The Japan connected TVs market is anticipated to reach USD 2,202.4 million by 2025, and it will register steady growth at a CAGR of 10.0% rising up to USD 5,712.5 million by 2035. Market growth is driven by increasing penetration of smart homes, High speed internet availability and the Demand for seamless content streaming.

| Attributes | Values |

|---|---|

| Estimated Japan Industry Size 2025 | USD 2,202.4 million |

| Projected Japan Industry Size 2035 | USD 5,712.5 million |

| Value-based CAGR from 2025 to 2035 | 10.0% |

Demand for smart TVs and connected streaming devices is ramping up in Japan through the proliferation of streaming platforms and on-demand content services. Additionally, growing consumer inclination toward OLED and QLED displays owing to enhanced display quality will also lead to market expansion. Additionally, content recommendation and voice-assistant capabilities powered by artificial intelligence contributes to improving user experience and accelerating the growth of connected TV devices.

The shift to 5G networks will also improve streaming performance, enabling ultra-HD and even 8K video content. Rapid advancements in display technology, coupled with the demand for high-quality displays is augmenting the industry growth. In addition, the market growth is driven by corporate adoption of the connected TVs for digital signage, remote conferencing, and hospitality solutions.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

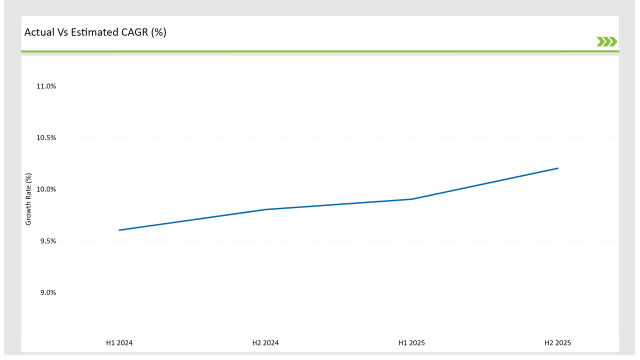

The following table provides a comparative CAGR analysis of the Japan connected TVs market over six-month intervals, offering insights into growth trends:

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 9.6% |

| H2, 2024 | 9.8% |

| H1, 2025 | 9.9% |

| H2, 2025 | 10.2% |

H1 signifies January to June, while H2 signifies July to December.

| Date | Development/M&A Activity & Details |

|---|---|

| Jan-2025 | Sony launches new OLED smart TV lineup with AI-driven image processing and voice-controlled navigation. |

| Oct-2024 | Panasonic partners with Amazon Prime Video to enhance streaming features on its smart TVs. |

| Mar-2024 | Toshiba unveils its latest QLED range with enhanced gaming support and 120Hz refresh rates. |

| Sep-2024 | Sharp partnered with Google to develop Android TV-based smart displays. |

| Dec-2023 | Japan Ministry of Internal Affairs and Communications introduced incentives for smart home device manufacturers help for encouraging smart TV penetration. |

5G & Wi-Fi 6 Revolutionizing Streaming

The unlocking of 5G and Wi-Fi 6 on networks throughout Japan enhances video clarity and reduces latency for a better streaming experience. These improvements allow for smooth, buffer-free streaming of ultra-high definition (UHD) and 8K content, a major selling point for the modern TV watcher who expects quality entertainment, no matter the price tag.

Without as much competition for bandwidth on the internet, streaming services are able to relay data-heavy programming like 4K content more efficiently, making the overall viewing experience better.

With these advancements, major streaming platforms such as Netflix Japan, Hulu Japan, and Amazon Prime Video are taking advantage by adding more on-demand content to their catalogs and enhancing video streaming for higher resolutions. These providers now offer greater 4K- and 8K-ready content in response to the increasing adoption of high-end viewing experiences at home.

Consequently, the growth of premium streaming content is fueling greater uptake of smart TVs since users are looking for devices that can make the most out of these network upgrades. Users will experience smooth streaming, even in the case of households that have multiple connected devices simultaneously accessing high-bandwidth applications, due to quicker and more steady connections.

Cloud Gaming & Smart TVs Integration

The continuing convergence of cloud gaming services with smart TVs is boosting consumer interest in large-screen entertainment experiences even further. Cloud gaming platforms like Sony’s PlayStation Now and Google Stadia enable users to access and play high-caliber games without the need for dedicated gaming consoles or hardware with high performance specifications.

Instead, the processing power is handled by cloud servers, which stream gameplay directly to smart TVs via the internet.

The emergence of 5G technology is making cloud gaming more mainstream, providing an uninterrupted and high-quality gaming experience that can match even console-based gaming. For gamers who want the kind of portability and convenience that a laptop can provide, while not sacrificing performance between a desktop and a laptop, this trend is especially exciting.

Playing gaming titles on smart TVs with little latency and no need for local storage is attractive to both casual and hardcore gamers. The growth of cloud gaming adoption has catalyzed smart TV manufacturers to introduce and build features such as optimized hardware and upgraded software to enable smoother gameplay experiences, and this has further propelled the demand for high-performance television displays.

Growth in AI-powered Smart TVs

With the evolution of artificial intelligence technologies, the demand for AI smart TVs is on the rise, as manufacturers work to ingratiate their devices with smart jobs for increasing user engagement and content consumption. These TVs use AI-powered algorithms that analyze viewing habits, learn user preferences, and provide tailored content recommendations.

By learning about viewing preferences, AI-enabled smart TVs personalize the entertainment experience, making sure consumers can easily find new programs, movies, and streaming services that align with their interests.

In addition to content recommendations, AI integration also enhances voice control capabilities, allowing users to navigate menus, control playback, and adjust settings using voice commands. Smart assistants like Google Assistant, Amazon Alexa, and TV brands' proprietary AI systems (HTC, LG, and Samsung) enhance accessibility; making interactions feel more natural and straightforward.

Furthermore, AI-enabled smart TVs are also being integrated more and more into home automation ecosystems, enabling users to control smart home devices - like lighting and security systems - from the TV interface itself. These innovations position AI-powered smart TVs as a hub for entertainment and home management, driving consumer demand even further.

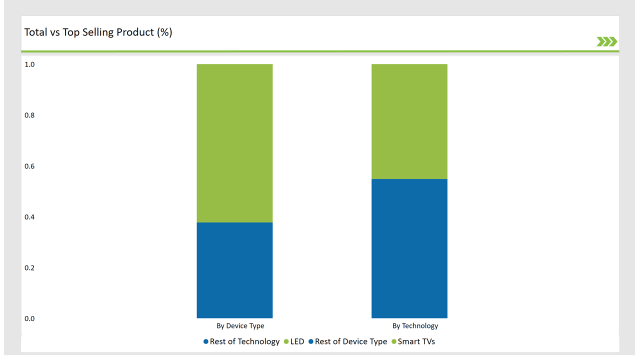

| Device Type | Market Share (2025) |

|---|---|

| Smart TVs | 62.3% |

| Others | 37.7% |

Smart TVs are dominating due to their built-in internet connectivity and access to streaming applications. Streaming devices, such as Roku, Chromecast and Apple TV hold a substantial market share as they help to extend the capabilities of non-smart televisions.

| Technology | Market Share (2025) |

|---|---|

| LED | 45.2% |

| Others | 54.8% |

LED technology are dominating the market due to affordability and widespread availability. However, OLED and QLED adoption are growing rapidly due to enhanced colour accuracy and deeper blacks, appealing to premium users.

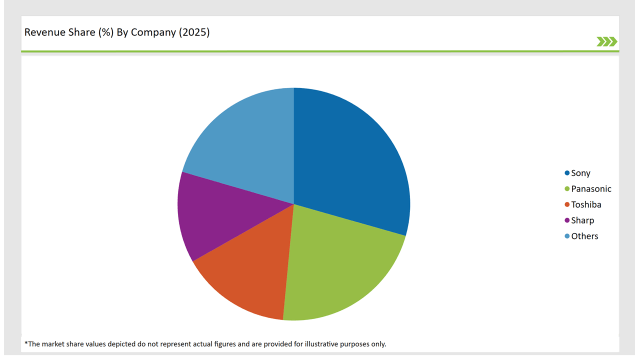

The Japan connected TVs market is highly competitive, with major players investing in R&D, strategic alliances, and cutting-edge technologies. Japanese electronic giants continue to lead the market with innovations in display technology and AI-driven smart TV features.

| Vendors | Market Share (2025) |

|---|---|

| Sony | 29.4% |

| Panasonic | 22.1% |

| Toshiba | 15.3% |

| Sharp | 12.7% |

| Others | 20.5% |

Smart TVs, Streaming Devices, and Others. Smart TVs lead due to built-in streaming services.

LED, LCD, OLED, and QLED. OLED and QLED adoption is rising, especially among premium consumers.

Residential and Commercial. Residential dominates, while the commercial sector is expanding in hotels, corporate offices, and digital signage applications.

The market is expected to grow at a CAGR of 10.0% from 2025 to 2035.

The industry is projected to reach USD 5,712.5 million by 2035.

5G deployment, rising demand for high-quality displays, AI-driven features, and cloud gaming adoption.

Tokyo, Osaka, and Kanagawa lead due to urbanization and tech-savvy consumers.

Sony, Panasonic, Toshiba, and Sharp dominate the market.

| Estimated Size, 2025 | USD 16,978.4 million |

| Projected Size, 2035 | USD 60,110.2 million |

| Value-based CAGR (2025 to 2035) | 13.5% CAGR |

Explore Electronics & Components Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.