The Japan aerial imaging market is anticipated to reach over USD 677 million in 2023, at an estimated CAGR of 12.0% during forecast period 2019 to 2023. The market is expected to estimate USD 693.6 million by 2025 and continue from there growing at a rate exceeding 10.8% CAGR to cross USD 2,212.6 million by 2035.

Japan Aerial Imaging Industry Outlook from 2025 to 2035

| Attributes | Values |

|---|---|

| Estimated Japan Market Size in 2025 | USD 693.6 Million |

| Projected Japan Market Size in 2035 | USD 2,212.6 Million |

| Value-based CAGR from 2025 to 2035 | 10.8% |

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

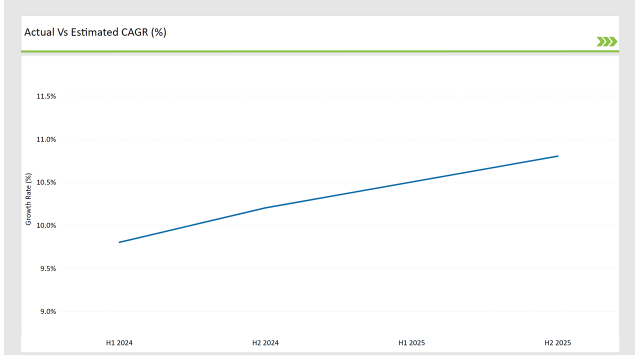

The table below outlines the semi-annual growth rate of the market, offering insights into industry trends.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 9.8% (2024 to 2034) |

| H2 2024 | 10.2% (2024 to 2034) |

| H1 2025 | 10.5% (2025 to 2035) |

| H2 2025 | 10.8% (2025 to 2035) |

Overall, growing confidence in the aerial imaging market in Japan is being reflected in consistently positive market growth. The market grew by 40 BPS between H1 2024 (9.8%) and H2 2024 (10.2%) as AI-powered aerial analytics became increasingly adopted. Growth Momentum sustained in H1 2025 (10.5%) & H2 2025 (10.8%); galvanizing contribution: Investment in Geospatial Intelligence & Smart City Initiatives.

| Date | Development / M&A Activity & Details |

|---|---|

| Jan-25 | Sony expands its drone division to enhance aerial imaging solutions for industrial applications. |

| Oct-24 | Mitsubishi Electric partners with the Japan Aerospace Exploration Agency (JAXA) for satellite-based aerial imaging services. |

| Mar-24 | Terra Drone raises investment funding to scale aerial imaging services for urban planning and infrastructure. |

| Sep-24 | Fujitsu launched AI-powered platform for disaster monitoring and environmental assessment. |

| Dec-23 | Japan Ministry of Land, Infrastructure, Transport and Tourism announced the new guidelines for drone usage. |

Growth of Smart Cities and Infrastructure Mapping

The demand of aerial imaging is driven by Japan's growing investment in infrastructure projects and smart cities. These technologies are applied across multiple domains such as accurate high-resolution aerial photographs and LiDAR technology used for planning of urban structure and traffic management and initiatives for improving disaster resilience. Japan’s cities such as Tokyo and Osaka are using drone-based imaging to carry out better infrastructure planning and monitor construction sites in real-time.

Increasing government-backed projects like the Digital Garden City Initiative provide incentives for aerial imaging to be used in land-use optimization, environmental monitoring, and utility planning, supporting the growth of the market.

Integration of AI and Machine Learning in Aerial Imaging

Automating aerial imaging applications in Japan via AI and machine learning Tools that facilitate automated image processing, object detection, and predictive analytics allow industries to gain insights from aerial data. In agriculture, AI solutions are used for crop health monitoring, risk assessment for insurance, and precision mapping for forestry.

Organizations like NTT Data, Mitsubishi Electric, etc. are also using AI-based aerial imaging for geospatial intelligence and disaster response applications, helping them analyze data faster and more efficiently, removing the dependency on manual labor as well as improving operational efficiency across industries.

Rising Demand for Disaster Management and Risk Assessment

The violent geological activity of earthquakes, typhoons and tsunamis to which Japan is prone has created a demand for aerial imaging technology to help with disaster management. Aerial surveys also help the authorities evaluate damage and plan any rescue operations and allocate resources accordingly.

These aerial images are also utilized in the activities by the Geospatial Information Authority of Japan (GSI) for post-disaster reconstruction and risk reduction measures. Thermal imaging, multispectral sensors, and real-time data transmission are some of the advances driving this demand to improve Japan’s preparedness and emergency response to natural disasters.

Expansion of Precision Agriculture and Forestry Management

The increasing demand for resource optimization and sustainability in agricultural and forestry practices is driving the adoption of aerial imaging in Japan. Application of drones using multispectral and hyperspectral cameras that analysis soil, healthiness and pest detection are emerging solutions.

This trend is being supported by the government’s push for smart farming technologies such as automated drone surveys and AI-driven analytics. In addition to deforestation monitoring, forestry agencies may use aerial imaging for tree density mapping and illegal logging prevention, so aerial imaging has become a critical tool for environmental conservation efforts.

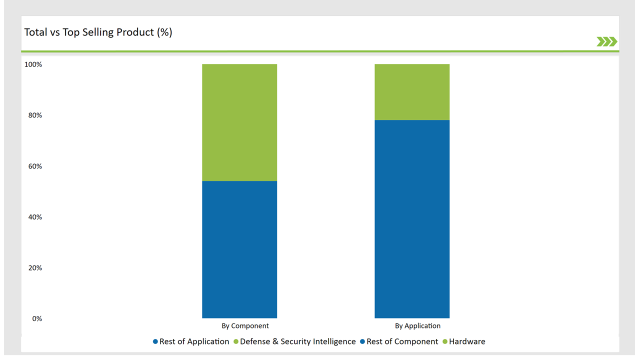

| Component | Market Share (2025) |

|---|---|

| Hardware | 46.0% |

| Others | 54.0% |

Hardware segment accounts for almost half of the aerial imaging market in Japan owing to the increased acceptance of drones, high-resolution camera and advanced sensors. Aerial mapping and monitoring in industries like infrastructure, disaster management, and agriculture also utilize UAVs equipped with thermal, multispectral, and LiDAR sensors. Growing investment in next-generation drones equipped with artificial intelligence-imaging capabilities is also fuelling growth.

| Application | Market Share (2025) |

|---|---|

| Defense & Security Intelligence | 22.00% |

| Others | 78.00% |

Japan’s military and security industry is among the largest users of aerial imaging, utilizing technology such as drones, satellite images and AI-powered surveillance for its border security, disaster response and national security efforts. Ministry of Defense (MoD) invests into the provision of sharper images, geospatial intelligence to battlefield to increases situational awareness and operation. Advanced UAVs with night vision and infrared sensors are deployed for real-time threat detection and maritime security.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

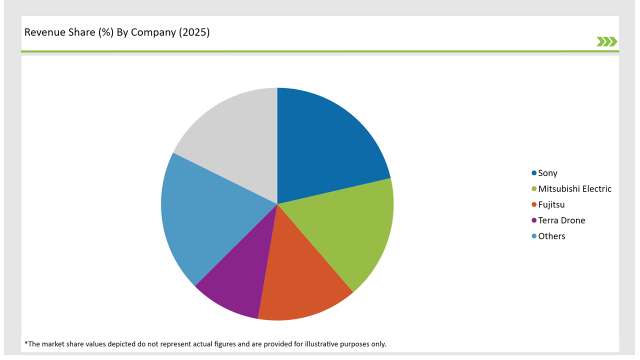

The Japan aerial imaging market is moderately competitive with the major giants are focused on technological advancements and strategic partnerships.

| Vendors | Market Share (2025) |

|---|---|

| Sony | 26.0% |

| Mitsubishi Electric | 21.0% |

| Fujitsu | 17.0% |

| Terra Drone | 12.0% |

| Others | 24.0% |

Hardware, Software, and Services.

Defense & Security Intelligence, Geospatial Mapping, Urban Planning, Disaster Management, Energy & Natural Resources.

Government, Military & Defense, Agriculture & Forestry, Energy & Mining, Media & Entertainment, Construction & Engineering.

The market will grow at a CAGR of 10.8% from 2025 to 2035.

The industry will reach USD 2,212.6 million by 2035.

Key drivers include advancements in drone technology, AI-based aerial analytics, and increasing investments in urban planning.

The Tokyo and Osaka metropolitan areas lead in aerial imaging adoption due to urbanization and infrastructure projects.

The major players include Sony, Mitsubishi Electric, Fujitsu, and Terra Drone.

Explore Digital Transformation Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.