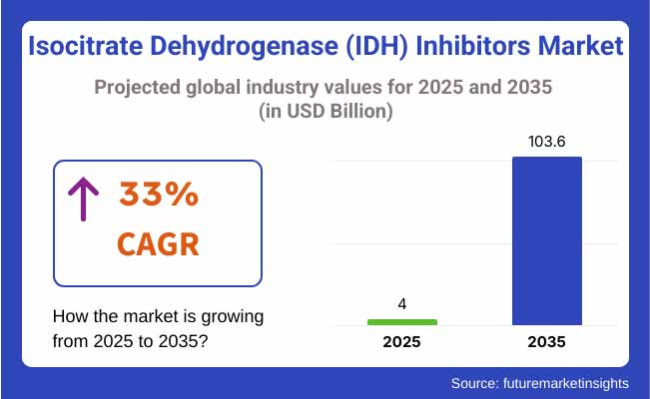

The Isocitrate Dehydrogenase Inhibitors industry will be valued at USD 4.00 billion in 2025. As per FMI's analysis, Isocitrate Dehydrogenase Inhibitors will grow at a CAGR of 33% and reach USD 103.6 billion by 2035.

In 2024, the inhibitors industry experienced faster growth due to expanding adoption in AML and solid tumors such as cholangiocarcinoma. The FDA approved accelerated approval for a novel IDH1/2 dual inhibitor based on Phase II trials demonstrating better progression-free survival in glioma, increasing the addressable patient population.

Agios Pharmaceuticals and Servier fortified their leadership with label expansions of ivosidenib (Tibsovo®) into combination regimens, and Bayer initiated late-stage trials for a next-generation pan-inhibitor.

Growth in the Asia-Pacific region surpassed the rest, led by China's NMPA accelerating approvals to meet unmet needs in orphan cancers. Priced pressure, though, arose in Europe as health technology assessments (HTAs) requested more robust cost-effectiveness.

The inhibitors industry is expected to grow beyond USD 4 billion by 2025, driven by a number of significant developments. The use of companion diagnostics, especially liquid biopsies for the identification of mutations, has facilitated streamlined patient stratification, allowing for more accurate and timely treatment decisions.

Combination therapy has also picked up speed, with clinical trials showing that the combination of inhibitors with immunotherapies, such as PD-1 inhibitors, could break resistance and achieve better outcomes.

Furthermore, pipeline diversification is gaining pace, with more than 15 Phase II/III candidates investigating novel targets like IDH3 and new mutations, expanding the treatment paradigm.

FMI Survey Findings: Trends According to Stakeholder Views

(Surveyed Q4 2024, n=450 stakeholders equally divided between pharmaceutical companies, distributors, oncologists, and healthcare providers in the US, Western Europe, Japan, and South Korea)

Regional Variance:

High Variance in Adoption:

ROI Views:

USA/EU: 75% saw targeted inhibitors as budget-friendly for niche use, compared to only 42% in Japan due to budget constraints.

Consensus:

Novel IDH1/2 Inhibitors: 70% of the manufacturers focused on next-generation inhibitors with enhanced blood-brain barrier penetration (most important for glioma).

Regional Difference:

Shared Concerns:

80% mentioned high development expenses and payer resistance to premium pricing, particularly for limited patient populations.

Regional Differences:

Manufacturers:

Distributors:

Healthcare Providers:

Global Alignment:

78% of manufacturers will R&D combination therapies (e.g., IDH + PD-1 inhibitors).

Regional Divergence:

Regulatory Impact

High Consensus: Effectiveness, pricing pressure, and regulatory compliance are global issues.

Critical Variances:

Strategic Insight:

Regional tailoring is key to success-faster approvals in the USA, HTA harmonization in Europe, and cost-optimized solutions in Asia.

| Country/Region | Key Policies & Regulations |

|---|---|

| USA |

|

| European Union |

|

| Japan |

|

| South Korea |

|

| China |

|

The inhibitors industry will experience explosive expansion (33% CAGR) by 2035, propelled by increasing IDH-mutant cancers and precision medicine adoption, with pharmaceutical innovators (e.g., Agios, Servier) and diagnostic companies as primary beneficiaries.

Cost constraints from USA price regulation and EU HTAs will pinch margins, while Asian landscape will trail behind because of reimbursement barriers requiring localized strategies. Advances in combination therapies (e.g., IDH+immunotherapy) and companion diagnostics will be determinants of long-term supremacy.

Speed up Precision Medicine Integration

Invest in companion diagnostics (liquid biopsies, AI-powered genomic profiling) to detect mutant patients sooner and maximize treatment eligibility, with first-mover advantage in primary industries such as the USA and EU.

Diversify Through Combination Therapies

Prioritize R&D and collaborations to create inhibitor combinations (e.g., with immunotherapy or targeted therapies) to bridge resistance, extend indications, and differentiate in a crowded pipeline.

Optimize Access & Localization

Construct regional-specific commercial strategies-price based on value in the USA, win HTA approvals in Europe, and form joint ventures in Asia to cross reimbursement barriers-while investigating M&A to consolidate niche leadership.

| Risk | Probability/Impact |

|---|---|

| Regulatory Rejection/Delay (e.g., failed HTA assessments, FDA/EMA pushback on trial data) | Medium |

| Pricing & Reimbursement Pressures (e.g., IRA-mandated price cuts, EU cost-effectiveness hurdles) | High |

| Competitive Disruption (e.g., CRISPR/gene-editing therapies displacing inhibitors in early-line settings) | Low-medium |

| Priority | Immediate Action |

|---|---|

| Secure FDA/EMA label expansions. | Submit supplemental NDAs for combo therapies (IDH+PD-1) in AML/glioma based on Phase II data. |

| Optimize pricing for IRA compliance. | Negotiate value-based contracts with 5+ USA payers ahead of 2025 price negotiations. |

| Accelerate APAC entry. | Partner with local distributors in Japan/S. Korea to navigate reimbursement (target NRDL/PLS listing). |

| Advance next-gen pipeline | Initiate Phase I trials for brain-penetrant IDH3 inhibitor (IND submission Q1 2025). |

| Strengthen diagnostic adoption | Launch 10 liquid biopsy partnership programs with Quest/LabCorp in key oncology centers. |

To stay ahead, companies need to leverage the 33% CAGR of the inhibitor industry and dominate competition, turn short-term right now to combo-therapy leadership-fast-track Phase III studies pairing your lead candidate with checkpoint inhibitors (e.g., Keytruda) for glioma, through the FDA's accelerated pathway.

At the same time, pre-empt price erosion by securing outcomes-based deals with leading USA payers ahead of IRA negotiations getting heated, and capture APAC beachheads through JV partnerships with in-country players in Japan (e.g., Daiichi Sankyo) to avoid reimbursement holdups.

This transforms your playbook from a one-drug play to an integrated precision oncology platform, with diagnostics (liquid biopsy partnerships) and regional pricing strategies as multipliers.

IDH1 mutations are much more common than IDH2 mutations in medullary malignant neoplasms (e.g., gliomas, cholangiocarcinoma), fueled by their greater frequency in major cancers and accepted diagnostic protocols. IDH1 mutations are present in ~80% of IDH-mutant gliomas and ~60% of IDH-mutant cholangiocarcinoma, while IDH2 mutations are less frequent (~5-10% in these neoplasms).

This difference also mirrors IDH1's wider oncogenic function in cellular metabolism and epigenetic dysregulation, thus being a key target for drug development. The FDA/EMA-approved IDH1-targeting inhibitor ivosidenib (Tibsovo®) is therefore used more broadly clinically, whereas IDH2 inhibitors (e.g., enasidenib) are niche due to small patient populations.

Among monoclonal antibodies (mAbs), peptides, and small molecules, the most commonly used type of medication in oncology, including for IDH1/2-mutant cancers, are small molecules because they have oral bioavailability, are cost-effective, and penetrate blood-brain barriers as well as cellular barriers.

Small-molecule inhibitors such as ivosidenib (IDH1) and enasidenib (IDH2) are the way to go because they can be taken orally, readily permeate tumor cells, and powerfully inhibit intracellular mutant IDH enzymes. They have low manufacturing costs (compared to biologics) and dosing flexibility, which make them ideal for long-term cancer therapy.

Although mAbs (such as checkpoint inhibitors) play a critical role in immunotherapy, they fail to reach intracellular enzymes such as IDH. Peptides, although very promising, have issues in stability, delivery, and scalability of manufacturing, which confine them to clinical application.

Oral delivery is far and away the most commonly utilized route by therapeutic area, especially for chronic diseases such as cancer therapy, because it combines unmatched patient convenience, cost efficiency, and infrastructural provenance. Oral administration for IDH inhibitors such as ivosidenib enables patients to take medications themselves at home instead of clinical appointments for injections or infusions.

This pathway illustrates enhanced bioavailability for small-molecule medications, circumvents the pain and infection hazards of injections, and allows for flexible dosing modification.

Although parenteral routes (IV/IM) are still necessary for hospital-based acute care, biologics, or drugs with limited GI absorption, they necessitate much greater healthcare resources. Subcutaneous delivery has increased for some biologics but is subject to volume constraints and local tolerability concerns.

The USA is anticipated to experience a significant CAGR from 2025 to 2035 in the IDH inhibitors industry. This growth is driven by an existing healthcare infrastructure, high investments in oncology research, and high incidence rates of IDH-mutant cancers.

The presence of major pharma companies and supportive regulatory policies further support the industry. The USA held around 40% of the world's market share in 2025 and is expected to continue its dominance during the forecast period. The isocitrate dehydrogenase (IDH) inhibitors sales in the USA is likely to grow at 34% CAGR through 2025 to 2035.

The United Kingdom is estimated to witness a considerable CAGR during 2025 to 2035 in the IDH inhibitors industry. The UK's aggressive emphasis on cancer research, bolstered by government support and investments, is the reason behind this consistent growth.

The National Health Service (NHS) helps the implementation of new therapies, making patients more accessible to IDH inhibitors. Academic collaborations with pharmaceutical firms further propel growth.

The isocitrate dehydrogenase (IDH) inhibitors sales in the UK is likely to grow at 32% CAGR through 2025 to 2035.

The nation's focus on oncology research and development, as well as a strong healthcare system, drives this growth. Government efforts to enhance cancer treatment and raise awareness regarding targeted therapies help the industry expand.

France's involvement in global clinical trials also increases the number of advanced treatments available. The isocitrate dehydrogenase (IDH) inhibitors sales in France is likely to grow at 31% CAGR through 2025 to 2035.

Advanced healthcare infrastructure in the country, coupled with an intense focus on research and development and associations between academic research centers and pharmaceutical companies, fuel growth.

Germany's aggressive adoption of new medical technologies and treatments further fuels growth.The isocitrate dehydrogenase (IDH) inhibitors sales in Germany is likely to grow at 35% CAGR through 2025 to 2035.

The growing incidence of IDH-mutant cancers, coupled with rising healthcare services and patient exposure to new treatments, drive this expansion. Italy's involvement in European Union health care programs and clinical research initiatives further fuels the use of IDH inhibitors.

The isocitrate dehydrogenase (IDH) inhibitors sales in Italy is likely to grow at 34% CAGR through 2025 to 2035.

South Korea is expected to witness a significant CAGR from 2025 to 2035 in the IDH inhibitors market. Sudden developments in healthcare infrastructure, rising investments in pharmaceutical and biotechnology research, and expanding emphasis on precision medicine are fueling growth.

Government encouragement of novel cancer therapies and the increasing incidence of IDH-mutant cancers also support the market. The isocitrate dehydrogenase (IDH) inhibitors sales in South Korea is likely to grow at 34% CAGR through 2025 to 2035.

The well-developed healthcare infrastructure in the country, high focus on research and development, and aging population are some of the factors driving this growth. Japan's high uptake of sophisticated medical technologies and therapies and government efforts to enhance cancer treatment also fuel the market growth.

The isocitrate dehydrogenase (IDH) inhibitors sales in Japan is likely to grow at 33% CAGR through 2025 to 2035.

China is expected to see a significant CAGR between 2025 and 2035 in the market for IDH inhibitors. Cancer's rising prevalence, healthcare spending, and heightened awareness of targeted therapies are responsible for the growth. China's vast population and government efforts to enhance healthcare accessibility and infrastructure also help expand the market.

The isocitrate dehydrogenase (IDH) inhibitors sales in China is likely to grow at 33% CAGR through 2025 to 2035.

Agios/Servier has 55% with ivosidenib (Tibsovo) today and is expected to continue growing at a 25-30% CAGR until 2027 based on its widening label in glioma and cholangiocarcinoma indications.

Bristol-Myers Squibb has 25% with enasidenib but must contend with a more modest growth of 10-12% CAGR based on its restrictive IDH2-mutant AML indication and future patent expirations.

Novartis' pipeline candidate vorasidenib 12% might record 40-45% CAGR if approved in 2025, with a strong possibility of gaining a large share in the glioma market from Agios/Servier.

Bayer, Forma, and others' remaining 8% share of early-stage candidates might record 50-60% CAGR as next-generation pan- pan-inhibitors march on, albeit from a much lower revenue base.

With respect to the type, it is classified into IDH1 mutant medullary malignant tumor and IDH2 mutant medullary malignant tumor.

In terms of molecule types, it is divided into monoclonal antibodies, peptides, small molecules, and others.

In terms of route of administration, it is divided into oral, parenteral, subcutaneous, and topical.

In terms of region, it is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, and MEA.

AML, cholangiocarcinoma, and glioma are the major indications for therapies available now.

Agios Pharmaceuticals (now Servier) is the leader with ivosidenib (Tibsovo).

They inhibit mutated IDH enzymes that fuel abnormal cancer cell proliferation.

Regulatory barriers, price pressures, and competition from next-generation candidates constrain adoption.

Novartis' vorasidenib can replace existing medications if approved to treat glioma.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Molecule Types, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Molecule Types, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Molecule Types, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Molecule Types, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Molecule Types, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Molecule Types, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Molecule Types, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Molecule Types, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Molecule Types, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Molecule Types, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Molecule Types, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Molecule Types, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 17: Global Market Attractiveness by Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Molecule Types, 2023 to 2033

Figure 19: Global Market Attractiveness by Route of Administration, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Molecule Types, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Molecule Types, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Molecule Types, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Molecule Types, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 37: North America Market Attractiveness by Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Molecule Types, 2023 to 2033

Figure 39: North America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Molecule Types, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Molecule Types, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Molecule Types, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Molecule Types, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Molecule Types, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Molecule Types, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Molecule Types, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Molecule Types, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Molecule Types, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 77: Europe Market Attractiveness by Type, 2023 to 2033

Figure 78: Europe Market Attractiveness by Molecule Types, 2023 to 2033

Figure 79: Europe Market Attractiveness by Route of Administration, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Molecule Types, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Molecule Types, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Molecule Types, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Molecule Types, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 97: South Asia Market Attractiveness by Type, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Molecule Types, 2023 to 2033

Figure 99: South Asia Market Attractiveness by Route of Administration, 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Molecule Types, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Molecule Types, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Molecule Types, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Molecule Types, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Molecule Types, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Route of Administration, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Molecule Types, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Molecule Types, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Molecule Types, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Molecule Types, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 137: Oceania Market Attractiveness by Type, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Molecule Types, 2023 to 2033

Figure 139: Oceania Market Attractiveness by Route of Administration, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Molecule Types, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Molecule Types, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Molecule Types, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Molecule Types, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 157: MEA Market Attractiveness by Type, 2023 to 2033

Figure 158: MEA Market Attractiveness by Molecule Types, 2023 to 2033

Figure 159: MEA Market Attractiveness by Route of Administration, 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Alcohol Dehydrogenase Enzymes Market Size and Share Forecast Outlook 2025 to 2035

FcRn Inhibitors Market Size and Share Forecast Outlook 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

SGLT2 Inhibitors Market Size and Share Forecast Outlook 2025 to 2035

SGLT2 Inhibitors Treatment Market Overview – Trends & Growth 2024-2034

NF-KB Inhibitors Market

Mould Inhibitors Market

Kinase Inhibitors For Cancer Treatment Market Size and Share Forecast Outlook 2025 to 2035

Enzyme Inhibitors Market

Paraffin Inhibitors Market

Corrosion Inhibitors Market Growth - Trends & Forecast 2025 to 2035

PD-1/PD-L1 Inhibitors Market – Trends, Growth & Forecast 2025 to 2035

Proton Pump Inhibitors Market Insights - Demand, Size & Industry Trends 2025 to 2035

Angiopoietin Inhibitors Therapeutic Market

Small Molecule Inhibitors Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Protein Kinase B Inhibitors Market

Alpha Glucosidase Inhibitors Market Size and Share Forecast Outlook 2025 to 2035

Immune Checkpoint Inhibitors Market

Volatile Corrosion Inhibitors Market Size and Share Forecast Outlook 2025 to 2035

Volatile Corrosion Inhibitors (VCI) Packaging Market Insights - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA