The culinary tourism market in Italy is experiencing steady growth driven by the increasing global interest in authentic food experiences and gastronomic heritage. The market’s future outlook is shaped by the rising demand for experiential travel, where tourists seek immersive encounters with local cuisines, cooking techniques, and regional specialties. The expansion of digital booking platforms and travel apps has facilitated easy access to curated culinary experiences, further propelling market growth.

Increasing investments by tour operators and local businesses in culinary trails, food festivals, and cooking classes are enhancing the variety and quality of offerings. Additionally, growing awareness of Italian culinary culture and the rising popularity of slow travel have made culinary tourism a key attraction for both domestic and international travelers.

The market is also supported by the increasing disposable income and willingness of tourists to spend on premium food experiences As the trend of integrating food experiences with travel continues to gain momentum, culinary tourism in Italy is expected to witness sustained expansion in the coming years.

| Metric | Value |

|---|---|

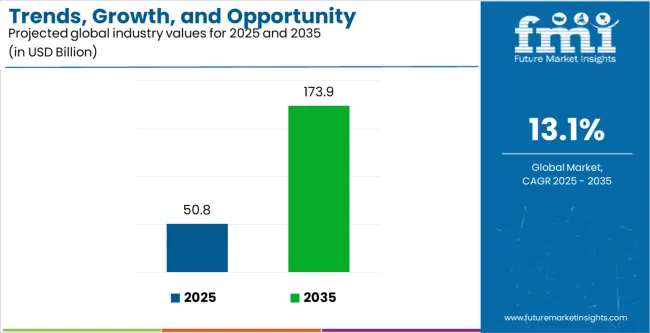

| Trends, Growth, and Opportunity Analysis of Culinary Tourism in Italy Estimated Value in (2025 E) | USD 50.8 billion |

| Trends, Growth, and Opportunity Analysis of Culinary Tourism in Italy Forecast Value in (2035 F) | USD 173.9 billion |

| Forecast CAGR (2025 to 2035) | 13.1% |

The market is segmented by Segment Name and region. By Segment Name, the market is divided into Culinary Trials, Cooking Classes, Restaurants, Food Festivals, and Others. In terms of Segment Name, the market is classified into Phone Booking, Online Booking, and In-Person Booking. Based on Segment Name, the market is segmented into Domestic Tourists and International Tourists.

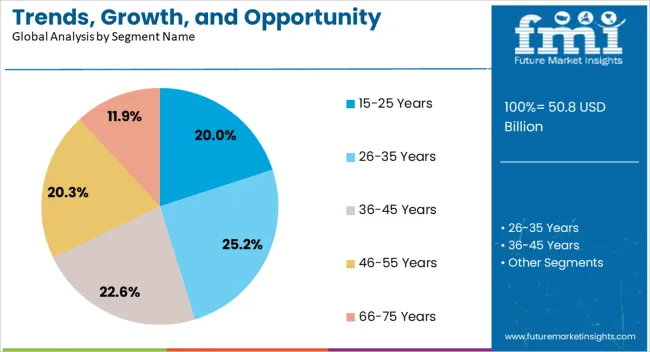

By Segment Name, the market is divided into Independent Traveler, Package Traveler, and Tour Group. By Segment Name, the market is segmented into Men, Women, and Children. By Segment Name, the market is segmented into 15-25 Years, 26-35 Years, 36-45 Years, 46-55 Years, and 66-75 Years. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The culinary trials segment is projected to hold 25.00% of the culinary tourism market revenue in Italy in 2025, establishing it as a leading activity-based segment. The growth of this segment has been driven by the high demand for hands-on experiences such as cooking classes, wine tasting, and regional food workshops, which allow tourists to engage directly with Italian culinary traditions.

Culinary trials provide immersive learning experiences that enhance traveler satisfaction and encourage repeat visits. The segment’s popularity is further reinforced by the desire for authentic, local, and artisanal food experiences, which are increasingly valued over conventional dining.

Tour operators and local businesses have also expanded offerings to include interactive and thematic food experiences, boosting adoption Moreover, culinary trials serve as a strong cultural engagement tool, allowing visitors to connect with regional heritage, thereby solidifying the segment’s prominence in the market.

The phone booking segment is expected to account for 30.00% of the culinary tourism market revenue in Italy in 2025, positioning it as the leading booking channel. The segment’s growth is influenced by the convenience and immediacy offered by phone reservations, enabling travelers to plan culinary activities efficiently.

Many tourists prefer personalized guidance and direct interaction with service providers when booking immersive food experiences. The segment also benefits from improved customer support and the ability to customize tours according to preferences, which enhances satisfaction and loyalty.

Additionally, phone booking serves as a bridge for older travelers and those less familiar with digital platforms, ensuring broader accessibility This convenience-driven approach has contributed to increased participation in culinary tours, classes, and tastings, reinforcing the dominance of phone booking in the market.

The domestic tourist segment is anticipated to hold 60.00% of the culinary tourism market revenue in Italy in 2025, making it the leading end-use segment. The growth of domestic participation is fueled by increasing interest among Italian residents in exploring regional culinary diversity and local gastronomic traditions.

Domestic tourists often seek authentic experiences closer to home, which reduces travel costs and promotes frequent engagement with culinary tours and festivals. The segment also benefits from government initiatives and local promotions aimed at boosting regional tourism and supporting small food businesses.

Moreover, domestic travelers contribute to the sustained demand for specialized culinary experiences, including cooking workshops, wine tastings, and local farm visits The strong cultural connection and appreciation for Italian cuisine drive repeat visits, reinforcing the domestic tourist segment’s dominant share in the market.

Social Media and Food Platforms are Positively Influencing Culinary Tourism Sector in Italy

Social media has the power to transform travel trends, which cannot be overstated. Food-focused platforms such as Instagram and food websites play a crucial role in intensifying interest and stimulating travel to destinations known for their multi-cuisine food. Therefore, Italy positions itself as an ideal destination in this context.

Culinary Tourism in Italy Flourishes through Cooking Classes, Food Tours, and Organic Dining

The culinary tourism sector in Italy has emerged as a strong infrastructure to encourage culinary tourism. This includes comprehensive tour operators, cooking institutions, food festivals, and agritourism schemes. Such resources simply travel for people and enjoy culinary experiences. These factors bolster the growth of the culinary tourism industry in Italy.

Culinary tourism perfectly associates itself with the broader trend toward immersive travel, where profound engagement prevails above material possessions. Taking part in cooking classes, food tours, and organic dining helps travelers engage better with Italian cuisine, thriving the culinary tourism adoption in Italy.

The Industry Faces Logistical Roadblocks across Diverse Regions, Impeding Overall Ecosystem Growth

The culinary tourism sector in Italy is significantly decentralized, with various offerings spread across diverse regions. The culinary tourism providers in Italy encounter logistical roadblocks in collaborative activities, procuring ingredients, and ensuring consistent quality, especially if they operate in different places. This inhibits the growth of the culinary tourism ecosystem in Italy.

Vendors Struggle with Cultural Variability in and Choices, Hindering Culinary Tourism Demand in Italy

Language barriers are a huge roadblock for culinary tourism vendors in Italy serving international tourists, specifically in places where English expertise is constrained. The cultural variability in culinary etiquette and choices requires businesses to tailor their portfolio to align with the inclination of a varied consumer base. Such factors impede the adoption of culinary tourism in Italy.

Expansive tourism trends, like seasonal shifts in traveler alternatives, negatively impact the culinary tourism industry in Italy. Culinary tourism providers in Italy must remain informed about the trends and adjust their offerings to remain motivated and benefit from developing opportunities.

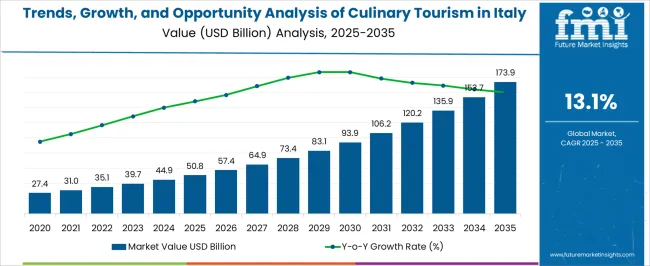

The culinary tourism sector in Italy recorded a CAGR of 8.3% from 2020 to 2025. From 2020 to 2025, Italy encountered an escalation in culinary tourism, indicating a booming global interest in cultural gastronomic experiences. Italy’s rich culinary heritage comprises diverse local cuisines and emphasizes high-quality, regionally grown ingredients. This combination has lured a considerable number of tourists seeking immersive food experiences.

During the historical period between 2020 and 2025 culinary tourism industry in Italy witnessed a substantial increase in the various food tours, cooking lessons, and garden-to-plate experiences. This growth was pushed by demand from local and foreign tourists.

Between 2025 and 2035, the demand for culinary tourism in Italy is likely to experience an upward trajectory ushered by diverse factors. The amplifying popularity of food-centered travel experiences is linked with a booming recognition for organic and regionally sourced cuisine. This strengthens the demand among tourists looking for authentic culinary travel. Innovation in technology and eCommerce platforms augments better availability of culinary experiences, serving an assortment of choices and budgets.

The culinary tourism sector in Italy is slated for sustained development, presenting numerous opportunities for providers. They can cash on the rich gourmet heritage and entice a perceptive global audience.

The section contains information about the leading segments in the industry. In terms of tourist type category, the international tourist segment is estimated to account for a share of 53.8% in 2025. By activity type category, the restaurants segment is projected to dominate by holding a share of 36.2% in 2025.

| Segment | International Tourist (Tourist Type) |

|---|---|

| Value Share (2025) | 53.8% |

International travelers often issue more budgets for food experiences, stimulating revenue for providers serving culinary tourism. Culinary tourism presents international tourists with a wider cultural immersion, aiding their choices for gastronomic experiences in Italy. The charm of touring Italy's cookery landscape stimulates international tourists to choose gastronomic experiences over anything else, thrives the industry growth.

| Segment | Restaurants (Activity Type) |

|---|---|

| Value Share (2025) | 36.2% |

Gourmet chefs in restaurants ensure premium food preparation and display, augmenting the cooking experience. Restaurants are centers for cooking adventure, giving recommendations and comprehension of local cuisines.

Restaurants offer more than just food. They provide a door to cultural immersion, permitting tourists to experience the richness of Italian culture. The ambiance of the restaurants is carefully considered to augment the gratification of the culinary tour, leaving tourists eager to return for more. These factors amplify the restaurants segment growth.

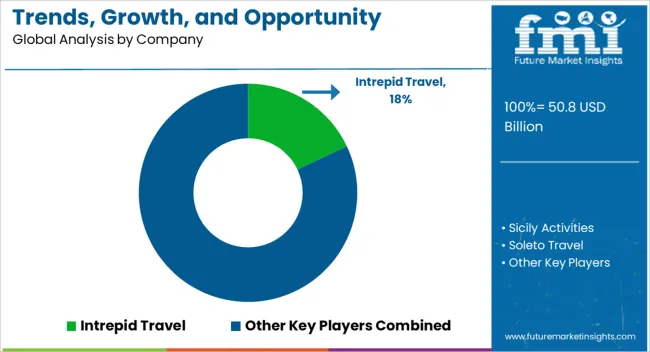

Prominent culinary tourism companies in Italy offer immersive participation like conducted tours to popular food festivals and hands-on cookery classes set in significant parts of the country. Culinary tourism providers of Italy focus on exhibiting the gastronomic delights of Italy as well as providing authentic culinary processes and societal dynamics to tourists.

By using social media platforms and devoted internet sites, culinary tourism providers in Italy skillfully advertise their portfolio to international viewers, attracting travelers with intriguing visuals and pleasing content. By designing memorable experiences and employing digital channels efficiently, the culinary tourism vendors aid Italy's recognition as a pre-eminent destination for cooking experts looking for immersive and refining experiences.

Industry Updates

Sicily Activities

Companies like Sicily Activities present tours and experiences concentrated around Sicilian cuisine. Sicily Activities has broadened its product portfolio to present immersive experiences like culinary lessons with local chefs, visits to markets, and wine connoisseurship promoting Sicilian wines.

Soleto Travel

It specializes in tours and travels in southern Italy. Soleto Travel launches new plans that give a complete tour of Italy’s culinary areas, from customary family-run restaurants to gourmet food providers.

Let's Cook in Umbria

Umbria is well-recognized for its classic cuisine and photographic terrains. Let's Cook in Umbria persists in presenting hands-on culinary lessons where tourists learn to make classic Umbrian cuisines with fresh and seasonal substances.

The report consists of key activity types like culinary trials, cooking classes, restaurants, food festivals, and others.

Key booking channels present in the industry include phone booking, online booking, and in-person booking.

The tourist type category is bifurcated into domestic and international.

The tour type category is trifurcated into independent traveler, package traveler, and tour group.

Based on consumer orientation, the industry is trifurcated into men, women, and children.

Key age groups present in the industry include 15-25 years, 26-35 years, 36-45 years, 46-55 years, and 66-75 years.

The global trends, growth, and opportunity analysis of culinary tourism in italy is estimated to be valued at USD 50.8 billion in 2025.

The market size for the trends, growth, and opportunity analysis of culinary tourism in italy is projected to reach USD 173.9 billion by 2035.

The trends, growth, and opportunity analysis of culinary tourism in italy is expected to grow at a 13.1% CAGR between 2025 and 2035.

The key product types in trends, growth, and opportunity analysis of culinary tourism in italy are culinary trials, cooking classes, restaurants, food festivals and others.

In terms of segment name, phone booking segment to command 30.0% share in the trends, growth, and opportunity analysis of culinary tourism in italy in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Trends, Growth, and Opportunity Analysis of Drinking Water in Saudi Arabia Forecast and Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Micro-investing Platform in Australia Size and Share Forecast Outlook 2025 to 2035

US Luxury Fine Jewelry Market Insights 2024 to 2034

Trends, Growth, and Opportunity Analysis of Pea Protein in South Korea Size and Share Forecast Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Shisha Tobacco in GCC Countries Forecast and Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Data Center Facility in Morocco Size and Share Forecast Outlook 2025 to 2035

Europe Connected Car Market Growth - Trends & Forecast through 2034

Trends, Growth, and Opportunity Analysis of Tourism in Burma Size and Share Forecast Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Rail Tourism in Europe Size and Share Forecast Outlook 2025 to 2035

Monaco Casino Tourism Industry Trends – Growth & Forecast through 2034

Trends, Growth, and Opportunity Analysis of Sports Tourism in South Africa Size and Share Forecast Outlook 2025 to 2035

UK Medical Tourism Market Analysis – Growth & Forecast 2024-2034

Trends, Growth, and Opportunity Analysis of Outbound Tourism in GCC Countries Size and Share Forecast Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Outbound Tourism in France Forecast and Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Outbound Tourism in China Market Forecast and Outlook 2025 to 2035

United States Outbound Tourism Market Analysis - Size, Share, and Forecast 2024 to 2034

Trends, Growth, and Opportunity Analysis of Sustainable Tourism in Thailand Size and Share Forecast Outlook 2025 to 2035

Indonesia Sustainable Tourism Market Growth – Forecast 2024-2034

Trends, Growth, Opportunity Analysis of Medical Tourism in Thailand Size and Share Forecast Outlook 2025 to 2035

Hair Regrowth Treatments Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA