The Japan structured product label (SPL) management market is projected to reach a value of USD 5,174.2 million in 2025 and will grow at a CAGR of 12.3%, reaching USD 16,432.5 million by 2035.

| Attributes | Values |

|---|---|

| Estimated Japan Industry Size 2025 | USD 5,174.2 million |

| Projected Japan Industry Size 2035 | USD 16,432.5 million |

| Value-based CAGR from 2025 to 2035 | 12.3% |

Japan SPL management market has been witnessing rapid growth due to the rising demand for regulatory compliance, increasing complexity in pharmaceutical labelling, and growing adoption of digital solutions in various life sciences industries. Japanese companies are introducing structured labelling solutions to ensure efficiency, reduce compliance risks, and maintain labelling standardization.

Moreover, growing adoption of cloud-based SPL solutions is reshaping the industry by enabling real-time access to documents, reduced cost of operations, and scalable operations. As a result, the demand for structured labelling solutions is only expected to increase with the rise of biologics, personalized medicine, and the tightening of regulatory guidelines. Automation, AI-based compliance managing, Blockchain powered safety mechanisms will favour the market.

Explore FMI!

Book a free demo

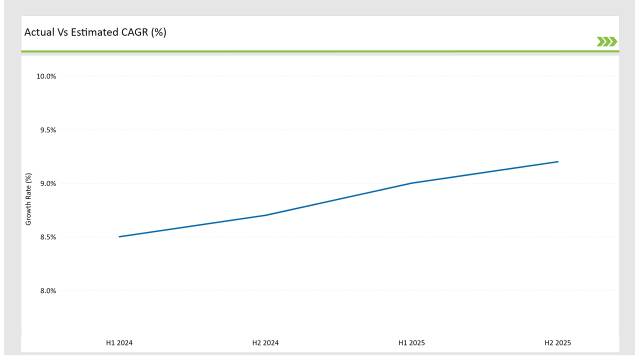

The table below provides a semi-annual comparison of the CAGR, showing market progression across six-month intervals.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 11.9% |

| H2, 2024 | 12.1% |

| H1, 2025 | 12.2% |

| H2, 2025 | 12.5% |

H1 signifies January to June, while July to December analysis is signified through H2.

Accelerated adoption of AI-based regulatory automation, cloud solutions, and digital labeling compliance has driven consistent growth in the market. The market CAGR is expected to rise from 11.9% in H1 2024 to 12.5% by H2 2025, reflecting strong industry momentum.

| Date | Development/M&A Activity & Details |

|---|---|

| Jan-2025 | Fujitsu collaborates with a leading pharmaceutical company to enhance AI-driven SPL solutions. |

| Oct-2024 | NEC launches a cloud-based SPL platform integrating blockchain technology for enhanced security. |

| Mar-2024 | Takeda Pharmaceuticals partners with a global IT firm to implement automated compliance tracking in SPL. |

| Sep-2024 | Japan’s Ministry of Health introduces stricter electronic labeling compliance policies. |

| Dec-2023 | Regulatory authorities in Japan expand the scope of SPL mandates for biologics and medical devices. |

These developments emphasize automation, compliance tracking, and cloud adoption as major trends shaping the industry. The increasing collaboration between technology firms and life sciences companies is expected to drive the adoption of advanced SPL solutions.

AI-Powered Regulatory Compliance Transformation

As regulatory frameworks become more complex, the adoption of AI-powered compliance solutions in SPL management. AI will automate updates to labelling documents, avoiding human error and maintaining a more accurate understanding of real-time compliance status.

Regulatory compliance data is fed into machine learning algorithms in order to understand whether our systems are compliant with global compliance standards as well as Japan’s PMDA (Pharmaceuticals and Medical Devices Agency) guidelines. AI-enabled SPL management solutions minimize non-compliance risk, mitigate heavy penalties and enhance workflow efficiency for pharmaceutical and biotechnology companies.

Cloud-Based SPL Solutions Gain Traction

Cloud adoption for SPL management is witnessing a hasty catch-up due to its cost-effectiveness, instant accessibility, and easy plug into the enterprise infrastructure. They are seeking SaaS-based SPL solutions from pharmaceutical and biotechnology firms in Japan for better control over documents, automated work processes, and centralized tracking of relevant regulation changes.

Deployment on the cloud avoids the headache of infrastructure maintenance and provides better scalability which is suitable for regulatory authorities and contract research organizations (CROs).

Rising Demand for Biologics and Personalized Medicine

Japan has seen increased demand for SPS management solutions due to the nation's increasing focus on biologics, cell therapies and personalized medicine. The nature of biologics themselves must ensure the tightest possible mechanisms of labeling and traceability to ensure safety and compliance.

With features such as automated data validation, real-time updates, and the ability to translate into multiple languages, SPL platforms minimize the complexity associated with biologic drug labelling, enabling pharmaceutical companies to find their footing.

Blockchain Integration in Libelling Systems

SPL management is seeing the adoption of blockchain technology due to data integration and security concerns. The immutable nature of blockchain provides tamper-proof records, improved traceability, and seamless compliance reporting. Blockchain-based SPL solutions bolster pharmaceutical data security, minimize counterfeit drug risks, and promote regulatory transparency by creating unalterable records of all labelling changes.

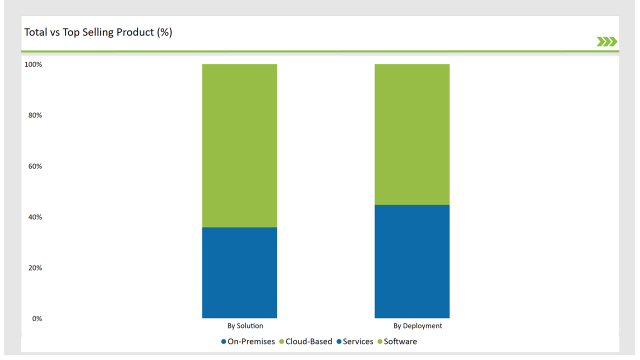

| Solution | Market Share (2025) |

|---|---|

| Software | 64.2% |

| Services | 35.8% |

The software solution software has the highest market share of about 64.2% by 2025 primarily due to the need for automation tools to replace the manual work of compliance, growing adoption of cloud-based platforms, and availability of AI-powered SPL solutions.

Segmentation by component reveals that the largest share of the services segment (35.8%) is focused on consulting, integration, and training support to aid SPL implementations. The service providers are crucial enablers that help enterprises with customization, compliance alignment, and systems optimization.

In addition, the accelerating demand for AI-based SPL solutions in Japan is due to the strict regulatory and operational infrastructure of Japan as well as the active Japanese government on digital transformation. Such technologies improve accuracy, improve the approval process, and make compliance with the Pharmaceuticals and Medical Devices Agency (PMDA) regulations, more thought-less, improving the overall efficiency of the market.

| Deployment | Market Share (2025) |

|---|---|

| Cloud-Based | 55.4% |

| On-Premises | 44.6% |

Cloud-based SPL solutions are in the lead in the SPL market in 2025, with a market share of 55.4%, due to their scalability, remote availability, and cost-effective features. For large enterprises with strict data regulation and control requirements, on premise solutions continue to have validity.

Also, the combination of blockchain technology has begun to gain traction in Japan SPL market for data security, traceability, and regulatory transparency. Such development is of paramount importance in order to reduce risks related to data alteration.

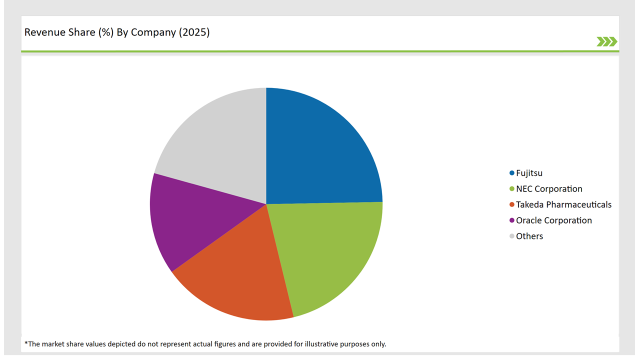

The Japan SPL management market is highly competitive, with key players investing in automation, AI integration, and blockchain. Leading companies are expanding their regulatory compliance solutions through strategic partnerships and R&D.

| Vendor | Market Share (2025) |

|---|---|

| Fujitsu | 24.7% |

| NEC Corporation | 21.5% |

| Takeda Pharmaceuticals | 18.9% |

| Oracle Corporation | 14.2% |

| Others | 20.7% |

The market will expand at a CAGR of 12.3% from 2025 to 2035.

By 2035, the market will reach USD 16,432.5 million.

Regulatory compliance, cloud adoption, AI-driven SPL solutions, and blockchain security.

Tokyo and Osaka are the leading regions due to their strong pharmaceutical and biotech presence.

Fujitsu, NEC Corporation, Takeda Pharmaceuticals, and Oracle Corporation.

The market is segmented into software and services. Software dominates due to automation and AI-driven compliance tools, while services provide essential support, including implementation and consulting.

The industry spans cloud-based and on-premises solutions. Cloud solutions lead due to scalability and accessibility, whereas on-premises solutions remain relevant for organizations prioritizing data security.

Pharmaceutical companies, biotechnology firms, medical device companies, regulatory authorities, and CROs drive the market. Pharmaceutical and biotech firms hold the largest share due to strict compliance requirements.

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Residential VoIP Services Market Insights – Trends & Forecast 2025 to 2035

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Safety Mirrors Market - Growth & Forecast 2025 to 2035

Heat Interface Unit Market Analysis - Size, Demand & Forecast 2025 to 2035

Induction Motors Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.