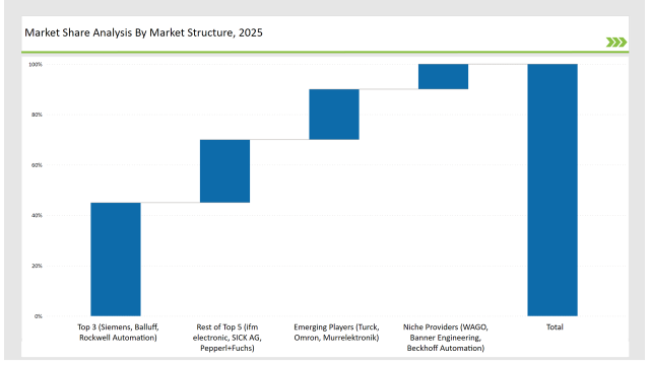

The I/O-Link market is expanding rapidly as industries adopt intelligent communication protocols to enhance automation, improve interoperability, and enable real-time data exchange. Leading vendors such as Siemens, Balluff, and Rockwell Automation dominate the market, collectively holding 45% market share with their innovative sensor-actuator communication solutions and seamless integration with industrial automation platforms.

Second-tier players, including ifm electronic, SICK AG, and Pepperl+Fuchs, capture 25% market share, focusing on smart factory solutions and optimized field-level communication. Emerging players such as Turck, Omron, and Murrelektronik account for 20%, driving adoption through cost-effective, flexible, and scalable I/O-Link solutions. Niche vendors such as WAGO, Banner Engineering, and Beckhoff Automation hold 10%, catering to specialized use cases in factory automation, robotics, and industrial networking.

Explore FMI!

Book a free demo

| Category | Industry Share (%) |

|---|---|

| Top 3 (Siemens, Balluff, Rockwell Automation) | 45% |

| Rest of Top 5 (ifm electronic, SICK AG, Pepperl+Fuchs) | 25% |

| Emerging Players (Turck, Omron, Murrelektronik) | 20% |

| Niche Providers (WAGO, Banner Engineering, Beckhoff Automation) | 10% |

The I/O-Link Market remains moderately concentrated, with leading firms collectively controlling 60-70% market share. Industry leaders such as Siemens, Balluff, and Rockwell Automation define technological advancements, compliance standards, and pricing strategies, creating moderate barriers for new entrants.

Hardware dominates due to the widespread deployment of I/O-Link sensors, hubs, and actuators in factory automation and industrial robotics. Siemens and Balluff lead in this segment with robust I/O-Link master modules and advanced sensor-actuator connectivity solutions.

Software tools, accounting for 25%, are growing due to the demand for real-time monitoring, predictive maintenance, and device parameterization tools. Vendors like ifm electronic and Rockwell Automation specialize in I/O-Link diagnostic tools that optimize industrial operations.

Services contribute 20%, encompassing installation, integration, and maintenance of I/O-Link solutions. SICK AG and Pepperl+Fuchs lead in offering customized I/O-Link deployment services for manufacturing and logistics.

Handling & Assembly Automation (30%): The largest segment, driven by the adoption of I/O-Link-enabled robots and smart actuators in automotive and electronics industries. Siemens and Rockwell Automation lead in intelligent factory automation solutions.

Packaging (25%): The rise in automated packaging and material handling has led to increased use of I/O-Link sensors and controllers. Balluff and ifm electronic provide precise position monitoring and smart conveyor tracking.

Machine Tools (20%): The demand for CNC machines, presses, and cutting tools using I/O-Link-integrated monitoring and control is growing. Pepperl+Fuchs and Omron specialize in real-time diagnostics and performance optimization tools.

Intralogistics (15%): Smart warehouse automation, conveyor systems, and AGVs (Automated Guided Vehicles) leverage I/O-Link for real-time asset tracking and predictive maintenance. Turck and Murrelektronik lead in providing modular I/O-Link-enabled logistics solutions.

Others (10%): Applications in food & beverage processing, pharmaceuticals, and water treatment plants are increasing, with Beckhoff Automation and WAGO focusing on niche solutions for environmental monitoring and industrial safety.

Advanced Automation Reshapes Industrial Networks

Modern automation systems have transformed industrial operations through enhanced real-time analytics. Manufacturing facilities now leverage sophisticated algorithms to process sensor data, enabling smarter decision-making and improved production efficiency. These systems continuously analyze equipment performance, adjusting parameters automatically to maintain optimal operating conditions.

Remote Monitoring Transforms Industrial Operations

Cloud platforms have revolutionized industrial monitoring capabilities. Plant managers access device data from anywhere, configuring equipment settings and tracking performance metrics through secure online dashboards. This remote accessibility enables rapid response to maintenance needs and helps prevent costly downtime through early detection of potential issues.

Enhanced Security Protects Smart Manufacturing

Industrial networks have evolved to incorporate robust security measures, protecting critical manufacturing data and operations. Modern protocols defend against unauthorized access while maintaining seamless communication between devices. These security frameworks prove essential as factories become increasingly connected and automated.

Wireless Technology Advances Factory Communication

The latest wireless solutions have eliminated traditional wiring constraints in industrial settings. Manufacturing facilities now deploy sensors and automation equipment with greater flexibility, reducing installation complexity and maintenance costs. This wireless approach allows rapid reconfiguration of production lines while maintaining reliable communication between devices.

Expanded Applications Drive Industrial Innovation

The reach of industrial communication networks continues to grow beyond traditional manufacturing. Healthcare facilities use automated tracking systems for medical equipment and supplies. Retail distribution centers employ smart sensors for inventory management. Urban infrastructure projects integrate connected devices for efficient monitoring and control of city services. These diverse applications demonstrate the versatility and value of modern industrial networking technology.

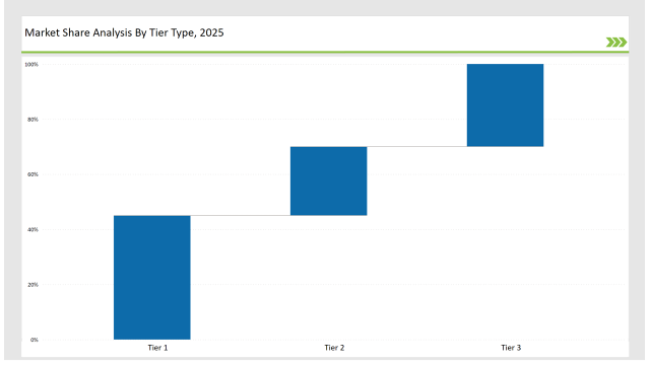

| Tier | Tier 1 |

|---|---|

| Vendors | Siemens, Balluff, Rockwell Automation |

| Consolidated Market Share (%) | 45% |

| Tier | Tier 2 |

|---|---|

| Vendors | ifm electronic, SICK AG, Pepperl+Fuchs |

| Consolidated Market Share (%) | 25% |

| Tier | Tier 3 |

|---|---|

| Vendors | Turck, Omron, Murrelektronik, WAGO, Beckhoff Automation |

| Consolidated Market Share (%) | 30% |

| Vendor | Key Focus |

|---|---|

| Siemens | Advancing AI-driven I/O-Link data analytics & cloud integration. |

| Balluff | Expanding wireless I/O-Link and predictive maintenance tools. |

| Rockwell Automation | Developing real-time diagnostics & cybersecurity for I/O-Link. |

| ifm electronic | Enhancing edge computing capabilities for smart automation. |

| Pepperl+Fuchs | Strengthening industrial connectivity with robust I/O-Link gateways. |

Next-Generation Automation Solutions

Advanced automation capabilities greatly enhance industrial operations through sophisticated machine learning systems. These technologies deliver improved predictive maintenance outcomes while minimizing operational disruptions. The integration of smart algorithms enables manufacturing facilities to achieve unprecedented levels of efficiency and productivity.

Remote Monitoring and Cloud Integration

The industrial sector increasingly demands robust remote monitoring capabilities and cloud-based analytics platforms. Modern wireless solutions provide the necessary infrastructure for expanded scalability in manufacturing environments. These advancements enable real-time data collection and analysis across distributed industrial operations.

Advanced Security Protocols

Manufacturing facilities require comprehensive security measures to protect critical industrial networks. Implementing multi-layered protection helps maintain data integrity throughout automated systems. Regular security audits and updates ensure industrial operations remain protected against emerging threats.

Expanding Market Applications

The evolution of industrial automation creates valuable opportunities across diverse sectors. Healthcare facilities benefit from precise monitoring and control systems. Smart city infrastructure leverages automated processes for improved efficiency. Digital logistics operations achieve enhanced tracking and management capabilities through modern automation platforms.

System Integration and Connectivity

Seamless integration between operational technologies delivers significant advantages for manufacturing facilities. Connection to industrial IoT platforms enables comprehensive monitoring and control. Integration with existing SCADA and MES implementations creates cohesive automation ecosystems. This technological convergence supports end-to-end visibility and management of industrial processes.

The rise of wireless and cloud-based IO-Link applications has introduced greater flexibility into industrial automation processes. These technological advancements enable manufacturing facilities to scale operations more effectively while maintaining robust connectivity across their systems.

The scope of IO-Link applications continues to expand beyond traditional manufacturing. Healthcare facilities have integrated IO-Link solutions to enhance medical equipment monitoring and maintenance. Smart city initiatives leverage these systems for infrastructure management, while digital logistics operations depend on IO-Link technology for precise inventory tracking and warehouse automation. This diversification has prompted manufacturers to develop specialized IO-Link solutions that address the unique requirements of each sector.

Leading vendors Siemens, Balluff, and Rockwell Automation control 45% of the market.

Emerging players Turck, Omron, and Murrelektronik hold 20% of the market.

Niche providers WAGO, Banner Engineering, and Beckhoff Automation hold 10% of the market.

The top 5 vendors (Siemens, Balluff, Rockwell Automation, ifm electronic, and SICK AG) control 70% of the market.

Market concentration is categorized as medium, with the top 10 players controlling 70% of the market.

Electric Switches Market Insights – Growth & Forecast 2025 to 2035

Electrical Bushings Market Trends – Growth & Forecast 2025 to 2035

Edge Server Market Trends – Growth & Forecast 2025 to 2035

Eddy Current Testing Market Growth – Size, Demand & Forecast 2025 to 2035

3D Motion Capture Market by System, Component, Application & Region Forecast till 2035

IP PBX Market Analysis by Type and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.