thus, organizations gain from accurate audit results and more effective risk management practices. With their ever-evolving capabilities, such advanced solutions also facilitate real-time monitoring, allowing for rapid response to product quality issues, which in turn enhances the overall performance of the supplier in terms of meeting regulatory compliance in time-sensitive sectors like automotive and aerospace.

Cloud-Based SQM Solutions Gain Popularity

Japanese industries especially automotive, electronics and food & beverage yet they have embraced cloud-based SQM as best practice. These could be on demand and help you to scale without spending millions getting costly on premise infrastructure. Cloud apps provide remote access, allowing teams to collaborate in real time from different locations, resulting in faster decision-making.

By providing organizations with a centralized platform to track and manage supplier performance, compliance, and risk, they can improve transparency and efficiency in their supply chains. Moving to Cloud solutions will fit Japan's growing demand for simply, digital and easily-accessible tools that enhance supplier quality management process on continuous improvement.

Regulatory Authorities Push for Digital Supplier Audits

Japan's METI (Ministry of Economy, Trade, and Industry) and JIS (Japan Industrial Standards) authorities are on a forced drive for the electronic submission of supplier compliance data which has prompted industries to move towards digital Supplier Quality Management (SQM) platforms.

These regulations look to cut out inefficiencies, reduce paperwork, and allow timely and more precise reporting of vendor performance and risk. The move to digital audits will foster increased transparency in supply chains and help strengthen the quality, reliability and frequency of compliance reporting.

Industries are developing SQM platforms that find resemblance with such regulations across automotive and electronics, supporting automated error-free submissions to not only mitigate risk, but also ensure compliance with industry and international standard.

Integration of Block chain for Supplier Traceability

Japanese automotive and electronics industries will enhance supplier traceability by exploring the application of blockchain technology into their SQMS (supplier quality management system). It is a distributed ledger with records that are transparent (accessible to authorized parties) and immutable (can't be modified) whereby it keeps track of the movement of materials, components, and finished goods as they flow through the supply chain.

Blockchain's role: By adopting blockchain, companies are able to detect counterfeit products, eliminate fraud and ensure compliance with quality standards. The technology also provides a means to ensure tamper-proof record keeping, allowing industries to retain auditable, verifiable compliance data for regulatory purposes.

The integrated solution is especially effective in industries such as automotive, where there is high demand for supply chain integrity and regulatory consistency. Because Blockchain impacts data security, it gives stakeholders assurance in the authenticity and quality of a product.

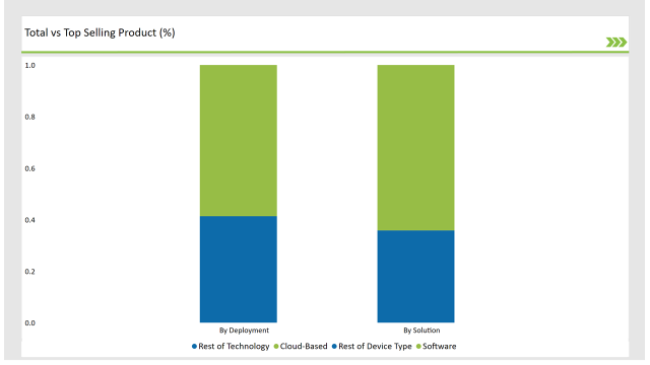

| Solution | Market Share (2025) |

|---|---|

| Software | 64.2% |

| Services | 35.8% |

Software solutions lead the market due to their capabilities in real-time supplier assessment, compliance automation, and integration with enterprise IT ecosystems. Services are growing due to increasing demand for supplier compliance consulting and implementation support.

| Deployment Type | Market Share (2025) |

|---|---|

| Cloud-Based | 58.7% |

| On-Premises | 41.3% |

Cloud SQM solutions are gaining importance both in terms of costs and scalability along with security. They enable businesses to scale operations without incurring significant upfront costs on infrastructure while providing remote access for real-time collaboration. The same advantages clearly make cloud solutions a strong match for sectors with always-changing supply chain requirements.

However, on-premises solutions continue to serve the needs of large enterprises with complex compliance processes. These organizations often demand enhanced control over sensitive data and prefer the tailored solutions that on-premises systems offer, allowing them to ensure exact alignment with their particular compliance requirements and security protocols.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

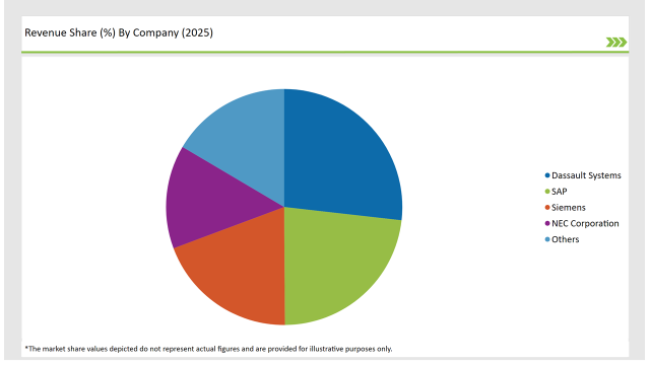

Leading SQM software providers are leveraging AI, cloud computing, and block chain innovations to differentiate their solutions in Japan.

| Vendors | Market Share (2025) |

|---|---|

| Dassault Systems | 26.8% |

| SAP | 23.1% |

| Siemens | 19.4% |

| NEC Corporation | 14.2% |

| Others | 16.5% |

Software dominates due to automation and compliance needs.

Cloud-based adoption surges due to flexibility and cost savings.

Automotive and electronics drive market demand, followed by aerospace & defense and healthcare.

The Japan Supplier Quality Management Applications Market will grow at a CAGR of 9.5% from 2025 to 2035.

The industry is projected to reach USD 3,737.3 million by 2035.

Key drivers include regulatory compliance mandates, AI-powered supplier audits, and increased cloud adoption.

Software solutions lead with a 64.2% market share due to automation and compliance features.

Leading vendors include Dassault Systèmes, SAP, Siemens, NEC Corporation, and others.

| Estimated Size, 2025 | USD 14,061.6 million |

| Projected Size, 2035 | USD 38,081.4 million |

| Value-based CAGR (2025 to 2035) | 10.5% CAGR |

Explore Vertical Solution Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.