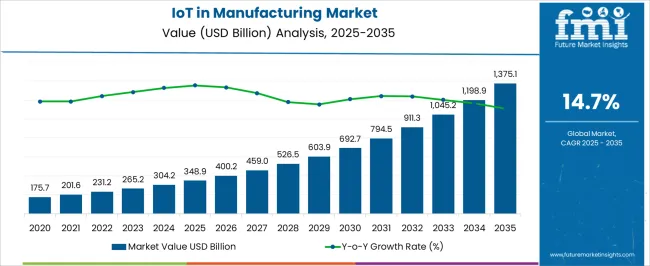

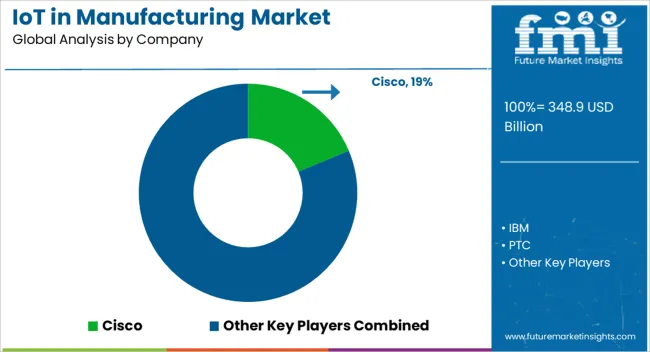

The IoT in Manufacturing Market is estimated to be valued at USD 348.9 billion in 2025 and is projected to reach USD 1375.1 billion by 2035, registering a compound annual growth rate (CAGR) of 14.7% over the forecast period.

| Metric | Value |

|---|---|

| IoT in Manufacturing Market Estimated Value in (2025 E) | USD 348.9 billion |

| IoT in Manufacturing Market Forecast Value in (2035 F) | USD 1375.1 billion |

| Forecast CAGR (2025 to 2035) | 14.7% |

The IoT in manufacturing market is expanding steadily, driven by the rising adoption of smart factory initiatives, industrial automation, and the need for real time monitoring to optimize production efficiency. Increasing demand for predictive maintenance, reduced downtime, and enhanced asset utilization is fueling the integration of IoT across manufacturing ecosystems.

Advances in cloud computing, artificial intelligence, and edge analytics are further strengthening the value proposition of IoT platforms. Regulatory support for energy efficiency and sustainability in industrial operations is also accelerating adoption.

The market outlook remains strong as manufacturers prioritize digital transformation to enhance competitiveness, operational resilience, and supply chain visibility in global production environments.

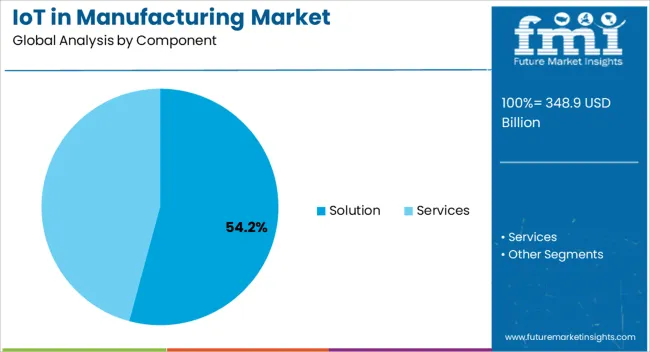

The solution component is projected to hold 54.20% of total revenue in 2025, making it the leading segment in the IoT in manufacturing market. Growth is being driven by the demand for platforms that integrate analytics, automation, and machine learning for real time process optimization.

Solutions offer manufacturers the ability to track performance, minimize downtime, and streamline operations across diverse production lines.

The scalability of these solutions has further reinforced adoption, particularly as enterprises expand digital infrastructure to support Industry 4.0 initiatives.

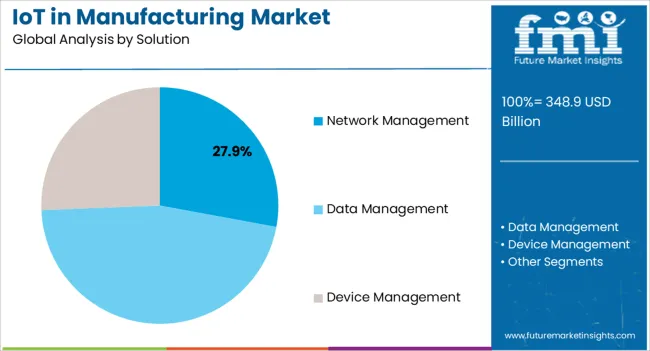

Within the services category, network management is expected to contribute 27.90% of revenue in 2025. Its growth is attributed to the increasing complexity of connected manufacturing environments that require reliable and secure communication across machines and systems.

Network management ensures seamless connectivity, reduced latency, and enhanced cybersecurity, which are critical to uninterrupted manufacturing operations.

The rising volume of IoT devices deployed in factories has created strong demand for effective network oversight, establishing this subsegment as a vital enabler of IoT adoption in manufacturing.

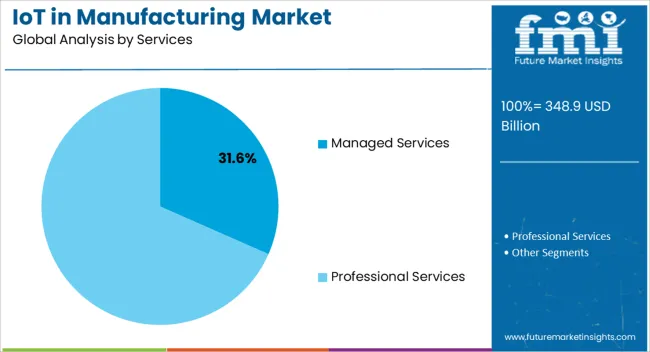

Managed services are projected to account for 31.60% of market revenue by 2025, emerging as the most significant subsegment under services. Manufacturers are relying on managed service providers to reduce the burden of infrastructure management, enhance system uptime, and ensure cost effective IoT deployment.

These services allow companies to focus on core production activities while outsourcing monitoring, maintenance, and optimization of IoT systems.

The ability to deliver flexible, scalable, and secure solutions has positioned managed services as a key growth driver in the manufacturing IoT ecosystem.

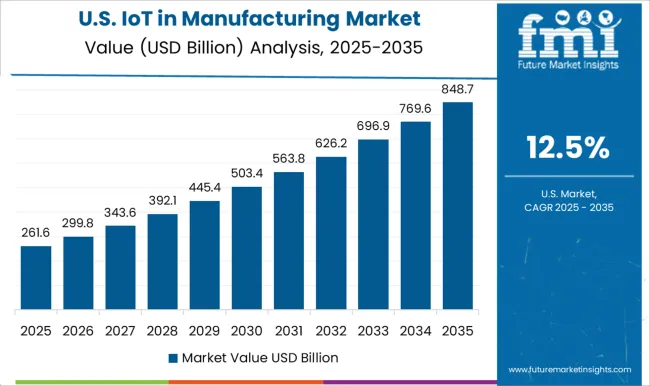

Short-term Growth (2025 to 2029): IoT and cyber-physical systems are the need of the hour. With highly productive systems and smooth supply chains, manufacturers look for 100% errorless proficiency. Furthermore, the new-age products and their production involving new technological additions are also flourishing the market growth. With these wide ranges of applications, the market is expected to hold USD 348.9 billion in 2025 while it is anticipated to reach USD 603.9 billion by 2029.

Mid-term Growth (2029 to 2035): The higher penetration of sustainability in manufacturing along with the integration of IoT and AI, adds value to the market trajectory. Higher production value along with the cost-cutting benefits delivered by it is fuelling the demand for IoT in manufacturing. This takes a market value from USD 603.9 billion in 2029 to a value of USD 1375.1 billion in 2035.

Long-term Growth (2035 to 2035): This period is expected to witness the manufacturing units working along with AI, cloud computing, and IoT. This is anticipated to happen due to the improved network bandwidths and high-speed internet. Thus, the market is anticipated to thrive at a strong CAGR of 14.7% between 2025 and 2035.

Industrial expansion is witnessing the addition of advanced software and hardware while it becomes the center-point of transformation for other experiments. The addition of IoT in manufacturing is likely to add a new chapter to the history of production. There is a rising demand for agile production and operational efficiency along with the importance of intelligent machine applications. Alongside this, an increase in regulatory compliance around the globe is anticipated to boost the IoT in the manufacturing market. The IoT-integrated manufacturing devices accelerate predictive maintenance, track data, and deliver real-time insights.

Some key restraints for the market are lack of infrastructure, awareness, and capital. The brands that have lost their business during the pandemic period. Hence, surviving on limited capital sources is the only option that these businesses have. Furthermore, the semi-automatic alternatives with affordable pricing are also limiting the market growth. Another factor that limits the market growth is the integration of these standards in a way that Machine-to-Machine (M2M) communication. As it becomes more user-friendly and versatile.

| Region/Country | United States |

|---|---|

| Revenue Share % (2025) | 20.5% |

| Region/Country | Germany |

|---|---|

| Revenue Share % (2025) | 12.1% |

| Region/Country | Japan |

|---|---|

| Revenue Share % (2025) | 8.6% |

| Region/Country | Australia |

|---|---|

| Revenue Share % (2025) | 2.3% |

| Region/Country | North America |

|---|---|

| Revenue Share % (2025) | 38.5% |

| Region/Country | Europe |

|---|---|

| Revenue Share % (2025) | 24.3% |

Higher Industrial Automation, Availability of Infrastructure, and Increased Application of Robotics in Industrial Spaces Fuel the Regional Growth

The United States IoT in manufacturing market leads in terms of market share in the North American region. The region held a market share of 20.5% in 2025. North America has dominance in the IoT in the manufacturing market as it held a 38.5% global share in 2025. The developed economies in this region, such as the United States and Canada, are continuously investing in industrial research and development. Adding new technological layers to their manufacturing systems.

Manufacturers use IoT and analytics to operate and enhance their businesses to stay competitive. The application of smart sensors is also helping the producers in utilizing data, better communication, and enhanced productivity.

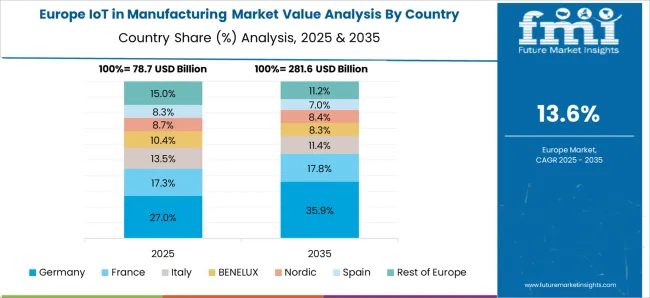

Restoration of Automotive Manufacturing, Error-less Manufacturing, and Integration of AI are garnering the Regional Growth

The German IoT in Manufacturing market held a market share of 12.1% in 2025 while the European Union held a market share of 24.3%. The growth is attributed to the existing automotive industry with large-scale parts manufacturing facilities. These firms have started automating and integrating them with advanced technology. Furthermore, these manufacturing facilities and their data processing has been made easy through the integration of IoT and artificial intelligence. The increased cross-border trade and investment are expected to improve the supply chain through the application of IoT.

| Category | By Vertical |

|---|---|

| Leading Segment | Discrete Manufacturing |

| Market Share (2025) | 57.6% |

| Category | By Application |

|---|---|

| Leading Segment | Automation Control and Management |

| Market Share (2025) | 19.3% |

Based on vertical type, discrete manufacturing leads as it held a substantial market share of 57.6% in 2025. The growth of this segment is due to the transforming IT and OT systems. The shift towards software-defined infrastructure and machines is also making the segment successful. Lastly, data-driven innovations are expected to decrease the barriers to IoT in manufacturing.

Based on application, the automation control and management segment lead as it held a market share of 19.3% in 2025. The growth is attributed to the IoT’s integration with computer automation controls. This further helps in streamlining the industrial systems, and tracking their performance while removing errors and inefficiencies.

The key players in the market focus on delivering better integration options. The IoT hardware and software launched by vendors are updated with the ongoing functions and should be customizable. Furthermore, Industry 4.0’s other elements like artificial intelligence, and cloud computing are also being integrated with IoT deployments.

How can IoT in Manufacturing Vendors Providers Scale their Businesses in the Market?

Market players in the market are working on three key strategies.

Market Developments

The global IoT in manufacturing market is estimated to be valued at USD 348.9 billion in 2025.

The market size for the IoT in manufacturing market is projected to reach USD 1,375.1 billion by 2035.

The IoT in manufacturing market is expected to grow at a 14.7% CAGR between 2025 and 2035.

The key product types in IoT in manufacturing market are solution and services.

In terms of solution, network management segment to command 27.9% share in the IoT in manufacturing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

IoT Network Management Market Size and Share Forecast Outlook 2025 to 2035

IoT Spend by Logistics Market Size and Share Forecast Outlook 2025 to 2035

IoT Chip Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Market Size and Share Forecast Outlook 2025 to 2035

IoT Application Enablement Market Size and Share Forecast Outlook 2025 to 2035

IoT Processor Market Size and Share Forecast Outlook 2025 to 2035

IoT Application Development Services Market Size and Share Forecast Outlook 2025 to 2035

IoT Connectivity Management Platform Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Platform Market Size and Share Forecast Outlook 2025 to 2035

IoT Development Kit Market Size and Share Forecast Outlook 2025 to 2035

IoT Communication Protocol Market - Insights & Industry Trends 2025 to 2035

IoT for Public Safety Market

IoT Data Governance Market

IoT In Aviation Market Size and Share Forecast Outlook 2025 to 2035

IoT In Construction Market Size and Share Forecast Outlook 2025 to 2035

IoT in Utilities Market Size and Share Forecast Outlook 2025 to 2035

IoT in Product Development Market Analysis - Growth & Forecast 2025 to 2035

IoT in Healthcare Market Insights - Trends & Forecast 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

IoT For Cold Chain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA