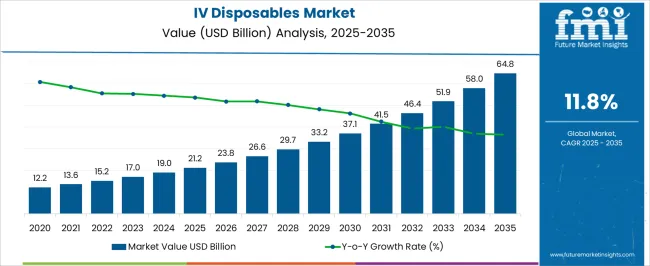

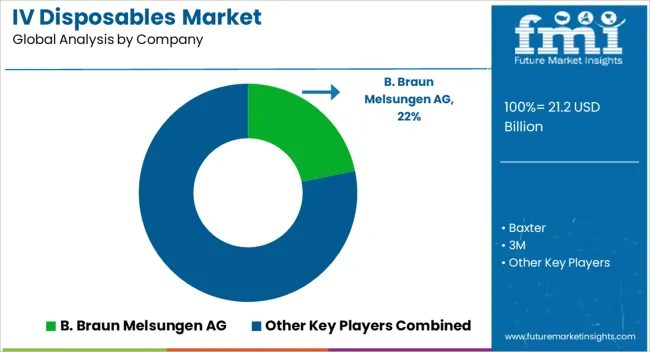

The IV Disposables Market is estimated to be valued at USD 21.2 billion in 2025 and is projected to reach USD 64.8 billion by 2035, registering a compound annual growth rate (CAGR) of 11.8% over the forecast period.

| Metric | Value |

|---|---|

| IV Disposables Market Estimated Value in (2025 E) | USD 21.2 billion |

| IV Disposables Market Forecast Value in (2035 F) | USD 64.8 billion |

| Forecast CAGR (2025 to 2035) | 11.8% |

The IV disposables market is expanding steadily due to the rising prevalence of chronic illnesses, increasing hospitalization rates, and growing reliance on intravenous therapies for drug and fluid administration. Demand is further fueled by the need for sterile, single use medical supplies that minimize the risk of hospital acquired infections.

Advancements in material safety, precision manufacturing, and compatibility with infusion monitoring systems are enhancing efficiency and reliability in clinical use. Additionally, regulatory emphasis on patient safety and infection control has accelerated adoption of disposable intravenous products across developed and emerging healthcare systems.

The outlook for this market remains strong as healthcare providers continue to prioritize infection prevention, treatment accuracy, and operational efficiency, ensuring consistent demand across hospitals and other healthcare facilities.

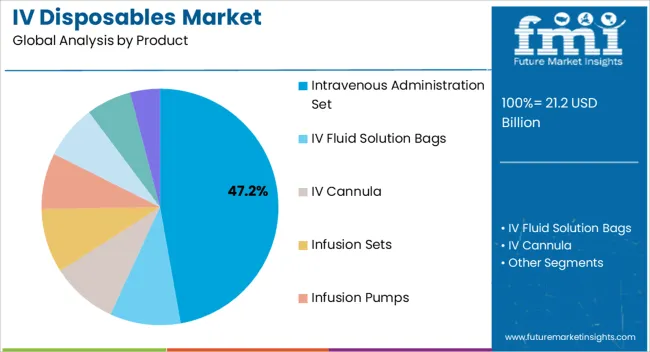

The intravenous administration set segment is projected to hold 47.20% of total market revenue by 2025 within the product category, making it the leading segment. Growth is being driven by its critical role in enabling accurate fluid delivery, medication infusion, and blood transfusion procedures.

The product’s wide applicability across a range of treatments has ensured consistent demand in both acute care and long term therapeutic settings. Enhanced focus on patient safety and the need to minimize contamination risks have further supported increased usage of sterile disposable IV sets.

In addition, advancements in design and flow control mechanisms have improved clinical outcomes, reinforcing the prominence of this segment in the overall market.

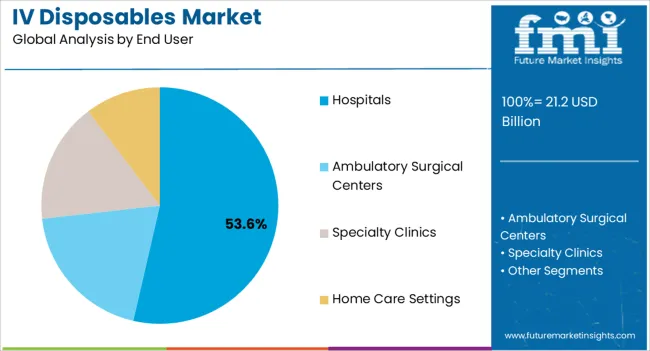

The hospitals segment is anticipated to account for 53.60% of market revenue by 2025, positioning it as the dominant end user. This is attributed to the high volume of inpatient treatments, emergency care requirements, and surgical interventions that necessitate the use of IV disposables.

Hospitals maintain stringent infection prevention standards, which has strengthened their reliance on sterile single use devices. Additionally, their large patient base and extensive treatment portfolios have driven consistent procurement of IV disposables at scale.

With increasing healthcare infrastructure investments and rising patient admissions, hospitals continue to lead in adoption, underscoring their role as the primary growth driver in the end user category.

Sales of the IV disposables market grew at a CAGR of 8.6% between 2020 to 2025. IV disposables market contributes 11.5% revenue share to the global medical supplies market which is valued around USD 21.2 Billion 2025.

The demand for IV disposables has been steadily increasing due to factors such as the rising prevalence of chronic diseases, an aging population, and the expansion of healthcare infrastructure.

Diabetes is one of the leading cause of kidney failure, lower-limb amputations, and new cases of impaired vision among adults. Moreover, health risks by the dearth of exercise, high alcohol and tobacco consumption, and poor nutrition cause much illness and early death due to chronic diseases.

The market is expected to continue growing during the forecast period. Factors such as the increasing prevalence of chronic diseases, ongoing advancements in medical technology, and the expansion of healthcare services in developing regions are likely to drive the market's growth.

The COVID-19 pandemic has highlighted the importance of IV therapy in critical care settings, further emphasizing the need for IV disposables. The market is also expected to benefit from the continued focus on infection control and the adoption of advanced healthcare technologies.

Considering this, FMI expects the global market to grow at a CAGR of 11.8% through the forecasted years.

The demand for IV therapy has increased as the prevalence of chronic diseases like diabetes, cancer, and coronary artery disease has increased. IV disposables are essential for giving patients their fluids, drugs, and nutrition, which opens up new business prospects for providers and manufacturers.

Technological advancements in the intravenous equipment market include smart pumps, wireless and remote monitoring, needle-free ports, closed system transfer devices, portable intravenous devices, and nanotechnology. These advances have the potential to improve the safety, effectiveness, and efficiency of intravenous therapy and create new opportunities for manufacturers in this market.

There is a growing demand for smart pumps, a type of infusion pumps, that use advanced software algorithms to improve the accuracy and safety of intravenous drug administration. They can detect potential errors, such as incorrect dosages or administration rates, and alert healthcare professionals. These factors can open up several opportunities in the intravenous equipment market.

The high cost of intravenous equipment can limit their acceptability in some healthcare settings, especially those with limited budgets. Healthcare providers may opt for lower-cost alternatives, such as oral medications or subcutaneous injections, which may limit the growth of the intravenous equipment market. Healthcare providers may face lower profit margins due to the high cost of intravenous equipment, which may limit their willingness to invest in new equipment or expand their services.

Product recalls can affect the intravenous equipment market in the United States by damaging brand reputation, reducing revenue, increasing regulatory scrutiny, raising patient safety concerns, and increasing litigation costs. Product recalls can raise patient safety concerns and limit the adoption of intravenous equipment by healthcare providers. This may impact the overall growth of the intravenous equipment market.

Some of the factors that can increase demand for alternative therapies include reducing demand, limiting cost-effectiveness, patient preference, limiting investment in innovation and research, and regulatory challenges.

Alternative therapies may be more cost-effective for healthcare providers and insurance companies because they require less equipment and human resources. This may limit the adoption of intravenous equipment and affect the overall growth of the market.

These factors are expected to hamper the revenue growth of the market over the forecast period.

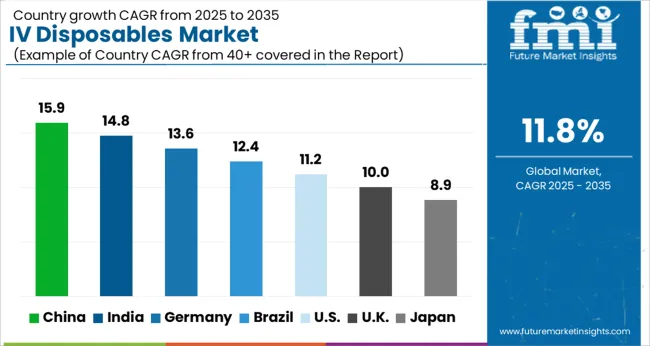

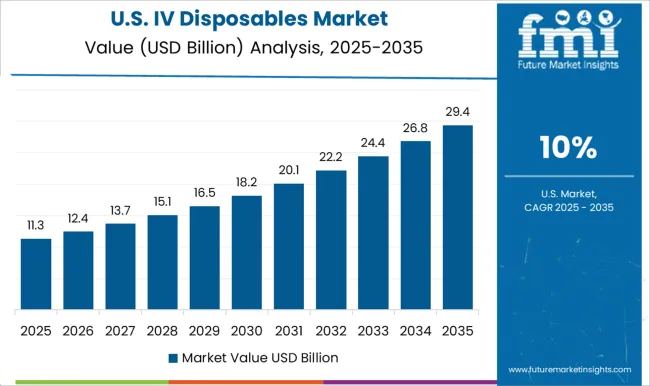

The USA market is expected to register a CAGR of 10.3% during the forecast period.

The demand for IV disposables in the USA is driven by factors such as the aging population, the need for improved patient care and safety, the expansion of healthcare infrastructure, and the growing focus on infection control.

The USA market is highly competitive, with several prominent companies operating in the industry. These companies compete based on factors such as product innovation, pricing strategies, distribution networks, and relationships with healthcare providers, which will drive the expansion of the market.

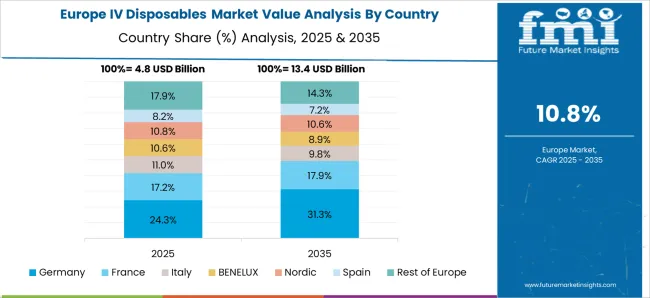

Germany dominated the European market for IV disposables and accounted for around 29.8% of the market share in 2025.

Germany has a robust healthcare infrastructure with a well-established network of hospitals, clinics, and healthcare facilities. The country is known for its high-quality healthcare services and advanced medical technology. This infrastructure creates a favorable environment for the adoption and utilization of IV disposables, driving market growth.

Germany is a lucrative segment of the market in Europe. The strong healthcare infrastructure, technological advancements, aging population, stringent regulations, reimbursement system, medical tourism, and emphasis on research and development create a favorable market landscape for IV disposable manufacturers and suppliers.

China is projected to be the most attractive market in IV disposables and is expected to grow over a significant CAGR of 11.8%.

The market in China is expected to grow significantly in the coming years due to several factors. China has been increasing its healthcare expenditure in recent years, with a focus on improving healthcare infrastructure and services. This increased investment in the healthcare sector is expected to drive the demand for IV disposables as the country seeks to enhance patient care and treatment outcomes.

Another factor contributing to the growth of the market in China is the prevalence of chronic diseases such as cardiovascular diseases, diabetes, and cancer is on the rise in China, primarily due to factors like an ageing population, sedentary lifestyles, and changing dietary patterns. IV therapy is often necessary for the management and treatment of these chronic conditions, leading to an increased demand for IV disposables.

The infusion pumps segment held the major chunk of about 48.1% of the global market by the end of 2025.

Infusion pumps offer precise and controlled administration of fluids, medications, and nutrition to patients. They are designed to deliver these substances at specific rates and volumes, ensuring accuracy and consistency in dosage. This level of precision is critical in many medical scenarios, such as critical care, chemotherapy, and pain management.

IV disposables, such as specialized connectors and pressure sensors, are designed to work in conjunction with infusion pumps to ensure the safe and accurate delivery of fluids and medications.

Overall, infusion pumps are a widely adopted treatment option for IV Disposables due to their precise and controlled administration of fluids and medications, enhanced safety features, and compatibility with various IV disposables.

The hospitals accounted for a revenue share of 54.6% in the global market at the end of 2025.

Hospitals typically have a significantly higher volume of patients compared to other healthcare settings such as clinics or ambulatory surgical centers. This higher patient load translates into greater demand for IV therapy, which drives the need for IV disposables. Hospitals often have multiple departments and units that administer IV treatments, including emergency departments, intensive care units, operating rooms, and general wards, further contributing to the demand for IV disposables.

Hospitals primarily provide inpatient services, where patients stay for an extended period during treatment or recovery. In such cases, patients often require continuous or intermittent IV therapy throughout their hospital stay. This continuous demand for IV disposables further solidifies the dominance of hospitals in the IV disposable market.

Key players in the market are focused on increasing their product portfolio for strengthening their position in the market and to expand their footprint in emerging markets. The key strategy adopted by manufacturers to gain a competitive edge in the market is pricing strategies, market strategies, technological advancements, and acquisition with other companies to expand their business.

For instance

Similarly, recent developments have been tracked by the team at Future Market Insights related to companies in the IV disposables market space, which are available in the full report

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania and Middle East & Africa (MEA) |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Argentina, Germany, UK, France, Italy, Spain, Russia, BENELUX, Nordics, China, Japan, South Korea, India, Thailand, Indonesia, Malaysia, Vietnam, Philippines, Australia, New Zealand, Türkiye, South Africa, North Africa and GCC Countries |

| Key Segments Covered | Product, End User, and Region |

| Key Companies Profiled | B. Braun Melsungen AG; Baxter; 3M; Terumo Corporation; Nipro Corporation; Teleflex Incorporated; Becton, Dickinson and Company; Smiths Medical/ICU Medical; Moog Inc; AngioDynamics.; Fresenius SE & Co. KgaA; arcomed ag |

| Report Coverage | Market Forecast, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global IV disposables market is estimated to be valued at USD 21.2 billion in 2025.

The market size for the IV disposables market is projected to reach USD 64.8 billion by 2035.

The IV disposables market is expected to grow at a 11.8% CAGR between 2025 and 2035.

The key product types in IV disposables market are intravenous administration set, IV fluid solution bags, IV cannula, infusion sets, infusion pumps, catheter needles, securement devices and others (stopcocks, connectors, extension tubes).

In terms of end user, hospitals segment to command 53.6% share in the IV disposables market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

IVC Host Market Size and Share Forecast Outlook 2025 to 2035

IV Pole Market Size and Share Forecast Outlook 2025 to 2035

IV Infusion Bottle Seals & Caps Market Size and Share Forecast Outlook 2025 to 2035

IVD Antibodies Market Size and Share Forecast Outlook 2025 to 2035

IV Infusion Gravity Bags Market Size and Share Forecast Outlook 2025 to 2035

IV Bag Market Outlook - Growth, Demand & Forecast 2025 to 2035

IV Fluid Transfer Drugs Devices Market Trends – Growth & Forecast 2025 to 2035

IV Disinfecting Caps Market Trends - Growth, Demand & Forecast 2025 to 2035

Market Share Breakdown of the IV Bag Market

Examining Market Share Trends in IV Infusion Bottle Seals & Caps

IV Therapy and Vein Access Devices Market Insights – Trends & Forecast 2024-2034

Global IVD Contract Manufacturing Market Trends – Size, Forecast & Growth 2024-2034

IVF Workstation Market

River Cruise Market Size and Share Forecast Outlook 2025 to 2035

HIV Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Dive Computer Market Forecast and Outlook 2025 to 2035

Diving And Survival Equipment Market Size and Share Forecast Outlook 2025 to 2035

Divided Motor Core Market Size and Share Forecast Outlook 2025 to 2035

Liver Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

HIV Self-testing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA