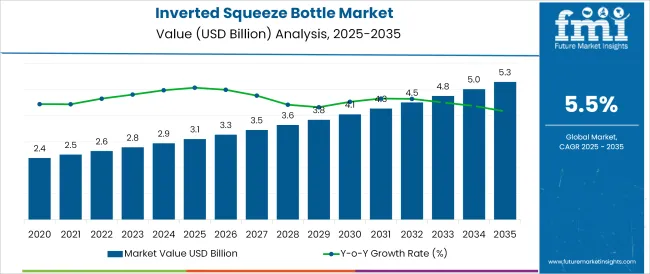

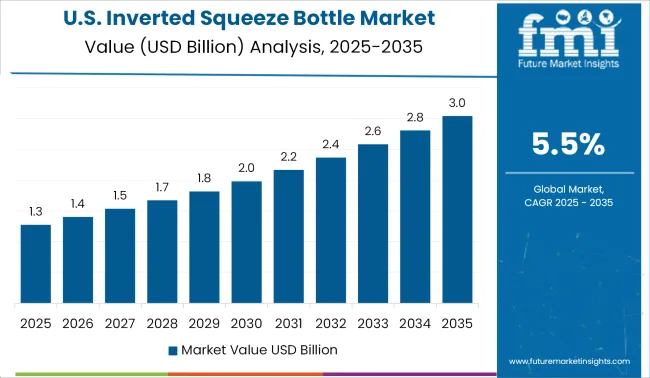

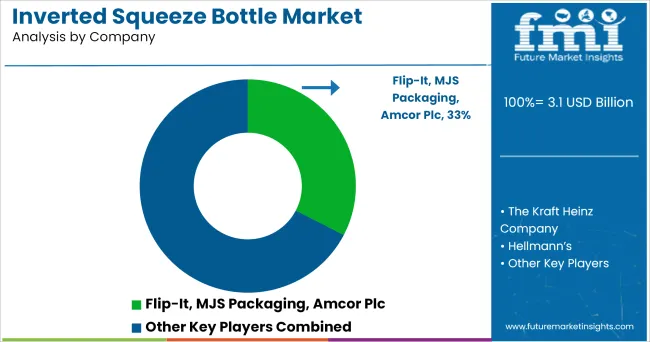

The Inverted Squeeze Bottle Market is estimated to be valued at USD 3.1 billion in 2025 and is projected to reach USD 5.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

The inverted squeeze bottle market is experiencing significant growth, supported by evolving consumer preferences for convenient, mess-free dispensing and rising demand across food, personal care, and household product segments. This packaging format has gained favor for its user-centric design that ensures product flow until the last drop, reducing waste and improving customer satisfaction. Increasing adoption of thicker formulations like sauces, creams, and gels has driven preference for inverted designs over traditional upright bottles.

Brands are focusing on improving ergonomic designs and closure systems, while incorporating recyclable materials to meet sustainability goals. Regulatory pressure for reduced packaging waste and growing adoption of reusable or refillable dispensing formats, particularly in North America and Europe, have further contributed to market expansion.

As consumers seek packaging solutions that combine ease-of-use, hygiene, and product longevity, inverted squeeze bottles are becoming integral to brand differentiation strategies across industries.

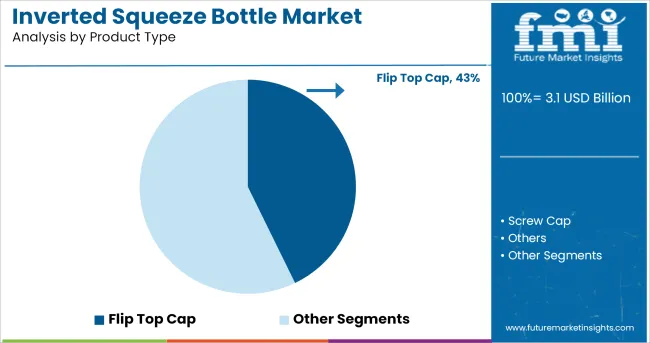

It is noted that the flip top cap sub-segment holds a 42.80% revenue share in 2025 within the product type category, establishing its dominance in the market. This position has been supported by its superior convenience, hygiene, and leak-resistant design that aligns with on-the-go consumption trends.

The flip top cap allows for single-handed operation, which enhances usability across food, personal care, and household products. Manufacturers have increasingly adopted this format to improve user experience and minimize contamination risks.

The compatibility of flip top caps with various viscosities has also broadened their application range. As brand owners prioritize intuitive packaging that maintains product freshness while improving shelf visibility, the flip top cap has emerged as the preferred closure system, reinforcing its lead in the segment.

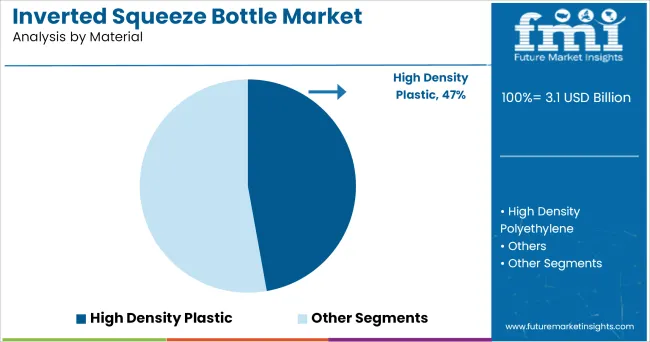

High density plastic accounts for 47.20% of total market revenue in 2025 within the material segment, making it the leading material choice for inverted squeeze bottles. This preference has been influenced by its high strength-to-density ratio, excellent barrier properties, and resilience during repeated use.

Its compatibility with food-safe manufacturing processes and recyclability under standard protocols have further reinforced its appeal. Brands have increasingly relied on high density plastic to ensure structural integrity, reduce weight, and meet sustainability objectives without compromising performance.

The material’s adaptability to complex moldings and cost-efficiency in mass production has enabled its wide adoption across both premium and mass-market product lines. These factors collectively support its continued dominance in the material segment.

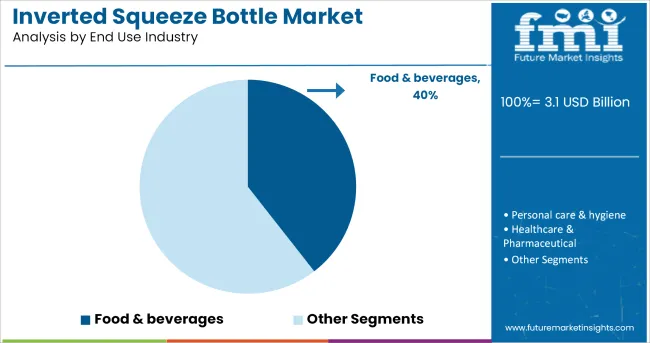

The food & beverages sector is projected to contribute 39.50% of the market revenue by 2025 under the end use industry segment, positioning it as the leading application area.

This growth has been driven by rising demand for convenient and hygienic dispensing of condiments, sauces, spreads, and syrups. Inverted squeeze bottles are increasingly preferred in this segment due to their ability to deliver precise portions, minimize product residue, and extend shelf life. Additionally, the shift toward ready-to-use and on-the-go consumption formats has accelerated demand for packaging that is both functional and aesthetically aligned with evolving consumer lifestyles.

The format supports efficient storage and branding, enabling food manufacturers to cater to retail and foodservice markets effectively. As regulatory scrutiny increases around food safety and packaging waste, inverted squeeze bottles offer a compelling combination of utility, compliance, and sustainability—solidifying their role as a packaging mainstay in the food and beverages industry.

Several factors are predicted to drive growth in the worldwide inverted squeeze bottle industry. Squeeze bottles are used in a variety of industries, including food, drinks, healthcare and pharmaceuticals, personal care, and so on.

For usage with the latest inverted dispensing system seals, upturned squeeze bottles are utilized. Plastic squeeze bottles are also gaining popularity in the household cleaner sector, where they provide the same directional and portion-controlled dispensing features.

Upturned squeeze bottle are popular for spices like ketchup, but they're made of flexible film rather than solid plastic. Squeeze bottle are used for toppings, dairy goods including sour cream and yoghurt, salad dressings, spreads, honey, and jellies.

Upturned squeeze bottles benefit consumers, businesses, and even the environment. Consumers benefit from having more control over how much product comes out of the package. Thus, such benefits is driving demand for the upturned squeeze bottle.

A prominent trend in the inverted squeeze bottle market is the eco-friendly trend. Inverted squeeze flasks weigh less and have substantially less air space than rigid plastic packaging. As a result, they take up much less space, cost cheaper, and spend less to ship each unit. Finally, because the packaging is more sanitized than traditional packaging, items have a longer shelf life, reducing food waste for both brands and individual consumers.

Furthermore, various brands are creating the inverted squeeze flask as a result of positive demand for squeeze bottles due to its advantages. Hellmann's Mayonnaise, for example, has launched a fresh new and better squeeze package that allows customers to pour the last droplets of product from their mayonnaise bottles. The bottle is made of inverted PET and sits on a flared polypropylene cap with two parts: a precision tip in blue and a clear flip-top over cap.

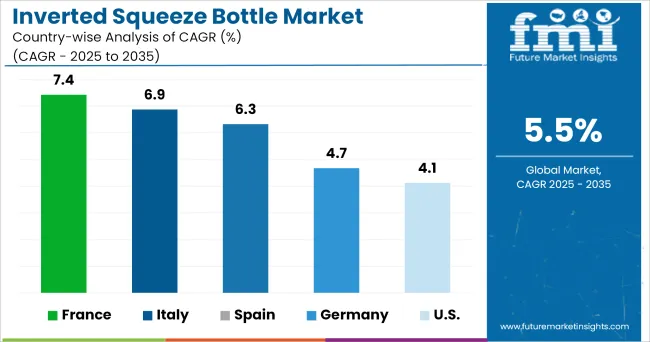

The United States is the most valuable market for inverted squash bottles in the world. The food culture of the United States is very distinct from that of other regions, since they eat burgers and pizza as a snack, and they are more concerned with the toppings such as ketchup.

The consumers expect more developed and innovative squeeze bottles. Furthermore, companies began inventing ketchup tastes based on consumer taste and preferences. Melinda's brand, for example, provides five sizzling flavors: Habanero, Ghost, Chipotle, Jalapeo, and Black Pepper.

The growing popularity of spicy and ethnic foods, America's rapidly expanding population of Central, South American, and Caribbean immigrants, the widely recognized health benefits of chile peppers, and the growing purchasing power of Millennials, who are more likely to experiment with new spices and flavour features, all contributed to the high demand for these products.

Although European cuisines varies from country to country, there are some basic qualities that distinguish European foods from, example, Asian cuisines. Wheat flour, as well as numerous types of dumplings, pasta, and pastries, are the most common sources of starch in the kitchen. Sauces and spices are commonly used as condiments in most European countries.

Thus, the manufacturers in the region focus on offering more developed ketchup bottles such as upturned squeeze bottle. As a result, refillable squeeze bottles have long been popular in Europe, and manufacturers predict that they will become more popular here as disposal costs rise and as the consumption of sauces rises in European countries, the demand for the upturned squeeze bottles will increase.

Some of the leading manufacturers and suppliers of upturned squeeze bottle include

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global inverted squeeze bottle market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the inverted squeeze bottle market is projected to reach USD 5.3 billion by 2035.

The inverted squeeze bottle market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in inverted squeeze bottle market are flip top cap, screw cap and others.

In terms of material, high density plastic segment to command 47.2% share in the inverted squeeze bottle market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Breakdown of Inverted Squeeze Bottle Providers

Squeeze Pouch Market Growth – Demand & Forecast 2025 to 2035

Squeeze Tube Market

Squeeze Bottle Market Trends – Growth & Forecast 2024-2034

Cattle Squeeze Market Size and Share Forecast Outlook 2025 to 2035

Dropper Squeeze Bottle Market Trends & Industry Growth Forecast 2024-2034

Hydraulic Squeeze Chute Market Size and Share Forecast Outlook 2025 to 2035

Metered Dose Squeeze Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Bottle Sealing Wax Market Size and Share Forecast Outlook 2025 to 2035

Bottle Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Bottle Shippers Market Size and Share Forecast Outlook 2025 to 2035

Bottled Water Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bottle Sticker Labelling Machine Market Size and Share Forecast Outlook 2025 to 2035

Bottle Dividers Market Size and Share Forecast Outlook 2025 to 2035

Bottle Jack Market Size and Share Forecast Outlook 2025 to 2035

Bottles Market Analysis - Growth & Forecast 2025 to 2035

Bottle Capping Machine Market Analysis by Automation, Operating Speed, Machine Type, End-use Industry, and Region Forecast Through 2035

Market Share Distribution Among Bottle Dividers Suppliers

Bottle Carrier Market Trends – Growth & Forecast 2024-2034

Bottle Cap Market Analysis & Industry Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA