The market for Japan protein A resins is awaiting growth from the USD 53.5 million in the year 2025 up to USD 60.3 million by the year 2035, CAGR of 1.2%. The predominant drivers for these growths happen to be developments in bioprocessing technology coupled with constant interest in biopharmaceutical drug research and commercial production of the monoclonal antibodies.

Market Overview

| Attributes | Values |

|---|---|

| Estimated Market Size 2025 | USD 53.3 Million |

| Projected Value 2035 | USD 60.3 Million |

| Value-based CAGR from 2025 to 2035 | 1.2% |

The Japan protein A resins market is growing with the increasing demand for highly selective purification resins in the biopharmaceutical industry. The areas for process improvement associated with antibody purification are novel generation resins of recombinant protein A as well as emerging techniques of chromatography. With personalized medicine as the increasing trend, increased monoclonal antibodies for treatment of cancer and auto-immune diseases would demand a purification process of antibodies. Improved technologies in bio-separation lead to manufactures of multi-cycle and high-capacity resins. In effect, this leads to an increased ability to scale the process up; therefore, bringing down the costs of production Additional regulatory support for the growth of biopharmaceutical advancement and manufacturing capacity expansion also boost the adoption of protein A resins across several applications.

Explore FMI!

Book a free demo

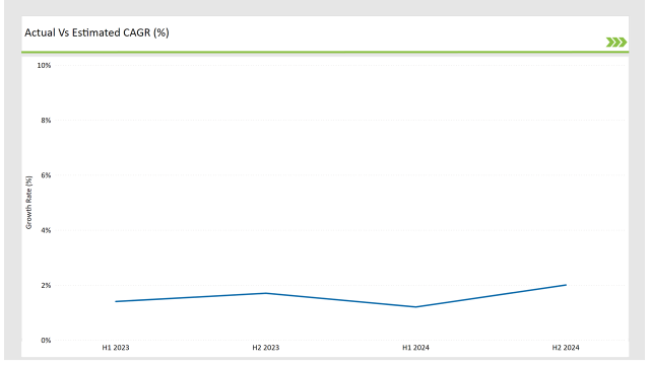

The table below highlights key shifts in the compound annual growth rate (CAGR) over six-month intervals for the base year (2023) and the current year (2024), providing insights into revenue realization trends.

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 1.4 |

| H2 Growth Rate (%) | 1.7 |

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 1.2 |

| H2 Growth Rate (%) | 2.0 |

The market has demonstrated steady growth, with an decline of 19 basis points in H1 2025 compared to H1 2024. H2 2025 is projected to grow by 24 basis points, driven by increasing adoption of recombinant protein A resins and innovations in bioseparation technologies. Rising investments in next-generation chromatography systems and automation in downstream processing are further fueling market expansion. The integration of AI-driven analytics for resin performance optimization is also enhancing process efficiency.

H1 signifies period from January to June, H2 Signifies period from July to December

Additionally, growing collaborations between biotech firms and academic institutions are leading to advancements in protein purification methodologies, further strengthening the market outlook for protein A resins.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Product Expansion: Pfizer, which is a Leading biopharmaceutical, firm, launches high-capacity recombinant protein A resin. |

| 2024 | Product Approval: JSR Life Sciences introduced Amsphere A+ in September 2024, a next-generation Protein A chromatography resin aimed at improving antibody drug purification. |

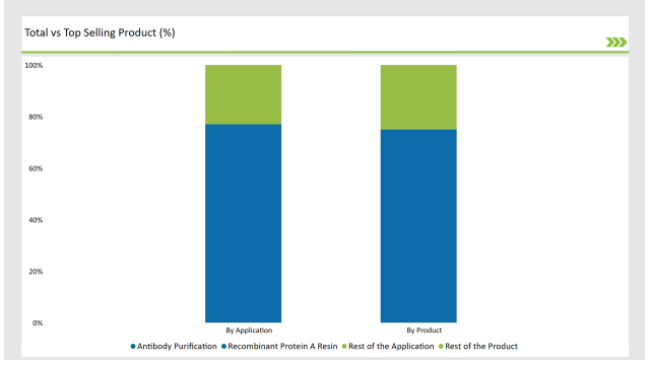

Growing Adoption of Natural and Recombinant Protein A Resins in Japan: While in Japan, due to their highly selective nature of purity in antibodies, natural protein A resins continue to have large-scale utilization; however, there is now greater adoption of recombinant protein A resins because these show higher affinity to bind more antigens at relatively stable rates while being significantly economical. Recombinant protein A resins are expected to capture a large share of the Japanese market by 2035, exceeding 50% market share, mainly driven by the development of engineered ligands and increased durability of the resin.

Growing Demand for Agarose-Based and Polymer-Based Matrices in Japan: Agarose-based matrices remain the most favored choice for protein A resins in Japan. They have strong binding properties that can be scaled up. Growth is slow in glass or silica-based matrices. Organic polymer-based matrices are gradually gaining popularity because they are inexpensive, and there is a potential increase in the efficiency of purification in different applications.

Growing Applications in Antibody Purification and Immunoprecipitation in Japan: Protein A resins, the biggest applications of antibody purification, lead Japan's market. High-performance resins have experienced an upsurge due to the emphasis of Japan on the use of monoclonal antibodies in therapeutics. Immobilized protein A is a vital tool in techniques of immunoprecipitation, and applications are rising for both clinical and academic uses since precision medicine emphasizes the necessity for highly selective, efficient purification processes.

Manufacturing Biopharmaceutical Companies Using Resin in Japan: Major end-users of protein A resins among the biopharmaceutical companies in Japan make extensive use in the production and downstream processing of antibodies. Similarly, research laboratories in Japan use these resins for experimental and preclinical research, while academia is instrumental in the advancement of resin development and innovation for use in future applications in biotechnology.

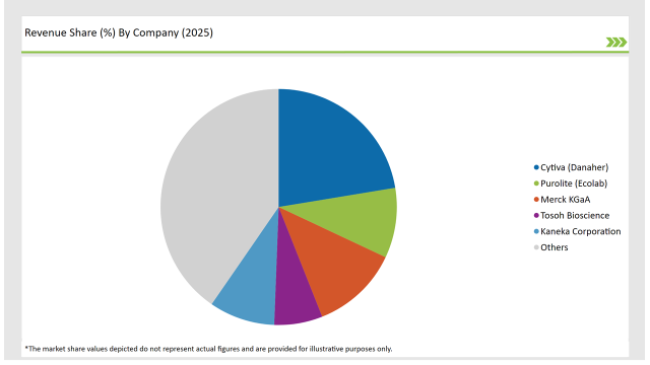

The Japan protein A resins market is moderately consolidated, with key players including Takara Bio Inc., Fujifilm Diosynth Biotechnologies, Tosoh Corporation, and Shimadzu Corporation. These companies are investing in expanding resin production capacity, developing high-performance resins, and forming strategic partnerships to strengthen their market position.

Smaller biotechnology firms and academic research institutions are also entering the market, focusing on developing cost-effective resin alternatives and advancing bioseparation techniques. Increasing government and private sector investments in bioprocessing infrastructure are expected to support market expansion and innovation in protein purification solutions.

By 2025 to 2035 , the Japan Protein A resin market is expected to grow at a CAGR of 1.2%.

By 2035, the sales value of the Japan protein A resin industry is expected to reach is 60.3 million.

Key factors propelling the Japan protein A resin market include growing demand of biopharmaceutical, advancement in precision medicine, regulatory support, aging population, strong research and development investment.

The key players operating in the global electrosurgery generators space include Medtronic Plc, Ackermann Instrument, B. Braun Melsungen AG, Symmetry Surgical Inc. (Aspen Surgical), Chengdu Mechan Electronic Technology Co., Ltd, Miconvey SURGICAL, Telea Electronic Engineering S.r.l., Olympus Corporation, Ethicon US, LLC (Johnson and Johnson Surgical Technologies) and others.

Epidemic Keratoconjunctivitis Treatment Market Overview – Growth, Trends & Forecast 2025 to 2035

Eosinophilia Therapeutics Market Insights – Trends & Forecast 2025 to 2035

Endometrial Ablation Market Analysis - Size, Share & Forecast 2025 to 2035

Endotracheal Tube Market - Growth & Demand Outlook 2025 to 2035

Encephalitis Treatment Market - Growth & Future Trends 2025 to 2035

Edward’s Syndrome Treatment Market – Growth & Future Prospects 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.