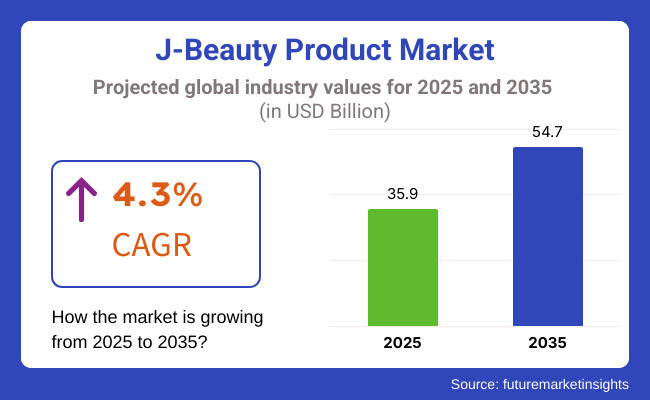

The J-beauty product market is slated to register USD 35.9 billion in 2025. The industry is poised to witness 4.3% CAGR from 2025 to 2035 and witness USD 54.7 billion by 2035.

J-Beauty products are notable for their top-grade raw ingredients, tried-and-true recipes, and commitment to hydration, anti-aging, and sun safety. Brands like Shiseido, SK-II, and Tatcha have set global standards for the design of minimalist beauty routines which focus on feeding the skin rather than temporary fixes. Differently from the multi-step methods that dominate in other beauty sectors, the Japanese skincare technique simplified the process with the basic three steps, i.e., cleansing, moisturizing, and sun protection.

This trend has taken the "skinimalism" movement to another level, as people have started to prefer a smaller number of exclusive products in their skincare rituals. For instance, the high repute of double cleansing-a way of cleaning the skin that uses oil-based and water-based cleansers-started in Japan and is now universal for the achievement of deep yet soft cleanse.

Furthermore, J-Beauty's stress on anti-aging is the one that particularly feeds the market of products for collagen, hyaluronic acid, and antioxidant infusion, dating it to people who want to take preventive measures rather than coping with the problems.

Sustainability is another key trend driving the J-Beauty market. Consumers are opting for eco-friendly and ethically produced beauty products and the Japanese companies have responded by employing eco-friendly packaging, refillable packaging, and biodegradable ingredients. Hada Labo and Muji brands have adopted minimalist designs and ethical manufacturing practices, which appeal to socially responsible consumers. In addition, through the employment of traditional Japanese ingredients, i.e., matcha, seaweed, and sake extracts, it is highlighted the union of science and nature in J-Beauty products.

Explore FMI!

Book a free demo

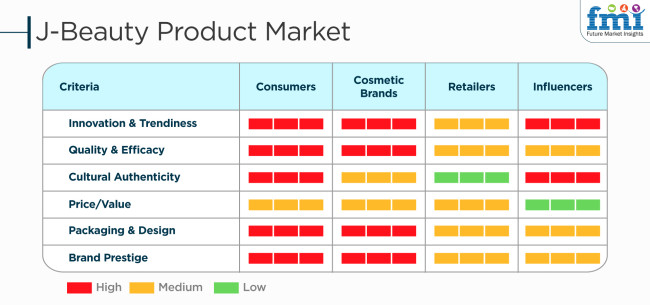

The J-Beauty Product Market is influenced by consumers, cosmetic brands, retailers, and influencers, who all have different priorities in the business. Consumers and cosmetic brands are very concerned with innovation, latest trends, quality, and cultural authenticity, ensuring that products are of high standards and true to their origins. Influencers also give high priority to innovation and brand prestige, as these factors help increase their credibility and interaction with their audience. However, retailers are more concerned with price, value, and sales opportunity than with cultural authenticity and packaging design, mirroring their focus on marketability and profitability.

Although packaging and design are paramount for brands and consumers, influencers care about brand prestige to fit their image and credibility. This market trend points to the importance of J-Beauty brands balancing innovation, authenticity, and price while applying solid branding techniques to attract all stakeholders in order to sustain growth and success in the global beauty market.

Between 2020 and 2024, the J-Beauty product market saw growth driven by minimalist skincare routines, clean beauty trends, and high-tech formulations. Consumers gravitated toward gentle, multi-functional products featuring traditional Japanese ingredients like rice bran, camellia oil, and fermented extracts. Sustainability became a priority as well, with brands introducing refillable packaging and sustainable formulations. E-commerce and social media were instrumental in facilitating international reach as J-Beauty spread its popularity beyond Japan, especially in North America and Europe.

The period between 2025 and 2035 will be marked by innovation and personalization. It will be AI-supported skin diagnosis and biotech formulation that will provide personalized solutions to skin issues. With greater sustainability demands will come an age where beauty products that contain no water will be the standard. Traditional Japanese beauty rituals will gain more appeal as sophisticated technology will prefer J-Beauty. With the rising need for holistic and functional skin care, J-Beauty being a blend of tradition and modern science will have a bright future.

Trend Analysis across Different End User Segments

The J-beauty product market is influenced by consumers, cosmetic brands, retailers, and influencers, who all have different priorities in the business. Consumers and cosmetic brands are very concerned with innovation, latest trends, quality, and cultural authenticity, ensuring that products are of high standards and true to their origins. Influencers also give high priority to innovation and brand prestige, as these factors help increase their credibility and interaction with their audience. However, retailers are more concerned with price, value, and sales opportunity than with cultural authenticity and packaging design, mirroring their focus on marketability and profitability.

Although packaging and design are paramount for brands and consumers, influencers care about brand prestige to fit their image and credibility. This market trend points to the importance of J-Beauty brands balancing innovation, authenticity, and price while applying solid branding techniques to attract all stakeholders in order to sustain growth and success in the global beauty market.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Customers remained centered around traditional J-Beauty fundamentals such as hydration, mild formulations, and anti-aging. Demand for sheet masks, cleansing oils, and essences picked up. | Demand will move towards multi-functional, high-performance skincare with a focus on anti-pollution, probiotic-based, and AI-personalized beauty products. |

| Natural, organic, and green skincare is in ever-growing demand, with brands opting for plant-based formulations and minimal plastic usage in their packaging. | Sustainability will also take the front seat with brands actively seeking to woo green-conscious consumers through biodegradable packaging, water-less products, and carbon-neutral manufacturing. |

| Product formulas focused on traditionalingredients like rice water, camellia oil, and collagen. Skincareroutines were simple but impactful. | The Best in Skincare Tech: Crème de La Crème of AI-Powered Skin Analysis,Personalized Beauty Routines and AI-Powered Innovative Ingredients Will Drive the Future of J-Beauty. |

| Japan was the primary industry, with increasing popularity in NorthAmerica, Europe and parts of Asia next. A major player wasKorean Beauty (K-Beauty). | J-Beauty will likely continueits growth into new markets including Latin America and the Middle East, spurred by global penetration via online retailing channels. |

| Historically, distribution channels have largely depended on offline stores, shops, and beauty retailers. Growth in e-commerce was aided by the pandemic. | Subscription models, direct-to-consumer brands, and social commerce are infusing vigorous growth into this domain. The future of e-commerce looks bright. |

| Celebrity endorsements and other traditional forms of marketing were a major part of bringing J-Beauty product names toward the mainstream. | Gen Z and Millennials will still remain a major trend in engaging through influencer marketing, beauty tech apps, and AI-driven virtual try-ons, all while shopping for their products online first. |

One of the major risks concerning the J-Beauty (Japanese Beauty) product industry is a regulatory compliance issue. Different nations have strict rules governing the use of cosmetic ingredients, product labeling, and the attainment of safety standards. Noncompliance to the regulations in regions such as the EU, US, or GCC may lead to product bans, recalls, or legal cases, which can, in turn, damage the brand's reputation and sales.

Dependable supply chains are another major topic. The majority of J-Beauty items are made using premium goods, such as rice extracts, camellia oil, and fermented botanicals. Scarcity of raw materials owing to climate change, territorial problems, or supplier disputes could lead to higher production costs and delays.

Even though a J-Beauty product is associated with minimalism and natural elements, new trends such as fast-results skin care or electronic advances might change consumer thoughts. For survival, companies have to balance their traditional techniques with the ongoing technological advancements.

Transportation issues, especially in relation to the international expansion which can deconsolidate profits are on the agenda. High shipping rates, import levies, and unilateral complex networks are some of the problems that may raise the prices of the product making it lose its competitiveness. However, partnering with local distributors and the optimization of e-commerce strategies could help in overcoming the same and facilitating industry accessibility.

Pricing mechanisms at the J-Beauty industry should serve as a true mirror of product quality, brand history, and consumer expectations. Since J-Beauty products not only provide protection against skin damage but also assist in getting back to their original state, the pricing must incorporate a balance of affordability versus the perceived value, since both premium and mass market consumers are the targeted market for both skincare brands.

The value-based pricing approach is the principal method, given that the consumers of J-Beauty are those who give the priority to the purity and efficiency of the ingredients, and the preference to the product innovation. Upscale brands can sell their products at higher prices under the argument of using ancient Japanese beauty rituals, advanced formulations, and clinical studies that back up their items. This plan keeps J-Beauty's creative identity from being overridden by mass-market competitors.

Cost-plus pricing is employed to keep stable profit margins by pegging a fixed percentage on the production costs. While this one-step process is simple, it may fail to conform to the community's willingness to pay, anywhere K-Beauty and Western brands provide similar products at competitive prices.

Competitive pricing is pivotal to sustaining industry penetration. The best way to attract price-conscious consumers while still being true to the brand is to set up prices equivalent to those of rival brands. Nevertheless, J-Beauty brands should fully convince the industry of their quality through relevant heritage storytelling and substantial differences from the products of their competitors, besides becoming less driven by prices.

Market entry tricks such as Penetration Pricing have duality when J-Beauty products are entering new territories. Begin with discounts, size options, or package mixing points, which among other perks would attract a stay-to buyer. After forming, the brand can ramp up costs little by little to the necessary level while keeping the trust of the customers.

The J-Beauty movement is driven by skincare, characterized by a minimalist approach to beauty with highly efficacious formulas, many of whichcontain high-grade natural ingredients. Japanese skincare emphasizes anti-aging and skin barrier protection, both of which make it excellentfor all skin types. Available productsinclude oil-based cleansers, hydrating lotions, essences, serums and sunscreens. Industry leaders include brands like Shiseido, SK-II and Hada Labo and they focus on innovativeingredients like fermented rice extract, green tea, seaweed and hyaluronic acid.

Organic J-Beauty products are popular because they prioritize using natural ingredients, simple formulations, and long-term skin health. People are turning towards clean beauty, looking for skincare that is chemical-free, paraben-free, and synthetic additive-free. J-Beauty products are centered around ancient Japanese botanicals like rice bran, green tea, camellia oil, and seaweed extracts, which have the power of hydration, anti-aging, and soothing effects. This is consistent with the increasing world trend for cruelty-free and plant-based cosmetics, and hence organic J-Beauty products are extremely popular.

The fastest-growing channel is e-commerce. This can be ascribed to the surge in the per capita income of people especially in emerging economies. This, along with the wide availability of a diverse array of products in online channels at discounted prices is favoring their adoption. The increased penetration of smartphones is further bolstering the purchase of products through online channels. These channels offer convenience and deliver instant ownership.

| Country | CAGR |

|---|---|

| USA | 4% |

| India | 4.8% |

| Germany | 3.6% |

| China | 5.4% |

| Australia | 4.5% |

The USA J-Beauty industry is expanding, driven by consumer demand for simple yet high-performance skincare. Japanese beauty focuses on gentle ingredients, long-term skin wellness, and natural ingredients, which appeal to American consumers. J-Beauty is different from trend-driven beauty in that it's based on science-backed ingredients such as rice water, camellia oil, and hyaluronic acid, which target hydration, anti-aging, and sun protection.

One of the driving growth drivers is the digital beauty retailing platform. Online platforms, specialty beauty outlets, and DTC brands alike have greater access to genuine Japanese cosmetics and skincare today. J-Beauty particularly is discovered on social media and influencer platforms by Millennials and Gen Z shoppers. Sustainability trends are also evident, with J-Beauty companies, the majority of whom highlight biodegradable packaging, refillable packaging, and clean formulas.

FMI states that the USA J-Beauty industry is expected to grow at a CAGR of 4% during the study period.

Growth Drivers in the USA

| Key Drivers | Information |

|---|---|

| Science-Based Skincare | Demand for camellia oil, hyaluronic acid, and rice water-containing products. |

| Digital Beauty Retail | Expansion in e-commerce and specialty beauty outlets. |

| Influencer Marketing | Growth in engagement in social media campaigns. |

| Sustainability Trends | Demand for clean formulations and biodegradable packaging. |

India's J-Beauty industry is growing since there is greater care for healthy skincare and cosmetics. Indian customers are shifting from chemical-based skincare towards mild yet efficient products using natural ingredients. With diverse climatic conditions like humid coastlines, dry deserts, and high pollution, J-Beauty’s themes of hydration, anti-aging, and sun protection are most applicable to domestic skincare needs. FMI states that the Indian industry is slated to grow at 4.8% CAGR during the study period.

Discretionary income increase is also a key driver. As purchasing power grows, there is high demand for foreign cosmetics and skincare, with J-Beauty being in vogue for innovation and quality as perceived. Online marketplaces and social media have brought greater accessibility with plant-based ingredients and green packaging J-Beauty brands coveted by environment-conscious consumers.

Growth Drivers in India

| Key Drivers | Information |

|---|---|

| Climate-Targeted Skincare | Hydrating, sun protection, and anti-aging product demand. |

| Disposable Income Growth | Increased spending on imported and high-end skincare. |

| Online Retail Growth | Increased accessibility via online stores. |

| Sustainability Awareness | Eco-friendly packaging and vegetable product demand. |

Germany’s J-Beauty industry is expanding with demand for minimalist, natural, and efficient skincare. Germans care about long-term skin health and performance, and these are precisely the areas where J-Beauty’s emphasis on hydration, sun protection, and anti-aging will appeal. The country’s cold winters and dry weather also result in higher demand for richly moisturizing but gentle skincare.

Sustainability is likewise a significant mover as Germans increasingly want ethically sourced ingredients, biodegradable packaging, and clean formulations. Online and specialist beauty store growth have otherwise driven access further. Social networking and beauty experts have likewise assisted in fueling J-Beauty promotion among high-performance yet environmentally aware Millennial and Gen Z consumers who are beauty purchasers.

FMI cites that Germany's J-Beauty industry will achieve a growth rate of CAGR 3.6% during the forecast period.

Growth Drivers in Germany

| Key Drivers | Information |

|---|---|

| Need for Efficacy | Scientific, long-term skin care preference. |

| Climate-Related Needs | Very high demand for moisturizing products due to harsh winters. |

| Sustainability Movement | High concern about clean ingredients and green packaging. |

| Growth through E-Commerce | Supported by online payments facilitating access to J-Beauty products. |

China’s J-Beauty industry is expanding rapidly with growing demand for high-end, high-quality skincare. Consumers are shifting towards minimalist beauty regimens, in line with the J-Beauty emphasis on hydration, anti-aging, and gentle care. Japan’s popularity as a culture, as well as the use of high-tech and natural ingredients, has made J-Beauty’s industry dominant.

One of the key drivers of growth is an expanding middle-class consumer with higher disposable income, leading to higher expenditure on foreign beauty brands. Cross-border shopping and online platforms have made it easily accessible to buy J-Beauty products. Social media sites like Xiaohongshu and WeChat have played a crucial role in fueling the popularity of J-Beauty, and the power of online influencers and beauty bloggers has generated interest in its benefits.

Growth Drivers in China

| Key Drivers | Information |

|---|---|

| Minimalist Beauty Trend | Growing need for easy but effective skincare routines. |

| Rising Disposable Income | Expenditure on foreign and premium brands rising. |

| E-Commerce & Social Media | Influencer communities and cross-border platforms driving adoption. |

| Sustainability Movement | Spiking demand for green packaging and botanical-based formulations. |

Australia’s J-Beauty trend is thriving as the locals seek high-performance skincare that answers to the country’s sunny, warm weather. Hydration, sun protection, and anti-aging are all hot topics on shoppers’ agendas, so light but potent J-Beauty products lead the pack. The trend toward natural and science-based formulas also aligns with consumers’ fantasies.

Ethical beauty and sustainability are the driving forces for industry growth. Australian consumers prefer cruelty-free manufacturing, biodegradable packaging, and clean ingredients. Social media, online sales, and beauty influencers have driven high recognition and sales of J-Beauty, growth in availability through online stores and specialty beauty shops.

Growth Drivers in Australia

| Key Drivers | Information |

|---|---|

| Climate-Specific Skincare | High demand for hydrating and sun protection products. |

| Natural & Science-Based Formulations | Preferring gentle but effective skincare products. |

| Sustainability Focus | Growing demand for biodegradable and cruelty-free beauty products. |

| E-Commerce Growth | Beauty bloggers and online buying expanding industry coverage. |

The J-Beauty product market comprises old and new indie brands, as well as mass-market international competitors looking into its increasing appeal worldwide. Old-established beauty giants in Japan could master in their field with innovative skincare practices, elaborate formulations, and bud-infused beauty philosophy. They have established massive trust with consumers through extensive R&D, expensive and efficacious anti-aging solutions with high-efficacy hydration and sun protection. Their large distribution networks include department stores, specialty beauty retailers as well as lead e-commerce platforms that ensure a strong presence across Asia, North America, and Europe.

Meanwhile, the increasing demand for organic, clean, and sustainable beauty products has propelled the rise of independent and niche J-Beauty brands. DTC models enable them to build traction, along with influencer-led marketing programs, and personalized skincare solutions that particularly attract younger consumers who are so attuned to digitality. New competitive channels like subscription beauty services, social media trends, and new approaches to targeted e-commerce are changing the competitive landscape, creating the right environment for new niche brands to take chances against traditional leaders. K-Beauty and Western players are stirring the pot by bringing in natural ingredients, creating more minimalist formulations, as well as developing hybrid skincare technologies. With this evolving beauty global industry, Japanese beauty companies are leaving no stone unturned to enhance differentiation and innovate continuously.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Shiseido Co., Ltd. | 20-25% |

| Kao Corporation | 15-19% |

| Kosé Corporation | 10-14% |

| POLA ORBIS HOLDINGS INC. | 7-11% |

| FANCL CORPORATION | 5-9% |

| Other Companies (combined) | 25-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Shiseido Co., Ltd. | Leaders within the industry with luxurious skincare and cosmetics, a strong emphasis in R&D, and strategies on global expansion. |

| Kao Corporation | Known for premium and mass-market skincare and personal care products, with an emphasis on sustainability and innovation. |

| Kosé Corporation | Offers high-end and drugstore skincare and makeup, leveraging natural ingredients and high-tech formulations. |

| POLA ORBIS HOLDINGS INC. | This is an anti-aging and high-performance skincare brand with a strong domestic presence. |

| FANCL CORPORATION | Pioneers in the preservative-free and additive-free beauty spectrum, attracting clean beauty inclinations. |

Shiseido Co., Ltd. (20-25%)

Leads the industry with a diverse product portfolio, strong global branding, and significant investment in skincare R&D.

Kao Corporation (15-19%)

Focuses on both high-end and everyday beauty, integrating sustainability into its innovation pipeline.

Kosé Corporation (10-14%): Stands out with its blend of traditional Japanese ingredients as well as advanced skincare technologies.

POLA ORBIS HOLDINGS INC. (7-11%)

A specialist in anti-aging and premium skincare, targeting the luxury consumer segment.

FANCL CORPORATION (5-9%)

Gains traction with clean beauty innovations, emphasizing preservative-free and additive-free formulations.

Other Key Players (25-30% Combined)

The industry is slated to register USD 35.9 billion in 2025.

The industry is predicted to reach a size of USD 54.7 billion by 2035.

Key manufacturers in the industry include Shiseido Co., Ltd., Mandom Corp., Unilever, L'Oréal Groupe (Nihon L’Oréal), Procter & Gamble Company, Kao Corporation, Lion Corporation, POLA ORBIS HOLDINGS INC., FANCL CORPORATION, CANMAKE, and Kosé Corporation.

China, slated to witness 5.4% CAGR during the study period, is poised for fastest growth.

Skincare products, especially hydrating lotions and anti-aging serums, have gained immense popularity.

The J-Beauty industry includes haircare, skincare, colour cosmetics, and others.

Products are categorized as organic and conventional.

J-Beauty products are sold through e-commerce, specialty stores, hypermarkets/supermarkets, and other retail channels.

Foot Care Product Market Analysis by Product Type, Distribution Channel and Region Through 2035

POU Water Purifier Industry Analysis In MENA: Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.