The acetaminophen industry will achieve a market value of USD 1,025.2 million by 2025, expanding at 4.6% annually, and is set to hit USD 1,607.4 million by 2035.

| Attributes | Values |

|---|---|

| Estimated Industry Size 2025 | USD 1,025.2 million |

| Projected Value 2035 | USD 1,607.4 million |

| Value-based CAGR from 2025 to 2035 | 4.6% |

Japan is rapidly aging to 30% of its citizens aged over 65, making osteoporosis and fracture-related conditions a national concern in healthcare terms. In contrast to Western markets, Japan puts significant focus on precision treatment using advanced pharmaceutical therapies in concert with robotic-assisted surgical interventions As a matter of fact, under the National Health Insurance program, the treatment of osteoporosis and bone density testing is actively subsidized for the mass majority of the population, leading to early diagnosis.

Japan is leaping on to the advanced infrastructure of medical development and high-technology capabilities here to develop innovation therapies with key global companies such as Johnson & Johnson, leading to the augmentation of its smart orthopedic implants portfolio at DePuy Synthes of Japan, especially in AI post-operative monitoring to grow in keeping with the momentum of the ever-growing digital ecosystem of healthcare there. This is also a trend being seen in Japan's digital health ecosystem.

Newclip Technics is a European firm focusing on customized 3D-printed implants, responding to the skeletal structures of Japanese patients, which are much smaller compared to the models used in Western anatomy. Zimmer Biomet is transforming the market with its robotic-assisted fracture fixation systems, designed to minimize surgical risks in elderly patients. Moreover, domestic players and university-led research initiatives are pioneering bioresorbable materials, a rapidly emerging segment that aligns with Japan's preference for minimally invasive and regenerative treatments

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

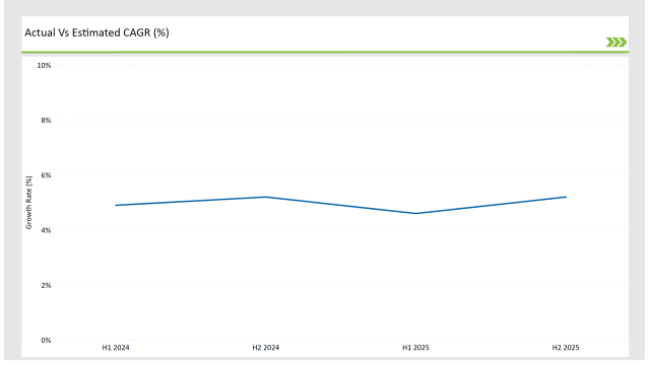

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the Japan acetaminophen market.

This semiannual analysis highlights all the critical shifts of market dynamics as well as details the revenue realization pattern, thus more precisely providing to the stakeholders insight into the trajectory of growth within a year. In other words, H1 contains January to June, and the other half H2 contains July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

Japan market is expected to grow in the Anti-Osteoporosis Fracture Healing sector at a CAGR of 4.9% in H1 of 2023, and by second half, it should be greater than 5.2%. This is expected to decline a bit at 4.6% in H1 of 2024. The same, however, should be up by H2 to 5.2%.

This pattern presents an decline of 28 basis points in the first half of 2023 through to the first half of 2024, whereas it is higher in the second half of 2024 by 5 basis points compared with the second half of 2023.

These figures represent a dynamic and fast-changing Japan acetaminophen market, largely influenced by regulations, consumer trends, and improvements in acetaminophen. This semestral breakup is crucial to businesses that chart their strategies, taking into consideration the growth trends and navigating market complexities.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Expansion: J&J is focusing on AI-assisted post-fracture monitoring and robotic-assisted fracture repair systems in Japan. Given the country’s preference for smart healthcare solutions, J&J has introduced sensor-integrated bone implants that provide real-time healing progress tracking via hospital networks. |

| 2024 | Product Innovation: Newclip Technics is leveraging custom 3D-printed orthopedic implants, specifically designed for Asian bone structures, as Western-sized implants often require modifications for Japanese patients. |

| 2024 | Product Innovation: Zimmer Biomet has expanded its Mako SmartRobotics™ into the Japanese fracture healing market, capitalizing on the country’s high adoption rate of surgical robotics. |

Artificial Intelligence and Robotics in the Treatment of Fractures

Zimmer Biomet and J&J have begun to apply AI-based predictive models for bone healing and robotic precision in fracture fixation. The government is actively funding research into medical robotics, and hospitals focus on automation in complex surgeries, which further increases demand for AI-powered fracture management systems.

Government-Supported Bone Health Programs

The Japanese government requires osteoporosis screening programs for women over 50 to be diagnosed early and to begin treatment as soon as possible. Subsidized bisphosphonates and bone-strengthening therapies under the NHI system have increased the availability of treatment. Public awareness campaigns on preventing fractures through diet and medication have improved adherence rates for osteoporosis treatments.

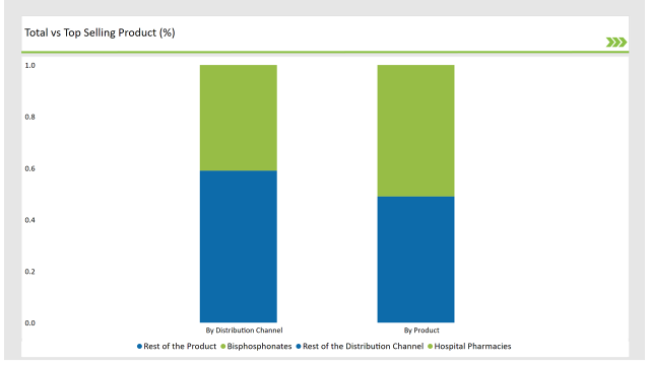

% share of Individual categories by Drug Type and by Distribution Channel in 2025

Bisphosphonates dominate the Japanese market because of their cost-effectiveness, long-term efficacy, and insurance reimbursement policies. Oral bisphosphonates such as alendronate and risedronate are easily available through primary care physicians, while injectable biologics need hospital administration and are more expensive.

Japan has an aging population with a high risk of fracture, and this population prefers bisphosphonates as first-line treatment due to proven benefits in fracture prevention. The government's stringent cost-containment measures also encourage physicians to prescribe oral therapies that are cost-effective compared with expensive alternatives.

Hospital pharmacies continue to be the primary channel for dispensing osteoporosis drugs in Japan because prescriptions for such drugs remain strictly controlled by physicians and available osteoporosis treatment programs within hospitals.

On the contrary to other developed countries, retail and online pharmacy sales are witnessing growth, Japan's regulatory framework necessitates most of the osteoporosis drugs especially injectable biologics to be dispensed through hospital- affiliated pharmacies. Diagnostic facilities, orthopedic specialists, and physiotherapy programs available within the hospitals consolidate their position as the primary entry point for the osteoporosis medications.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

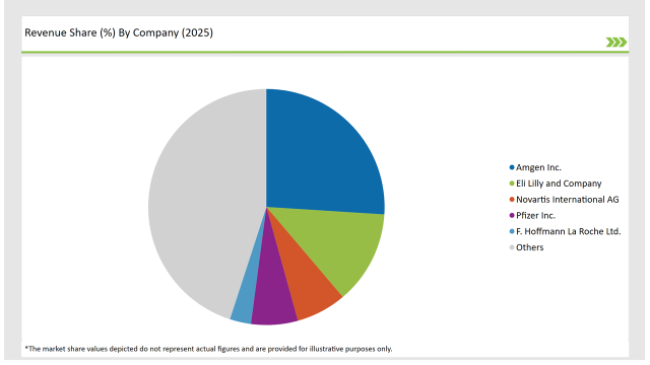

The market for anti-osteoporosis fracture healing in Japan is moderately concentrated, with a mix of multinational corporations and local players competing for market share. Foreign companies such as Johnson & Johnson and Zimmer Biomet dominate the high-tech orthopedic business, offering robotic-assisted fracture fixation and smart implants. Domestic firms are more focused on bioengineered solutions, fitting in with Japan's preference for minimally invasive and resorbable implants.

Competition is shaped by the NHI system, because the reimbursement policies favor cost-effective treatments such as bisphosphonates, whereas innovative biologics and advanced implants require substantial periods for regulatory approvals. Moreover, the distribution of drugs is dominated by hospitals rather than retail pharmacies, which influences yet further how companies should strategize to enter markets.

Japanese research institutions and university hospitals are actively developing tie-ups with global medical technology companies, including R&D collaborations on the application of regenerative bone therapies. Therefore, biotechnology-based solutions for fracture healing are gradually gaining traction, thereby indicating a paradigm shift in next-generation orthopedic innovations in the Japanese market.

2025 Market share of Japan Anti-Osteoporosis Fracture Healing suppliers

Note: above chart is indicative in nature

In terms of drug type, the industry is divided into Bisphosphonates (Osteoporosis and Others), Calcitonin (Osteoporosis and Others), Estrogen or Hormone Replacement Therapy (Osteoporosis and Others), Anabolics (Osteoporosis and Others), others (Osteoporosis and Others)

In terms of route of administration, the industry is segregated into oral and injectable.

In terms of distribution channel, the industry is divided into hospital pharmacies, drug stores, retail pharmacies and E-commerce.

By 2025, the Japan Anti-Osteoporosis Fracture Healing market is expected to grow at a CAGR of 4.6%.

By 2035, the sales value of the Japan acetaminophen industry is expected to reach Japan is 1,607.4 million.

The key drivers fueling the growth of the Japan acetaminophen market include government-supported bone health programs and high demand for bioengineered and resorbable implants.

Prominent players in the Japan acetaminophen manufacturing include Pfizer Inc., Sanofi, Janssen Pharmaceuticals (Johnson & Johnson), Bayer AG, GlaxoSmithKline plc, Teva Pharmaceutical Industries Ltd, Cardinal Health Inc., Novartis AG, Abbott, Sun Pharmaceutical Industries Ltd, Procter & Gamble Company, Amneal Pharmaceuticals among Others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Explore Therapy Area Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.