The Japan NFV market is growing rapidly, driven by cloud-based networking, 5G expansion, and demand for scalable infrastructure. With enterprises and service providers adopting NFV to cut costs and boost efficiency, the market is set to reach USD 4,693.2 million by 2025, growing at an 25.2% CAGR to USD 44,413.1 million by 2035. Growth is fueled by SDN, AI-driven automation, and NFV integration in data centers and enterprises.

Market Attributes and Growth Projections

| Attributes | Values (USD Million) |

|---|---|

| Estimated Japan Market Size in 2025 | USD 4,693.2 million |

| Projected Japan Market Size in 2035 | USD 44,413.1 million |

| Value-based CAGR from 2025 to 2035 | 25.2% |

Explore FMI!

Book a free demo

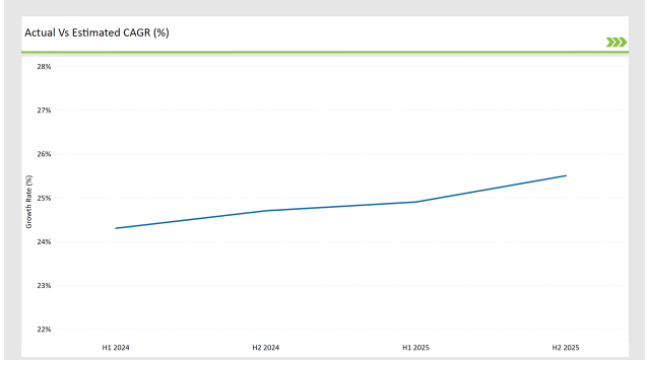

The table below outlines the semi-annual growth rate of the market, offering insights into industry trends.

| Particular | Value of CAGR |

|---|---|

| H1 2024 | 24.3% (2024 to 2034) |

| H2 2024 | 24.7% (2024 to 2034) |

| H1 2025 | 24.9% (2025 to 2035) |

| H2 2025 | 25.5% (2025 to 2035) |

Japan's NFV market is steadily developing driven by a growing investment in virtualization technologies. In comparison, 5G and cloud-native solutions drove the market upward by 40 BPS - H1 2024 (24.3%) to H2 2024 (24.7%). Investment momentum continued into H1 2025 (24.9%) and H2 2025 (25.5%), driven by AI-enabled network automation and SDN integration.

| Date | Development / M&A Activity & Details |

|---|---|

| Jan-25 | NEC launches AI-powered NFV automation platform for telecom operators. |

| Oct-24 | NTT Communications partners with VMware to accelerate NFV deployment. |

| Mar-24 | SoftBank invests in cloud-based NFV solutions for 5G network expansion. |

| Sep-24 | Fujitsu unveils an open-source NFV orchestration platform for enterprises. |

| Aug-24 | KDDI collaborates with Cisco to enhance NFV security solutions for enterprise networks. |

| Feb-24 | Hitachi is focused on developing AI-integrated NFV analytics platform for real-time network optimization. |

| Dec-23 | Japan Ministry of Internal Affairs and Communications introduced a new NFV regulatory guidelines. |

| Nov-23 | Panasonic introduced a NFV-based SD-WAN solutions for business connectivity. |

Growing Adoption of NFV in 5G Network Infrastructure

Japan has quickly rolled out 5G, which is pushing the move toward NFV by allowing telecom operators to virtualize core network functions, allowing for higher scalability and agility to adapt as well as reduce costs. NFV enables this smooth integration between software defined networking (SDN) and cloud-native architectures, decreasing dependency on traditional hardware.

NFV is emerging as a key enabler in the growing virtualized radio access network (vRAN) and artificial intelligence (AI) automation-based telecom ecosystem, as investments pour into these new systems to more efficiently deliver network capacity and scale to meet the rising tide of data. Telecom leaders like NTT Docomo, SoftBank, and KDDI use NFV for enhanced agility of services, slicing of the networks and for dynamic resource allocation of applications over 5G.

The integration of AI and machine learning is set to revolutionize NFV™-based networks through resource allocation, predictive maintenance, and fault detection automation. AI driven NFV orchestration allows telecom operators and enterprises to dynamically optimize network performance with minimal manual intervention thereby cutting the operational cost across the value chain.

Japan's top tech companies such as NEC and Fujitsu are pouring money into AI-powered NFV automation platforms to accelerate service provisioning and network security. AI-enabled NFV solutions will likely refine real-time management of Telco traffic as the future of 5G and IoT adoption is still some distance away to revolutionize service reliability and low latency, but it is becoming more dynamic and responsive to volatility of demand across the industrial spectrum.

Network functions virtualization (NFV) is combined with cloud and edge computing which is acting as a game changer in network architecturally enabling business and service providers to process data near the end. Fuji Xerox is using NFV-enabled cloud platforms to enhance network agility while reducing infrastructure costs in Japan.

NFV edge computing enables low-latency applications as found in smart cities, autonomous vehicles and industrial automation. Examples of firms investing in NFV-based edge solutions include NTT Communications and Rakuten Mobile, which hope to improve service delivery. Cloud-native NFV is being utilized by enterprises with increased adoption, focusing on managing application workloads, which in turn improve the performance of the network and offer greater flexibility in scaling services.

Japan's enterprises are realizing the benefits of adopting NFV for modernizing network infrastructure, enhancing cybersecurity, and improving operational efficiency. NFV allows companies to implement virtual firewalls, software-defined WAN (SD-WAN), and other network security solutions without requiring physical hardware.

NFV is utilized across industries from finance to healthcare to retail to scale network capabilities while maintaining high quality, enabling cloud applications to be always connected and remote employees to work effectively. Enterprise Network Virtualization (NFV) solutions similar to those offered by Cisco, VMware, and Hitachi, allow companies to alleviate network complications, maximize bandwidth utilization, and enable business continuity. This push is speeding Japan’s adoption of software-defined networking environments.

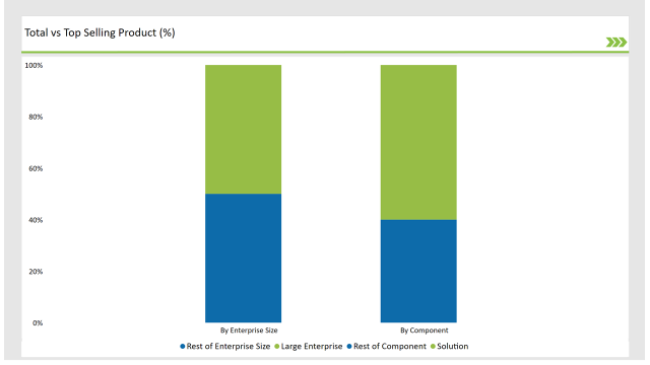

| Component | Market Share (2025) |

| Solution | 60.0% |

| Services | 40.0% |

The software-based virtualization platforms needed for this are contributing to Solutions' 2025 market share of 60.0% in the Japan NFV marketplace. Services (consulting, integration, and managed services) account for 40.0% share, enabling enterprises and service providers to smoothly deploy NFV.

| Enterprise Size | Market Share (2025) |

| Large Enterprise | 50.0% |

| Others | 50.0% |

The NFV market is dominated by large enterprises with a 50.0% share as they invest heavily in network virtualization to achieve scalability and efficiency. The rest (Medium & small enterprises) accounts for 50.0% which is majorly driven by rising adoption of cloud and affordable NFV solutions.

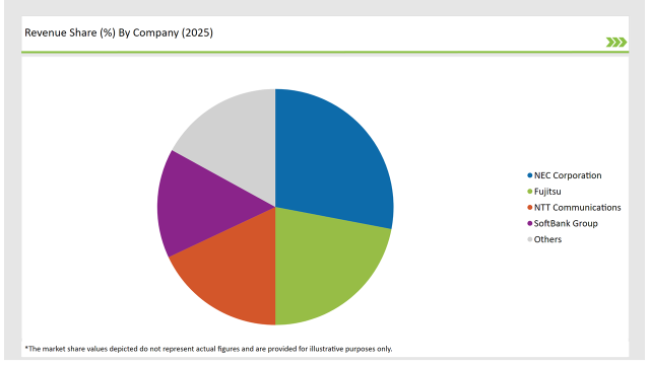

The Japan NFV market is moderately competitive, with major players focusing on technological innovations and strategic collaborations.

| Vendors | Market Share (2025) |

|---|---|

| NEC Corporation | 28.0% |

| Fujitsu | 22.0% |

| NTT Communications | 18.0% |

| SoftBank Group | 15.0% |

| Others | 17.0% |

Nippon Electric Company Corporation and Fujitsu lead the NFV market in Japan with next-gen AI-driven networking and a stable NFV portfolio. Japanese telecommunication giants Nippon Telegraph and Telephone Communications and SoftBank Group are rapidly building up NFV capabilities of their own through aggressive partnerships and cloud-native innovations. And, by embracing NFV technologies, companies like Panasonic, Toshiba and Rakuten Mobile are both further igniting the competitive scene and speeding up the adoption and innovation across Japan’s telco space.

The market will grow at a CAGR of 25.2% from 2025 to 2035.

The market is expected to reach USD 44,413.1 million by 2035.

Key players include NEC Corporation, Fujitsu, NTT Communications, and SoftBank Group.

Services hold a 40.0% share in the market in 2025.

Service providers lead the market with a 55.0% share in 2025.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.