The Japan NFC Reader ICs market is set to reach a market value of USD 2,762.8 million in 2025 and is projected to expand steadily at a CAGR of 13.1%, reaching USD 9,420.2 million by 2035.

| Attributes | Values |

|---|---|

| Estimated Japan Market Size 2025 | USD 2,762.8 million |

| Projected Japan Market Size 2035 | USD 9,420.2 million |

| Value-based CAGR 2025 to 2035 | 13.1% |

The NFC (Near Field Communication) Reader IC Market in Japan is growing substantially with the rising preference for cashless transactions, digital payments, and secure access control systems.

The rising demand for this technology in various sectors is mainly due to the expanding government-led smart city projects and heavy investments in contactless payment infrastructure. NFC payment terminals are widely adopted by merchants since they allow swift and secure contactless payments with a variety of mobile phones and wearables.

The rising penetration of IoT devices and smartphones in Japan is also contributing to the growth of NFC-based authentication and identification systems.

The NFC tech is being used by banks, eCommerce sites, and many other parties to offer the functionality of secure and effortless transactions on mobile banking, contactless card payments, and digital wallets. As same goes with Cybersecurity, NFC based solution are evolving as a key enabler of seamless, highly secure and fraud resistant financial transactions.

Meanwhile, NFC technology is also spreading to the automotive sector, including applications like keyless entry, in-car purchases, and dynamic infotainment systems. Japanese auto makers are nonetheless focusing on connected car ecosystems whose NFC-enabled capabilities are designed to put life at the fingertips of its drivers and passengers.

These innovations contribute to the future development of not only smart mobility but also advanced and connected transport networks across Japan, consistent with global trends in digital transformation.

Explore FMI!

Book a free demo

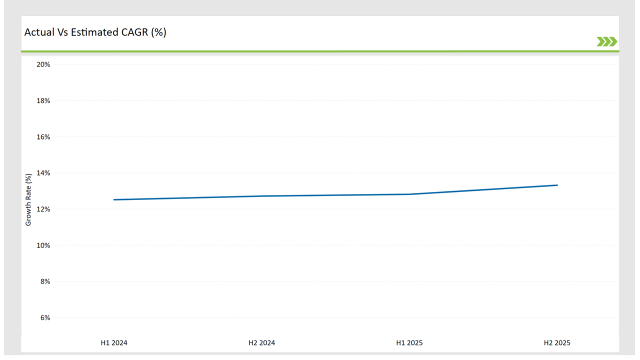

The table below highlights the CAGR trends in six-month intervals, aiding stakeholders in understanding market fluctuations and growth momentum.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 12.5% |

| H2, 2024 | 12.7% |

| H1, 2025 | 12.8% |

| H2, 2025 | 13.3% |

H1 signifies January to June, while July to December analysis is signified through H2.

The consistent increase in CAGR from 12.5% in H1 2024 to 13.3% in H2 2025 reflects growing integration of NFC-based payment systems and the expansion of contactless authentication solutions across industries. Accelerated government initiatives for smart mobility, cashless transactions, and secure access management fuel steady market expansion.

| Date | Development/M&A Activity & Details |

|---|---|

| Jan-25 | Sony launches NFC-based payment solutions for public transport and retail chains. |

| Nov-24 | SoftBank partners with NXP Semiconductors for NFC-enabled mobile wallet services. |

| Sep-24 | Toyota integrates NFC-based keyless entry systems in its latest vehicle models. |

| Jun-24 | Japan Railways introduces NFC-powered ticketing for seamless travel access. |

| Mar-24 | Mitsubishi UFJ Financial Group enhances NFC-based contactless banking solutions. |

The market is witnessing strong collaborations between financial institutions, transport sectors, and technology providers to advance NFC-based authentication, digital transactions, and secure access solutions across Japan.

NFC Transforms Contactless Payments in Japan

The contactless payments using NFC is booming in Japan to become a cashless society. Banks and retailers are rolling out Near Field Communication (NFC) enabled mobile wallets and tap-and-go payments in banking, shopping and hospitality.

Smart Transportation and Public Mobility Adoption

Japan Railways and urban metro services are integrating NFC-enabled smart ticketing, reducing reliance on physical tickets and enhancing commuter convenience.

Healthcare and Secure Authentication Accelerate NFC Adoption

NFC solutions are revolutionizing healthcare access identification and health records management. NFC Medical ID Systems being adopted by hospitals across Japan.

Expansion in Retail and Automotive Sectors

NFC state the terminals to strengthen the customer experience. Nissan & Toyota Expanding NFC Applications in Automotive by Integrating Keyless Entry and Ignition for Connected Cars.

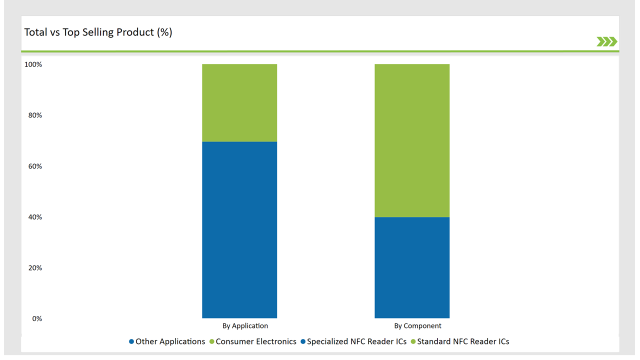

The Japan NFC Reader ICs market is segmented into Standard NFC Reader ICs and Specialized NFC Reader ICs. Standard NFC Reader ICs are the dominant product type, accounting for a large share of the NFC Reader IC market owing to their widespread implementation in segments such as retail, financial services, and transportation systems.

They are extremely reliable in terms of compatibility with various NFC-equipped devices and they are thus the most qualified choice for contactless payment and authentication systems. In the field of healthcare and automotive, the better security and exclusive communication protocols are present for better performance, specialized NFC Reader ICs are gaining traction.

| Component | Market Share (2025) |

|---|---|

| Standard NFC Reader ICs | 60.2% |

| Specialized NFC Reader ICs | 39.8% |

Consumer electronics dominate the segment, driven by increasing smartphone adoption and wearable technology integrating NFC for seamless transactions. Retail applications leverage NFC for contactless POS systems and secure transaction processing, particularly in Japan's digital-first shopping environment.

Automotive applications are expanding, with major car manufacturers implementing NFC for keyless entry and vehicle connectivity. Healthcare sees rapid adoption with NFC-enabled patient ID systems and medical device communication, improving patient security and data accuracy. Public transportation integrates NFC for smart ticketing and seamless commuter experiences.

| Application | Market Share (2025) |

|---|---|

| Consumer Electronics | 30.5% |

| Others | 69.5% |

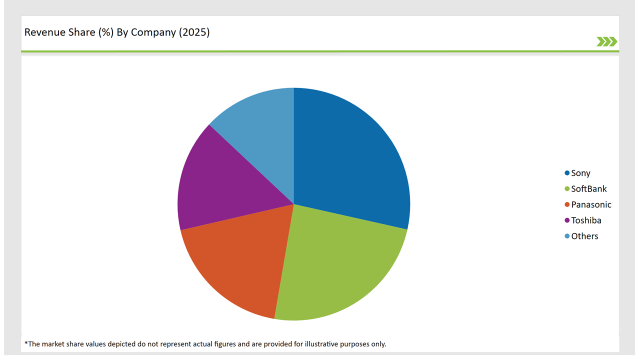

| Vendor | Market Share (2025) |

|---|---|

| Sony | 28.5% |

| SoftBank | 24.2% |

| Panasonic | 18.7% |

| Toshiba | 15.6% |

| Others | 13.0% |

The top three vendors control over 70% of the Japan market, benefiting from strong technology partnerships, financial service expansions, and smart city projects.

The Japan NFC Reader ICs market will grow at a CAGR of 13.1% from 2025 to 2035.

By 2035, the market is expected to reach USD 9,420.2 million.

Prominent players include Sony, SoftBank, Panasonic, and Toshiba.

Standard NFC Reader ICs and Specialized NFC Reader ICs.

Consumer electronics, retail, automotive, healthcare, public transportation, and others.

Low Frequency (LF), High Frequency (HF), and Ultra High Frequency (UHF).

Catenary Infrastructure Inspection Market Insights - Demand & Forecast 2025 to 2035

Category Management Software Market Analysis - Trends & Forecast 2025 to 2035

Residential VoIP Services Market Insights – Trends & Forecast 2025 to 2035

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Safety Mirrors Market - Growth & Forecast 2025 to 2035

Heat Interface Unit Market Analysis - Size, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.