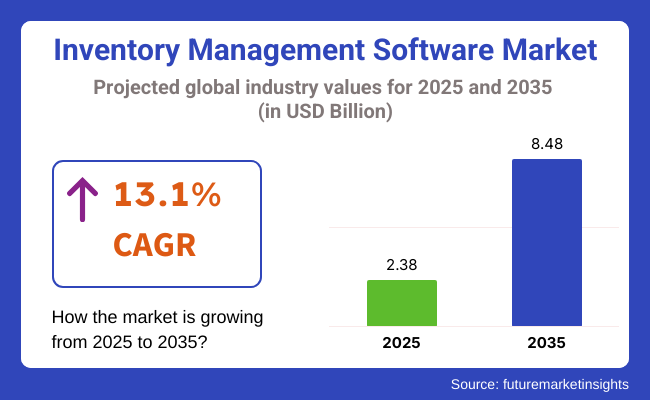

The global inventory management software market is valued at USD 2.38 billion in 2025, with a CAGR of 13.1% from 2025 to 2035, reaching a projected value of USD 8.48 billion by 2035.

This strong growth is driven by increasing digital transformation efforts across sectors such as retail, manufacturing, healthcare, and logistics, where real-time inventory visibility and control are becoming critical.

The rising adoption of cloud-based systems, which offer scalability, flexibility, and cost-efficiency, is significantly enhancing operational agility. Additionally, the expansion of e-commerce and the demand for omnichannel fulfillment are compelling businesses to implement advanced inventory software to manage supply chain complexities effectively and improve customer experience.

Looking forward, the market is likely to benefit from ongoing technological advancements. Integration of artificial intelligence, machine learning, and the Internet of Things (IoT) is likely to transform inventory systems by enabling predictive analytics, real-time data synchronization, and proactive decision-making.

These innovations are expected to help businesses reduce excess inventory, avoid stockouts, and better align supply with demand. Furthermore, as sustainability becomes a core business focus, inventory software is evolving to support greener practices, including optimized resource utilization and reduced logistical waste.

The rise in small and medium-sized enterprises adopting software-as-a-service (SaaS) platforms is also likely to contribute to market expansion by making advanced inventory tools more accessible and affordable.

Government regulations in the inventory management software space primarily address data protection, cybersecurity, and international trade compliance. With increasing concerns over data privacy, regulatory frameworks such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the USA require software providers to ensure stringent data handling and storage practices.

Additionally, companies engaged in cross-border trade must comply with electronic invoicing standards, import-export documentation, and audit trail requirements. These regulations are expected to become more rigorous, driving software innovation to meet compliance demands while supporting secure and transparent inventory management operations.

The market is segmented by component into inventory management software and inventory management services, by deployment into SaaS-based and on-premises, and by industry into consumer goods and retail, manufacturing, automotive, oil and gas, and others (healthcare, logistics, food and beverage, electronics, e-commerce, aerospace, and textiles). Regionally, the market is divided into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East, and Africa.

Inventory management software stands out as the most lucrative component in the market, registering a remarkable 14.0% CAGR between 2025 and 2035. This rapid expansion reflects a surge in demand for solutions that deliver real-time inventory tracking, demand forecasting, and automated replenishment.

Companies are embracing platforms that integrate cloud computing with advanced analytics to gain deeper insights into stock movements, reduce carrying costs, and improve order accuracy. These software tools often come with user-friendly dashboards, mobile access, and plug-and-play integrations for existing enterprise systems, enabling businesses to respond quickly to shifting market conditions and evolving customer expectations.

On the other hand, inventory management services play a vital role in translating technology into tangible business results. Service offerings cover system implementation, customization of workflows, data migration from legacy databases, and ongoing user training.

Experienced consultants guide clients through configuration choices and best practices, helping to align software capabilities with unique operational challenges. After initial deployment, maintenance agreements ensure that patches, version upgrades, and performance tuning occur without disrupting day-to-day operations.

Some providers also extend strategic advisory services, advising on process improvements, compliance requirements, and supply chain risk management. Even as software platforms mature and incorporate more built-in functionality, the human expertise wrapped around these products remains indispensable.

Organizations rely on service teams to bridge the gap between out-of-the-box features and industry-specific needs, ensuring a smooth transition and maximizing return on investment. Over time, this blend of software innovation and professional support underpins greater efficiency, stronger governance, and more resilient supply chains.

| By Component | CAGR (2025 to 2035) |

|---|---|

| Inventory management software | 14.0% |

The software-as-a-service deployment model leads the pack with a robust 15.0% CAGR rate between 2025 and 2035. Firms are drawn to its subscription pricing, which converts large capital expenditures into predictable operating costs. Implementation times shrink from months to weeks, since there is no hardware to install on-site.

Regular feature updates arrive automatically, keeping organizations on the cutting edge without tying up internal support teams. Mobile and web interfaces let employees access inventory data from anywhere, while vendor-hosted security protocols protect sensitive information without burdening corporate networks. This flexibility makes SaaS solutions especially attractive to fast-growing businesses and distributed supply chains.

On-premises offerings continue to serve a dedicated audience that values full control over its infrastructure. Because the software runs within a company’s own data center, customizations can be more granular, and integrations with legacy enterprise resource planning systems achieve a higher degree of precision.

Some industries, such as defense and certain segments of healthcare, have strict data sovereignty or compliance demands that favor localized deployments. Although up-front investments in servers, storage, and specialized personnel are typically higher, the total cost of ownership can level out over an extended time horizon. On-premises installations also allow for offline operation during network interruptions, which can be critical in remote manufacturing facilities or field operations.

In both models, the underlying goal remains the same: streamline stock management, improve order accuracy, and enable decision makers to respond swiftly to changing market conditions. As companies balance agility against control, each deployment choice offers a distinct set of benefits that align with unique organizational priorities.

| By Deployment | CAGR (2025 to 2035) |

|---|---|

| SaaS-based | 15.0% |

The consumer goods and retail segment leads the market with a 14.3% CAGR. Retailers rely on advanced inventory management systems to balance stock levels across physical outlets and online channels.

During peak shopping seasons, they use demand forecasting modules to predict surges in product interest and adjust replenishment schedules accordingly. Real-time visibility into inventory helps them avoid both stockouts and overstock situations, which can otherwise erode margins or frustrate customers. Many brands integrate barcode scanning and radio-frequency identification tags into their systems so that frontline staff can perform rapid cycle counts without disrupting store operations.

These platforms also feed sales data back into planning tools, allowing merchandising teams to spot regional differences in consumer preferences. For example, a fashion retailer might discover that athleisure items outperform formal wear in certain zip codes and can then tailor promotional campaigns to match local tastes.

Loyalty program information can be linked to purchasing histories, enabling personalized offers that encourage repeat visits. Beyond storefronts, retail chains use centralized dashboards to coordinate inventory movements between distribution centers and outlets, cutting transportation costs by combining replenishment runs.

As consumers demand faster delivery, many companies have adopted micro-fulfillment solutions inside stores, using software to allocate stock to in-store pickup while maintaining safety levels for walk-in shoppers.

The outcome is a more responsive supply chain, shorter lead times, and improved customer satisfaction. In a landscape where brand loyalty hinges on availability and speed of service, robust inventory management has become a critical differentiator for consumer goods and retail businesses.

| By Industry | CAGR (2025 to 2035) |

|---|---|

| Consumer Goods and Retail | 14.3% |

Rising Demand for Automation and Real-time Inventory Tracking Drives Market Growth

The inventory management software market is propelled by increasing demand for automation and real-time visibility into stock levels. Businesses across manufacturing, retail, and logistics sectors are adopting these solutions to optimize inventory accuracy, reduce carrying costs, and enhance order fulfillment efficiency.

Integration with IoT devices, barcode scanners, and AI-powered analytics enables continuous monitoring and predictive replenishment, minimizing stockouts and overstocks. Additionally, growing e-commerce and omnichannel retailing require seamless coordination across multiple warehouses and sales channels.

Regulatory compliance and sustainability goals further encourage adoption of sophisticated software for traceability and waste reduction. As companies seek to improve supply chain resilience amid disruptions, demand for flexible, cloud-based inventory management solutions is expected to accelerate significantly.

High Implementation Costs and Integration Complexity Restrain Market Expansion

Despite robust growth drivers, the inventory management software market faces challenges due to high initial investment and integration complexities. Small and medium enterprises (SMEs) often find upfront licensing fees, hardware expenses, and training costs prohibitive.

Legacy systems in many organizations create compatibility issues when integrating new inventory software, leading to longer deployment cycles and operational disruptions. Additionally, concerns around data security and privacy in cloud deployments make some businesses hesitant to migrate.

Variations in technical expertise across industries slow adoption, while customization needs increase implementation time and costs. These factors collectively restrain rapid market penetration, particularly among cost-sensitive segments and in regions with limited digital infrastructure.

Opportunities in AI, Machine Learning, and Emerging Markets

Emerging technologies such as artificial intelligence (AI) and machine learning (ML) present significant growth opportunities for inventory management software. Advanced analytics enable more accurate demand forecasting, dynamic pricing, and automated replenishment, improving operational efficiency.

The rise of IoT-enabled smart warehouses further fuels innovation in real-time tracking and asset management. Expanding e-commerce and manufacturing in emerging economies such as India, Southeast Asia, and Latin America open vast new markets eager for scalable, cloud-based inventory solutions. Additionally, growing emphasis on sustainability encourages adoption of software that supports circular economy practices and waste reduction.

Vendors investing in AI-driven platforms and localized solutions are well positioned to capture these opportunities in the coming decade.

Competitive Pressure and Rapid Technological Change Pose Market Threats

The inventory management software market faces threats from intense competition and fast-paced technological evolution. The presence of numerous vendors offering overlapping features drives price pressures and reduces profit margins. Rapid innovation demands continuous product upgrades and significant R&D investment, which smaller players may struggle to sustain.

Emerging technologies like blockchain for supply chain transparency and augmented reality for warehouse operations could disrupt existing solutions, forcing incumbents to adapt swiftly. Furthermore, cybersecurity risks associated with cloud-based deployments threaten customer trust and regulatory compliance. Market entrants face high barriers due to complex integration requirements and the need for certifications. These threats require agile strategies and innovation to maintain market relevance and growth.

The United States is expected to maintain its leadership in the global inventory management software market due to early digitalization, enterprise software maturity, and rapid cloud adoption. In 2025, the USA. market is projected to be valued at USD 752.4 million, driven by strong adoption across e-commerce, retail, and logistics sectors. Key players like Oracle, SAP, and Microsoft continue to enhance their SaaS-based inventory solutions, aligning with AI and IoT trends.

The market is witnessing widespread deployment in small and medium businesses as well, thanks to cost-effective subscription-based pricing models. Integration with ERP and e-commerce platforms like Shopify and Amazon is a key growth enabler. By 2035, the USA inventory management software market is forecasted to reach USD 2,920 million, advancing at a CAGR of 14.6%. Government incentives for digital supply chain transformation, combined with the rising need for real-time inventory visibility, are likely to sustain this momentum.

Additionally, labor shortages in warehousing and logistics are increasing demand for automated inventory tracking, which is further accelerating software investments. As B2B commerce platforms expand, USA firms are increasingly adopting inventory automation tools that support omnichannel fulfillment and predictive restocking.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 14.6% |

Germany’s inventory management software market is projected at USD 188.7 million in 2025, driven by the manufacturing sector’s transition to Industry 4.0. German industries are prioritizing end-to-end digital supply chain visibility to align with European Green Deal sustainability targets. Integration of inventory systems with MES (Manufacturing Execution Systems), WMS (Warehouse Management Systems), and robotics is a growing trend among precision manufacturers. By 2035, the market is projected to hit USD 664.1 million, growing at a CAGR of 13.2%. Companies are leveraging advanced inventory analytics to optimize lean manufacturing and just-in-time procurement. SAP, a major enterprise software provider headquartered in Germany, continues to innovate with modular, cloud-based inventory tools for SMEs.

Compliance with EU-wide traceability norms, especially in pharma and automotive sectors, is pushing businesses to adopt real-time inventory control systems. The emphasis on circular economy practices is also creating demand for reverse inventory management modules. With strong government support for smart manufacturing and digital transformation grants, the German market is expected to sustain a healthy upward trajectory throughout the forecast period.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 13.2% |

In the United Kingdom, the inventory management software market is forecasted to reach USD 166.8 million in 2025. The ongoing shift to omnichannel retailing and the rise in direct-to-consumer (D2C) e-commerce brands are fueling investments in real-time inventory solutions. Post-Brexit trade complexities and customs compliance requirements have also led to increased demand for integrated inventory and logistics systems. By 2035, the UK market is expected to grow to USD 610.7 million, registering a CAGR of 13.9%. Retailers and wholesalers are prioritizing inventory accuracy and fulfillment automation, especially as they expand across Europe.

The food & beverage, apparel, and pharmaceutical sectors are increasingly using AI-enabled forecasting tools to minimize stockouts and overstocking. Integration with ERP platforms like NetSuite and Microsoft Dynamics has gained traction across mid-sized enterprises. Government grants for digital transformation among SMEs, combined with high cloud maturity, are key enablers. Additionally, sustainability requirements in supply chains are driving the use of software for end-to-end inventory tracking and waste reduction. With increased focus on agile supply chains post-pandemic, UK-based companies are rethinking inventory control strategies, positioning the software market for continued expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 13.9% |

Japan’s inventory management software market is valued at USD 152.3 million in 2025, driven by demand from the country’s electronics and automotive sectors. These industries require highly precise and synchronized inventory operations across complex supplier networks. As Japan deals with workforce shortages and an aging population, automation in logistics and warehouse operations has accelerated, prompting strong adoption of inventory software solutions. By 2035, the market is projected to reach USD 512.6 million, advancing at a CAGR of 12.8%.

Japanese firms are integrating AI-powered demand planning tools and predictive restocking models to enhance resilience. The government’s "Society 5.0" initiative promotes digital transformation, which includes smart inventory technologies. Moreover, integration of robotics and IoT within smart factories is elevating inventory software to a strategic investment area.

Local vendors are collaborating with logistics partners and ERP providers to develop industry-specific inventory modules. Continuous improvement (Kaizen) and lean practices remain foundational, and software solutions that align with these philosophies are witnessing steady uptake. The shift toward green supply chains and carbon tracking is also prompting wider adoption of intelligent inventory systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 12.8% |

France’s inventory management software market is projected at USD 131.9 million in 2025, supported by automation trends in retail, aerospace, and food sectors. French companies are investing in scalable inventory solutions to streamline procurement, enhance traceability, and improve fulfillment speed. A key driver is the growth in omnichannel commerce and the consumer shift toward click-and-collect and home delivery models. By 2035, the French market is forecasted to reach USD 477.5 million, expanding at a CAGR of 13.4%.

The adoption of AI and machine learning in inventory forecasting is gaining momentum, particularly among mid-size enterprises. Regulatory mandates on product origin and traceability, especially in food and pharmaceuticals, have intensified demand for real-time inventory monitoring tools. French software startups are innovating in cloud-based inventory systems tailored for SMEs, while large enterprises continue to rely on established ERP vendors. Public-private partnerships to digitize manufacturing and logistics have further boosted adoption.

Moreover, green supply chain mandates under the EU Green Deal are prompting retailers and manufacturers to adopt inventory systems capable of lifecycle tracking and carbon accounting.

| Country | CAGR (2025 to 2035) |

|---|---|

| France | 13.4% |

The inventory management software market is highly competitive and characterized by the presence of several well-established global players alongside innovative niche providers. Leading the market are technology giants like Oracle Corporation, IBM Corporation, and SAP SE, which offer comprehensive enterprise resource planning (ERP) Software integrating advanced inventory management capabilities.

These companies leverage their extensive client bases, robust global networks, and vast R&D resources to provide scalable, feature-rich platforms that address the complex needs of large enterprises. Their solutions often incorporate cutting-edge technologies such as artificial intelligence (AI), machine learning (ML), and Internet of Things (IoT) integration, enabling real-time inventory tracking, demand forecasting, and supply chain optimization. Oracle and SAP, in particular, focus on cloud-based deployment models, which appeal to enterprises seeking flexibility and cost efficiency.

IBM complements its software offerings with strong consulting and implementation services, further strengthening its market position.

Mid-sized and specialized vendors such as Infor, Inc., Kinaxis Inc., and SAGE Group Plc occupy a significant space by focusing on industry-specific solutions and mid-market clients. Infor is known for its industry-tailored cloud ERP systems that include robust inventory and warehouse management modules designed for sectors like manufacturing, healthcare, and retail. Kinaxis differentiates itself with its RapidResponse platform, which emphasizes concurrent planning and supply chain agility, providing customers with real-time visibility and responsiveness.

SAGE Group, with its user-friendly and scalable offerings, targets small to medium-sized businesses (SMBs) seeking reliable inventory control integrated with financial management. These companies often emphasize ease of use, flexibility, and integration with other business systems, which helps them maintain competitiveness against larger ERP vendors.

Emerging and niche players like Zebra Corporation, Zoho Corporation, Brightpearl Ltd., and HighJump Software Inc. (part of Körber AG) contribute to market dynamism by offering innovative, cloud-native, and highly customizable solutions.

Zebra Corporation primarily focuses on hardware-enabled inventory tracking solutions such as barcode scanners and RFID, but it also offers software that seamlessly integrates with inventory management systems for enhanced data capture accuracy. Zoho Corporation delivers affordable, scalable cloud-based inventory software designed for small businesses and startups, featuring intuitive interfaces and multi-channel sales support.

Brightpearl provides retail-focused inventory and order management solutions that enable omnichannel retailers to unify sales, inventory, and customer data for improved operational efficiency.

Recent Inventory Management Software Industry News

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.38 billion |

| Projected Market Size (2035) | USD 8.48 billion |

| CAGR (2025 to 2035) | 13.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion |

| By Component | Inventory Management Software and Inventory Management Services |

| By Deployment | SaaS-based and On-Premises |

| By Industry | Consumer Goods and Retail, Manufacturing, Automotive, Oil and Gas, and Others ( healthcare, logistics, food and beverage, electronics, e-commerce, aerospace, and textiles) |

| Regions Covered | North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Germany, the United Kingdom, Russia, India, Australia, China, and Japan |

| Key Players | Oracle Corporation, IBM Corporation, SAP SE, Zebra Corporation, Kinaxis Inc., Infor, Inc., Zoho Corporation, SAGE Group Plc, Brightpearl Ltd., and HighJump Software Inc ( Körber AG) |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The market is forecast to reach about USD 8.48 billion by 2035, driven by rapid e-commerce expansion and widespread adoption of cloud-based analytics tools.

Cloud-hosted, subscription models top the list due to minimal up-front investment, swift roll-out times, and continuous, vendor-managed updates.

Top providers embed machine learning to analyze historical sales, predict demand trends, and automate replenishment. Some also use Internet of Things data to trigger real-time stock alerts.

Public companies follow Sarbanes-Oxley for audit controls. Food and drug firms comply with FDA traceability rules under Title 21. Healthcare entities implement HIPAA safeguards for patient-related inventory.

Retailers invest heavily to avoid stockouts and optimize promotions. Manufacturers apply real-time tracking to lean production. Healthcare providers use these systems to manage critical supplies and ensure patient safety.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 4: Global Market Value (US$ Million) Forecast by Industry , 2019 to 2034

Table 5: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 6: North America Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 8: North America Market Value (US$ Million) Forecast by Industry , 2019 to 2034

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: Latin America Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 11: Latin America Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 12: Latin America Market Value (US$ Million) Forecast by Industry , 2019 to 2034

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Western Europe Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 15: Western Europe Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 16: Western Europe Market Value (US$ Million) Forecast by Industry , 2019 to 2034

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 20: Eastern Europe Market Value (US$ Million) Forecast by Industry , 2019 to 2034

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by Industry , 2019 to 2034

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: East Asia Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 27: East Asia Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 28: East Asia Market Value (US$ Million) Forecast by Industry , 2019 to 2034

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by Industry , 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Component, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Industry , 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 9: Global Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 10: Global Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 11: Global Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 12: Global Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 13: Global Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 14: Global Market Value (US$ Million) Analysis by Industry , 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Industry , 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Industry , 2024 to 2034

Figure 17: Global Market Attractiveness by Component, 2024 to 2034

Figure 18: Global Market Attractiveness by Deployment, 2024 to 2034

Figure 19: Global Market Attractiveness by Industry , 2024 to 2034

Figure 20: Global Market Attractiveness by Region, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Component, 2024 to 2034

Figure 22: North America Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 23: North America Market Value (US$ Million) by Industry , 2024 to 2034

Figure 24: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 28: North America Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 29: North America Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 30: North America Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 31: North America Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 34: North America Market Value (US$ Million) Analysis by Industry , 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Industry , 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Industry , 2024 to 2034

Figure 37: North America Market Attractiveness by Component, 2024 to 2034

Figure 38: North America Market Attractiveness by Deployment, 2024 to 2034

Figure 39: North America Market Attractiveness by Industry , 2024 to 2034

Figure 40: North America Market Attractiveness by Country, 2024 to 2034

Figure 41: Latin America Market Value (US$ Million) by Component, 2024 to 2034

Figure 42: Latin America Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 43: Latin America Market Value (US$ Million) by Industry , 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 54: Latin America Market Value (US$ Million) Analysis by Industry , 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Industry , 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Industry , 2024 to 2034

Figure 57: Latin America Market Attractiveness by Component, 2024 to 2034

Figure 58: Latin America Market Attractiveness by Deployment, 2024 to 2034

Figure 59: Latin America Market Attractiveness by Industry , 2024 to 2034

Figure 60: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 61: Western Europe Market Value (US$ Million) by Component, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 63: Western Europe Market Value (US$ Million) by Industry , 2024 to 2034

Figure 64: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 68: Western Europe Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 71: Western Europe Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) Analysis by Industry , 2019 to 2034

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by Industry , 2024 to 2034

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by Industry , 2024 to 2034

Figure 77: Western Europe Market Attractiveness by Component, 2024 to 2034

Figure 78: Western Europe Market Attractiveness by Deployment, 2024 to 2034

Figure 79: Western Europe Market Attractiveness by Industry , 2024 to 2034

Figure 80: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 81: Eastern Europe Market Value (US$ Million) by Component, 2024 to 2034

Figure 82: Eastern Europe Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 83: Eastern Europe Market Value (US$ Million) by Industry , 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by Industry , 2019 to 2034

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by Industry , 2024 to 2034

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by Industry , 2024 to 2034

Figure 97: Eastern Europe Market Attractiveness by Component, 2024 to 2034

Figure 98: Eastern Europe Market Attractiveness by Deployment, 2024 to 2034

Figure 99: Eastern Europe Market Attractiveness by Industry , 2024 to 2034

Figure 100: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 101: South Asia and Pacific Market Value (US$ Million) by Component, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 103: South Asia and Pacific Market Value (US$ Million) by Industry , 2024 to 2034

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by Industry , 2019 to 2034

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by Industry , 2024 to 2034

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Industry , 2024 to 2034

Figure 117: South Asia and Pacific Market Attractiveness by Component, 2024 to 2034

Figure 118: South Asia and Pacific Market Attractiveness by Deployment, 2024 to 2034

Figure 119: South Asia and Pacific Market Attractiveness by Industry , 2024 to 2034

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 121: East Asia Market Value (US$ Million) by Component, 2024 to 2034

Figure 122: East Asia Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 123: East Asia Market Value (US$ Million) by Industry , 2024 to 2034

Figure 124: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 128: East Asia Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 131: East Asia Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 134: East Asia Market Value (US$ Million) Analysis by Industry , 2019 to 2034

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Industry , 2024 to 2034

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Industry , 2024 to 2034

Figure 137: East Asia Market Attractiveness by Component, 2024 to 2034

Figure 138: East Asia Market Attractiveness by Deployment, 2024 to 2034

Figure 139: East Asia Market Attractiveness by Industry , 2024 to 2034

Figure 140: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 141: Middle East and Africa Market Value (US$ Million) by Component, 2024 to 2034

Figure 142: Middle East and Africa Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 143: Middle East and Africa Market Value (US$ Million) by Industry , 2024 to 2034

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by Industry , 2019 to 2034

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by Industry , 2024 to 2034

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by Industry , 2024 to 2034

Figure 157: Middle East and Africa Market Attractiveness by Component, 2024 to 2034

Figure 158: Middle East and Africa Market Attractiveness by Deployment, 2024 to 2034

Figure 159: Middle East and Africa Market Attractiveness by Industry , 2024 to 2034

Figure 160: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Inventory Tag Market Size and Share Forecast Outlook 2025 to 2035

Inspection and Inventory Labels Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in Inspection and Inventory Labels

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Cash Management Services Market – Trends & Forecast 2025 to 2035

CAPA Management (Corrective Action / Preventive Action) Market

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Exam Management Software Market

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Labor Management System In Retail Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA