The sales of high tibial osteotomy (HTO) plates in Japan is projected to grow from USD 21.1 million in 2025 to USD 41.2 million by 2035, exhibiting an 6.9% CAGR throughout the period.

| Attributes | Values |

|---|---|

| Estimated Japan Industry Size (2025) | USD 21.1 million |

| Projected Japan Value (2035) | USD 41.2 million |

| Value-based CAGR (2025 to 2035) | 6.9% |

In the Japan-based HTO plates market, one witnesses an emerging expansion of it that is prompted by an ever-growing population along with a steady growth in patients experiencing disorders concerning their knee joints like osteoarthritis.

Facilitating and influencing this wider diffusion of the procedures in healthcare services, no less than elsewhere around the globe, is an even more mature, world class system of Japan's. An increasing number of orthopedic specialists are shifting to minimally invasive surgeries like HTO, which offer the patient a faster recovery and the preservation of knee function.

The country has an aging population, and a significant proportion of its elderly population is plagued by knee problems, thereby increasingly seeking delay of knee replacement surgeries, hence increasing demand for joint-preserving alternatives such as HTO.

Several major companies are significantly contributing to this market. Johnson & Johnson offers a wide range of HTO implants with a focus on ensuring patient safety and faster recovery. Arthrex is gaining traction by focusing on innovative surgical techniques and high-quality implants.

Newclip Technics has carved out a niche in Japan with its state-of-the-art implant technology, emphasizing precision in orthopedic solutions. These companies are using Japan's strong healthcare infrastructure to expand their reach in both urban and rural areas, enhancing their market presence.

Explore FMI!

Book a free demo

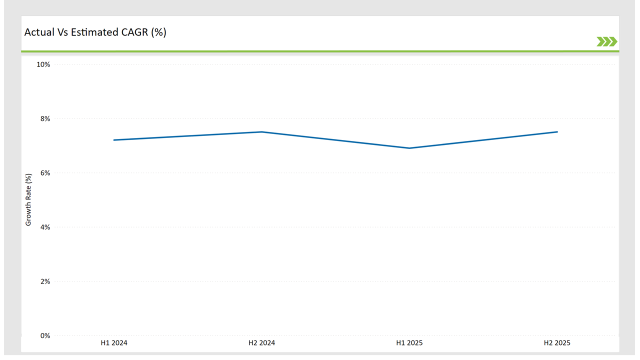

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the Japan high tibial osteotomy (HTO) plates market.

This semiannual analysis highlights all the critical shifts of market dynamics as well as details the revenue realization pattern, thus more precisely providing to the stakeholder’s insight into the trajectory of growth within a year. In other words, H1 contains January to June, and the other half H2 contains July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

High tibial osteotomy (HTO) plates market of the Japan is expected to grow at 7.2% CAGR for the first half of 2023, followed by an upgradation to 7.5% in the same year's second half.

For 2024, the growth is forecasted to go a little down and reach 6.9% in H1 and is expected to rise to 7.5% in H2. This pattern presents a decline of -27.0 basis points in the first half of 2023 through to the first half of 2024, whereas it is higher in the second half of 2024 by 6.0 basis points compared with the second half of 2023.

These figures are for a dynamic and fast-changing high tibial osteotomy (HTO) plates market of the Japan, which is primarily affected by regulations, consumer trends, and improvements in high tibial osteotomy (HTO) plates. This semestral breakup becomes important for businesses as they plan their strategies, keeping in consideration these growth trends and going through the market complexities.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Technology Advancements: Johnson & Johnson places emphasis on gaining access to advancements in Japanese technologies in healthcare systems to improve their HTO implant effectiveness. Therefore, the corporation collaborates with top-ranked Japanese hospitals and experts in orthopedics to establish awareness of the joint preservation methods. The research and development to improve surgical techniques and speed the recovery process addresses the needs peculiar to the region. |

| 2024 | Training Programs: Arthrex goes for the high demand for precision and innovation in Japan for orthopedic procedures. The company stresses that only top-tier training for surgeons, especially in minimally invasive techniques, should ensure its products will be used optimally. Through localized solutions by the latest advancements in orthopedic technology, Arthrex is focusing on strengthening its presence in a major metropolitan area like Tokyo where demand is particularly high in advanced orthopedic treatments. |

| 2024 | Collaboration: Newclip Technics provides specifically tailored solutions and high-tech surgical equipment for the unique demands of surgery surgeons and patients in Japan. The growth strategy in Japan for the company is through collaboration with the hospitals on new techniques in surgery and ensuring that its implants are produced with the strict requirements of the Japanese healthcare system. Newclip Technics also puts great emphasis on the delivery of personalized customer service for trust building and increasing sales in the country. |

The strong demand for minimally invasive surgical techniques.

Traditionally, the Japanese have followed the most state-of-the-art technologies, specifically in the area of healthcare. Minimally invasive surgeries are gaining popularity by the day; HTO falls under this bracket as patients quickly recover and endure less post-surgical pain.

Surgeons have been adopting state-of-the art techniques to try and save knee joints, of course, consequently, there was a growing market for HTO plates. In short, this has been technology innovation along with the demand to have lesser invasive procedures.

Sophisticated Healthcare Infrastructure and Emphasis on Preventive Care

The Japanese health care system is one of the most developed systems in the world, and it has top-notch medical facilities and orthopedic surgeons. With the culture of preventive care in the country, High Tibial Osteotomy is highly attractive to at-risk patients suffering from knee degeneration.

The governmental focus on offering various joint-preserving alternatives, in addition to government encouragement towards new medical technologies, is driving the HTO plates' adoption throughout the country.

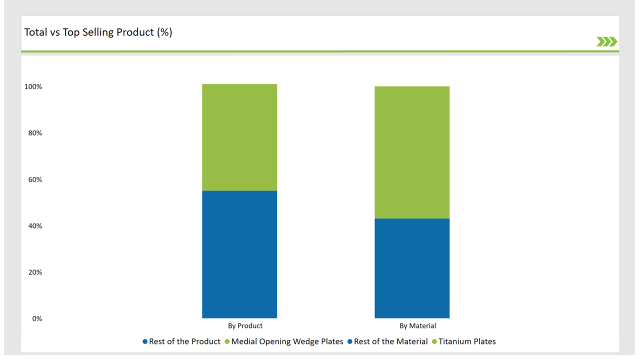

% share of Individual categories by Product Type and Material in 2025

Medial Opening Wedge Plates records significant surge in Japan High Tibial Osteotomy (HTO) Plates, By Product

The medial opening wedge plates have dominated the Japanese market due to their ability to accurately realign the knee joint, especially for valuation deformities that are very common among patients suffering from knee osteoarthritis.

This technique allows a more accurate correction of the tibial alignment particularly benefiting patients coming from Japan, as they are mostly younger, active, and looking forward to delaying total knee replacements.

The procedure is less invasive, hence promoting speedier recovery with lesser postoperative pain, which aligns with the Japanese preference for efficient and low-risk treatment. Furthermore, the healthcare system of Japan emphasizes prevention and preservation, and hence Medial Opening Wedge Plates have found a significant market share.

Titanium plates are the most prominent in Japan today because of its excellent biocompatibility and low weight, ideal for long-term implantation. The strength combined with corrosion resistance of titanium plates ensures durability, thus reducing complications in the long run, especially in a country like Japan that is aging rapidly.

The Japanese healthcare system is also focused on providing patients with high-quality, reliable solutions, which is in line with the demand for premium materials. The demand for long-lasting, reliable implants has positioned titanium as the material of choice in the HTO plates market, further boosting its dominance in Japan.

Note: above chart is indicative in nature

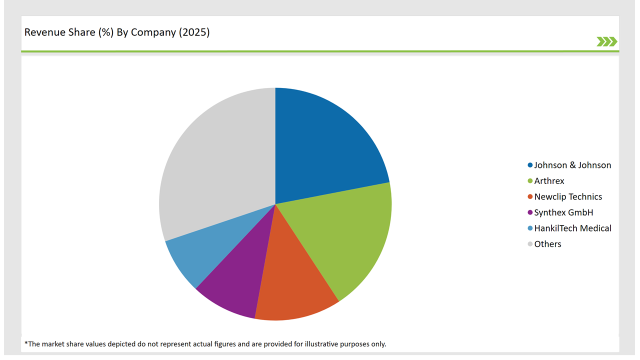

Concentration in the Japan market for High Tibial Osteotomy plates is moderate because there are fewer global players which hold a sizeable share but with intense rivalry from regional and local companies.

The healthcare systems of Japan attract the big manufacturers of orthopedic implants that include Johnson & Johnson, Arthrex, Newclip Technics, among many others. With recognized brands and leading-edge surgical capabilities, these businesses are able to establish themselves at the top rung of this market.

In addition to such well-established players, there will be space for specialized local players to grow because of the varied needs of the Japanese surgeons and patients.

Players like Jeil Medical Corporation, which have benefited from local know-how and innovation, have achieved success by being able to present products that serve the unique requirements of the Japanese market, for example, the localized surgical technique and high-quality, cost-effective implants.

Additionally, strong emphasis from the Japanese sector on minimally invasive surgeries as well as treatment methods that address patient needs urges the companies into innovation. High levels of competition persist, along with price where a few tiny players try and offer cheaper drugs in comparison while ensuring the price remains low rather than compromising over quality.

Strict standards set out by Japan pharmaceutical as well as the medical apparatus regulatory authorities see that the companies stay within guidelines of competition allowing growth in market steadiness.

By 2025, the Japan high tibial osteotomy (HTO) plates market is expected to grow at a CAGR of 6.9%.

By 2035, the sales value of the Japan high tibial osteotomy (HTO) plates industry is expected to reach is USD 41.2 million.

Key factors propelling the Japan high tibial osteotomy (HTO) plates market include the strong demand for minimally invasive surgical techniques and sophisticated healthcare infrastructure and emphasis on preventive care.

The key players operating in the global high tibial osteotomy plates market include Johnson & Johnson, Synthex GmbH, Newclip Technics, Arthrex, Intrauma S.p.a., aap Implantate, Aplus Biotechnology, Astrolabe, Changzhou Zener Medtec, Corentec, DTM - Deva Tibbi Malzemeler, Groupe Lépine, HankilTech Medical, I.T.S., Intercus, Jeil Medical Corporation and Others.

In terms of product, the industry is divided into- Medial Opening Wedge Plates, Lateral Closing Wedge Plates, Biplanar Osteotomy Plates, Locking Compression Plates (LCPs), Contoured Plates and Spacer Plates.

In terms of material, the industry is segregated into- medial opening wedge plates, lateral closing wedge plates, biplanar osteotomy plates, locking compression plates (LCPs), contoured plates and spacer plates.

In terms of indication, the industry is segregated into- Knee Osteoarthritis, Knee Valgus/Varus Deformities, Sports Injuries and Trauma and Other Indications.

In terms of end user, the industry is segregated into- Hospitals, Ambulatory Surgical Centers and Independent Orthopedic Centers.

In Vitro Diagnostics Market Insights - Trends & Forecast 2025 to 2035

Stable Angina Management Market Analysis by Drug Class, Distribution Channel, and Region: Forecast for 2025 to 2035

Pet DNA Testing Market Analysis by Animal Type, Sample Type, Test Type, End User and Region: Forecast for 2025 to 2035

Panuveitis Treatment Market Analysis & Forecast by Drug Class, Route of Administration, Distribution Channel, and Region Through 2035

Phenylketonuria Therapeutics Market Analysis & Forecast by Drug Type, Route of Administration, Distribution Channel, and Region Through 2035

Dental Practice Management Software Market Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.