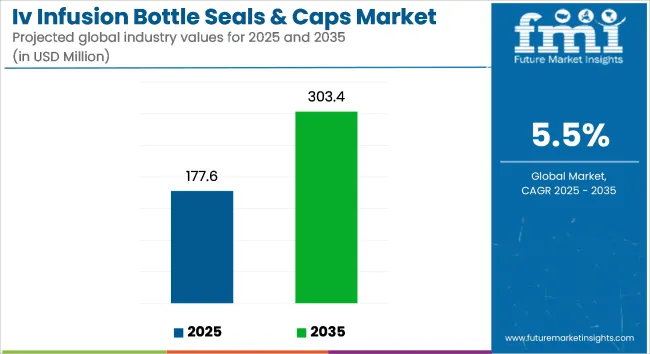

The IV infusion bottle seals & caps market is projected to grow from USD 177.6 million in 2025 to USD 303.4 million by 2035, registering a CAGR of 5.5% during the forecast period. Sales in 2024 reached USD 168.3 million. Growth is being driven by rising demand for sterile, tamper-proof packaging in the pharmaceutical and clinical nutrition sectors, particularly across Asia-Pacific and Europe.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 177.6 Million |

| Industry Value (2035F) | USD 303.4 Million |

| CAGR (2025 to 2035) | 5.5% |

Hospitals and contract manufacturing organizations are emphasizing drug integrity and patient safety, further boosting demand for advanced closure systems. The rising penetration of biologics and parenteral formulations has also supported the adoption of high-barrier cap and seal technologies that reduce contamination risks.

Recyclability, alongside regulatory compliance with USP Class VI and ISO 15378, has been emphasized to minimize environmental impact while maintaining sterility. In addition, automation-driven innovations in sealing machines have enhanced precision in component fit and minimized leakage. Smart traceability features such as RFID tagging for infusion bottles are being trialed in hospitals.

These enhancements reflect growing interest in digital integration and lifecycle transparency. Strategic partnerships with pharma suppliers are also being cultivated to accelerate rollout of compliant, sustainable solutions that support both bulk and unit-dose parenteral formats. Sustainability efforts have been reinforced through the shift toward recyclable aluminum seals and medical-grade polypropylene caps.

Future growth is expected to be fueled by increased adoption of advanced infusion therapies in oncology and critical care, requiring robust primary sealing solutions. The industry is projected to benefit from strong regulatory push around traceability, authentication, and user safety. Custom-designed caps and color-coded seal systems for drug differentiation are forecast to become more mainstream as hospitals demand operational ease.

Competitive focus is likely to intensify around compliant, automation-ready closure designs. In addition, the growing prevalence of home infusion treatments may prompt further miniaturization and safety-lock features, enhancing market scope globally. Strategic R&D in polymer blends and high-integrity sealing profiles will remain a key differentiator.

The market is segmented based on product type, material type, end-use application, and region. By product type, the market includes flip-off seals, tear-off seals, euro cap seals, aluminum seals, plastic caps, and combination seals. In terms of material type, the market is categorized into aluminum, polypropylene (PP), polyethylene (PE), rubber, and elastomeric composites.

By end-use application, the market comprises hospitals & clinics, ambulatory surgical centers, home healthcare settings, emergency medical services, and veterinary healthcare. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

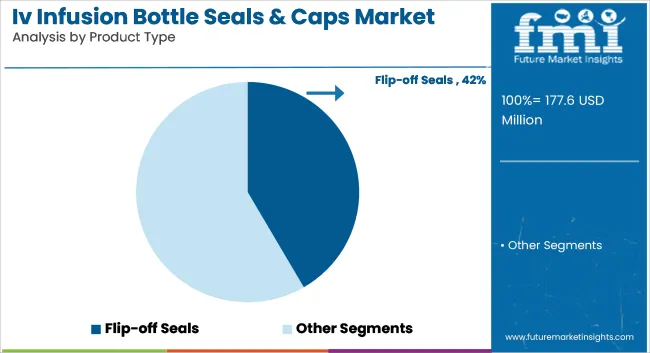

Flip-off seals have been projected to lead the market with an estimated 41.6% share in 2025, driven by their combination of tamper evidence and easy vial access. These seals have been favored for compatibility with automated sealing lines and various IV container formats. Hospitals and pharmaceutical firms have prioritized them for sterility and reliability in liquid drug administration.

Widespread regulatory compliance has supported their adoption globally. Durability and uniform crimping capabilities have made flip-off seals suitable for high-speed fill-and-finish operations. Their color-coded caps have facilitated identification, aiding inventory control and clinical efficiency. Pharmaceutical packaging standards have endorsed flip-off designs for single-use and parenteral applications. Compatibility with glass and plastic infusion bottles has ensured product flexibility across medical formats.

Technological upgrades have improved seal coating materials and cap ergonomics. Barrier properties and tamper-evident band integrity have been strengthened through design optimization. Flip-off systems have minimized particulate contamination during removal, ensuring sterility upon opening.

Manufacturers have integrated FDA and USP-compliant materials to meet stringent hygiene mandates. Demand has been bolstered by expanding biologics and injectable drug markets, where secure sealing remains critical. Cost-effective manufacturing and recyclability have further increased appeal in value-driven healthcare segments. Local sourcing and regional production strategies have helped maintain supply chain resilience. With hospitals scaling up procedural volumes, demand for these closures has remained robust.

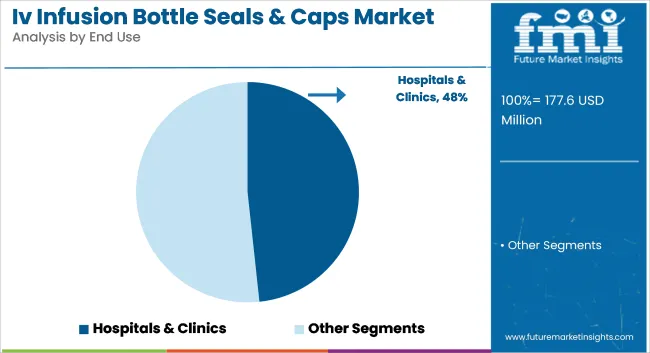

Hospitals & clinics have been expected to dominate the end-use segment with 48.3% of the market share in 2025, due to their centralized role in intravenous drug administration. A high concentration of surgical procedures, emergency treatments, and critical care units has fueled packaging volume requirements.

Daily operations have necessitated reliable and sterile seal formats to support patient safety. Consistent consumption patterns have provided stable demand across developed and developing regions. Large-scale procurement programs and standardization across hospital networks have favored products like flip-off and tear-off seals.

Central pharmacies within hospitals have relied on high-quality seal integrity for drug reconstitution and storage. Accreditation bodies have enforced packaging safety norms, driving investment in compliant sealing technologies. Integration with automated IV filling lines has enhanced operational efficiency.

Hospitals have prioritized closures that prevent microbial ingress while enabling rapid clinical access. Reusable devices and multi-dose vials have also used these seals for resealing capabilities. Training protocols and staff familiarity with flip-off systems have ensured adherence to safe administration practices.

Clinical trials and in-house compounding units have further stimulated seal consumption. As healthcare infrastructure expands, especially in Asia and Latin America, hospital-based packaging needs have been forecast to rise significantly. Public-private partnerships have promoted localized seal manufacturing aligned with national health goals.

Product traceability, batch identification, and anti-counterfeit features have been incorporated in institutional procurement specifications. The hospital segment is therefore expected to maintain its leadership in the global IV infusion bottle seals and caps market.

Stringent Regulatory Compliance and Material Safety

The most profound challenge for the IV infusion bottle caps and seals market is compliance with stringent regulatory guidelines for medical packaging. Biocompatible, non-reactive with intravenous pharma drugs, and serializable are just some of the myriad material testing that has to accompany any innovative device with an international regulatory stamp (such as the FDA, EMA, and other health agencies worldwide).

This leads the manufacturers to use medical-grade polymers, aluminum, and rubber materials that are very costly and have a set standard safety requirement statements and a very delicate and tedious supply chain.

Advancements in Sustainable and Smart Packaging

The growing need for sustainable healthcare packaging is presenting high growth opportunities to the IV Infusion Bottle Seals & Caps market. Companies are adopting green solutions such as recyclable and degradable materials to reduce medical packaging waste. Smart packaging technologies like RFID tracking and tamper-evident technology are gaining traction on the back of patient safety, in addition to enhancing inventory management in hospitals and healthcare centers.

Only innovation-led, compliant, and sustainable packaging solution providers with financial muscle to invest in such partnerships will capitalize on the growing opportunity in IV infusion bottle sealing components segments.

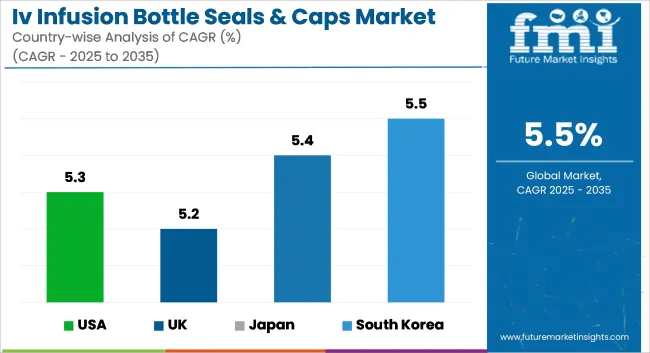

The USA IV infusion bottle seals & caps market is expected to grow steadily, owing to an increasing demand for advanced packaging in the healthcare sector, growing hospitalizations, and a surge in the pharmaceutical industry. The expanding demand for tamper-evident and sterile packaging solutions is driving new material formats as well as designs. Additionally, rigorous FDA regulations related to the safety of medical packaging, coupled with environmental sustainability initiatives, are driving companies to manufacture BPA-free and recyclable parts.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.3% |

Growing use of aseptic packaging in the healthcare industry & increasing investments in biopharmaceutical manufacturing are expected to drive the UK IV infusion bottle seals & caps market. As more of the manufacturing industry moves towards sustainable and EU-compliant products, companies are looking even more towards recyclable and bio-compatible materials. Expansion of home healthcare services is also creating the demand for safe, easy-to-handle, and leak-proof infusion packaging.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.2% |

The EU IV Infusion Bottle Seals &Caps Market is driven by improving investments in healthcare infrastructure, stringent pharmaceutical packaging regulations, and the increasing need for sterile, tamper-proof seals and caps.

The press release also mentioned that the German market is the leading region in the sample analysis market, followed by France and Italy, where the high pharmaceutical manufacturing capacity and increased focus on regulatory compliance adherence towards EMA guidelines are driving the market. Apart from this, the increasing need for single-use medical packaging in hospitals and clinics is driving the market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.6% |

Japan IV infusion bottle seal & caps industry is growing in response to a growing population of geriatrics, the surging demand for novel drug delivery mechanisms, and heavy regulatory restrictions imposed on the pharmaceutical packaging segment. Japan's demand for very strict sterilization requirements and contaminant avoidance measures are creating demands for high-performing, multi-layer sealing compounds. Smart package solutions like RFID-bearing seals are gaining momentum among smart packaging investment priorities in the health care space across Japan.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.4% |

South Korea’s IV infusion bottle seals & caps market is growing due to expanding pharmaceutical manufacturing, increasing government healthcare spending, and the rising need for tamper-proof medical packaging. The country’s push for localized production of medical-grade plastics and aluminum caps is further boosting the market. Additionally, advancements in cleanroom manufacturing and automation are supporting the production of highly sterile and durable infusion bottle components.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.5% |

The IV Infusion Bottle Seals & Caps market is experiencing significant growth driven by the rising demand for advanced and sterile medical packaging solutions. With the increasing use of IV therapies in hospitals, clinics, and home healthcare settings, the need for secure and contamination-free bottle seals and caps has surged.

Advancements in material science, regulatory compliance, and sterilization technologies have further contributed to market expansion. Leading players in the industry are focusing on innovation, sustainable materials, and manufacturing scalability to strengthen their market presence.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 177.6 million |

| Projected Market Size (2035) | USD 303.4 million |

| CAGR (2025 to 2035) | 5.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and million units for volume |

| Products Analyzed (Segment 1) | PP Caps, Rubber Seals |

| Neck Sizes Analyzed (Segment 2) | Up to 20 mm, 21 to 28 mm, 29 to 32 mm, Above 32 mm |

| Applications Analyzed (Segment 3) | Packaging, Printing |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the IV Infusion Bottle Seals & Caps Market | B. Braun Medical Inc., RENOLIT SE, Medline Industries Inc., Wuxi Qitian Medical Technology Co., Ltd, Datwyler Holding AG, Winfield Laboratories Inc., Prasad Meditech, Taiwan Hon Chuan Enterprise, Jiangsu Changjiang Lids, Cardinal Health Inc. |

| Additional Attributes | Dollar sales by product type (PP vs rubber), Neck size compatibility trends across standard IV packaging, Demand from contract manufacturing and hospital pharmacies, Regulatory emphasis on seal integrity and sterility assurance, Innovations in tamper-evident and printable cap solutions |

| Customization and Pricing | Customization and Pricing Available on Request |

The overall market size for IV infusion bottle seals & caps market was USD 177.6 Million in 2025.

The IV infusion bottle seals & caps market is expected to reach USD 303.4 Million in 2035.

The rising demand for advanced and safe packaging solutions in the pharmaceutical and healthcare industries fuels IV infusion bottle seals & caps Market during the forecast period.

The top 5 countries which drives the development of IV infusion bottle seals & caps Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of product, PP Caps to command significant share over the forecast period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.