Projected to be worth USD 66.9 million in 2025, the Japan axillary hyperhidrosis treatment market is set to register a CAGR of 7.2%, reaching USD 134.1 million by 2035.

| Attributes | Values |

|---|---|

| Estimated Japan Industry Size in 2025 | USD 66.9 million |

| Projected Japan Value in 2035 | USD 134.1 million |

| Value-based CAGR from 2025 to 2035 | 7.2% |

The Japanese hyperhidrosis treatment market is on an upward growth curve as more individuals come to learn about the disorder and the antidotes. In the past few years, the system of acceptance of treatment has gained recognition, and consumers in Japan are now aware that there are other options apart from the conventional drugs known as antiperspirants. This is why there are positive trends both in clinical treatments and also over-the-counter products.

Amongst the top companies, Allergan plc. (ABBVie) is the biggest player due to their Botox, a leading and most effective treatment in axillary hyperhidrosis. Botox is now an integral part of Japanese aesthetic treatment culture, especially in fast-developing cities like Tokyo and Osaka, which are seeing the patient base swell in dermatological clinics.

On the OTC side, GlaxoSmithKline Plc. has drugs like Drysol, which find great acceptance because of easy availability in retail outlets. The Japanese consumer likes the fact that he can buy treatments over the counter. Self-care is at a premium in society, so buying such products over the counter makes a big difference. CORAD Healthcare was one of the local players that focused on lower-cost topical products, which were more suitable for the sensitivities, preferences, and demand of the Japanese market for mild products.

Another factor that is affecting the country's market is the well-established healthcare system in Japan and increased cooperation of pharmaceutical companies with dermatology professionals to disseminate awareness among patients of the benefits of newer hyperhidrosis treatments, which is further helping in reducing the stigma associated with the condition, hence driving the demand for both clinical as well as OTC products in the country.

Explore FMI!

Book a free demo

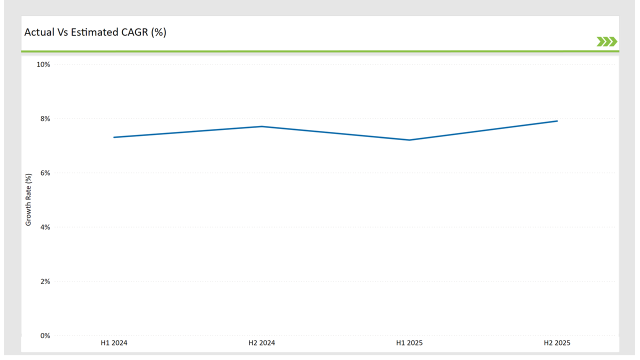

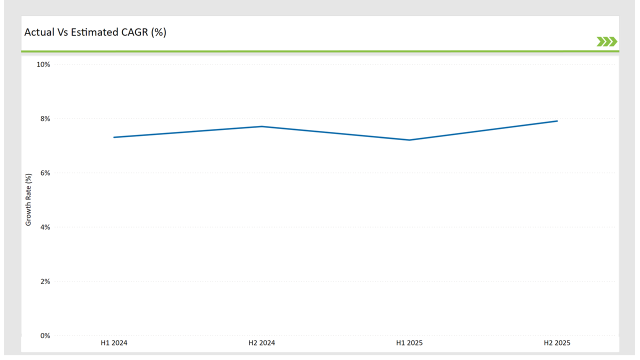

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the Japan axillary hyperhidrosis treatment market.

This semiannual analysis highlights all the critical shifts of market dynamics as well as details the revenue realization pattern, thus more precisely providing to the stakeholder’s insight into the trajectory of growth within a year. In other words, H1 contains January to June, and the other half H2 contains July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

Axillary hyperhidrosis treatment market of the Japan is expected to grow at 7.3% CAGR for the first half of 2023, followed by an upgradation to 7.7% in the same year's second half. For 2024, the growth is forecasted to go a little down and reach 7.2% in H1 and is expected to rise to 7.9% in H2. This pattern presents a decline of -12.0 basis points in the first half of 2023 through to the first half of 2024, whereas it is higher in the second half of 2024 by 21.0 basis points compared with the second half of 2023.

These figures are for a dynamic and fast-changing axillary hyperhidrosis market of the Japan, which is primarily affected by regulations, consumer trends, and improvements in axillary hyperhidrosis treatment. This semestral breakup becomes important for businesses as they plan their strategies, keeping in consideration these growth trends and going through the market complexities.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Collaboration: Allergan wants to increase its penetration in Japan through local collaborations with healthcare providers. It can leverage the platform for Botox in the context of dermatology and cosmetics, strengthen relations with key opinion leaders in Japan's dermatology segment, partner with clinics in raising awareness and knowledge among doctors and patients to boost adoption in the case of clinical treatments in the hyperhidrosis segment. |

| 2024 | Supply Chain Network: The Japanese strategy of GlaxoSmithKline revolves around the country's strong retail pharmacy channels and extending Drysol. GSK would focus on affordable, over-the-counter options while building relationships with retail pharmacies in order to expand its brand and make it more accessible. GSK is also using digital marketing and education to raise awareness, making the products reliable, high-quality solutions for consumers experiencing hyperhidrosis. |

| 2024 | Portfolio Expansion: CORAD Healthcare's growth strategy in Japan focuses on customization of hyperhidrosis products that specifically cater to the local consumer preference. The company is enhancing product formulations to meet Japan's high standards for skin sensitivity and personal care. It is also focusing on expanding distribution through regional retail partnerships and online platforms, capitalizing on the growing demand for accessible and affordable hyperhidrosis treatments. This approach targets both urban and rural populations. |

High Demand for Non-invasive Aesthetic Treatments

Cultural preferences in Japan mostly opt for the non-invasive aesthetic treatments and also personal grooming and appearance can be gaining much attention from the ever-growing base of consumers there. Botox is a common form of prescription drug-based cosmetic medical treatment that should provide effective axillary hyperhidrosis treatment

with minimal downtime. Dermatology clinics in cities like Tokyo and Osaka are now embracing such treatments more and more as they respond to the demand for convenient, effective solutions and push the growth of the market.

Strong Healthcare Infrastructure and Confidence in Contemporary Medication

Healthcare in Japan is well developed; the population, in general, is highly open-minded to new scientific developments in medicines. The society has confidence not only in pharmaceutical products but also in medical doctors, which prompts the acceptance of specialized treatments for hyperhidrosis.

The governmental climate favors the promotion of clinical as well as over-the-counter remedies, thus making the market increasingly grow. Japanese consumers are also very well-informed about health, which increases the likelihood of them looking for treatments for conditions such as excessive sweating, hence the increasing market demand.

% share of Individual categories by Treatment and Distribution Channel in 2025

Drug therapy is the predominant treatment in Japan because of its developed health system and preference for medical solutions with scientific research to back them. The effectiveness of drug therapies, such as Botox and oral medications, has led to wide-scale adoption among people with severe hyperhidrosis. With the reputation of medical professionalism in Japan, patients will trust treatments recommended by dermatologists, which makes drug therapy more prominent. These therapies can be accessed in specialized clinics located within urban territories, thus making the available solutions for hyperhidrosis more accessible to a wider audience.

Retail pharmacy chains in Japan dominate hyperhidrosis treatment distribution as it is accessible and structured. For instance, due to various branches of highly respectable retail pharmacy chains like Matsumoto Kiyoshi, the customer can access over-the-counter treatment such as Perspirex easily. Japan's highly organized retail system ensures that even in smaller towns, people can access treatments without the need for a doctor's visit. In addition, pharmacies often provide valuable consultations, making them a reliable point of contact for consumers seeking affordable solutions for excessive sweating.

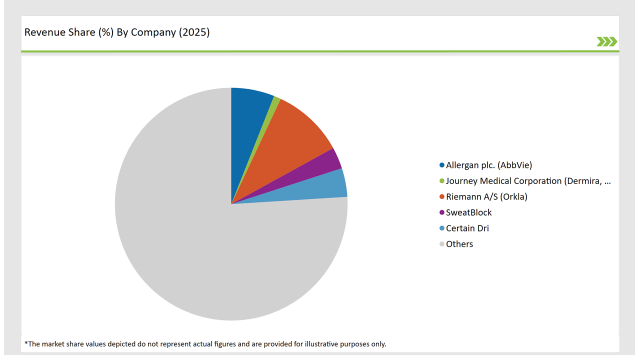

The axillary hyperhidrosis treatment market in Japan is moderately concentrated, with competition from international players and local firms. Allergan plc., or AbbVie, commands a significant portion of the market share with Botox. Botox is well-established in dermatology clinics in major Japanese cities, including Tokyo and Osaka.

It remains a popular treatment as it is less invasive and highly effective for severe hyperhidrosis patients. The strong brand presence of the product and its collaboration with dermatologists are helping to strengthen its market position.

2025 Market share of Japan Axillary Hyperhidrosis Treatment suppliers

Note: above chart is indicative in nature

On the other hand, GlaxoSmithKline Plc. has utilizing the retail pharmacy network for over-the-counter products like Drysol, which set to be moderate competition scenario. The company has built a robust distribution channel, ensuring wide accessibility across urban and rural areas.

Local player CORAD Healthcare, focusing on relatively cheap topical drugs, is targeted to the Japanese love for mild, skin-sensitive formulations. CORAD has capitalized on local expertise to make products specifically targeted at the Japanese market, presenting an accessible product to consumers.

By 2025, the Japan axillary hyperhidrosis treatment market is expected to grow at a CAGR of 7.2%.

By 2035, the sales value of the Japan axillary hyperhidrosis treatment industry is expected to reach Japan is USD 134.1 million.

Key factors propelling the Japan axillary hyperhidrosis treatment market include high demand for non-invasive aesthetic treatments and well established healthcare infrastructure.

Prominent players in the Japan axillary hyperhidrosis treatment manufacturing include Allergan plc. (AbbVie), Journey Medical Corporation (Dermira, Inc.), Riemann A/S (Orkla), SweatBlock, Certain Dri. among others These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

In terms of treatment, the industry is divided into- drug therapy, botulinum toxins, and medicated wipes.

In terms of end user, the industry is segregated into- hospitals, general physician’s clinics, retail pharmacy chains and online sales

Home Respiratory Therapy Market – Growth & Forecast 2025 to 2035

Veterinary Auto-Immune Therapeutics Market Growth - Trends & Forecast 2025 to 2035

Radial Compression Devices Market Growth - Trends & Forecast 2025 to 2035

Digital Telepathology Market is segmented by Application and End User from 2025 to 2035

Suture Anchor Devices Market Is Segmented by Product Type, Material Type, Tying and End User from 2025 to 2035

Home Infusion Therapy Devices Market - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.