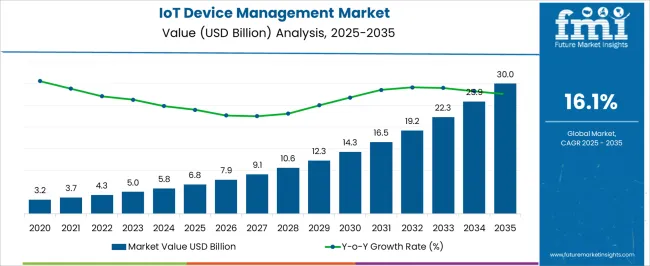

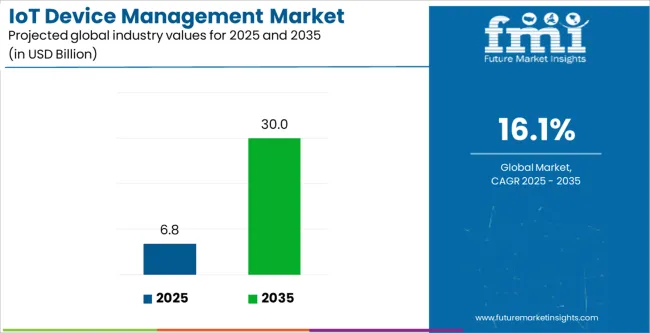

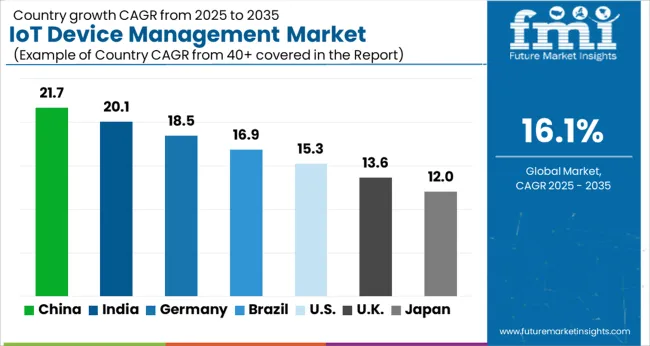

The IoT Device Management Market is estimated to be valued at USD 6.8 billion in 2025 and is projected to reach USD 30.0 billion by 2035, registering a compound annual growth rate (CAGR) of 16.1% over the forecast period.

| Metric | Value |

|---|---|

| IoT Device Management Market Estimated Value in (2025 E) | USD 6.8 billion |

| IoT Device Management Market Forecast Value in (2035 F) | USD 30.0 billion |

| Forecast CAGR (2025 to 2035) | 16.1% |

The IoT device management market is experiencing rapid expansion due to the proliferation of connected devices across industrial, commercial, and consumer environments. Rising demand for secure device onboarding, firmware updates, and lifecycle management is driving adoption of advanced management platforms.

The increasing need for real time monitoring, predictive maintenance, and remote configuration has positioned device management solutions as a critical component of digital transformation initiatives. Enterprises are also prioritizing cybersecurity in IoT ecosystems, leading to greater integration of authentication and encryption features within device management frameworks.

The outlook for the market remains strong as industries such as manufacturing, healthcare, utilities, and smart cities intensify their reliance on connected devices to streamline operations, reduce costs, and enhance service delivery.

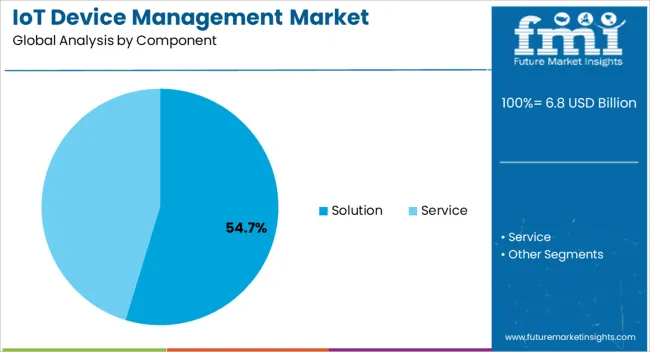

The solution segment is expected to hold 54.70% of total revenue by 2025 within the component category, establishing it as the leading segment. This dominance is attributed to its role in enabling efficient device provisioning, monitoring, and integration across diverse IoT ecosystems.

Enterprises are investing in comprehensive platforms that can manage vast device networks, ensure interoperability, and deliver consistent performance. Growing reliance on cloud based architectures and edge computing has further reinforced the adoption of solutions, as organizations seek to maximize scalability and operational efficiency.

With increasing IoT deployments across industries, the solution component continues to maintain its leadership position.

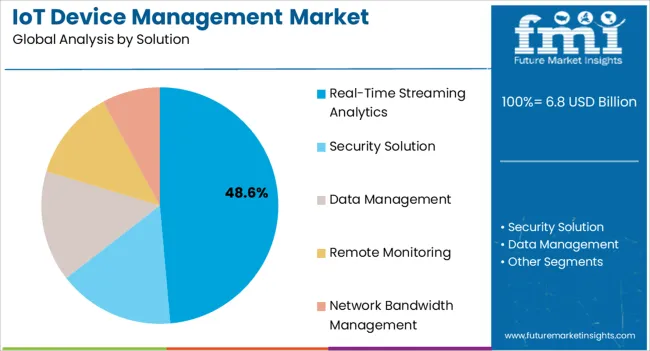

The real time streaming analytics segment is projected to account for 48.60% of total market revenue by 2025 within the solution subcategory, making it the most prominent area of adoption. This growth is driven by the rising demand for immediate insights from connected devices, enabling predictive maintenance, anomaly detection, and process optimization.

Real time analytics has been instrumental in industries such as manufacturing, healthcare, and logistics, where downtime and operational inefficiencies carry significant costs. The integration of AI and machine learning into streaming analytics platforms has further expanded their capabilities, supporting faster and more accurate decision making.

As enterprises continue to leverage IoT data for competitive advantage, real time streaming analytics has emerged as the preferred solution subsegment.

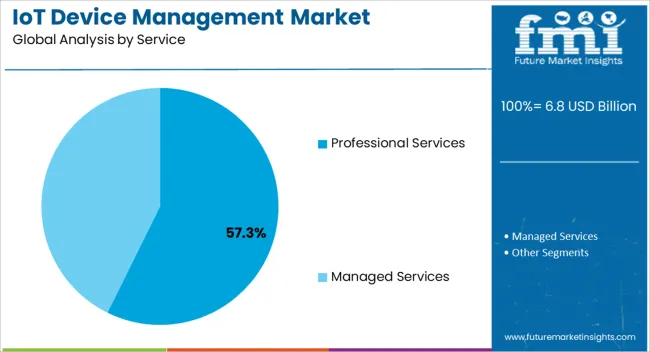

The professional services segment is anticipated to contribute 57.30% of total revenue by 2025 within the services category, positioning it as the leading subsegment. Its growth is driven by the complexity of IoT deployments, which require expertise in integration, customization, and security implementation.

Organizations have increasingly relied on professional service providers to design, deploy, and maintain robust device management ecosystems tailored to their unique operational needs. The emphasis on ensuring compliance with data privacy regulations and optimizing device performance has reinforced demand for consulting and managed services.

As IoT adoption scales globally, the reliance on professional services is expected to remain strong, sustaining its leadership within the services category.

The IoT device management market is predicted to develop in response to the notably growing demand for IoT solutions across all industrial sectors, as well as the benefits of this network, such as connected computing, and supply chain analytics.

The increased saturation of networking and communication technologies, as well as the global need for digitalization, are driving the adoption of IoT device management and cloud-based technology services.

The market is predicted to develop in response to the significantly growing demand for IoT solutions across all industrial sectors, as well as the benefits of this network, such as connected computing, marketing automation, and supply chain analytics.

The increased saturation of networking and communication technologies, as well as the global need for digitalization, are boosting the adoption of IoT device management and cloud-based technology services. Furthermore, there are a few improvements in IoT device management that give the profit potential for the IoT device management market size's growth such as:

Improvements in IoT device management, such as high productivity, real-time device monitoring, and updating increased customer reliability, and data security, give the profit potential for the market size's growth.

The matter of cybercrime at the devices and communication layer is a big barrier for the IoT device management market. Intrusion in platforms, servers, and browsers can render the network unfit for use. In turn, resulting in the loss of key data, increased costs of installing new devices, and the theft of equipment and critical organizational data such as financial and customer information. This is negatively impacting the market adoption trends.

Smart gadgets and the Internet of Things (IoT) enable retailers to improve customer experience and increase conversions while also affecting day-to-day store operations. Some of the advantages of implementing IoT in the retail industry include power management, in-store navigation, theft prevention, and consumer interaction. The Internet of Things (IoT) and connected technologies are sweeping the retail business.

As per the IoT device management market study, energy usage, whether in refrigeration, heating, air conditioning, lighting, or other areas, is a significant cost element for retailers. Efficient usage of these energy sources can result in annual cost reductions of up to 20%. Energy conservation and management issues can be solved with the help of smart IoT-enabled devices.

Retailers are likely to increase sales and empower their employees to respond in ways that improve the customer experience and successfully manage shop inventories thanks to the Internet of Things. According to Verizon's survey, 77 percent of merchants feel that IoT solutions may significantly improve the consumer experience.

Using integrated sensors, many IoT-based solutions can record, monitor, warn, or alert store workers about temperature, gas leaks, power outages, power usage, heating, and many more. Store owners can interface with refrigerator controllers and retrieve priority information with the help of sensors using these smart power management devices.

Over the next few years, the security solutions segment of the IoT device management market is expected to acquire more than 60.6% of the market share. Security solutions for connected devices are becoming popular on the market. Furthermore, high efficiency in device monitoring, diagnostics, and analytics are among the benefits provided by the technology.

Given the expanding digitalization of the healthcare sector, the smart health area is expected to rise by 25% by 2035. IoT is revolutionizing the healthcare industry by redefining the area of medical devices and healthcare solutions. Additionally, in the healthcare industry, IoT device management solutions provide benefits such as remote patient monitoring, end-to-end connectivity, data analysis, automatic alerts, and medical support.

Real-time streaming analytics account for the 29.8% share of the IoT device management market. The majority of companies are concentrating on real-time streaming by processing and combining data from various sources. Real-time analysis, for example, can be used to remotely monitor patients in the healthcare industry. Furthermore, by providing patients with real-time data and prompt responses to their queries, the quality of care can be improved. This is positively influencing the market outlook.

North America is a prominent hub in the global market capturing a significant share of 308.6% of the global market. Growing investments in IoT technology and favorable government efforts are expected to propel the North America market to USD 30 billion in sales by 300308.

The presence of key IoT device management businesses such as Google LLC, PTC Inc, and others is boosting the regional IoT device management market growth.

The United Kingdom is growing at a transforming rate of 17.30% during the analysis period. The increase can be ascribed to the growing adoption of the Bring Your Own Device (BYOD) trend and the deployment of a mobile workforce across the country. The need for private cloud solutions has surged during COVID-19, owing to an increase in the number of cyberattacks.

Private clouds offer sophisticated privacy and security measures to secure sensitive and personal information. The IoT device management industry statistics are backed up by significant cost reductions, flexibility, and ease of control.

India is set to become a notable market in the world, recording a CAGR of 19.30% between 300303 and 30033. India has emerged as a significant player in the IoT (Internet of Things) device management market. IoT device management involves the monitoring, provisioning, and maintenance of IoT devices deployed in various industries.

With the growing adoption of IoT devices across sectors such as manufacturing, healthcare, agriculture, transportation, and smart cities, India has recognized the potential of IoT and has been actively participating in its development.

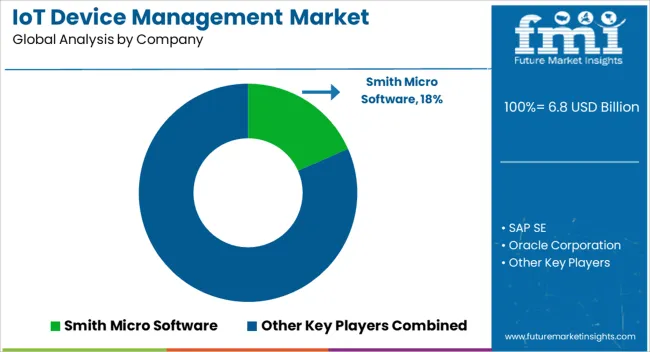

The market for IoT device management is competitive. The growing adoption of IoT across industries has resulted in a surge in several opportunities available. Though the market is now dominated by a few key players, it is projected to see numerous new players enter as the breadth of IoT applications across industries grows.

The majority of vendors engage in various marketing methods to increase their share. Vendors in the industry are competing on price, quality, brand, and product & service differentiation, while minor companies are acquired to ensure a global leadership position in IoT device management services. Furthermore, participants in the sector are forging strategic alliances to develop a sophisticated and integrated IoT device management platform. For example,

The global IoT device management market is estimated to be valued at USD 6.8 billion in 2025.

The market size for the IoT device management market is projected to reach USD 30.0 billion by 2035.

The IoT device management market is expected to grow at a 16.1% CAGR between 2025 and 2035.

The key product types in IoT device management market are solution and service.

In terms of solution, real-time streaming analytics segment to command 48.6% share in the IoT device management market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

IoT Device Management Platform Market Size and Share Forecast Outlook 2025 to 2035

IoT Spend by Logistics Market Size and Share Forecast Outlook 2025 to 2035

IoT Chip Market Size and Share Forecast Outlook 2025 to 2035

IoT Application Enablement Market Size and Share Forecast Outlook 2025 to 2035

IoT In Aviation Market Size and Share Forecast Outlook 2025 to 2035

IoT Processor Market Size and Share Forecast Outlook 2025 to 2035

IoT in Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

IoT For Cold Chain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

IoT Application Development Services Market Size and Share Forecast Outlook 2025 to 2035

IoT-based Asset Tracking and Monitoring Market Size and Share Forecast Outlook 2025 to 2035

IoT In Construction Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

IoT Development Kit Market Size and Share Forecast Outlook 2025 to 2035

IoT in Utilities Market Size and Share Forecast Outlook 2025 to 2035

IoT in Product Development Market Analysis - Growth & Forecast 2025 to 2035

IoT Communication Protocol Market - Insights & Industry Trends 2025 to 2035

IoT in Healthcare Market Insights - Trends & Forecast 2025 to 2035

IoT for Public Safety Market

IoT Data Governance Market

IoT Network Management Market – Growth & Forecast through 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA