Over the forecast period of 2025 to 2035, the IP PBX market is set to grow from USD 32.2 billion in 2025 to USD 87.2 billion in 2035 at a CAGR of 10.4% over the period. The transformation from the traditional PBX to IP PBX reflects the growing tendency to be cost-effective, flexible and scalable (in the urgent required need for adaptive communication systems across such industries as IT, healthcare and education for example).

Companies are beginning to integrate computer telephony systems with general-purpose, powered-by-DC (debit and credit)-based customer networks to increase cooperation, effectiveness, and customer interaction.Companies are free to install these systems in their own premises or keep them in the cloud. They can also mix and match four main types of systems, including on-premises, in the cloud, or hybrids with different mixes.

These systems are gaining popularity among business organizations as they offer multi-device connectivity, facilitate remote workers to interact on platforms of their choice and provide a consistent interoperable experience across heterogeneous environments.Growth in this industry is due to several causes. As enterprises realize the need for high-quality, flexible-push-to-talk telephone systems at lower cost, they seem to be moving away from their old PBXs in favor of VoIP.

The growth is also being driven by the growing uptake of Unified Communications (UC), which integrates voice, video, messaging, and conferencing. In addition, business communication is moving to more cloud-based IP PBX solutions due to the ever-growing demand for remote workforce connectivity, security, and automation. Firms are using CRM and third-party integrations to automate communication workflows and improve customer relationship management.

Although the industry holds much promise, there are also challenges ahead. Questions arise over risks related to VoIP-based voice systems, such as cyber-attacks, data breaches, and call fraud-not very big concerns when regulatory agencies hold sway over regulators. Moreover, large upfront setup costs for on-premises deployment, plus the complexity of integration with legacy infrastructure, may dampen adoption to a great extent.

Network reliability concerns and bandwidth restrictions affect the performance of these solutions, especially for companies situated in locations with unreliable internet connectivity. Adherence to regulatory standards and data privacy laws is yet another complicated factor for companies deploying these solutions. Some trends are AI-based voice assistants, cloud telephony, and communication with WebRTC support.

Businesses are now working on machine learning tools that can be used for smart call routing, sentiment analysis, and proactive customer support. The development of 5G networks will likely improve VoIP-based communications, providing high-definition voice and video calls that are low on latency.

As companies attend to digital transformation projects, follow hybrid work styles, and employ customer-centric communication practices, the demand for IP PBX solutions will only increase. Business phones will be redefined in the future.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 32.2 billion |

| Industry Size (2035F) | USD 87.2 billion |

| CAGR (2025 to 2035) | 10.4% |

Explore FMI!

Book a free demo

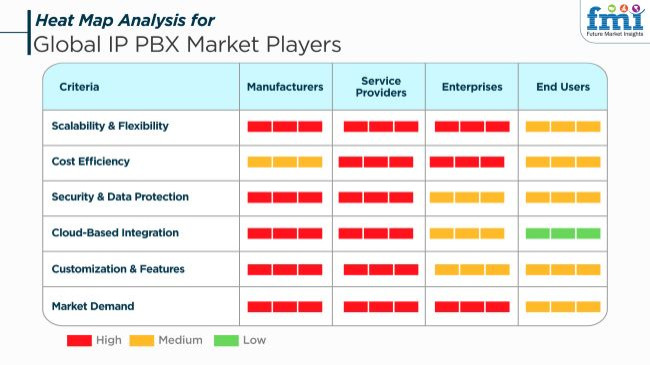

Along with the increase in cloud-based telephony, the provision of VoIP telephony, and the presence of hybrid workplaces, the Global IP PBX market is witnessing a rapid change. The development of the AI-based integration of automation, increased security layers, and the multitenancy of manufacturers is the main focus. The automation of AI technologies, cloud migration, and cost reduction are the key components that the service integrators are utilizing to implement these requirements.

Transitioning to IP-based telephony systems from conventional PBX installation in businesses will be easy and faster through the technology-enabled cloud integration. Enterprises are attracted to features like unifying communication, video conferencing, and IT-CRM integration, which allow them to streamline the workflow and increase customer engagement. Customers are the main focus for companies now thus, they are putting more targeted resources in areas like the quality of the call, user-friendliness, and mobility.

The result is the increasing demand for remote access and smartphone-compatible solutions. The major demand drivers are reduced costs, improved security, interoperability, and the support of remote teams that come with the hybrid IP system. With the advent of the requirement for flexible, budget-friendly, and all-inclusive telecommunication solutions, the industry is projected to grow, serving the IT, healthcare, retail, and BFSI sectors, among others.

Contracts and Deals Analysis

| Organization | Contract Value (USD Million) |

|---|---|

| City of Moses Lake | 24.3 |

| Central University of South Bihar (CUSB) | 2.4 |

| Barrow County School District | 1.9 |

Between 2020 and 2024, the industry grew gradually as businesses transitioned from telephony systems to cloud-based communication solutions. The transition to remote and hybrid workspaces increased demand for scalable, cost-effective, and feature-rich PBX systems. Companies emphasized seamless integration with collaboration software, CRM systems, and AI-driven call analytics to enhance customer interactions and operational efficiency. However, cybersecurity threats and the need for skilled IT support slowed down adoption in certain regions.

Between 2025 and 2035, there will be a further rise as there will be AI-powered automation, improved voice recognition, and integrated communication platforms. Cloud-hosted PBX will reign supreme, providing companies flexibility, reduced maintenance costs, and analytics-based insights. The convergence of 5G networks will facilitate quicker, more consistent communication, with real-time voice and video communications and low latency. Further, increasing uptake by SMEs and emerging markets will fuel demand for subscription-based and managed PBX services, providing sustained growth.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments imposed stricter rules to increase call security and reduce the cases of fraud. Businesses implemented compliance models to satisfy local telephony regulations. | Governments make cybersecurity policies stronger, mandating companies to adopt AI-based fraud protection in networks. Data localization requirements compel service providers to set up local data centers. |

| Cloud-based deployment accelerated as businesses migrated from traditional phone systems to unified communications. Artificial intelligence-aided call routing and analytics enhanced business efficiency. | Artificial intelligence-aided automation maximizes voice recognition, call analytics, and sentiment analysis. Quantum computing maximizes call encryption, protecting IP PBX networks from emerging cyber threats. |

| Enterprises incorporated VoIP with collaboration tools such as Microsoft Teams and Zoom to enhance remote working. | Companies use AI-powered virtual assistants and real-time transcription. Integrated 5G connectivity improves voice quality and lowers latency. |

| Hosted IP PBX solutions were embraced by small and medium-sized businesses to minimize hardware expenses and ease management. | Edge computing minimized reliance on centralized data centers. |

| AI-driven chatbots and voice assistants enhanced customer experiences. | AI-based call sentiment analysis enhances customer experience. Businesses use predictive call analytics for proactive customer interaction. |

| Businesses embraced multi-factor authentication and end-to-end encryption to secure VoIP networks against cyber threats. | AI-powered threat detection systems prevent telecom fraud proactively. Blockchain deployment secures VoIP transactions and user authentication. |

| The pandemic boosted the adoption of remote and hybrid work models. Enterprises deployed cloud-hosted IP PBX for distributed teams. | 6G networks and AI-based collaboration tools facilitate smooth global communication. Virtual presence and holographic conferencing redefine hybrid work patterns. |

| Growth was fueled by digital transformation, remote work adoption, and low-cost VoIP solutions. | AI-based telephony growth, cybersecurity innovations, and IoT-enabled communication systems propel development. |

Globally, the industry is particularly vulnerable to risks across cybersecurity threats, regulatory compliance, technological disruptions, competition, and integration issues.

The major aspect of cybersecurity threats includes the reality that these systems are being operated over the internet, which exposes them to hacking, VoIP fraud, denial-of-service (DoS) attacks, and eavesdropping.

Being on unsecured networks may cause problems like data breaches, financial losses, and non-business people reading company communications. Networking equipment should be in end-to-end encryption, secure SIP protocols, and multi-factor authentication configurations to be resistant to any of these attacks.

Regulatory compliance is very important for the providers, and they have to take care of telecom regulations, data protection laws, and emergency calling requirements (e.g., E911 in the USA). Lack of compliance may translate to legal penalties like service interruptions and punishment by withdrawal of business licenses. Rightful regional compliance and dealing with data according to the GDPR are paramount to industry expansion.

The cloud communication services, AI-driven call management, and 5G integration are the enemies that cause problems to the service providers. The trend of moving from traditional equipment manufacturers to hosted enterprises has become even quicker with the integration of communications. Sellers are directed to reprogram their insights to technology through matters like AI automation, cloud, and analytics development.

Integration problems come up when enterprises seek interconnections with other systems like CRM platforms, collaboration tools, and IoT-enabled devices. Inefficient integration can lead to downtime, unproductive work, and overcosted operations. API-based connectivity and plug-and-play solutions are some of the improvements that can support the adoption of these systems.

Tier-1 vendors are large multinational companies with extensive reach, advanced R&D capabilities, and comprehensive Unified Communications (UC) integrations. These vendors, including Cisco, Avaya, and Mitel, dominate with high-end, scalable solutions catering to large enterprises, government, and telecom sectors. T

hey offer cloud, on-premises, and hybrid IP PBX with AI-driven automation, security enhancements, and deep CRM integration. Their strong channel partnerships, global distribution networks, and strategic acquisitions allow them to maintain technological leadership. These companies focus on 5G, AI, and cybersecurity innovations, setting industry benchmarks for reliability, performance, and enterprise-grade communication solutions.

Tier-2 vendors cater to mid-sized businesses and regional enterprises, offering cost-effective, customizable solutions with strong customer support. Companies like 3CX, Grandstream, and Yeastar focus on SMEs, education, retail, and healthcare, providing feature-rich IP PBX with VoIP, SIP trunking, and cloud-hosted capabilities.

These vendors often target specific geographic regions or industry verticals, differentiating themselves with ease of deployment, flexible pricing, and localized support. Their ability to offer hybrid solutions and integrate with existing IT infrastructure allows them to compete against Tier-1 vendors, especially in developing markets and cost-sensitive industries seeking scalable communication solutions.

Tier-3 vendors primarily focus on small businesses, startups, and niche applications, providing low-cost, open-source, or industry-specific solutions. Vendors like FreePBX, Sangoma, and Elastix offer affordable, self-managed systems that appeal to businesses needing basic VoIP functionality with limited investment.

Many Tier-3 players specialize in open-source software, enabling high customization for tech-savvy users and managed service providers (MSPs). These vendors rely on direct online sales, reseller networks, and community-driven support rather than large-scale enterprise contracts. While their share is smaller, they thrive in niche markets, particularly among SMEs and IT service providers.

The section below covers the industry analysis for different countries. Market demand analysis on key countries in several regions of the globe, including the USA, Germany, China, India and Saudi Arabia is provided.

| Country | Value CAGR (2025 to 2035) |

|---|---|

| USA | 12.3% |

| Germany | 10.0% |

| China | 14.3% |

| India | 15.7% |

| Saudi Arabia | 13.2% |

The industry in the USA grows as businesses adopt advanced communication technologies to enhance operational efficiency. Enterprises and small businesses integrate cloud-based solutions to reduce infrastructure costs and improve remote collaboration. The demand for unified communications, VoIP solutions, and AI-driven call management increases as organizations prioritize seamless connectivity.

The shift toward hybrid work models accelerates investments in scalable platforms that offer flexibility and security. Regulatory frameworks encourage digital transformation, boosting the adoption of IP PBX solutions across various industries. FMI is of the opinion that the USA market is slated to grow at 12.3% CAGR during the forecast period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Cloud-Based IP PBX Adoption | Businesses migrate to the cloud to cut expenses and improve scalability. |

| Hybrid Work Model Expansion | Investments in flexible communication platforms bridging remote teams with in-office teams. |

| AI-Driven Call Management | Companies utilize AI-based tools to better route and analyze calls. |

More and more enterprises in Germany are upgrading their communication structure to enable digitalization of their operations and the construction of IP PBX infrastructure. Organizations across the globe implement VoIP-based IP PBX systems in order to improve the cost-effectiveness and overall efficiency of business communications. T

he rise of GDPR-compliant and IP PBX solutions is driven by data protection laws. Telephony system as a service provides various solutions that help enhance the productivity of the workforce with remote work and mobile workforce.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| VoIP-Based Solutions | Organizations are moving to VoIP systems for better cost efficiency and Connectivity. |

| Industry Expansion | Companies need advanced communication infrastructure for automation and digitalization. |

| GDPR Compliance | Organizations seek secure, regulation-compliant solutions. |

China shows a rapid growth as businesses and government institutions invest in next-generation communication technologies. Enterprises adopt cloud-based and AI-enhanced solutions to optimize operations and customer service. The expansion of 5G infrastructure enhances the efficiency of IP telephony networks, supporting high-speed and low-latency communication.

Digital transformation initiatives across industries, including manufacturing, finance, and healthcare, accelerate the adoption of IP PBX systems. The rise of e-commerce and digital businesses further strengthens the demand for scalable and cost-effective communication solutions. FMI is of the opinion that the Chinese industry is slated to grow at 14.3% CAGR during the study period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Open Infrastructure for 5G Expansion | They support high-speed, low-latency IP telephony in networks. |

| AI-Enhanced Solutions | AI-driven automation for optimizing call management in the IPPBX solutions |

| Digital Transformation Initiatives | Organizations standardize communication systems to improve efficiency. |

As businesses and startups continue to prefer to automate idleness while reducing expenditure on calls, the Indian market is on the rise. Cloud telephony and VoIP services also allow businesses to expand operations with minimal investment in infrastructure. IT and outsourcing, as well as investment (Fintech), are growing at a fast pace and would need seamless and secure communication in their networks.

Government initiatives to promote digitalization and smart cities further drive the growth of these systems. The growth of the industry is driven by increased internet penetration along with mobile Connectivity. FMI analysis shows that the Indian market is projected to grow at 15.7% CAGR, as observed during the study period.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Use of Cloud Telephony | Businesses is predicted to leverage a cloud-based communication platform instead of expanding the capital expenditure. |

| IT and Outsourcing Growth | Demand for effective and scalable communication solutions rises. |

| Government Digitalization Initiatives | Smart city projects and digital policies boost the IP PBX solutions providers. |

Saudi Arabia has an expanding market as organizations invest in modern communication technologies to support business growth. Companies in finance, healthcare, and retail adopt cloud-based solutions to improve connectivity and customer interactions. The government's Vision 2030 initiative accelerates digital transformation, encouraging enterprises to upgrade their communication infrastructure.

The growing adoption of AI-driven call centers and VoIP-based enterprise communication solutions makes the market stronger. Increased focus on cybersecurity and data protection ensures businesses implement secure and compliant IP PBX systems.

Growth Factors in Saudi Arabia

| Key Drivers | Details |

|---|---|

| Vision 2030 Digitalization | Various initiatives in the government segment are driving businesses to upgrade communication infrastructure. |

| AI-Driven Call Centers | Businesses implement AI to streamline customer service processes. |

| Cybersecurity and Data Protection | Businesses prioritize secure and compliant communication solutions. |

| Industry | Value Share (2025) |

|---|---|

| IT & Industry (By IP PBX Software) | 42.5% |

IT & Telecom Industry Dominate

The IT & Telecom industry dominates the IP PBX market because of its requirement for flexible, affordable, and converged communications solutions. IT and software organizations, BPOs, large enterprises, and call centers heavily utilize VoIP-based PBX for seamless international connectivity.

The heavy dependence of the industry on cloud computing, remote worker collaboration, and instant communication has pushed the demand for cloud-hosted and hybrid solutions along with UCaaS (Unified Communications as a Service).

Telecommunications operators increasingly integrate SIP-based solutions with VoIP services to offer cost-effective communication packages to enterprises.IT service providers, particularly managed service providers (MSPs), bundle PBX-as-a-Service (PBXaaS) with security, AI-driven automation, and analytics to drive adoption.

The quick adoption of AI, WebRTC, and 5G in the industry enables the expansion of IP PBX solutions, improving call quality, security, and automation capabilities. Moreover, IT companies incorporate IP PBX with CRM, workforce management, and helpdesk software to automate processes. With ongoing digitalization, increased demand for cloud telephony, and hybrid work patterns, the IT & Telecom sector is the largest user of IP PBX solutions.

The market is highly competitive, with both global and regional vendors offering on-premises, cloud-based, and hybrid solutions to meet diverse enterprise needs. Competition is driven by advancements in AI integration, Unified Communications (UC) adoption, and the shift toward cloud-based solutions, which are preferred for their scalability, cost-effectiveness, and remote work compatibility.

Leading companies such as Cisco Systems, Avaya, and Mitel dominate the market with enterprise-grade solutions. These companies focus on AI-powered automation, security enhancements, and CRM integration to enhance business communication efficiency.

The emergence of PBX-as-a-Service (PBXaaS) is reshaping the competitive landscape by increasing adoption among startups and service-based industries. Vendors are expanding their market presence through partnerships with cloud providers, telecom operators, and Managed Service Providers (MSPs). With advancements in 5G, WebRTC, and edge computing, innovation in real-time collaboration and intelligent call management remains a crucial competitive factor.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cisco Systems | 20-25% |

| Avaya | 15-20% |

| Mitel | 12-18% |

| 3CX | 10-15% |

| Grandstream Networks | 8-12% |

| Other Players | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cisco Systems | Enterprise-grade cloud and on-premises solutions with AI-powered automation. |

| Avaya | Hybrid communication solutions integrating PBX, cloud telephony, and collaboration tools. |

| Mitel | VoIP and UC solutions catering to SMEs and large enterprises with scalable deployments. |

| 3CX | Software-based IP PBX with WebRTC integration and advanced call management. |

| Grandstream Networks | Cost-effective PBX solutions with SIP-based communication and VoIP capabilities. |

Key Company Insights

Other Key Players (20-30% Combined)

The industry is expected to reach USD 32.21 billion in 2025.

The industry is projected to grow to USD 87.23 billion by 2035.

Some of the major companies include Cisco Systems, Avaya, Mitel, and 3CX.

India, growing at a 15.7% CAGR during the forecast period, is expected to witness the fastest growth.

The cloud deployment is being widely used.

By type, the market is segmented into IP PBX software, hardware, and services.

The market is segmented by region into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.