Japan’s outbound tourism market is expected to grow rapidly between 2025 and 2035 as disposable income rises, travel restrictions are relaxed and interest in international experiences grows.

A growing middle class combined with favourable exchange rates has spurred Japanese tourists to visit countries in Asia, Europe, and North America. Also, improved technology and seamless travel bookings at digital travel platforms inspire more outbound travellers.

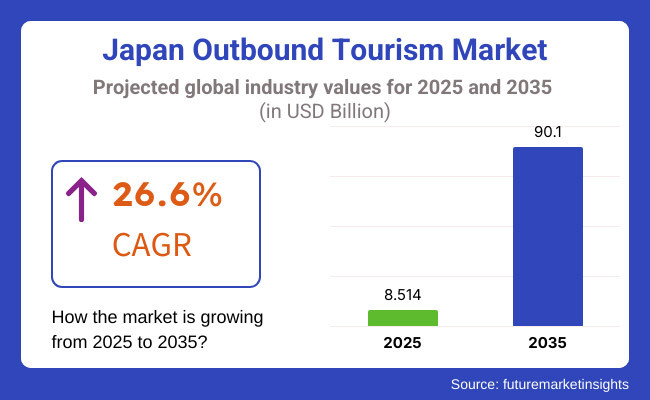

In 2025, outbound tourism from Japan contributed to USD 8.514 Billion and is projected to reach USD 90.1 Billion by the end of 2035, increasing at a CAGR of 26.6%. Trends, such as an increasing preference for cultural tourism, adventure travel, and experiential luxury, are also driving the growth of the market.

Japanese tourists are also embracing sustainable tourism practices and eco-friendly travel options that impact the destination and travel package selected.

Japan is still the destination most favoured by tourists from other Asian countries for its proximity, cultural similarities, and low-cost services. Countries like South Korea, China and Thailand still see a strong influx of Japanese tourists who enjoy historical sites, attractions and food.

Added to this fact, the increase in digital visa applications, as well as direct flight connections, had also strengthened outbound travel from Japan to these countries.

Furthermore, the Asia-Pacific countries have improved their tourism infrastructure, allowing international visitors to move freely with better transportation networks, smart mobile travel applications, as well as language assistance services, making Japanese tourists feel more at ease traveling abroad. Global sporting events and cultural festivals spark even more interest in travel, contributing to an ever-evolving environment for outbound tourism from Japan.

Europe is seeing an influx of Japanese tourists looking for cultural immersion and visits to historical sites. Countries like France, Italy and the UK are particularly popular for their cultural heritage, art and gastronomic specialties.

Seasonal trends, such as visits in Europe during cherry blossom seasons or Christmas markets, add to the surge of outbound tourism to the region. High-end shopping, bespoke travel experience: all are still major attractions for Japanese visitors to Europe.

The introduction of multi-country rail passes, language-friendly travel apps and specific tour guides catering to Japanese tourists have further improved the travel experience. In addition to the rising spectrum of direct flight routes, and promotional pushes by European tourism boards, this growing trend for long-haul travel - especially to Europe - fills the bill for repeat visits.

It remains popular as a destination for theme parks, entertainment, and scenery, and Japan's outbound tourists continue to search for the United States and Canada. Destinations - often big urban centres like New York, Los Angeles and Vancouver - are booked by Japanese tourists with shopping, entertainment and cultural offerings.

On the back of the increased prevalence of digital marketing, along with the rise of travel influencers, outbound travel to North America from Japan is also on the rise. Japanese tourists are increasingly drawn to adventure tourism, national parks and educational exchange programs.

Anime and pop culture-related tourism is booming, with places like Los Angeles and San Francisco becoming Meccas for many young travellers. In addition, travel agencies and airlines are crafting tailored packages to suit various traveller preferences, enhancing accessibility and convenience for Japanese travellers looking for exceptional experiences in North America.

Evolving Travel Preferences and Rising Costs

Challenges in the Japan Outbound Tourism Market: Changing traveller trends, rising travel prices, and fluctuating currency exchange rates. While traditional Japanese tourists seek structured, high-quality experiences based on premium hospitality, the trend is moving towards a younger generation seeking flexible, experience-focused travel.

Meanwhile, outbound travel demand has been affected by increasing airfare and accommodation expenses, as well as the global economic situation. The complexity of visa requirements to some specific destinations and modifications in international travel regulations other contribute to the challenges the market is facing.

These problems need to be overcome by travel companies and tour operators by providing affordable but premium travel experiences, designing customized travel packages and upgrading planning strategies to meet rapidly changing traveller demands.

Growth in Experience-Driven Travel and Cultural Tourism

As the young outdoor enthusiasts seek personalized and immersive experiences, Japan's Outbound Tourism market will face great opportunities. Japanese tourists are looking for authentic cultural experiences, culinary tourism, adventure travel, and seasonal travel choices.

Intending Outbound Tourism Trends: The growth of luxury travel, wellness retreats, and heritage tours Also, language support, tailored experiences, and Japanese-friendly services are growing in popularity among destinations. Travel companies that were focused on personalized travel planning, thematic experiences, and exclusive partnerships with global hospitality brands will propel market growth.

Inbound tourism between Japan from 2020 to 2024 saw a rise in sustainable tourism which continues today, consistent with the trend towards sustainable tourism seen in 2023. Outbound Tourism: Outbound tourism was driven by demand for the best in comfort, guided cultural tours, and unique experiences.

But variable exchange rates, shifting travel policies and changing consumer behaviour created challenges for travellers and tour operators. Companies acted by creating high-end but wallet-friendly travel experiences, growing digital booking services and partnering with local experience providers to provide even more exciting adventures to owners.

In the future, the tourism market (2025 to 2035) will move towards integrating not only sustainable tourism by destination but also providing organic and farm-to-table experiences, personalized travel coordination, and destination partners with Japanese taste preferences.

Japan’s outbound tourism sector will be revolutionised by the rise of tailored travel experiences, easy planning services and food tourism Kurama-type artisan experiences focused on classic tastes of Japan. Moreover, the future is also paving the way with sustainable travel initiatives, heritage-focused tours, and high-end leisure travel.

Outbound tourism market in Japan will be at the forefront of those who invest in specialized experiences, where consumers are engaged and travel itineraries are tailored within the destination.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with international travel regulations and visa policies |

| Tourism Growth | Increase in cultural, luxury, and adventure-based travel |

| Industry Adoption | Growth in structured package tours, guided experiences, and family travel |

| Supply Chain and Sourcing | Dependence on traditional travel agencies and structured itineraries |

| Market Competition | Presence of traditional tour operators and premium travel services |

| Market Growth Drivers | Demand for international experiences, premium hospitality, and cultural exploration |

| Sustainability and Energy Efficiency | Initial focus on eco-conscious travel and green accommodations |

| Integration of Travel Planning | Limited adoption of customized travel planning services |

| Advancements in Travel Experiences | Use of luxury travel, structured tours, and guided excursions |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Streamlined visa procedures, expanded travel agreements, and enhanced Japanese traveller support abroad. |

| Tourism Growth | Expansion into sustainable tourism, wellness retreats, and immersive local experiences. |

| Industry Adoption | Shift toward niche tourism, solo travel, and personalized travel planning. |

| Supply Chain and Sourcing | Rise of specialized travel planning, customized itineraries, and direct-to-consumer travel booking platforms. |

| Market Competition | Growth of experiential travel providers, destination-specific tourism programs, and customized travel agencies. |

| Market Growth Drivers | Increased investment in sustainable tourism, destination partnerships, and tailored culinary travel experiences. |

| Sustainability and Energy Efficiency | Large-scale implementation of carbon-neutral travel, sustainable tourism partnerships, and responsible travel initiatives. |

| Integration of Travel Planning | Expansion of consultation-based travel planning, destination-specific itineraries, and structured theme-based tours. |

| Advancements in Travel Experiences | Development of highly tailored travel experiences, immersive cultural engagement, and theme-based outbound tourism programs cantered around Japanese cuisine and seasonal travel interests. |

The United States continues to be one of the most popular destinations for Japanese outbound travellers, facilitated by its combination of cultural landmarks, shopping districts, and urban attractions. New York, Los Angeles and Honolulu remain popular destinations for affluent Japanese tourists, who spend heavily on shopping, fine dining and entertainment.

Japanese travellers are also gravitating toward outdoor and adventure tourism - national parks, ski resorts, and coastal destinations are proving popular. Business and educational travel are other factors contributing to the steady increase in Japanese travelers to the USA

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 27.2% |

France continues to be a popular destination for Japanese travelers due to its historic and cultural wealth. Paris remains a perennial favourite and is set to attract its world-famous landmarks, renowned museums and high-end shopping districts to spend big Japanese visitors.

There are multiple motives behind Japan’s growing outbound tourism, such as love getaways, art & fashion tourism, and gastronomy tour. Japanese travellers are also finding demand for seasonal trips to regions ranging from Provence to The French Riviera, with more Japanese travellers opting for pastoral landscapes and premium leisure experiences.

| Country | CAGR (2025 to 2035) |

|---|---|

| France | 26.8% |

One of the closest and most popular places in Japan is South Korea, the cultural similarities and developed entertainment that attracts Japanese tourists. Seoul and Busan remain popular among Japanese travelers in search of shopping, K-beauty products and food experiences.

Weekend getaways of the short-haul kind, music and entertainment tourism, and spa and wellness retreats are growing trends in market. Also, historical sites and many traditional experiences, including Hanbok rentals and temple stays, remain attractive offerings for Japanese tourists.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 26.5% |

Some popular traditional travel destinations include London, Paris, New York, Singapore, etc. The UAE, especially Dubai, is increasingly becoming a major luxury travel destination for Japanese travelers. The combination of high-end shopping, luxury hotels and distinctive desert experiences is attracting well-to-do Japanese visitors to the country.

Dubai’s globally renowned sights, from Burj Khalifa to Palm Jumeirah and its many dining and entertainment offerings, propel tourism. Toulon: Stopover tourism is on the rise as well, with Japanese tourists using the UAE as a transit base for long-range journeys to European and African countries.

| Country | CAGR (2025 to 2035) |

|---|---|

| UAE | 26.3% |

Out of Japan, Safari experiences, adventure tourism, and culture and heritage tourism attractions in South Africa are emerging. Japanese travelers, in search of wildlife tours and luxury travel experiences, are expressing more interest in cities like Cape Town and Johannesburg.

More visitors are going to safari lodges, wine tourism and historical sites like Robben Island. Also, Japan and South Africa’s improved air connectivity and diplomatic relationship is likely to facilitate the growth of outbound tourism.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Africa | 25.9% |

The leisure travel and couple tourism segments are the leading part in Japan’s outbound tourism market as people are gradually moving towards getting new cultural experiences and adventure-based trips, and premium romance trips.

Being a source of gaining new international tourism partnerships, increasing the income of airlines and hotels; including and even shaping the new preferences in tourism on the lucrative market, these activities are crucial for travel agencies, airlines, luxury resorts, and intermediaries for digital tourism.

Surpassing business trips in terms of growth, leisure travel has become the great catalyst for Japan’s outbound tourism industry, promising travellers carefully curated holidays and travel routes organised around heritage site explorations, adventure tourism and even gastronomic tours.

In contrast to business trips, where a staff was relatively busy coordinating meetings and meetings, leisure tourism is a personalized, culturally evolved, exploratory and iconic scenic and luxury holiday itinerary, which is the most popular segment of the Japanese multi-diplomatic travel.

The growing desire for destination to specific tourism experiences such as UNESCO World Heritage sites tours, immersive art and history tours, and adventure-based trips are fuelling the market adoption. Leisure travel continues to dominate, with statistics showing that more than 70% of Japanese travellers are on leisure trips when heading overseas, as opposed to business or educational trips, assuring strong demand for this segment.

The growth of niche leisure travel formats characterized by customized tour packages, AI-based travel customization systems and multi-experience travel suites have fortified market demand, making the travel easier to access and engage for a wide range of travellers.

The rise of digital travel planning platforms, with AI-based vacation suggestions, block chain-protected flight reservations, and immersive pre-travel experiences for foreign travel, has catalysed adoption, facilitating smooth outbound travel participation.

Such trends nurture the market growth rooted in the development of luxury-centric leisure travel experiences (high-end resort stays, exclusive culinary tours, private guided adventure packages) that brings optimum investment; notably, this market growth ensures a far-reaching reach in terms of service providers.

Meanwhile, adoption of sustainable leisure tourism initiatives such as green lodgings, carbon-neutral travel experiences, and ethical wildlife tourism concepts, further propelled market development, ensuring better congruence with global responsible tourism practices.

With its economic tourism engagement, cultural tourism diversification, and experience-based travel growth advantages the leisure travel segment also faces challenges like seasonal fluctuations of travel demand, destination-specific visa restrictions, and changing preferences of tourists. Emerging technologies that provide AI-powered travel personalization, block chain-driven tourism security, and interactive mobile travel concierge services will improve efficiency, accessibility, and visitor engagement and will ensure that the availability of market is growing for outbound Japanese leisure tourism across the globe.

The honeymoon / anniversary tourism segment has seen a considerable rise, webbing newlyweds and long-time couples opt for world-class destinations for their milestone celebrations. This segment is looking for exclusive, private and premium experiences unlike traditional leisure tourism and is a valuable market for outbound tourism.

There is increasing demand for romantic getaways, private beachfront villas and immersive couple activities (spa retreats, and fine-dining, private yacht excursions, etc.) - confirming the luxury-driven nature of outbound couple travel. Research shows that over 60% of Japanese couples travelling abroad on honeymoon or anniversary visits choose premium travel, so demand in this segment will remain strong.

This increased accessibility and engagement in the sector have led luxury travel operators to curate customized honeymoon experiences, VIP travel services, and romance-themed packages.

The rise of digital honeymoon planning platforms, with features such as AI-driven travel personalization, real-time luxury resort availability checking, and block chain-operated honeymoon registry plans, has also helped increase adoption, making for smooth travels for couples.

The emergence of initiatives like couples only resorts, private dining, and adventure getaways has enhanced market growth, wherein key luxury and experiential tourism brands have found a stronger penetration in the markets.

While benefiting greatly from strong margins in tourism revenue, an increase in high-end lodging and a trend towards experience-heavy travel habits, the couple tourism sector struggles with pricing spikes in seasonal destinations, travel prohibitions to popular romantic destinations, and an increasingly-expectation customer base regarding unique experiences.

That said, the market potential for Japanese couple travel abroad is getting higher and more accessible with the innovation of AI couple travel personalization, block chain loyalty, and interactive honeymoon experience concierge services in new trends to improve couple efficiency, access, and engagement with visitors.

High-net-worth couples are opting for private couple travel as the private luxury couple travel segment has seen strong market adoption, especially in high-net-worth individuals (HNWIs), upper-echelon business professionals and celebrities as couples increasingly depend on private, exclusive travel services, couple-friendly travel accommodation and bespoke luxury romantic experiences.

Which is a little different from the kind of honeymoon tourism that’s been standardised - this is about out-of-the-way, personalised travel-styles, offering ultra-luxe service-minima, in quiet and hidden locales.

Luxury couple travel experiences have become increasingly popular due to the growing demand for private islands, boutique honeymoon resorts, and tailored travel concierge services for couples that include VIP airport transfers, in-room ambient spa treatments, and fine dining amenities.

Despite that, this specific travel type offers a plethora of constraints like destination availability, high operational costs, and low accessibility for mid-range costs travellers along with high-profit margin tourism services, travel exclusivity and luxury branding.

Nonetheless, new innovations like AI-driven travel concierge platforms, block chain-powered luxury experience validation and membership-based private travel networks boost efficiency and accessibility while attracting higher rates of visitor satisfaction, prompting luxury couple travel to thrive within the outbound tourism ecosystem.

Industry Overview

Japan is seeing a revival of its outbound tourism industry, which was fuelled by rising disposable income, improved connectivity, and a growing interest in diverse travel experiences. Japanese travellers favourite travel location includes Southeast Asia, Europe and North America, with an upsurge interest for cultural tourism, luxury also adventure tourism.

Changes in the sector with digitalization and AI-based travel planning tools now allow for bespoke itineraries, language translation services, and smooth international travel experiences. Therefore, travel agencies, airlines, and online booking platforms are adopting technology to improve both consumer engagement and gain a competitive edge in the market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| JTB Corporation | 20-25% |

| HIS Co., Ltd. | 15-20% |

| Rakuten Travel | 10-15% |

| Expedia Japan | 8-12% |

| ANA X Inc. (All Nippon Airways Travel Services) | 5-9% |

| Other Travel Agencies & Online Platforms (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| JTB Corporation | Comprehensive international travel packages, luxury travel experiences, and corporate travel services. |

| HIS Co., Ltd. | Budget-friendly outbound travel options, customized tours, and extensive global destination partnerships. |

| Rakuten Travel | Digital-first travel booking solutions, exclusive discounts, and AI-powered personalized recommendations. |

| Expedia Japan | Global online travel agency with extensive flight and hotel booking services catering to Japanese tourists. |

| ANA X Inc. | Integrated airline and travel services, premium business travel solutions, and exclusive tour packages. |

Key Company Insights

JTB Corporation (20-25%)

JTB leads the outbound tourism market in Japan by offering premium travel experiences, personalized itinerary planning, and high-end tourism services across multiple destinations worldwide.

HIS Co., Ltd. (15-20%)

HIS caters to cost-conscious travellers, providing affordable travel options, group tours, and value-driven international travel packages.

Rakuten Travel (10-15%)

Rakuten Travel capitalizes on digital innovation, utilizing AI-driven booking features and customer reward programs to enhance the travel experience for Japanese outbound tourists.

Expedia Japan (8-12%)

Expedia Japan remains a key player by offering competitive online booking options, multilingual support, and a vast network of accommodation and flight choices.

ANA X Inc. (5-9%)

ANA X Inc. focuses on integrating travel and airline services, providing exclusive travel packages and business-class international travel solutions tailored for corporate and leisure travellers.

A variety of independent travel agencies, digital platforms, and regional service providers contribute to the outbound tourism sector in Japan. Notable players include:

The overall market size for Trends, Growth, and Opportunity Analysis of Outbound Tourism in Japan was USD 8.514 Billion in 2025.

The Trends, Growth, and Opportunity Analysis of Outbound Tourism in Japan is expected to reach USD 90.1 Billion in 2035.

The demand for outbound tourism in Japan will grow due to increasing disposable income, rising interest in international travel, expanding middle-class population, favourable visa policies, and growing demand for unique cultural experiences, driving greater travel frequency among Japanese tourists.

The top 5 countries which drive the development of Trends, Growth, and Opportunity Analysis of Outbound Tourism in Japan are USA, UK, European Union, and South Korea.

Couple Tourism to command significant share over the assessment period.

Table 01: Capital Investment in by Country (US$ million)

Table 02: Total Tourist Arrivals (million), 2022

Table 03: Total Spending (US$ million) and Forecast (2018 to 2033)

Table 04: Number of Tourists (million) and Forecast (2018 to 2033)

Table 05: Spending per Traveler (US$ million) and Forecast (2018 to 2033)

Figure 01: Total Spending (US$ million) and Forecast (2023 to 2033)

Figure 02: Total Spending Y-o-Y Growth Projections (2018 to 2033)

Figure 03: Number of Tourists (million) and Forecast (2023 to 2033)

Figure 04: Number of Tourists Y-o-Y Growth Projections (2018 to 2033)

Figure 05: Spending per Traveler (US$ million) and Forecast (2023 to 2033)

Figure 06: Spending per Traveler Y-o-Y Growth Projections (2018 to 2033)

Figure 07: Current Market Analysis (% of demand), By Demographics, 2022

Figure 08: Current Market Analysis (% of demand), By Purpose, 2022

Figure 09: Current Market Analysis (% of demand), By Tour, 2022

Figure 10: Current Market Analysis (% of demand), By Type, 2022

Figure 11: Current Market Analysis (% of demand), By Age Group, 2022

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Japan Inkjet Printer Market - Industry Trends & Forecast 2025 to 2035

Japan HVDC Transmission System Market - Industry Trends & Forecast 2025 to 2035

Japan Conference Room Solution Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA