The Japan biliary tract cancers (BTCs) treatment market will reach USD 53.2 million in 2025 and is expected to grow at a steady year-on-year rate of 8.6% in total value during the forecast period, reaching USD 121.9 million by 2035.

| Attributes | Values |

|---|---|

| Industry Size (2025E) | USD 53.2 million |

| Industry Value (2035F) | USD 121.9 million |

| CAGR (2025 to 2035) | 8.6% |

The biliary tract cancers market in Japan will be dynamic during the coming years and will drive forward due to advancements in the health care infrastructure, awareness levels regarding cancer, and increased demands for novel targeted therapies.

The main drivers of the market are that changing lifestyle has led to a rising geriatric patient who is becoming more cases of BTC. Improved adoption of the precision medicine with targeted therapy as being FGFR inhibitor and the development of the immunotherapy.

Consequently, there was, therefore a stronger demand to have the treatment out and show greater efficacy even within the underranged areas. For the said duration, there would be better chances for patient survival.

Strategic collaborations of leading pharmaceutical companies are further structuring the market. These collaborations are into developing advanced therapies, expanding clinical trials, and ensuring affordability without the compromise of innovation. As precision medicine and targeted therapies gain momentum, the Japan BTC treatment market is more efficient and impactful for the healthcare sector.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

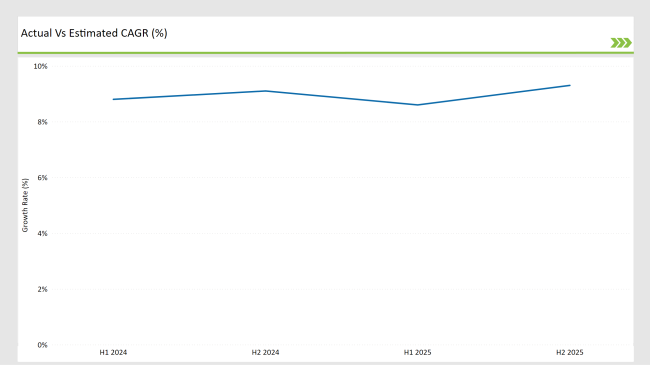

This table presents more explicit comparative assessment for variation in the six months of CAGR for base year, 2023, versus the current year, 2024, which relates exclusively to Japan biliary tract cancers (BTCs) treatment.

A midyearly comparison has identified flux in market trends and the cycle of generating revenue and can serve to further define, on more exact parameters, what has developed over time in a particular space. The first half of the year is from January to June, and the second half is from July to December. H1 refers to the period from January to June, while H2 refers to the period from July to December.

January to June corresponds to the first half of the year, whereas the latter half falls between July to December. In other words, H1 stands for that period from January till June. On the contrary, H2 is the portion that falls within July and up to December.

H1 signifies period from January to June, H2 Signifies period from July to December

For 2024, it is expected to decline to 8.6% for H1 but believed to rise up to 9.3% in H2. The pattern reflects a decline of 16 basis points from the first half of 2023 to the first half of 2024, while in the second half of 2024, it is up by 20 basis points against the second half of 2023.

It's a dynamic as well as swiftly changing Japan BTCs treatment market, mainly induced by regulations and consumer trends or improvements in treatments of biliary tract cancers, especially BTCs. Breaking up in semestris seems to be more important for firms that chart a strategy in an alignment with these trends of growth and broach through waters of complexities.

| Date | Development/M&A Activity & Details |

|---|---|

| August 2024 | Collaboration: Daiichi Sankyo and Merck jointly announced to expand their collaboration to co-develop MK-6070, an investigational T-cell engager targeting delta-like ligand 3 (DLL3), in August 2024. Though not specifically for BTC, this alliance signifies their active involvement in oncology with possible implications on future BTC treatments in Japan. |

| April 2024 | Clinical Study: In April 2024, AstraZeneca reported that it had released updated results of the TOPAZ-1 Phase III trial where it had noted that Imfinzi, durvalumab, with chemotherapy, has dramatically improved survival rates in overall patients with advanced BTC. Implications to treatment guidelines have been seen for Japan. |

| March 2024 | Regulatory Approval-BeiGene Received approval for Tislelizumab in advanced BTC in china in March, 2024, after proving its efficacy results in Phase-III trials in combination with chemotherapy. |

More emphasis on geriatric care and chronic disease management

A rapidly aging population in Japan has resulted in more frequent incidences of biliary tract cancers (BTCs) and other related chronic diseases, including liver cirrhosis and gallstone disease.

The healthcare system of the world's oldest population has set the highest priorities in their focus to develop care for older patients with highly advanced treatment options for BTCs. As the country becomes one of the fastest-aging in the world, this change fuels demand for personal and effective therapy suited to older patients, growing the BTC treatment market.

Government Support for Oncology Research and Drug Approvals

The Japanese government actively supports oncology research through funding and streamlined drug approval processes, encouraging the development and commercialization of innovative BTC treatments.

Policies like expedited approval for orphan drugs and incentives for R&D activities have led to faster market entry for advanced therapies. This supportive regulatory environment is fostering innovation and ensuring the availability of cutting-edge treatments, boosting the growth of Japan's BTC treatment market.

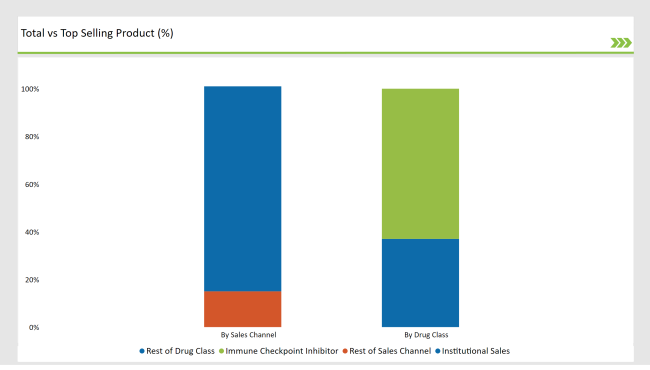

% share of Individual categories by Product Type and End User in 2025

Targeted Therapy records significant surge in Japan Biliary Tract Cancers (BTCs) Treatment by Drug Class

The main targeted therapies such as FGFR and IDH1 inhibitors, have significantly elevated the survival chance and quality of life for the cancer patients affected by biliary tract cancers in Japan. This is because the ground for the adoption of these therapies has come from significant development in genetic profiling and the identification of biomarkers, thus helping in developing a more tailored treatment plan related to each patient's specific genetic mutation.

These therapies have shown hope, especially in advanced-stage BTC, providing better outcomes and fewer side effects. The introduction of targeted therapies in combination with other treatments, for example immunotherapies, has further entrenched them into the realm of clinical practice and has further improved survival rates and overall treatment effectiveness.

In Japan, the BTC treatment market is dominated by institutional sales, and the largest market share is held by hospitals and specialized cancer centers. These institutions are significant providers of advanced care, heavily investing in cutting-edge therapies, diagnostic tools, and technologies.

The healthcare system in Japan emphasizes high-quality cancer care, especially for its aging population, thus leading to a rising demand for innovative treatments. With a high prevalence of BTC risk factors like liver diseases, these institutions will continue to be the central hubs in which state-of-the-art therapies will be delivered, further strengthening their hegemony in the market.

The presence of skilled oncologists and highly advanced healthcare infrastructure ensures that these therapies will be substantially integrated into the treatment regimen, further fueling growth in the BTC treatment market in Japan.

Note: above chart is indicative in nature

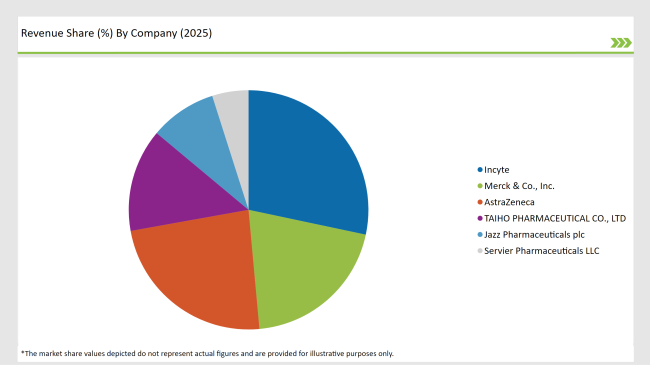

The Japan biliary tract cancers (BTCs) treatment market is moderately fragmented with the presence of both multinational companies and regional players, competing in a dynamic landscape. The leaders are Incyte, Merck & Co., Inc. and AstraZeneca.

who lead the market with their advanced technologies, strong service networks, and robust customer relationships. Regional players are increasingly gaining market shares by providing niche solutions to certain sectors such as emergency response and rural healthcare.

The competitive landscape focuses on innovation and customization. Leaders are investing a lot in R&D to enhance the efficiency, mobility, and environmental sustainability of biliary tract cancers (BTCs) treatment to meet the strict regulatory requirements and evolving consumer demand for safer, faster, and eco-friendly sterilization solutions. Strategic partnerships and acquisitions are also shaping the market.

This will help companies be able to expand their product offerings and also geographical presence. The mix of established multinational corporations and agile regional companies creates a vibrant and competitive environment in the Japan biliary tract cancers (BTCs) treatment market.

The industry includes various type such as targeted therapy (FGFR2 inhibitors, IDH1 inhibitor, HER2-targeted agents) and immune checkpoint inhibitor (pembrolizumab, durvalumab).

In terms of route of administration, the industry is segregated into- oral and intravenous.

In terms of line of therapy, the industry is segregated into- first-line treatment and second-line treatment.

In terms of sales channel, the industry is segregated into- institutional sales and retail sales.

The Japan biliary tract cancers (BTCs) treatment market will grow at 8.6% CAGR by 2035.

By 2035, the sales value of the Japan biliary tract cancers (BTCs) treatment industry is expected to be USD 121.9 million.

Key growth factors for Japan biliary tract cancers (BTCs) treatment markets include increased interest in early diseases detection and prevention, improved surgical and medical procedures.

Prominent players in the Japan biliary tract cancers (BTCs) treatment manufacturing include Incyte, Merck & Co., Inc., AstraZeneca, TAIHO PHARMACEUTICAL CO., LTD, Servier Pharmaceuticals LLC, Jazz Pharmaceuticals plc, Relay Therapeutics, DAIICHI SANKYO COMPANY, LIMITED., BeiGene, Ltd., HUTCHMED and Exelixis, Inc.

Explore Therapy Area Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.