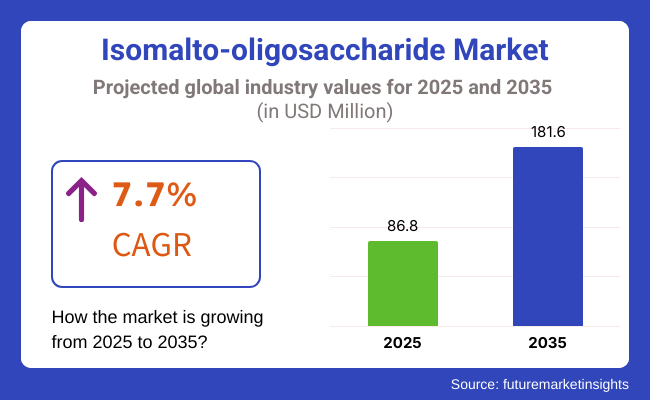

The global Isomalto-oligosaccharide market is estimated to be worth USD 86.8 million in 2025 and is projected to reach a value of USD 181.6 million by 2035, expanding at a CAGR of 7.7% over the assessment period of 2025 to 2035

Isomalto-oligosaccharides (IMO) are gaining popularity as a low-calorie sweetener and sugar substitute in various food and beverage products. With rising health concerns about sugar consumption and its link to obesity and diabetes, consumers are actively seeking healthier alternatives.

IMO offers a sweet taste with fewer calories, making it an attractive option for manufacturers looking to create low-sugar and reduced-calorie formulations. This trend is particularly evident in snacks, beverages, and desserts, where IMO enhances flavor without compromising health.

The functional foods and beverages market is experiencing significant growth, driven by consumer demand for products that offer additional health benefits beyond basic nutrition. Isomalto-oligosaccharides are increasingly being incorporated into a wide range of functional foods, including protein bars, dairy products, and health drinks, to improve their nutritional profiles.

As consumers prioritize health and wellness, the inclusion of IMO as a prebiotic fiber enhances digestive health and overall well-being, making it a sought-after ingredient in innovative product development.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for global isomalto-oligosaccharide market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision about the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 6.3% (2024 to 2034) |

| H2 | 6.9% (2024 to 2034) |

| H1 | 7.4% (2025 to 2035) |

| H2 | 8.0% (2025 to 2035) |

The above table presents the expected CAGR for the global isomalto-oligosaccharide demand space over semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2024, the business is predicted to surge at a CAGR of 6.3%, followed by a slightly higher growth rate of 6.9% in the second half (H2) of the same year.

Moving into year 2025, the CAGR is projected to increase slightly to 7.4% in the first half and remain relatively moderate at 8.0% in the second half. In the first half (H1 2025) the market witnessed a decrease of 16 BPS while in the second half (H2 2025), the market witnessed an increase of 34 BPS.

Expansion in the Infant Formula Sector

The growing recognition of gut health's critical role in infants has significantly boosted the demand for prebiotics, particularly isomalto-oligosaccharides (IMOs), in infant formulas. Manufacturers are increasingly focused on formulating products that closely replicate the nutritional profile of breast milk, which naturally contains prebiotics that support the development of beneficial gut bacteria.

This trend is driven by parents' desire to provide optimal nutrition for their infants, leading to a surge in innovative infant formula products enriched with IMOs. These formulations not only promote digestive health but also enhance immune function, making them appealing to health-conscious consumers. As a result, the infant formula sector is becoming a key growth area for isomalto-oligosaccharides.

Increased Use in Dietary Supplements

The dietary supplement market is experiencing robust growth, fueled by a rising consumer interest in health and wellness. Isomalto-oligosaccharides (IMOs) are gaining traction as a valuable ingredient due to their prebiotic properties, which support gut health, weight management, and overall well-being. Consumers are increasingly seeking supplements that enhance digestive health, and IMOs are being incorporated into various formulations, including powders, capsules, and functional foods.

This trend is particularly prominent among those looking to improve their gut microbiome and boost immunity. As awareness of the benefits of prebiotics continues to grow, the demand for dietary supplements containing isomalto-oligosaccharides is expected to rise, further solidifying their position in the market.

Growth in Animal Nutrition

The use of isomalto-oligosaccharides (IMOs) in animal nutrition is on the rise, particularly in the feed for poultry, swine, and cattle. Livestock producers are increasingly adopting prebiotics like IMOs to enhance animal health and productivity while addressing concerns over antibiotic use. IMOs promote the growth of beneficial gut bacteria, improving digestion and nutrient absorption, which can lead to better overall health and performance in livestock.

Additionally, the inclusion of prebiotics in animal feed is associated with reduced disease incidence and improved feed efficiency. As the demand for sustainable and health-focused animal husbandry practices grows, the incorporation of isomalto-oligosaccharides in animal nutrition is becoming a popular strategy among producers.

Global Isomalto-oligosaccharide sales increased at a CAGR of 5.3% from 2020 to 2024. For the next ten years (2025 to 2035), projections are that expenditure on isomalto-oligosaccharide will rise at 7.7% CAGR.

The rising awareness of gut health and its significant impact on overall well-being has fueled demand for prebiotic ingredients like isomalto-oligosaccharides (IMOs). Consumers are increasingly recognizing the importance of a healthy gut microbiome in preventing various health issues, leading to a greater interest in products that support digestive health. This trend has prompted manufacturers to incorporate IMOs into their offerings, catering to health-conscious consumers seeking natural solutions to enhance gut health and improve their quality of life.

Manufacturers are harnessing the potential of isomalto-oligosaccharides (IMOs) to drive innovation in product development, particularly in infant formulas and functional foods. By mimicking the health benefits of breast milk, IMOs are being integrated into infant nutrition products to support digestive health and immune function.

Additionally, their versatility allows for the enhancement of the nutritional profiles of various functional foods, attracting consumers looking for healthier options. This focus on innovation not only meets consumer demand but also expands market opportunities for manufacturers.

Tier 1 companies dominate the IMO market, accounting for approximately 40% to 50% of the global market share, with annual revenues exceeding USD 20 million. These industry leaders are characterized by their high production capacities, extensive product portfolios, and robust geographical reach.

They possess significant expertise in manufacturing and reconditioning across multiple packaging formats, catering to a wide array of end-use applications. Prominent companies in this tier include Kerry Group, Tate & Lyle, Ajinomoto, ADM, Cargill, Givaudan, and DSM. Their strong consumer base and established distribution networks enable them to maintain a competitive edge and drive innovation in product development.

Tier 2 companies represent a vital segment of the IMO market, with revenues ranging from USD 5 million to USD 20 million. These mid-sized players have a significant presence in specific regions and are influential in the local retail space. They are characterized by a strong understanding of consumer preferences and regional market dynamics.

While they may not possess the extensive technological capabilities or global reach of Tier 1 companies, they ensure regulatory compliance and leverage good technology to meet market demands. Notable companies in this tier include Ingredion, Corbion, Sensient Technology Corporation, Symrise, and Novozymes. Their regional focus allows them to cater effectively to niche markets and consumer needs.

Tier 3 comprises a majority of small-scale companies operating primarily at the local level, with revenues below USD 5 million. These enterprises are oriented towards fulfilling specific local marketplace demands and often serve niche segments within the IMO market.

Due to their limited geographical reach and smaller operational scale, Tier 3 companies are classified as part of an unorganized field, lacking the extensive structure and formalization seen in organized competitors. Despite their size, these companies play a crucial role in addressing localized consumer needs and preferences.

To enhance their market presence and foster innovation, companies across all tiers are increasingly forming strategic partnerships with research institutions, universities, and other industry players. This collaborative approach facilitates knowledge sharing and resource optimization, leading to innovative solutions that can strengthen their competitive positioning in the Global Isomalto-oligosaccharide market.

| Countries | Market Value (2035) |

|---|---|

| United States | USD 27.2 million |

| Germany | USD 18.2 million |

| China | USD 14.5 million |

| India | USD 9.1 million |

| Japan | USD 3.6 million |

Regulatory support for prebiotics, including isomalto-oligosaccharides (IMOs), from the USA Food and Drug Administration (FDA) plays a crucial role in driving their market demand. The FDA's recognition of the health benefits associated with prebiotics has provided a framework for manufacturers to confidently incorporate IMOs into their products.

This endorsement not only enhances the credibility of IMOs as safe and effective ingredients but also encourages innovation in product development. As a result, consumers are more likely to trust and choose products containing IMOs, knowing they are backed by regulatory approval, which ultimately boosts market growth and acceptance.

German consumers are increasingly prioritizing health and nutrition, leading to a heightened interest in functional foods that provide specific health benefits. This trend is driven by a desire for preventive health measures and improved quality of life. Isomalto-oligosaccharides (IMOs) fit seamlessly into this landscape, as they are recognized for their prebiotic properties that promote digestive health and enhance gut microbiota.

As consumers become more informed about the importance of gut health in relation to overall well-being, the demand for IMOs in food and beverage products is rising. This alignment with health-conscious consumer preferences positions IMOs as a sought-after ingredient in Germany.

The increased availability of health-focused products in the Indian market has significantly enhanced consumer access to isomalto-oligosaccharides (IMOs). As more manufacturers introduce a variety of products containing IMOs-ranging from functional foods to dietary supplements-consumer awareness and acceptance of these prebiotic ingredients are on the rise. This proliferation is further supported by endorsements from nutritionists and health professionals, who are increasingly recommending IMOs as part of a balanced diet.

Their advocacy educates consumers about the digestive health benefits associated with IMOs, reinforcing the ingredient's credibility and appeal. Together, these factors create a favorable environment for the growth of IMOs in India, as consumers seek healthier options that align with their wellness goals.

| Segment | Value Share (2025) |

|---|---|

| Tapioca (Source) | 23% |

As gluten intolerance and celiac disease become increasingly recognized, the demand for gluten-free alternatives has surged. Tapioca, derived from the cassava root, stands out as an excellent gluten-free option, making it highly appealing to consumers seeking safe and nutritious food choices. Its neutral flavor and versatile texture allow it to be seamlessly incorporated into a variety of products, including baked goods, snacks, and beverages.

By enriching gluten-free formulations with isomalto-oligosaccharides (IMOs), manufacturers can enhance the nutritional profile while catering to the growing market of health-conscious consumers who prioritize gluten-free diets for their well-being.

Key players are investing in research and development to enhance the nutritional profiles of their offerings and expand applications across food, beverages, and dietary supplements. Additionally, manufacturers are adopting sustainable sourcing practices and clean label initiatives to meet consumer demand for transparency and health. Collaborations with research institutions further drive innovation, enabling companies to stay competitive in this dynamic market.

For instance

This segment is further categorized into Liquid and Powder.

This segment is further categorized into Corn, Wheat, Potato, Tapioca, and Others (Oats, Rice).

This segment is further categorized into Food and Beverages, Dietary Supplements and Animal Feed Additives.

Industry analysis has been carried out in key countries of North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus and the Middle East & Africa.

The global Isomalto-oligosaccharide industry is estimated at a value of USD 86.8 million in 2025.

Sales of Isomalto-oligosaccharide increased at 5.3% CAGR between 2020 and 2024.

Dancheng Caixin Sugar Industry Co., Ltd., Guangzhou Shuangqiao Co., Ltd. , Luzhou Bio-Chem Technology Ltd., Mie-karyo Co., Ltd. , New Francisco Biotechnology Corporation (NFBC), Nihon Shokuhin Kako Co., Ltd. are some of the leading players in this industry.

The South Asia domain is projected to hold a revenue share of 26% over the forecast period.

North America holds 38% share of the global demand space for Isomalto-oligosaccharide.

Figure 1: Global Value (US$ million) by Form, 2023 to 2033

Figure 2: Global Value (US$ million) by Source, 2023 to 2033

Figure 3: Global Value (US$ million) by End-use Application, 2023 to 2033

Figure 4: Global Value (US$ million) by Region, 2023 to 2033

Figure 5: Global Value (US$ million) Analysis by Region, 2018 to 2033

Figure 6: Global Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Value (US$ million) Analysis by Form, 2018 to 2033

Figure 10: Global Volume (MT) Analysis by Form, 2018 to 2033

Figure 11: Global Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 12: Global Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 13: Global Value (US$ million) Analysis by Source, 2018 to 2033

Figure 14: Global Volume (MT) Analysis by Source, 2018 to 2033

Figure 15: Global Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 16: Global Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 17: Global Value (US$ million) Analysis by End-use Application, 2018 to 2033

Figure 18: Global Volume (MT) Analysis by End-use Application, 2018 to 2033

Figure 19: Global Value Share (%) and BPS Analysis by End-use Application, 2023 to 2033

Figure 20: Global Y-o-Y Growth (%) Projections by End-use Application, 2023 to 2033

Figure 21: Global Attractiveness by Form, 2023 to 2033

Figure 22: Global Attractiveness by Source, 2023 to 2033

Figure 23: Global Attractiveness by End-use Application, 2023 to 2033

Figure 24: Global Attractiveness by Region, 2023 to 2033

Figure 25: North America Value (US$ million) by Form, 2023 to 2033

Figure 26: North America Value (US$ million) by Source, 2023 to 2033

Figure 27: North America Value (US$ million) by End-use Application, 2023 to 2033

Figure 28: North America Value (US$ million) by Country, 2023 to 2033

Figure 29: North America Value (US$ million) Analysis by Country, 2018 to 2033

Figure 30: North America Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Value (US$ million) Analysis by Form, 2018 to 2033

Figure 34: North America Volume (MT) Analysis by Form, 2018 to 2033

Figure 35: North America Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 36: North America Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 37: North America Value (US$ million) Analysis by Source, 2018 to 2033

Figure 38: North America Volume (MT) Analysis by Source, 2018 to 2033

Figure 39: North America Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 40: North America Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 41: North America Value (US$ million) Analysis by End-use Application, 2018 to 2033

Figure 42: North America Volume (MT) Analysis by End-use Application, 2018 to 2033

Figure 43: North America Value Share (%) and BPS Analysis by End-use Application, 2023 to 2033

Figure 44: North America Y-o-Y Growth (%) Projections by End-use Application, 2023 to 2033

Figure 45: North America Attractiveness by Form, 2023 to 2033

Figure 46: North America Attractiveness by Source, 2023 to 2033

Figure 47: North America Attractiveness by End-use Application, 2023 to 2033

Figure 48: North America Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Value (US$ million) by Form, 2023 to 2033

Figure 50: Latin America Value (US$ million) by Source, 2023 to 2033

Figure 51: Latin America Value (US$ million) by End-use Application, 2023 to 2033

Figure 52: Latin America Value (US$ million) by Country, 2023 to 2033

Figure 53: Latin America Value (US$ million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Value (US$ million) Analysis by Form, 2018 to 2033

Figure 58: Latin America Volume (MT) Analysis by Form, 2018 to 2033

Figure 59: Latin America Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 60: Latin America Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 61: Latin America Value (US$ million) Analysis by Source, 2018 to 2033

Figure 62: Latin America Volume (MT) Analysis by Source, 2018 to 2033

Figure 63: Latin America Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 64: Latin America Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 65: Latin America Value (US$ million) Analysis by End-use Application, 2018 to 2033

Figure 66: Latin America Volume (MT) Analysis by End-use Application, 2018 to 2033

Figure 67: Latin America Value Share (%) and BPS Analysis by End-use Application, 2023 to 2033

Figure 68: Latin America Y-o-Y Growth (%) Projections by End-use Application, 2023 to 2033

Figure 69: Latin America Attractiveness by Form, 2023 to 2033

Figure 70: Latin America Attractiveness by Source, 2023 to 2033

Figure 71: Latin America Attractiveness by End-use Application, 2023 to 2033

Figure 72: Latin America Attractiveness by Country, 2023 to 2033

Figure 73: Europe Value (US$ million) by Form, 2023 to 2033

Figure 74: Europe Value (US$ million) by Source, 2023 to 2033

Figure 75: Europe Value (US$ million) by End-use Application, 2023 to 2033

Figure 76: Europe Value (US$ million) by Country, 2023 to 2033

Figure 77: Europe Value (US$ million) Analysis by Country, 2018 to 2033

Figure 78: Europe Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Value (US$ million) Analysis by Form, 2018 to 2033

Figure 82: Europe Volume (MT) Analysis by Form, 2018 to 2033

Figure 83: Europe Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 84: Europe Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 85: Europe Value (US$ million) Analysis by Source, 2018 to 2033

Figure 86: Europe Volume (MT) Analysis by Source, 2018 to 2033

Figure 87: Europe Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 88: Europe Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 89: Europe Value (US$ million) Analysis by End-use Application, 2018 to 2033

Figure 90: Europe Volume (MT) Analysis by End-use Application, 2018 to 2033

Figure 91: Europe Value Share (%) and BPS Analysis by End-use Application, 2023 to 2033

Figure 92: Europe Y-o-Y Growth (%) Projections by End-use Application, 2023 to 2033

Figure 93: Europe Attractiveness by Form, 2023 to 2033

Figure 94: Europe Attractiveness by Source, 2023 to 2033

Figure 95: Europe Attractiveness by End-use Application, 2023 to 2033

Figure 96: Europe Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Value (US$ million) by Form, 2023 to 2033

Figure 98: East Asia Value (US$ million) by Source, 2023 to 2033

Figure 99: East Asia Value (US$ million) by End-use Application, 2023 to 2033

Figure 100: East Asia Value (US$ million) by Country, 2023 to 2033

Figure 101: East Asia Value (US$ million) Analysis by Country, 2018 to 2033

Figure 102: East Asia Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: East Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Value (US$ million) Analysis by Form, 2018 to 2033

Figure 106: East Asia Volume (MT) Analysis by Form, 2018 to 2033

Figure 107: East Asia Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 108: East Asia Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 109: East Asia Value (US$ million) Analysis by Source, 2018 to 2033

Figure 110: East Asia Volume (MT) Analysis by Source, 2018 to 2033

Figure 111: East Asia Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 112: East Asia Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 113: East Asia Value (US$ million) Analysis by End-use Application, 2018 to 2033

Figure 114: East Asia Volume (MT) Analysis by End-use Application, 2018 to 2033

Figure 115: East Asia Value Share (%) and BPS Analysis by End-use Application, 2023 to 2033

Figure 116: East Asia Y-o-Y Growth (%) Projections by End-use Application, 2023 to 2033

Figure 117: East Asia Attractiveness by Form, 2023 to 2033

Figure 118: East Asia Attractiveness by Source, 2023 to 2033

Figure 119: East Asia Attractiveness by End-use Application, 2023 to 2033

Figure 120: East Asia Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Value (US$ million) by Form, 2023 to 2033

Figure 122: South Asia Value (US$ million) by Source, 2023 to 2033

Figure 123: South Asia Value (US$ million) by End-use Application, 2023 to 2033

Figure 124: South Asia Value (US$ million) by Country, 2023 to 2033

Figure 125: South Asia Value (US$ million) Analysis by Country, 2018 to 2033

Figure 126: South Asia Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Value (US$ million) Analysis by Form, 2018 to 2033

Figure 130: South Asia Volume (MT) Analysis by Form, 2018 to 2033

Figure 131: South Asia Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 132: South Asia Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 133: South Asia Value (US$ million) Analysis by Source, 2018 to 2033

Figure 134: South Asia Volume (MT) Analysis by Source, 2018 to 2033

Figure 135: South Asia Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 136: South Asia Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 137: South Asia Value (US$ million) Analysis by End-use Application, 2018 to 2033

Figure 138: South Asia Volume (MT) Analysis by End-use Application, 2018 to 2033

Figure 139: South Asia Value Share (%) and BPS Analysis by End-use Application, 2023 to 2033

Figure 140: South Asia Y-o-Y Growth (%) Projections by End-use Application, 2023 to 2033

Figure 141: South Asia Attractiveness by Form, 2023 to 2033

Figure 142: South Asia Attractiveness by Source, 2023 to 2033

Figure 143: South Asia Attractiveness by End-use Application, 2023 to 2033

Figure 144: South Asia Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Value (US$ million) by Form, 2023 to 2033

Figure 146: Oceania Value (US$ million) by Source, 2023 to 2033

Figure 147: Oceania Value (US$ million) by End-use Application, 2023 to 2033

Figure 148: Oceania Value (US$ million) by Country, 2023 to 2033

Figure 149: Oceania Value (US$ million) Analysis by Country, 2018 to 2033

Figure 150: Oceania Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: Oceania Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Value (US$ million) Analysis by Form, 2018 to 2033

Figure 154: Oceania Volume (MT) Analysis by Form, 2018 to 2033

Figure 155: Oceania Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 156: Oceania Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 157: Oceania Value (US$ million) Analysis by Source, 2018 to 2033

Figure 158: Oceania Volume (MT) Analysis by Source, 2018 to 2033

Figure 159: Oceania Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 160: Oceania Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 161: Oceania Value (US$ million) Analysis by End-use Application, 2018 to 2033

Figure 162: Oceania Volume (MT) Analysis by End-use Application, 2018 to 2033

Figure 163: Oceania Value Share (%) and BPS Analysis by End-use Application, 2023 to 2033

Figure 164: Oceania Y-o-Y Growth (%) Projections by End-use Application, 2023 to 2033

Figure 165: Oceania Attractiveness by Form, 2023 to 2033

Figure 166: Oceania Attractiveness by Source, 2023 to 2033

Figure 167: Oceania Attractiveness by End-use Application, 2023 to 2033

Figure 168: Oceania Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Value (US$ million) by Form, 2023 to 2033

Figure 170: Middle East and Africa Value (US$ million) by Source, 2023 to 2033

Figure 171: Middle East and Africa Value (US$ million) by End-use Application, 2023 to 2033

Figure 172: Middle East and Africa Value (US$ million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Value (US$ million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Value (US$ million) Analysis by Form, 2018 to 2033

Figure 178: Middle East and Africa Volume (MT) Analysis by Form, 2018 to 2033

Figure 179: Middle East and Africa Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 180: Middle East and Africa Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 181: Middle East and Africa Value (US$ million) Analysis by Source, 2018 to 2033

Figure 182: Middle East and Africa Volume (MT) Analysis by Source, 2018 to 2033

Figure 183: Middle East and Africa Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 184: Middle East and Africa Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 185: Middle East and Africa Value (US$ million) Analysis by End-use Application, 2018 to 2033

Figure 186: Middle East and Africa Volume (MT) Analysis by End-use Application, 2018 to 2033

Figure 187: Middle East and Africa Value Share (%) and BPS Analysis by End-use Application, 2023 to 2033

Figure 188: Middle East and Africa Y-o-Y Growth (%) Projections by End-use Application, 2023 to 2033

Figure 189: Middle East and Africa Attractiveness by Form, 2023 to 2033

Figure 190: Middle East and Africa Attractiveness by Source, 2023 to 2033

Figure 191: Middle East and Africa Attractiveness by End-use Application, 2023 to 2033

Figure 192: Middle East and Africa Attractiveness by Country, 2023 to 2033

Table 1: Global Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Value (US$ million) Forecast by Form, 2018 to 2033

Table 4: Global Volume (MT) Forecast by Form, 2018 to 2033

Table 5: Global Value (US$ million) Forecast by Source, 2018 to 2033

Table 6: Global Volume (MT) Forecast by Source, 2018 to 2033

Table 7: Global Value (US$ million) Forecast by End-use Application, 2018 to 2033

Table 8: Global Volume (MT) Forecast by End-use Application, 2018 to 2033

Table 9: North America Value (US$ million) Forecast by Country, 2018 to 2033

Table 10: North America Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Value (US$ million) Forecast by Form, 2018 to 2033

Table 12: North America Volume (MT) Forecast by Form, 2018 to 2033

Table 13: North America Value (US$ million) Forecast by Source, 2018 to 2033

Table 14: North America Volume (MT) Forecast by Source, 2018 to 2033

Table 15: North America Value (US$ million) Forecast by End-use Application, 2018 to 2033

Table 16: North America Volume (MT) Forecast by End-use Application, 2018 to 2033

Table 17: Latin America Value (US$ million) Forecast by Country, 2018 to 2033

Table 18: Latin America Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Value (US$ million) Forecast by Form, 2018 to 2033

Table 20: Latin America Volume (MT) Forecast by Form, 2018 to 2033

Table 21: Latin America Value (US$ million) Forecast by Source, 2018 to 2033

Table 22: Latin America Volume (MT) Forecast by Source, 2018 to 2033

Table 23: Latin America Value (US$ million) Forecast by End-use Application, 2018 to 2033

Table 24: Latin America Volume (MT) Forecast by End-use Application, 2018 to 2033

Table 25: Europe Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: Europe Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Value (US$ million) Forecast by Form, 2018 to 2033

Table 28: Europe Volume (MT) Forecast by Form, 2018 to 2033

Table 29: Europe Value (US$ million) Forecast by Source, 2018 to 2033

Table 30: Europe Volume (MT) Forecast by Source, 2018 to 2033

Table 31: Europe Value (US$ million) Forecast by End-use Application, 2018 to 2033

Table 32: Europe Volume (MT) Forecast by End-use Application, 2018 to 2033

Table 33: East Asia Value (US$ million) Forecast by Country, 2018 to 2033

Table 34: East Asia Volume (MT) Forecast by Country, 2018 to 2033

Table 35: East Asia Value (US$ million) Forecast by Form, 2018 to 2033

Table 36: East Asia Volume (MT) Forecast by Form, 2018 to 2033

Table 37: East Asia Value (US$ million) Forecast by Source, 2018 to 2033

Table 38: East Asia Volume (MT) Forecast by Source, 2018 to 2033

Table 39: East Asia Value (US$ million) Forecast by End-use Application, 2018 to 2033

Table 40: East Asia Volume (MT) Forecast by End-use Application, 2018 to 2033

Table 41: South Asia Value (US$ million) Forecast by Country, 2018 to 2033

Table 42: South Asia Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia Value (US$ million) Forecast by Form, 2018 to 2033

Table 44: South Asia Volume (MT) Forecast by Form, 2018 to 2033

Table 45: South Asia Value (US$ million) Forecast by Source, 2018 to 2033

Table 46: South Asia Volume (MT) Forecast by Source, 2018 to 2033

Table 47: South Asia Value (US$ million) Forecast by End-use Application, 2018 to 2033

Table 48: South Asia Volume (MT) Forecast by End-use Application, 2018 to 2033

Table 49: Oceania Value (US$ million) Forecast by Country, 2018 to 2033

Table 50: Oceania Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Oceania Value (US$ million) Forecast by Form, 2018 to 2033

Table 52: Oceania Volume (MT) Forecast by Form, 2018 to 2033

Table 53: Oceania Value (US$ million) Forecast by Source, 2018 to 2033

Table 54: Oceania Volume (MT) Forecast by Source, 2018 to 2033

Table 55: Oceania Value (US$ million) Forecast by End-use Application, 2018 to 2033

Table 56: Oceania Volume (MT) Forecast by End-use Application, 2018 to 2033

Table 57: Middle East and Africa Value (US$ million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Volume (MT) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Value (US$ million) Forecast by Form, 2018 to 2033

Table 60: Middle East and Africa Volume (MT) Forecast by Form, 2018 to 2033

Table 61: Middle East and Africa Value (US$ million) Forecast by Source, 2018 to 2033

Table 62: Middle East and Africa Volume (MT) Forecast by Source, 2018 to 2033

Table 63: Middle East and Africa Value (US$ million) Forecast by End-use Application, 2018 to 2033

Table 64: Middle East and Africa Volume (MT) Forecast by End-use Application, 2018 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA