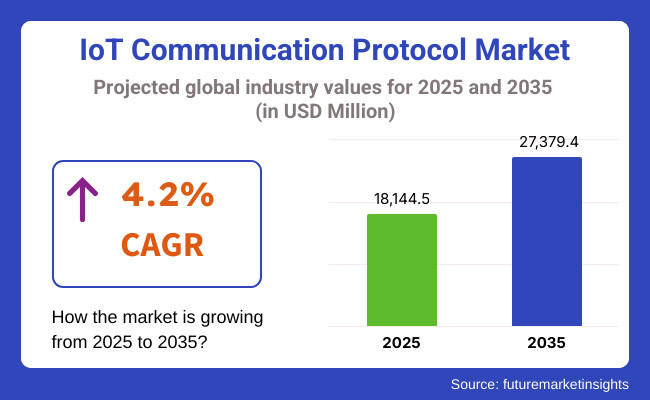

The IoT Communication Protocol Market is expected to witness significant growth between 2025 and 2035, driven by expanding IoT ecosystems, increasing adoption of smart devices, and the rising demand for seamless connectivity in industrial automation, healthcare, and smart cities. The market is projected to be valued at USD 18,144.5 million in 2025 and is anticipated to reach USD 27,379.4 million by 2035, reflecting a CAGR of 4.2% over the forecast period.

The growth of the LPWAN (Low-Power Wide-Area Network), 5G connectivity, and AI integrated network optimization is supporting the market. But, interoperability challenges, danger exposure, and high deployment cost are hindering the market growth. Improvements in software-defined networking (SDN), network slicing for IoT use cases, and self-governing device connectivity are supporting operational efficiencies and improved latency for real-time applications. The ongoing federation of multi-protocol IoT gateways: focused on reducing connectivity fragmentation in heterogeneous IoT ecosystems.

North America is expected to dominate the overall IoT communication protocols market, followed by Europe, in terms of adoption owing to the increasing adoption of industrial automation, smart infrastructure initiatives, and the presence of major IoT solution providers in the region.

As the top API provider and LPWA networks and IoT and private 5G sector scripting in the infrastructures, LPWAN and Networked sites in the USA and Canada. This, in turn, is fuelling demand for low-latency and high-bandwidth communications protocols further as IoT-driven healthcare applications, autonomous vehicle connectivity, and smart city projects grow.

Connectivity for IoT is booming across Europe, driven by regulatory structures favouring secure data, deployments of the smart grid, and funding of Industry 4.0 projects. Smart manufacturing, AI-integrated IoT networks, and standardization for cross-border IoT connectivity are led by countries like Germany, the UK, France and the Netherlands. GDPR-compliant IoT data transmission and secure IoT infrastructure are some of the key areas of innovation in the EU behind encrypted, decentralized IoT communication frameworks.

The Asia-Pacific market is estimated to be the fastest-growing market, largely due to extensive IoT adoption in China, Japan, India, and South Korea in consumer electronics, industrial automation, and urban infrastructure development.

China is rolling out its massive 5G and NB-IoT networks to drive smart city and industrial IoT growth, while Japan and South Korea are leading the charge into next-generation IoT networks to enable robotics, healthcare and smart transportation. The increasing adoption of LPWAN for agricultural and logistics IoT applications in India is also driving the market growth.

Challenges: Interoperability and Security Risks

While IoT connectivity is expanding, challenges such as protocol fragmentation, lack of universal standards, and cybersecurity threats remain key concerns. Additionally, scalability issues in handling massive IoT data volumes require advanced network management solutions.

Opportunities: AI-driven Network Optimization and 6G Integration

The rapid adoption of AI-based network optimization, use of digital twin-based active IoT network simulations, and blockchain-based IoT communication security is opening new avenues of growth. Autonomously coordinated devices with instantaneous communications using quantum-secured 6G connectivity would be another monumental achievement. Moreover, improvements in energy-efficient IoT protocols and self-healing networks boost IoT infrastructure resilience and cost efficiency.

The IoT communication protocol market has grown significantly from 2020 to 2024, led by the surge in the number of connected devices, the development of low-power wide-area networks (LPWANs), and the rise of 5G for IoT purposes.

Secure, low-latency, energy-efficient communication protocols began to dominate, particularly in applications such as industrial automation, smart cities, healthcare, and autonomous vehicles. MQTT, CoAP, Zigbee, and NB-IoT further improved the interoperability and real-time data exchange. Challenges to seamless IoT integration included cybersecurity vulnerabilities, congestion in the network, and the need for standardized protocol frameworks.

Transition Period 2025 to 2035: The age of AI-driven adaptive network protocols, quantum-secured IoT communication, and next-gen 6G on-demand IoT ecosystems. Blockchain-Backed Device Authentication, AI-Assisted Protocol Optimization, Edge-Intelligent IoT Networks etc. will add security and efficiency in IoT.

Innovations in self-learning Internet of Things (IoT) protocols, neuromorphic computing models for ultralow latency communication, and distributed autonomous networks of IoTs will spur even more changes to the industry. Further, AI-enabled real-time protocol switching, self-healing IoT networks, and energy-harvesting IoT communication systems will create new industry benchmarks for scalability, resilience, and sustainability.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with IEEE, IETF, and ITU-T IoT communication standards. |

| Technological Innovation | Use of LPWAN, Zigbee, Bluetooth Low Energy (BLE), and 5G IoT networks. |

| Industry Adoption | Growth in smart home automation, healthcare IoT, industrial IoT (IIoT), and connected transportation. |

| Smart & AI-Enabled Solutions | Early adoption of edge-computing-enabled IoT messaging, AI-assisted network traffic management, and real-time data synchronization. |

| Market Competition | Dominated by IoT protocol developers, network providers, and cloud service providers. |

| Market Growth Drivers | Demand fuelled by industrial automation, smart infrastructure projects, and real-time connected ecosystems. |

| Sustainability and Environmental Impact | Early adoption of low-power communication protocols, AI-assisted energy efficiency models, and network congestion reduction strategies. |

| Integration of AI & Digitalization | Limited AI use in network optimization, predictive maintenance, and real-time data processing. |

| Advancements in Network Infrastructure | Use of 5G, LoRaWAN, NB-IoT, and edge-computing-assisted IoT architectures. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter AI-driven compliance tracking, blockchain-backed device security mandates, and quantum-resistant cryptographic communication standards. |

| Technological Innovation | Adoption of AI-powered adaptive network protocols, quantum-encrypted IoT messaging, and self-optimizing neuromorphic IoT networks. |

| Industry Adoption | Expansion into AI-powered autonomous IoT ecosystems, bio-integrated IoT devices, and decentralized IoT infrastructure with self-learning protocols. |

| Smart & AI-Enabled Solutions | Large-scale deployment of AI-driven real-time protocol switching, autonomous network self-healing, and neuromorphic computing-based IoT traffic optimization. |

| Market Competition | Increased competition from AI-integrated IoT communication firms, quantum-assisted cybersecurity providers, and decentralized peer-to-peer IoT network developers. |

| Market Growth Drivers | Growth driven by AI-powered dynamic network adaptation, energy-harvesting IoT communication devices, and fully autonomous IoT networks. |

| Sustainability and Environmental Impact | Large-scale transition to zero-energy IoT communication systems, AI-driven sustainable network management, and biodegradable sensor-integrated communication frameworks. |

| Integration of AI & Digitalization | AI-powered self-evolving network protocols, blockchain-backed IoT transaction security, and fully decentralized autonomous IoT ecosystems. |

| Advancements in Network Infrastructure | Evolution of 6G-enabled quantum communication, AI-driven holographic IoT networking, and bio-inspired self-learning IoT network frameworks. |

The USA continues to be a large market for IoT communication protocols, supported by the growing use of smart devices, the booming industrial IoT (IIoT) sector, and considerable investments in 5G and edge computing. The proliferation of smart homes, connected healthcare, and autonomous vehicle ecosystems are driving the need for efficient and secure IoT communication protocols.

Moreover, the continued advancements of AI frameworks for network management and security measures also promises to bolster the resilience of IoT infrastructure. A key trend shaping the market includes the growing significance of LPWAN and private 5G networks in industrial automation.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.5% |

UK IoT communication protocol market is growing steadily, owing to the increasing adoption of smart city projects coupled with the rising installation of IoT-enabled energy management systems and stringent government policies promoting digital transformation. The advances of connected manufacturing, and Industry 4.0 solutions, have created the need for new strong and low-latency communication protocols.

Moreover, the growing importance of blockchain for ensuring IoT communication security and edge AI-driven data processing is also shaping the market where it is heading. The growth of hybrid IoT networking models comprising Wi-Fi, LPWAN, and cellular IoT is complementing this industry further.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.0% |

Germany, France, and the Netherlands are projected to dominate the market in the European Union, thanks to stronger industrial automation trends, adoption of smart grid technology, and rise in investments in AI-powered IoT infrastructure.

The EU's emphasis on data sovereignty and cybersecurity rules are accelerating the creation of standardized secure IoT communication frameworks. Research advancements in 6G and the development of edge computing are creating opportunity for more verticals to be involved with the further growth of edge computing and the market. Moreover, adoption of IoT in supply chain optimization and predictive maintenance solutions is further anticipated to boost the industry growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.3% |

Japan's IoT communication protocol industries show continuous growth owing to the growing inclination towards smart factory automation, increasing government investments in 5G and beyond-5G (B5G) networks and growing penetration of IoT for aging population care and smart healthcare solutions. Advancements in ultra-reliable, low-latency communication protocols can be seen in the country’s leadership in robotics, AI-driven IoT applications.

Moreover, the adoption of quantum-safe cryptography will impact market trends in IoT security frameworks segment. Autonomous infrastructure is growing in public transit and disaster response enabled by IoT technology, also affecting the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

In South Korea, it is becoming a strong market for the IoT communication protocols due to the substantial government investments for smart city developments, the rising deployment of 5G IoT networks, and the growing usage of AI-enhanced IoT data analytics platforms. Market growth is driven by the country concentrating on developing low-latency and high-security IoT communication frameworks.

Moreover, growth of connected healthcare’s app with smart home automation will grow the adoption of multi protocols IoT Gateways. Market adoption is also benefiting from the growth of quantum computing research and its potential role in IoT network security.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

Wi-Fi and Bluetooth Lead Market Adoption as IoT Connectivity Solutions Evolve

Both the Wi-Fi and Bluetooth segments have seen robust growth for their scalability, reliability, and simultaneous support for multiple IoT devices. These protocols are used in smart homes, connected cars, wearable technology, industrial automation, and smart healthcare ecosystems because they enable high-speed connectivity, simple and cost-effective implementation, and effortless device integration.

Wi-Fi Technology Leads IoT Communication Market as Smart Device Adoption Surges

Wi-Fi became the most widely used IoT communication protocol, thanks to its high data transfer rate, availability of networks, and strong information security protocols. Wi-Fi stands out among other communication technologies due to its interoperability of devices, which provides excellent support for real-time IoT applications in homes, industries, and public infrastructure.

The proliferation of Wi-Fi driven IoT solutions, incorporating mesh networking, cloud integration and AI-based network optimization, has also intensified the market demand which assist in providing improved flexibility and scalability. The adoption has been further accelerated with power up of AI driven solutions for detecting malicious threats and monitoring real-time anomalies, integrated with Wi-Fi solutions and supporting authenticating devices over blockchain.

Power-efficient Wi-Fi chipsets with specific IoT optimizations, ultra-low-power connectivity modes, and edge AI processing capabilities have facilitated market growth by extending the working life of the connected device battery and operational efficiency. Although it has benefits over high-speed connectivity, ubiquity, and a robust security infrastructure, the Wi-Fi segment is challenged by things like network congestion, power drainage and compatibility issues in high-density IoT setting.

Bluetooth Technology Gains Popularity as Low-Power IoT Applications Expand

Among all the segments, Bluetooth is witnessing the strong growth in the market as IoT manufactures required the energy efficient and short-range connectivity solution for wearables, medical, industrial sensor, etc. On the other hand, Bluetooth technology provides low-power wireless communications which helps continuous connection between devices for a long time without quickly running down batteries.

The rising adoption of Bluetooth Low Energy (BLE) technology, with low power consumption, long-range capabilities, and support for pairing several devices, has propelled market growth. Market demand could also be supported by the increase of Bluetooth-based IoT ecosystems and advancements such as smart beacons, proximity-based services, and AI-driven proximity devices.

Furthermore, the adoption of mesh networking for Bluetooth IoT applications, coupled with self-healing network architectures, and AI-enhanced data routing and decentralized connectivity protocols, has strongly contributed to the adoption rate, providing scalable and resilient IoT deployments.

Various solutions of next-generation Bluetooth 5.3, with stronger and more stable signal, less interference, and more stable connection optimized market growth stimulation, to ensure further extensive use in industrial and healthcare Internet of things.

However, while Bluetooth also offers benefits such as low-power connectivity, short-range efficiency, and device pairing, the Bluetooth segment grapples with limited bandwidth, interference issues & scalability concerns for larger IoT deployments.

Bluetooth 6.0, AI-driven frequency adjustment, and multiprotocol IoT chipsets have all ushered in new technologies to improve the efficiency of networks around either IoT or edge and cloud computing facilities, the compatibility of devices, and the robustness of connections make the market for Bluetooth-based IoT communication-enhancing solutions worldwide continue to grow through 2035.

Consumer Electronics Leads Market Growth as Smart Devices Gain Traction

Rising demand for smart home automation, wearable technology, and AI-powered personal assistants is propelling the consumer electronics segment to become the leading application area of IoT communication protocols.

Market demand has been driven by the growing adoption of IoT-enabled consumer electronics, including smart TVs, connected appliances, and AI-driven virtual assistants. The increasing adoption of wireless audio and video streaming solutions, including Wi-Fi-enabled media sharing, Bluetooth-connected home theatres, and voice recognition powered by artificial intelligence (AI) have bolstered the market demand, delivering immersive and intelligent entertainment experiences.

The growing implementation of IoT-based Home Automation systems with smart thermostats, AI-enabled camera with cloud light control which helped even more with adoption of the technology to offer easy and efficient management of home.

The evolution of next-generation IoT chipsets with multi-protocol capabilities, edge AI processing, and end-to-end real-time security encryption have maximized market growth for them, allowing for greater device interaction and data protection.

Automotive & Transportation Expands as Connected Vehicle Technologies Advance

The Automotive & Transportation segment remains among the fastest growing in the market as automobile, in particular, are adopting IoT enabled communication systems communicating with vehicles as well as real-time fleet tracking systems and predictive maintenance capabilities powered by AI.

As many vehicle-to-everything communication, Wi-Fi-enabled infotainment systems, Bluetooth-enabled vehicular diagnostics, and AI-based telematics pieces of the solution come to the forefront, this segment eagerly anticipated it and drove the market expansion. The rapid growth of smart transportation infrastructure characterized by Internet of Things (IoT)-based traffic control, AI-based automobile monitoring, and cloud-based fleet management has bolstered market demand by providing uninterrupted accessibility solution and lessening congestion.

The next generation of automotive connectivity systems, including 5G-powered IoT sensors, AI-enhanced vehicle diagnostics and blockchain-backed data security, further increases adoption of safe and efficient connected mobility.

While it has the potential to improve vehicle automation, road safety, and fleet management in the Automotive & Transportation segment, it also faces challenges, including high implementation costs, cybersecurity threats, and data transmission latency. Nevertheless, emerging innovations such as edge AI-powered vehicle analytics, decentralized IoT-based navigation systems and hybrid connectivity models are enhancing efficiency, security and real-time communication on road, thus assuring sustained growth in the automotive and transportation IoT-enabled solutions market worldwide.

Key factors fuelling the growth of the IoT communication protocol market include the rising number of connected devices, rapid advancements in wireless communication technologies, and the growing demand for secure and scalable data transmission. As its applications extend to smart homes, industrial automation, and healthcare, the market is seeing rapid growth. Break-out trends include low-power wide-area networks (LPWAN), integration with edge computing, and AI-powered communication management of IoT devices.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Qualcomm Technologies, Inc. | 12-16% |

| Texas Instruments Inc. | 10-14% |

| Cisco Systems, Inc. | 8-12% |

| NXP Semiconductors | 6-10% |

| STMicroelectronics | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Qualcomm Technologies, Inc. | Develops 5G-enabled IoT communication protocols with enhanced data security and low latency. |

| Texas Instruments Inc. | Specializes in ultra-low-power wireless IoT protocols for industrial and consumer applications. |

| Cisco Systems, Inc. | Offers secure IoT network solutions with cloud-based communication protocol management. |

| NXP Semiconductors | Focuses on edge computing and real-time IoT communication for automotive and industrial sectors. |

| STMicroelectronics | Provides embedded IoT communication chipsets with support for multiple wireless standards. |

Key Company Insights

Qualcomm Technologies, Inc. (12-16%) Qualcomm leads in 5G-based IoT communication protocols, enabling ultra-fast and secure connectivity for smart devices.

Texas Instruments Inc. (10-14%) Texas Instruments specializes in ultra-low-power IoT communication solutions, optimizing battery life for connected applications.

Cisco Systems, Inc. (8-12%) Cisco focuses on secure, scalable IoT network communication protocols, integrating cloud and edge computing technologies.

NXP Semiconductors (6-10%) NXP pioneers real-time IoT communication for automotive and industrial automation, enhancing edge computing efficiency.

STMicroelectronics (4-8%) STMicroelectronics develops embedded wireless IoT solutions, supporting multiple communication protocols for seamless integration.

Other Key Players (45-55% Combined) Several semiconductor and network technology providers contribute to the expanding IoT Communication Protocol Market. These include:

The overall market size for the IoT communication protocol market was USD 18,144.5 million in 2025.

The IoT communication protocol market is expected to reach USD 27,379.4 million in 2035.

The demand for IoT communication protocols will be driven by increasing adoption of smart devices and connected ecosystems, rising need for low-power and high-efficiency communication standards, growing deployment of industrial IoT (IIoT) solutions, and advancements in wireless and 5G communication technologies.

The top 5 countries driving the development of the IoT communication protocol market are the USA, China, Germany, Japan, and South Korea.

The Wireless IoT Communication Protocols segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ billion) Forecast by Region, 2017 to 2032

Table 2: Global Market Value (US$ billion) Forecast by Type, 2017 to 2032

Table 3: Global Market Value (US$ billion) Forecast by Application, 2017 to 2032

Table 4: North America Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 5: North America Market Value (US$ billion) Forecast by Type, 2017 to 2032

Table 6: North America Market Value (US$ billion) Forecast by Application, 2017 to 2032

Table 7: Latin America Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 8: Latin America Market Value (US$ billion) Forecast by Type, 2017 to 2032

Table 9: Latin America Market Value (US$ billion) Forecast by Application, 2017 to 2032

Table 10: Europe Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 11: Europe Market Value (US$ billion) Forecast by Type, 2017 to 2032

Table 12: Europe Market Value (US$ billion) Forecast by Application, 2017 to 2032

Table 13: Asia Pacific Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 14: Asia Pacific Market Value (US$ billion) Forecast by Type, 2017 to 2032

Table 15: Asia Pacific Market Value (US$ billion) Forecast by Application, 2017 to 2032

Table 16: Middle East and Africa Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 17: Middle East and Africa Market Value (US$ billion) Forecast by Type, 2017 to 2032

Table 18: Middle East and Africa Market Value (US$ billion) Forecast by Application, 2017 to 2032

Figure 1: Global Market Value (US$ billion) by Type, 2022 to 2032

Figure 2: Global Market Value (US$ billion) by Application, 2022 to 2032

Figure 3: Global Market Value (US$ billion) by Region, 2022 to 2032

Figure 4: Global Market Value (US$ billion) Analysis by Region, 2017 to 2032

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 7: Global Market Value (US$ billion) Analysis by Type, 2017 to 2032

Figure 8: Global Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 9: Global Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 10: Global Market Value (US$ billion) Analysis by Application, 2017 to 2032

Figure 11: Global Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 12: Global Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 13: Global Market Attractiveness by Type, 2022 to 2032

Figure 14: Global Market Attractiveness by Application, 2022 to 2032

Figure 15: Global Market Attractiveness by Region, 2022 to 2032

Figure 16: North America Market Value (US$ billion) by Type, 2022 to 2032

Figure 17: North America Market Value (US$ billion) by Application, 2022 to 2032

Figure 18: North America Market Value (US$ billion) by Country, 2022 to 2032

Figure 19: North America Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 22: North America Market Value (US$ billion) Analysis by Type, 2017 to 2032

Figure 23: North America Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 24: North America Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 25: North America Market Value (US$ billion) Analysis by Application, 2017 to 2032

Figure 26: North America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 27: North America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 28: North America Market Attractiveness by Type, 2022 to 2032

Figure 29: North America Market Attractiveness by Application, 2022 to 2032

Figure 30: North America Market Attractiveness by Country, 2022 to 2032

Figure 31: Latin America Market Value (US$ billion) by Type, 2022 to 2032

Figure 32: Latin America Market Value (US$ billion) by Application, 2022 to 2032

Figure 33: Latin America Market Value (US$ billion) by Country, 2022 to 2032

Figure 34: Latin America Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 37: Latin America Market Value (US$ billion) Analysis by Type, 2017 to 2032

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 40: Latin America Market Value (US$ billion) Analysis by Application, 2017 to 2032

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 43: Latin America Market Attractiveness by Type, 2022 to 2032

Figure 44: Latin America Market Attractiveness by Application, 2022 to 2032

Figure 45: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 46: Europe Market Value (US$ billion) by Type, 2022 to 2032

Figure 47: Europe Market Value (US$ billion) by Application, 2022 to 2032

Figure 48: Europe Market Value (US$ billion) by Country, 2022 to 2032

Figure 49: Europe Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 52: Europe Market Value (US$ billion) Analysis by Type, 2017 to 2032

Figure 53: Europe Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 55: Europe Market Value (US$ billion) Analysis by Application, 2017 to 2032

Figure 56: Europe Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 57: Europe Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 58: Europe Market Attractiveness by Type, 2022 to 2032

Figure 59: Europe Market Attractiveness by Application, 2022 to 2032

Figure 60: Europe Market Attractiveness by Country, 2022 to 2032

Figure 61: Asia Pacific Market Value (US$ billion) by Type, 2022 to 2032

Figure 62: Asia Pacific Market Value (US$ billion) by Application, 2022 to 2032

Figure 63: Asia Pacific Market Value (US$ billion) by Country, 2022 to 2032

Figure 64: Asia Pacific Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 65: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 66: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 67: Asia Pacific Market Value (US$ billion) Analysis by Type, 2017 to 2032

Figure 68: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 69: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 70: Asia Pacific Market Value (US$ billion) Analysis by Application, 2017 to 2032

Figure 71: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 72: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 73: Asia Pacific Market Attractiveness by Type, 2022 to 2032

Figure 74: Asia Pacific Market Attractiveness by Application, 2022 to 2032

Figure 75: Asia Pacific Market Attractiveness by Country, 2022 to 2032

Figure 76: Middle East and Africa Market Value (US$ billion) by Type, 2022 to 2032

Figure 77: Middle East and Africa Market Value (US$ billion) by Application, 2022 to 2032

Figure 78: Middle East and Africa Market Value (US$ billion) by Country, 2022 to 2032

Figure 79: Middle East and Africa Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 80: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 81: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 82: Middle East and Africa Market Value (US$ billion) Analysis by Type, 2017 to 2032

Figure 83: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 84: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 85: Middle East and Africa Market Value (US$ billion) Analysis by Application, 2017 to 2032

Figure 86: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 87: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 88: Middle East and Africa Market Attractiveness by Type, 2022 to 2032

Figure 89: Middle East and Africa Market Attractiveness by Application, 2022 to 2032

Figure 90: Middle East and Africa Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

IoT Spend by Logistics Market Size and Share Forecast Outlook 2025 to 2035

IoT Chip Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Market Size and Share Forecast Outlook 2025 to 2035

IoT Application Enablement Market Size and Share Forecast Outlook 2025 to 2035

IoT In Aviation Market Size and Share Forecast Outlook 2025 to 2035

IoT Processor Market Size and Share Forecast Outlook 2025 to 2035

IoT in Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

IoT For Cold Chain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

IoT Application Development Services Market Size and Share Forecast Outlook 2025 to 2035

IoT Connectivity Management Platform Market Size and Share Forecast Outlook 2025 to 2035

IoT-based Asset Tracking and Monitoring Market Size and Share Forecast Outlook 2025 to 2035

IoT In Construction Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Platform Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

IoT Development Kit Market Size and Share Forecast Outlook 2025 to 2035

IoT in Utilities Market Size and Share Forecast Outlook 2025 to 2035

IoT in Product Development Market Analysis - Growth & Forecast 2025 to 2035

IoT in Healthcare Market Insights - Trends & Forecast 2025 to 2035

IoT Network Management Market – Growth & Forecast through 2034

IoT for Public Safety Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA