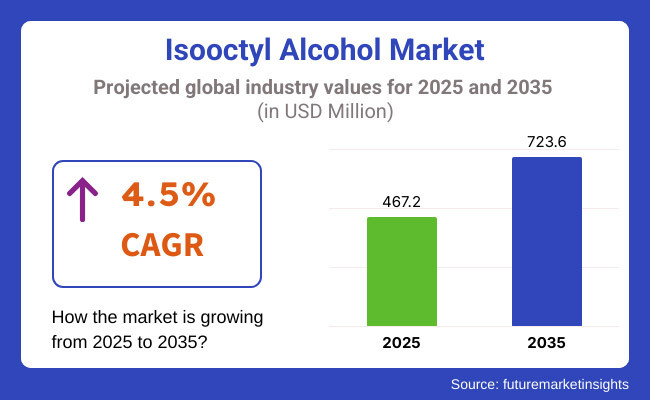

Isooctyl alcohol market will also grow from the year 2025 up to the year 2035 with the support of growing demands of all industries like plasticizers, coatings, adhesives, and lubricants. The market will reach around USD 467.2 million in 2025 and around USD 723.6 million in 2035 at a compound annual growth rate (CAGR) of 4.5% during the forecast period.

There are numerous reasons behind the new market scenario. Wider use of recycling and isooctyl alcohol as clean raw material to be used for making plasticizers used in flexible PVC applied in the construction, auto, and package industries is one of the key drivers of this changed market scenario.

Automobile components, for instance, demand resistance and plasticized components, which are flexible, among which plasticizer-based on base isooctyl alcohol. But mounting environmental pressures with certain plasticizers-phthalates are compelling industries to seek alternatives in non-toxic, eco-friendly substitutes without compromising on product effectiveness and competitiveness. Markets classify isooctyl alcohol into various classes of applications.

Lubricants, plasticizers, paints, adhesives, and agrochemicals are of major importance among them. Plasticizers lead the pack, with their general purpose being the imparting of flexibility and long life to PVC materials. Isooctyl alcohol lubricants are heavier and heat-resistant and are applied to high-performance machines and automotive parts in business.

In coatings and adhesives, the chemical contributes to formulation properties and solubility and adhesion and assists in improved adhesion and longevity. Isooctyl alcohol finds widespread usage in agrochemicals industry as a carrier solvent for a chemical ingredient in pesticides and herbicides.

Issooctyl alcohol has a robust market position in North America, and it is driven by end-use applications from the automotive, construction, and industrial manufacturing industries. The United States and Canada are high-consumption countries with extensive applications for high-performance coatings and flexible PVC in infrastructure construction and automobile manufacturing. Environmental standards in the region force manufacturers to produce non-phthalate plasticizers and low-VOC coatings, driving formulation innovation with the use of isooctyl alcohol.

Other North American producers are committing capital to create bio-based isooctyl alcohol under their sustainability initiative. The move to more environmentally friendly, high-performance lubricants used in precision engineering also adds demand for high-purity isooctyl alcohol.

Europe possesses a surfeit of regional demand share as a result of stringent protection of the environment and well-rooted automobile and chemical industries. Regional giants of demand are Germany, France, and Italy, and premium-grade lubricant and additives derived from plasticizers find application in automobile production by German automobile giants Volkswagen, BMW, and Mercedes-Benz. Italy's sophisticated adhesives and coating industries also churn out ginormous quantities for regional demand of isooctyl alcohol produced products.

European Union regulation of toxic chemicals is driving the transition to non-toxic plasticizers and solvent-free paints, forcing manufacturers to become green. Closed-loop manufacturing facilities and new chemical recycling technologies are becoming popular, reducing waste and making isooctyl alcohol applications more environmentally friendly.

Asia-Pacific would be the largest growing isooctyl alcohol market due to fast-growing industrialization, increasing vehicle production numbers, and a strong construction sector. China, India, Japan, and South Korea are largest producers and consumers and China is largest size market and production base.

China and India's construction and infrastructure boom fuels demand for multi-purpose applications of PVC including flooring, cables, and pipes. Automotive development in Asia-Pacific also fuels demand for plasticizers and specialty lubricants. Increased compliance with regulation is introduced, however, through mounting environment pressures on chemical manufacturing waste and emissions as well as environmental disposal. Governments are laying down policy alternatives on low-toxicity and bio-based chemicals, which will determine the way forward for Asia-Pacific isooctyl alcohol market.

Challenge

Environmental and Regulatory Concerns

The widespread application of isooctyl acetate as plasticizer and coating generates environmental and health problems for man because of the toxicity of phthalate plasticizers. The regulatory bodies such as the European Chemicals Agency (ECHA) and United States Environmental Protection Agency (EPA) have developed strict regulation of exposure, and disposal, of harmful chemicals. But reformulation cost and compliance by the company are a serious concern.

Opportunity

Expansion in Bio-Based and Green Chemistry Alternatives

Expansion in green chemistry alternatives is the largest opportunity in the isooctyl alcohol industry. Companies are investing heavily in the production of isooctyl alcohol from nature-sourced renewable bio-based sources, such as plant biomass. Green alternatives reduce environmental impacts with historic levels of performance in plasticizer, lubricant, and coating applications.

New technology in non-toxic plasticizers and solvent-free adhesives is also creating new possibilities in the market. Isooctyl alcohol material recycling technology and recycle technology are also becoming increasingly popular through which businesses can prevent wastage as well as reduce the cost of manufacturing.

The isooctyl alcohol market had more application in plasticizers, adhesives, paint, and agrochemicals from 2020 to 2024 because of more industrialization and the demand for performance additives. More demand for non-toxic products generated more research for bio-based plasticizers and solvent-free products.

Looking into 2025 to 2035, the strongest industry trends are moving towards green ways of manufacturing, rising environmental legislations, innovation along the bio-based pathway to chemical synthesis, and growing demands from the automotive and building industries. The industry will witness consistent growth as manufacturers focus on green technology at the cost of sacrificing the quality of high-performance grade solutions for use.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Regulatory agencies put caps on volatile organic compounds (VOCs) used in industrial use, affecting the use of isooctyl alcohol depending on solvents. |

| Technological Advancements | Refining and purification process advancements enhanced the purity and effectiveness of isooctyl alcohol as a plasticizer and solvent. |

| Plasticizers Market Dynamics | Tightened demand by the plasticizer industry due to its effectiveness as a flexible PVC manufacturing assistant provided solid demand. Construction and automobile industries' demand supported demand for phthalate plasticizers. |

| Coatings and Adhesives Trends | Isooctyl alcohol was ubiquitous in industrial solvent-based adhesives, coatings, and sealants. |

| Pharmaceutical & Personal Care Sector | Applied as a surfactant, active ingredient preparations, and emollients in pharmaceutical and personal care products. Increased demand for high-purity grades. |

| Bio-based Isooctyl Alcohol Adoption | Limited use due to cost and size limitations. Bio-based alternatives were in infancy phase. |

| Production & Supply Chain Dynamics | Volatility of raw material prices, particularly from crude oil-based feedstocks, impacted cost bases. Supply chain disruption from geopolitical tension impacted availability. |

| Market Growth Drivers | Growth from growing demand from plastics, coatings, and personal care end-use markets. Growth in infrastructure development and motor vehicle production drove consumption. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stringent environmental policies push the application of bio-based and low-VOC substitutes. Governments incentivize green chemistry technologies with incentives, which result in the development of eco-friendly isooctyl alcohol derivatives. |

| Technological Advancements | Efficient catalytic conversion and biotech synthesis procedures reduce manufacturing cost and impact on the environment. Bio-based isooctyl alcohol is increasingly applied to high-performance applications. |

| Plasticizers Market Dynamics | Non-phthalate plasticizers and bio-based replacements gain increased acceptance. Greater sustainability measures force manufacturers to produce greener products. |

| Coatings and Adhesives Trends | Waterborne coatings and low-VOC adhesives become increasingly more mainstream in the place of conventional formulations, with fewer uses for solvent-based isooctyl alcohol. Increased durability and performance accompany new formulations. |

| Pharmaceutical & Personal Care Sector | Natural and organic formulations burst onto the scene, with bio-based isooctyl alcohol playing the lead role in clean-label beauty and pharma product development. |

| Bio-based Isooctyl Alcohol Adoption | Commercial feasibility increases, with bio-based isooctyl alcohol gaining share in green formulations for cosmetics, pharmaceuticals, and industrial solvents. |

| Production & Supply Chain Dynamics | Raw material supply base diversification, including sustainable and bio-based feedstocks, anchors supply chains. |

| Market Growth Drivers | Local cluster production emerges to diminish dependence upon volatile markets. |

The US isooctyl alcohol market is reflecting a steady growth because of its extensive application in plasticizers, coatings, adhesives, and personal care products. The trend is set by the demand for non-phthalate plasticizers and formulation based on biological sources. Greenhouse regulations against VOC release and sustainable utilization are accelerating industry and consumer-level development and usage of cleaner substitutes.

Over the next few years, growing uses of isooctyl alcohol in specialty coatings, personal care, and bioplastics additives will be major drivers. Increasing customer demand in personal care markets for bio-based ingredients is fuelling the use of sustainably manufactured isooctyl alcohol in surfactants and emollients. Pharmaceutical formulation development is also fuelling demand for high-purity isooctyl alcohol as a carrier agent and solvent.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.9% |

The UK isooctyl alcohol industry is growing with higher demand from the adhesives, coatings, and personal care industries. The use of REACH regulations has spurred a low-VOC and bio-based solutions trend, with innovation stimulation for sustainable chemistry.

The coatings market, one of the forces behind market expansion, is embracing waterborne solutions that are more environmentally friendly and yet provide better performance. The sealants and adhesives sector is another major force, where sustainable formulating is increasingly becoming the choice in the construction and automotive segments. Green chemistry and sustainable manufacturing will be further boosted by government initiatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.5% |

The European Union market for isooctyl alcohol has strong demand from the plasticizer, personal care, and chemical industries. Environmental regulatory pressures, e.g., REACH, are driving the market toward bio-based and renewable substitutes.

The market for European plasticizers, where the automotive and construction industries are the largest markets, is decoupling from phthalate-based chemistry, leading to greater demand for biodegradable plasticizers made from isooctyl alcoholThe specialty chemicals business is investing in environmentally friendly production routes, again giving impetus to sustainable isooctyl alcohol derivatives.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 4.3% |

The isooctyl alcohol operations in Japan are being propelled by the nation's advanced chemical industry, coating technology, and personal care markets. Clean, high-performance plasticizers and solvents are increasingly being called for due to tightening environmental laws and rising adoption of sustainable processes. Automotive and electronics markets are also principal end-users, using high-purity isooctyl alcohol in plasticizers and coatings. Polymer chemistry and green solvents technologies can drive the future of Japan's market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

South Korea's isooctyl alcohol market is growing due to its firmly established automotive, construction, and personal care markets. Growing government focus on sustainability and sustainable chemicals is encouraging green coating, bio-based solvents, and non-phthalate plasticizers R&D. South Korea's personal care sector is also gravitating toward clean beauty formulations, adding fuel to the utilization of bio-based isooctyl alcohol for emollients and surfactants. Bio refinery technologies and specialty chemical spending will yield additional growth for the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.2% |

The chemical intermediate segment leads the isooctyl alcohol market on the strength of playing a central role in the manufacture of prominent industrial chemicals such as plasticizers, surfactants, and lubricants. Isooctyl alcohol is a raw material of supreme importance to manufacture the multi-purpose plasticizer diisooctyl phthalate (DIOP) that lends flex and strength to PVC-based products.

Flexible PVC growth in particular for the automotive and construction sector is one of the key drivers of this segment. Secondly, isooctyl alcohol is a critical feedstock for the production of surfactants that find their application in household and industrial cleaning agents.

With heightened demand for high-performance emulsifiers and detergents, manufacturers are stepping up capacities, thereby enhancing the chemical intermediate segment's dominance. This widespread industrial application, combined with broadening uses, holds the promise for the further growth of isooctyl alcohol in leading industrial industries.

The solvent segment of the isooctyl alcohol market also is growing tremendously, especially in applications like coatings, adhesives, and specialty chemicals. Isooctyl alcohol is an effective solvent for high-performance coatings and films, improving viscosity control and drying properties.

Its capacity to degrade a large number of resins renders it inevitable in adhesive formulation, particularly where usage in automotive and electronics is at stake. There could be alternative solvents to what is found in the market currently, but isooctyl alcohol continues to be the preferred solution whenever specialty applications require high levels of purity and low volatilities.

Expanding packaging and labelling industry utilizing heavy quantities of solvent-based adhesives is also fuelling demand. With industrialization continuing and specialized coatings and adhesives becoming more popular, the solvent segment is expanding, and isooctyl alcohol's pivotal role in the manufacturing of high-quality, superior products for different industries is being solidified.

Coatings and film is one of the major end-user application markets of isooctyl alcohol, which has a number of different applications in coatings to impart adhesion, flexibility, and hydrophobicity. Automotive and building decorative and protective coatings have been the key drivers for increased consumption of isooctyl alcohol.

Apart from this, since there is increasing need for green coatings and high-performance coatings, the companies are looking for bio-based chemicals with isooctyl alcohol. The move towards energy-conserving as well as green coatings will be focused on broadening the use base of the chemical.

As the future trend is going to be film and coating as film and coating, business in film and coating will be one of the motivating forces to isooctyl alcohol expansion. Its application in the production of hard as well as wear-resistant coatings is essential to applications as wide-ranging as industrial protective coatings to architectural and automotive product decorative finishes.

The isooctyl alcohol market fuel additive market is slowly on the rise, with world pressure towards biofuels and more emission controls keeping demand at the doorstep. Isooctyl alcohol is used for fuel blends for increased combustion efficiency, fuel stability, and reduced emissions.

It is therefore an essential ingredient in diesel as well as in gas blends, where it serves to offer contribution towards performance as well as environment-nicest situation. Increasing demand for cleaner, greener fuel, more so in Europe and North America, boosts sales of fuel additives, including isooctyl alcohol.

Innovation in performance enhancers and alternative fuel further continues the trend, opening up new and improved prospects for fuel blends. Industry and governments continue to push sustainability, and fuel additive market will keep on increasing steadily with isooctyl alcohol always in the demand.

The isooctyl alcohol market is a competitive market with the majority of it being controlled by major global companies and domestic players driving the growth of the industry. Large dominant companies with huge market shares drive high-purity manufacturing, environmental chemicals, and multi-industry applications in plasticizers, surfactants, lubricants, and paints industries. Mature players and emerging players dominate the market and are driving growth in rising industry trends.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| BASF SE | 15-20% |

| Evonik Industries AG | 10-14% |

| ExxonMobil Chemical | 8-12% |

| Perstorp Holding AB | 5-9% |

| Sinopec Limited | 3-7% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| BASF SE | Manufactures high-purity isooctyl alcohol used in plasticizers, surfactants, and adhesives. Focuses on sustainable production processes to meet regulatory demands. |

| Evonik Industries AG | Develops isooctyl alcohol for specialty applications, including lubricants and coatings. Invests in bio-based alternatives to reduce environmental footprint. |

| ExxonMobil Chemical | Produces high-performance isooctyl alcohol derivatives for polymer additives and fuel formulations. Prioritizes energy-efficient refining technologies. |

| Perstorp Holding AB | Specializes in isooctyl alcohol for high-quality plasticizers and performance-enhancing chemicals. Expands market reach through global distribution networks. |

| Sinopec Limited | Manufactures isooctyl alcohol for industrial applications, including detergents and synthetic lubricants. Focuses on large-scale, cost-effective production. |

Key Company Insights

BASF SE (15-20%)

BASF SE leads the world in isooctyl alcohol with refined production for use in plasticizers, surfactants, and adhesives. The organization employs cutting-edge sustainability methods, saving carbon emissions and ensuring optimal energy efficiency at production facilities. Well-represented worldwide, BASF goes on to establish sustainable alternatives to aggressive regulatory scenarios worldwide.

Evonik Industries AG (10-14%)

Evonik Industries AG is the largest manufacturer of isooctyl alcohol with specialty end use in lubricants and coatings. Evonik is still investing in low-toxicity chemicals and bio-based chemicals such that it becomes sustainable. It remains an option supplier of high-performance chemical solutions to industry segments needing it, under regulatory needs.

ExxonMobil Chemical (8-12%)

ExxonMobil Chemical holds expertise in production of high-performance derivatives of isooctyl alcohol for use in fuel blending and as polymer additive. ExxonMobil offers efficient supply and product quality by energy-efficient refinery technology. Based on its excellence in the North American and European markets, ExxonMobil offers more fuel-efficient and cleaner chemical processes.

Perstorp Holding AB (5-9%)

Perstorp Holding AB deals with the manufacturing of isooctyl alcohol, which is plasticizers and performance chemicals. There is expansion plans overseas, whereby distribution alliances are forged to enhance market penetration. Niche play through strength of innovation-driven specialty chemicals, is the business class where Perstorp excels with its quality product specialty formularies being its strength.

Sinopec Limited (3-7%)

Sinopec Limited, as a leading Asian petrochemical producer, has its business engaged in the production of isooctyl alcohol for industrial use in detergents and synthetic lubricants. With large-scale production, Sinopec has a good opportunity to avail itself of low production cost along with product quality management. With its vast distribution system in place, demand growth from domestic as well as international markets becomes a feasible goal.

Other Key Players (45-55% Overall)

Besides these market leaders, there are some players who possess a significant market share, which is responsible for innovation, cost leadership, and long-term growth. These include:

The global isooctyl alcohol market was valued at approximately USD 467.2 million in 2025.

The isooctyl alcohol market is projected to reach around USD 723.6 million by 2035, growing at a CAGR of 4.5% from 2025 to 2035.

The increasing demand for plasticizers in the production of flexible PVC products, growth in the construction industry, and rising applications in the automotive sector are expected to drive the isooctyl alcohol market during the forecast period.

The top 5 countries contributing to the growth of the isooctyl alcohol market are China, India, United States, Japan, and Germany.

On the basis of application, the plasticizers segment is anticipated to dominate the isooctyl alcohol market during the forecast period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.