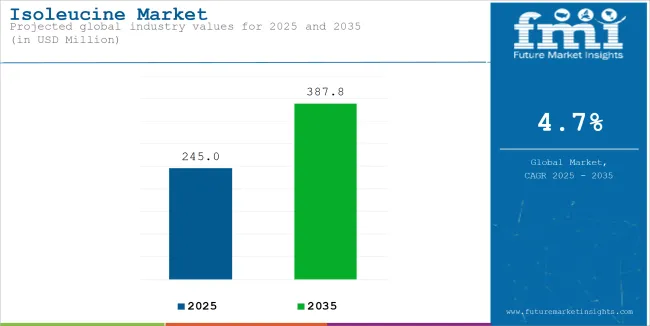

Expanding at a compound annual growth rate of 4.7%, the global isoleucine market is projected to increase from USD 245.0 million in 2025 to USD 387.8 million by 2035.

The increase in demand is majorly attributed to the enhanced awareness and increased adoption of health and fitness regimes. This is because as consumers get more involved in heavy physical exercises, the requirement for muscle recovery as well as endurance supplements increases significantly. Isoleucine, a branched-chain amino acid (BCAA), is a common ingredient in the diets of bodybuilders and athletes since it is important in the synthesis and repair of muscle proteins.

More so, several formulations are being developed for the treatment of various diseases, incorporating isoleucine into the mixture thus contributing to the growth of the industry. This amino acid being important in the synthesis of hemoglobin and the regulation of blood glucose levels makes it effective against anemia and diabetes. Due to this, there has been an increased inclusion of this amino acid in several pharmaceutical formulations.

Manufacturers in the food and beverage industry have also started appreciating the importance of this amino acid. This has broadened its use from supplement stores to other food products enabling isoleucine to have an expanded target industry which includes health-conscious individuals who want a diet fortified with nutrients. Due to this amino acid’s ability to enhance the protective and rebuilding capacity of skin cells, it has been incorporated into a few skincare products.

Such a tendency is assisted by manufacturers like Xintai Jiahe Biotech Co., Ltd., who are coming up with new formulations based on this amino acid to address the increased demand for holy grails for skin care. Furthermore, the production of amino acids has become relatively easier and cheaper because of better biotechnical approaches. Fermentation through Corynebacterium glutamicum has boosted yield and purity. All these advancements have greatly helped manufacturers to increase their output and respond to the growing international territories.

| Attributes | Description |

|---|---|

| Estimated Global Isoleucine Industry Size (2025E) | USD 245.0 million |

| Projected Global Isoleucine Industry Value (2035F) | USD 387.8 million |

| Value-based CAGR (2025 to 2035) | 4.7% |

In general, the industry has witnessed considerable growth owing to its varied applications in health, nutrition, and personal care, coupled with the growth of technology and proactive measures taken by players in the industry.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global isoleucine industry. This analysis reveals crucial shifts in performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 4.0% (2024 to 2034) |

| H2 | 4.2% (2024 to 2034) |

| H1 | 4.4% (2025 to 2035) |

| H2 | 4.7% (2025 to 2035) |

In the first half (H1) of the decade from 2025 to 2035, the business is predicted to surge at a CAGR of 4.0%, followed by a higher growth rate of 4.2% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase to 4.4% in the first half and remain considerably high at 4.7% in the second half. In the first half (H1) the sector witnessed an increase of 30 BPS while in the second half (H2), the business witnessed a decrease of 20 BPS.

Biotechnological Advancements Fuel the Industry's Exponential Growth

The industry is growing on the back of biotechnology, in particular fermentation technology of microorganisms such as Corynebacterium glutamicum. These innovations have increased production processes, thus making isoleucine easier and cheaper to produce. In response to the increasing consumers demand of amino acids, companies like Ajinomoto Co., Inc. are utilizing these technologies.

Health-conscious consumers, especially those involved in health, and fitness-related activities, are looking for amino acids to help in muscle recovery and energy boosting. The pharmaceutical industry however has begun to use this amino acid in medical preparations in treating muscle wasting and various other metabolic diseases.

This dual exposure in the ecosystem (health-oriented clients and the medical profession) is motivating manufacturers to embrace advanced biotechnology so that there is consistent availability of isoleucine in the industry. These innovations not only optimize production but also cater to the modern demand for green and effective manufacturing.

The Seamless Integration into Functional Foods Allures Consumers

The increasing incorporation into beverages and dietary foods stems from the demand from consumers for easy-to-use and nutritional products. Nestlé is one of the companies that is taking the lead in adding amino acids to the nutrition and well-being product lines as it expands them further. There is a growing segment of consumers who are looking for products specifically for recovery, energy, and general well-being enhancement products.

For example, in the struggle for nutrition control, Nestlé has incorporated isoleucine in BOOST® nutritional drinks aimed at muscle maintenance and recovery which may appeal to sportsmen and the aged among others.

Similar is the case with firms like Abbott Laboratories that have included this amino acid in their Ensure® range meant for the elderly and others needing more nutrition. Such measures not only correspond to an expanding demand for functional foods but also place these companies among the first to think and create in the health and wellness sector.

Isoleucine's Pharmaceutical Innovations to Tackle Chronic Conditions

There is an increase in interest in isoleucine use by pharmaceutical corporations for the treatment of various metabolic disorders and muscle-wasting diseases which are currently under research. In this line of research, Pfizer leads most pharmaceutical corporations in funding a campaign to come up with amino acid-based drugs that target such conditions. For instance, the ongoing clinical trials sponsored by Pfizer sought to capitalize on isoleucine effects in protein production as well as muscle repair to develop muscle atrophy treatment.

The ever-growing consumer need for chronic disease management effective therapies targeting improved life quality fuels such effort. This is the same trend that is being followed by other leaders in the industry such as Abbott Laboratories who are adding this amino acid in their medical nutrition products. Such technology not only satisfies the unmet needs of patients who are seeking more effective health products but also propels companies toward becoming leaders in the competitive business ecosystem.

Global sales increased at a CAGR of 4.2% from 2020 to 2024. For the next ten years (2025 to 2035), projections are that expenditure on such products will rise at 4.7%CAGR.

The demand for isoleucine is expected to peak between 2025 and 2035 because of several factors that are cutting across the industries. This period is expected to constitute a decade of outstanding growth with the introduction of new products, the formation of partnerships within the industry, and the use of this amino acid in various end-use industries.

The increasing consumer knowledge about the importance of essential amino acids in health and well-being is one of the aspects contributing to the growth. The increasing amount of health awareness amongst the general population as well as the growing need for quality sources of functional food asking for an increased supply of amino acids and its supplements.

Ajinomoto Co., Inc. is already taking the lead in this area by researching and marketing vegetarian-amino acid composites. Other prominent factors also include an increase in chronic diseases such as diabetes and muscle-wasting which has enhanced the interests of the pharmaceutical sub-industry on isoleucine. In turn, as new pharmaceutical applications become more popular, the demand for amino acids is expected to witness an increase as consumers emphasize finding solutions to improve their lifestyles.

The other driving factor for the industry is the sports and fitness sector. With athletes and fitness enthusiasts progressing toward peak physical performance, the need for supplements that can help muscles recover, increase endurance, and produce energy has increased exponentially. Companies like Evonik are meeting this demand by launching bioactive formulations based on isoleucine to address the targeted industry needs.

Also, the embedding of amino acids in functional foods and beverages is likely to be accelerated during that time. Considering consumer trends for easy-to-take health supplements, Nestlé, and other companies have already begun to use isoleucine in their health and wellness product lines to make them more affordable for the public.

The organized sector of the isoleucine business landscape consists of large well-known firms that have considerable resources and advanced production facilities. These are, for example, Ajinomoto Co., Inc. and Evonik Industries AG, which apply modern biotechnologies and environmentally friendly approaches to obtain amino acids of high purity.

They allocate substantial amounts of money to innovation activities to create and satisfy the high requirements set by industries. For instance, Ajinomoto employs sophisticated fermentation technologies aimed at increasing production output and improving product quality.

Such organized players are most of the time multinational corporations with characteristics such as broad networks of distribution and the capability to increase the scale of production to match the growing demand thus creating a steady quantity of isoleucine.

On the other hand, the unorganized segment comprises local producers using limited resources and basic production techniques. Such firms usually serve the local areas and may not possess the same sophistication and quality management standards as organized companies.

However, their importance stands out in fulfilling amino acid requirements in areas with less presence of large companies. For example, smaller firms in regions like Southeast Asia use isoleucine from the more traditional methods of production with a concentration on cheaper manufacturing costs to enable lower selling prices.

In the industry, this unorganized aspect probably accounts for a fraction of the business, but it comprises lots of smaller companies competing against highly organized and technologically superior companies. In so doing, the structure of the industry is such that the different needs of consumers ranging from high-end specialized goods to cheap mass-produced goods are all satisfied. All in all, both components are vital for the growth and strength of the market since isoleucine remains in sufficient supply and can cater to the diverse needs of the world.

The following table shows the estimated growth rates of the top three territories. USA and China are set to exhibit high consumption, recording CAGRs of 4.1% and 5.8%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| USA | 4.1% |

| Germany | 4.7% |

| China | 5.8% |

| Japan | 5.3% |

| India | 6.1% |

The USA market for isoleucine is predicted to grow as the population shifts towards sports and fitness. With more Americans exercising, the need for amino acid-based products, which help in muscle recuperation and endurance-boosting, has increased. GNC and Optimum Nutrition have begun this right trend and are selling amino acids to sportsmen and active consumers looking for a competitive edge.

The other important development is personalized nutrition. Customers are looking for a customized solution to match their health. This has led to an uplift in demand for isoleucine-fortified products that help with muscle and other metabolic health. Abbott Laboratories has also answered this by including this amino acid in Ensure® nutritional drinks meant for seniors and those with special dietary needs.

China’s history is embedded with traditional medicine, which combined with their biotechnology progress, presents an interesting opportunity for the market. TCM is gaining ease of applicability in China’s daily life, and due to this demand, there is a growing appreciation for the role of amino acids in health, which is intertwined with TCM. Additionally, the TCM evolution has also encouraged some research in the fermentation of isoleucine.

China has always emphasized research and has developed breakthroughs in most medicines, now including amino acid production. Chinese producers applied methods of coherent fermentation of microorganisms that improved the yield and purity of this essential amino acid. As the Chinese are increasingly becoming aware of the advantages of essential amino acids, including isoleucine, the increasing demand for amino acid-rich supplements and functional foods will help boost China's competitive advantage.

The population aged over 65 is known to be the fastest growing age bracket in the world and they require nutritional supplements for muscle and healthy aging and muscle maintenance support. This has increased the demand in Japan as still leading in the global longevity factor.

This trend was noticed by companies such as Ajinomoto Co., Inc., which is a Japan-based company, developing isoleucine-based products specifically designed for older populations for issues like loss of muscle and metabolic disorders.

In addition, the amino acid was largely used in the enhancement of the umami flavor which remains a key feature in dishes of this evergreen nation. Focusing on food science, Ajinomoto also added amino acids in its various functional foods and drinks that focus on Japanese character and help consumers to take more nutrients easily in their daily meals.

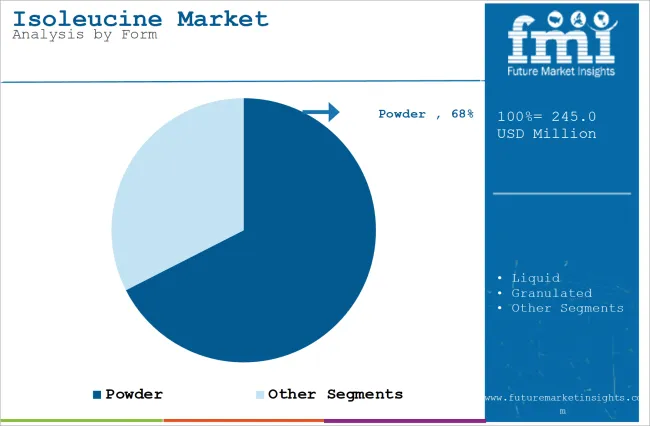

| Segment | Powder (By Form) |

|---|---|

| Value Share (2025) | 67.5% |

Adoption of the powder form is on the rise. This form is mainly used in the sports nutrition and dietary supplement sector to improve muscle recovery and performance. The competition among major manufacturers such as Optimum Nutrition and GNC aims towards producing and selling Isoleucine powder supplements that are embraced by athletes and other performers.

Another area is the application of amino acids in the food and beverage sector, particularly in functional foods and beverages, as people look for healthy products. For example, Nestlé has added amino acids to its nutritional beverages, making it easier for consumers to acquire this essential nutrient.

The form of powder is known to be effective because it is also stable and soluble which makes it appealing to manufacturers that want to produce more products that are health-related which in turn makes its demand and sales rise in the industry.

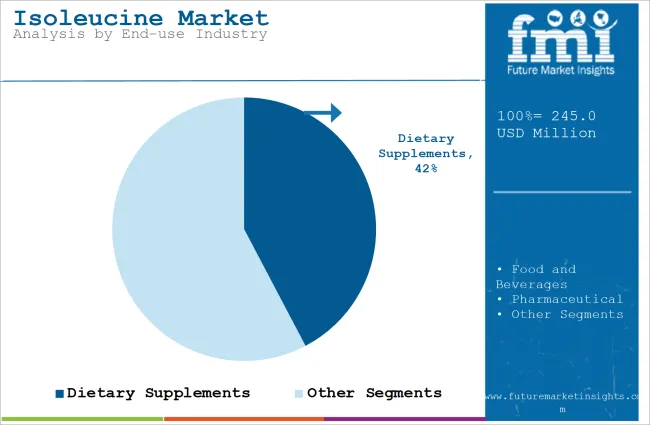

| Segment | Dietary Supplements (By End-use Industry) |

|---|---|

| Value Share (2025) | 42.3% |

There is an increasing tendency among consumers to use supplements to improve their health and avoid diseases. Isoleucine, which is responsible for muscle tissue maintenance and energy production, goes well with such an approach. Following this trend, companies such as Herbalife Nutrition are introducing products containing amino acids to help maintain general well-being.

Online shopping platforms such as Amazon and other health shops are giving consumers easy access to various amino acid supplements. This development has boosted sales as consumers have the option of ordering these items from their homes.

Furthermore, the rising focus on mental health and the enhancement of cognitive function have resulted in isoleucine being incorporated into nootropic supplements. These products designed for the optimization of brain performance are becoming increasingly popular, especially among practitioners and students.

For companies to achieve a key and advantageous dominance in the business environment, there are numerous approaches that they are putting into practice, including focusing on innovations and improvements. For example, a well-established producer of amino acids, Ajinomoto, has patented isoleucine under the brand name AjiPure® which they claim enhances absorption and use in the body.

There are other manufacturers, however, who concentrate on strategic alliances and joint efforts aimed at enlarging their distribution networks and hence reaching more customers. Evonik a German firm dealing in specialty chemical products has gone into collaboration with several nutraceutical companies incorporating its isoleucine product Biolys® into their formulations. This enables Evonik to take advantage of the recognition of its partners" brands and established customer loyalty.

Also, several companies are now involved in the promotion and marketing of isoleucine aimed at informing consumers of its benefits against competitors in the market. Japanese pharmaceutical and supplement manufacturer Kyowa Hakko embarked on marketing initiatives aimed at making evident the cognitive and athletic improvement brought about by its amino acid-based supplement, Cognizin®.

For instance

As per form, the industry has been categorized into Powder, Liquid, and Granulated.

This segment is further categorized into Food Grade, Feed Grade, Pharmaceutical Grade, and Industrial Grade.

This segment is further categorized into Dietary Supplements, Food and Beverages, Pharmaceuticals, Personal Care and Cosmetics, and Animal Feed.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The global isoleucine market is set to advance at a CAGR of 1% from 2022 to 2032.

The sales of isoleucine are anticipated to move forward in the Asia Pacific region owing to the high youth population and increase in consumer spending.

Some of the key players in the global isoleucine market are Merck KGaA, ADM Animal Nutrition, Inc., Wuxi Jinghai Amino Acid Co., Ltd., Wuhan Microsen Technology Co., Ltd., Evonik Industries AG.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA