The Japan software distribution market is set to experience steady growth in the coming decade, driven by the increasing adoption of cloud-based software solutions, digital transformation initiatives, and the rising demand for enterprise software across various industries. The market is projected to reach USD 22,112.1 million in 2025 and is expected to grow at a CAGR of 12.3%, reaching USD 70,539.1 million by 2035.

Market Attributes and Growth Projections

| Attributes | Values |

|---|---|

| Estimated Japan Market Size in 2025 | USD 22,112.1 million |

| Projected Japan Market Size in 2035 | USD 70,539.1 million |

| Value-based CAGR from 2025 to 2035 | 12.3% |

Explore FMI!

Book a free demo

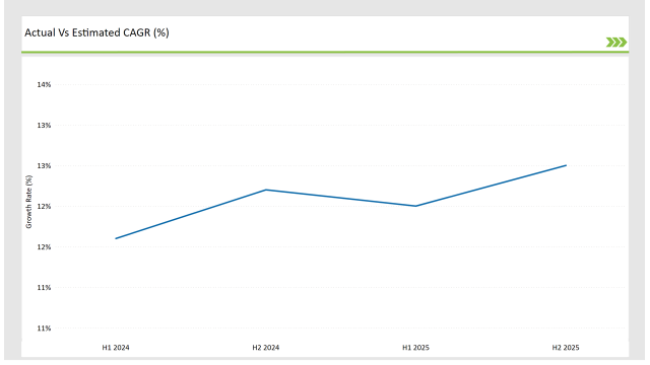

The table below outlines the semi-annual growth rate of the market, providing insights into industry trends.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 11.6% (2024 to 2034) |

| H2 2024 | 12.2% (2024 to 2034) |

| H1 2025 | 12.0% (2025 to 2035) |

| H2 2025 | 12.5% (2025 to 2035) |

The CAGR fluctuations reflect market dynamics, showing a 60 BPS increase from H1 2024 (11.6%) to H2 2024 (12.2%), indicating growing demand. A slight 20 BPS dip in H1 2025 (12.0%) suggests a market correction before rebounding in H2 2025 (12.5%), reflecting renewed investment in software distribution technologies.

| Date | Development / M&A Activity & Details |

|---|---|

| Jan-25 | Fujitsu launches an AI-powered software distribution platform to enhance cloud adoption. |

| Oct-24 | Rakuten partners with global software vendors to expand its cloud-based software distribution network. |

| Mar-24 | NEC acquires a local IT firm to strengthen its on-premise software distribution capabilities. |

| Sep-24 | SoftBank introduces a blockchain-based software licensing system to improve security. |

| Dec-23 | The Japanese government unveils new IT investment policies boosting digital transformation initiatives. |

Strong Demand for On-Premises Software in Regulated Industries

Japan’s regulated industries-finance, healthcare, and government-show an apparent preference for on-premises software distribution, contrary to global cloud adoption trends. New regulations around data residency and cybersecurity concerns encourage organizations to host their software in-house rather than use public clouds.

This resulted in a boom of hybrid IT models, where private cloud is used in conjunction with on-premises deployments by enterprises. Not only do software distributors profit by providing tailored licensing models and shaping compliance with the Financial Services Agency (FSA) and Personal Information Protection Act (PIPA) laws, localized, security-compliant solutions can become a prominently fucking differentiator in the Japanese landscape.

Preference for Localized Software and Language Support

In Japan, software solutions tailored for the domestic market take precedence, creating a unique requirement for localized software distribution. As opposed to the case of Western market where English based software are widely adopted, the Japanese enterprises need fully localized software, culturally adapted UI, and regional compliance features.

It allows international software solutions to find their local footing through software distributors like SoftBank Commerce & Service Corp. as well as SB C&S, providing translation, integration and dedicated customer service for customers in Japan. Localized SaaS platforms and customized ERP solutions constitute a specific demand segment for software vendors aiming for Japan, thanks to this unusual requirement.

Growing B2B Software-as-a-Service (SaaS) Reseller Networks

Japan’s corporate sector is quickly adopting SaaS (software as a service) solutions; however, enterprise clients often prefer trusted resellers to purchase software. However, in contrast to the direct vendor sales model prevalent in Western markets, SaaS adoption in Japan is dependent on channel partners, value-added resellers (VARs), and system integrators (SIs).

B2B software distribution channels are also growing from distributors like Saison Information Systems and SBT Corp. who are seeking to offer bundled cloud services and security solutions along with localized compliance support. As SMEs and large enterprises in Japan continue to adopt more SaaS, establishing solid reseller partnerships is key for outside software vendors to enter the market.

Rising Demand for Subscription-Based Licensing Models

Japan's software distribution market is undergoing a seismic shift from perpetual software licensing to subscription-based models aligned with cost optimization and scalability demands. Long gone are the days when Enterprises and SME’s purchase software upfront capital expenditure use through monthly or yearly software subscription serving to flexible licensing options.

This is especially true of productivity software, cybersecurity solutions, and cloud-based enterprise apps. Japanese Value-added Suppliers (VAR) and distributors partner with Pemier vendors to provide local pricing to register discounts to Japan’s strategic accounting and taxation requirements. The move toward subscription-related licensing ties into wider digital transformation efforts across sectors.

Expansion of AI and Automation Software in Business Workflows

AI-driven software is rapidly being adopted by Japan’s corporate sector, especially automation, customer service and data analytics. Companies are diving into AI-based chatbots, workflow automation tools, and machine learning platforms to optimize operational efficiency.

Distributors are responsible for accumulating AI software solutions around the world and tailoring them to Japanese business customs and workflow. Top software distributors collaborate with AI startups and major global tech companies to ensure compatibility with enterprise resource planning (ERP), customer relationship management (CRM), and business intelligence (BI) systems customized for the Japanese market.

Growth in Cybersecurity Software Distribution Due to Stringent Regulations

The growing demand for advanced security software solutions is increasing due to the evolving cybersecurity landscape in Japan. With the growing incident of cyberattacks and the change in regulatory enforcement being strictly followed, organizations are seeking for comprehensive cybersecurity solution for protecting their data, endpoints and compliance.

In response, entities like Japan’s Financial Services Agency (FSA) and National Center for Incident Readiness and Strategy for Cybersecurity (NISC) issued stricter-level guidelines which already have companies migrating towards zero-trust architectures and cloud-centric security solutions. Software distributors such as Macnica and SBT Corp. collaborate with global security vendors to deliver Japan-specific threat intelligence solutions ranging from regulatory compliance to security posture enhancement.

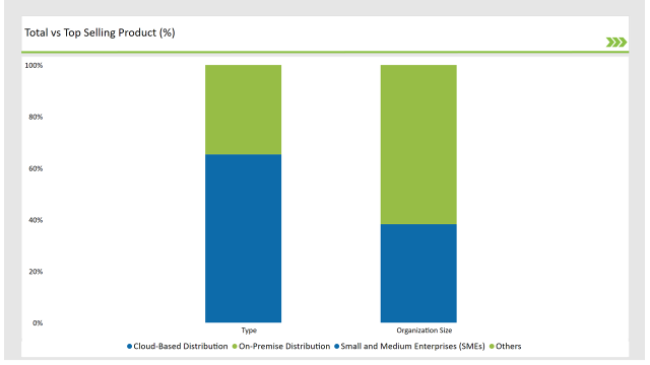

| Type | Market Share (2025) |

|---|---|

| Cloud-Based Distribution | 65.3% |

| On-Premise Distribution | 34.7% |

| Organization Size | Market Share (2025) |

|---|---|

| Small and Medium Enterprises (SMEs) | 38.2% |

| Others | 61.8% |

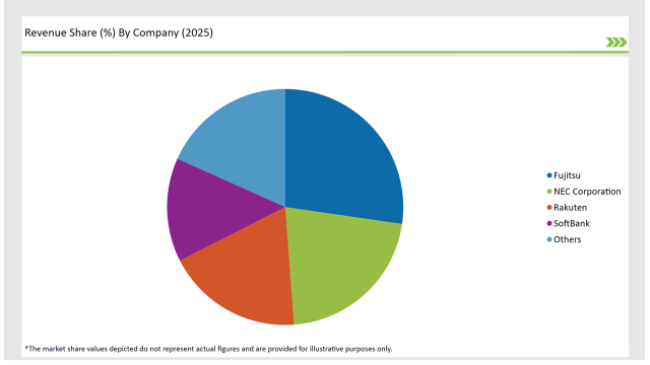

The Japan software distribution market is highly competitive, with key players driving technological advancements.

| Vendors | Market Share (2025) |

|---|---|

| Fujitsu | 27.3% |

| NEC Corporation | 21.5% |

| Rakuten | 18.7% |

| SoftBank | 14.2% |

| Others | 18.3% |

The Japan software distribution market will grow at a CAGR of 12.3% from 2025 to 2035.

The industry is projected to reach USD 70,539.1 million by 2035.

Cloud adoption and digital transformation, Government initiatives supporting IT infrastructure, Industry-specific demand for software solutions

Tokyo and Osaka dominate software adoption, given their strong tech ecosystem and enterprise presence.

The major players include Fujitsu, NEC Corporation, Rakuten, and SoftBank, among others.

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Residential VoIP Services Market Insights – Trends & Forecast 2025 to 2035

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Safety Mirrors Market - Growth & Forecast 2025 to 2035

Heat Interface Unit Market Analysis - Size, Demand & Forecast 2025 to 2035

Induction Motors Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.