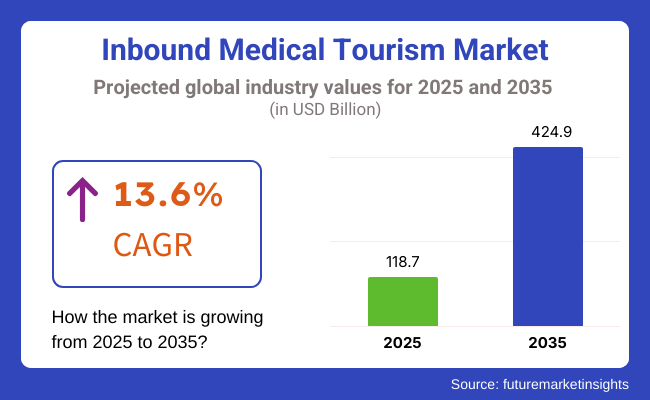

The global market for inbound medical tourism is estimated to attain USD 118.7 billion in 2025, expanding at 13.6% CAGR to reach USD 424.9 billion by 2035. In 2024, the revenue of the market was around USD 102.9 billion.

The surge in globalization and the use of the Internet are the main driving factors of the market. Globalization has given opportunities for the successful trade of various types of medical equipment and biopharmaceutical and pharmaceutical products across different nations, and the availability of high-quality healthcare facilities has risen in low and middle-income countries.

Apart from this, increasing foreign investment, which is driven by globalization, has contributed to the improvement of the quality standards concerning medical treatments in developing nations. This has been an eye-catching factor in the growth of the medical tourism market. Furthermore, digital health has gained a lot of popularity recently. The Covid-19 pandemic played a big role in the increased need for the acceptance of various digital tools. Medical tourism is utilizing digital healthcare fully in order to thrive in the long term.

The market has faced significant losses due to COVID-19 with a whopping drop of 47.3% from 2019 to 2020. FMI estimated that the market has started gaining momentum in 2021 after the stagnation in 2020. However, market recovery and normalization as it was pre-COVID is expected only in 2024.

This is because, although countries have started to open borders in 2021, stringent regulations imposed post-COVID such as vaccination certifications and upgrades in visa processes will restrict full-fledged recovery. In addition, patients fear to travel due to the continuous impact of different COVID-19 strains globally, which may slow down industry growth for the next few years.

Healthcare costs soared in developed nations, during 2020 to 2024 which resulted in patients seeking cheap treatment. Medical tourists searched for nations offering quality treatment at lower rates. These two components, namely better medical technology and globally standard healthcare facilities, boosted the reputation of foreign health in the minds of patients. Another wave of growth was ushered in with blossoming popularities of procedures like cosmetic surgery, dental care, and infertility treatments.

In general, many countries adopted or strengthened their medical tourism-friendly policies such as easy visa acquisition, and government promotion to attract international patients. The pandemic caused people to search for alternatives to their overcrowded domestic healthcare systems, further enhancing the demand for medical travel.

Finally, the introduction of telemedicine opened the door for initial consultations and follow-ups, thus making medical tourism more convenient and efficient. All these factors helped in the increase of inbound medical tourism.

Explore FMI!

Book a free demo

Several people from the USA and Canada are increasingly traveling abroad for medical treatment for superior care at bargain prices. Due to the fast-rising cost of healthcare, long wait times for specialty procedures, and limited insurance coverage, many patients are searching for out-of-country alternatives. States like Mexico, Costa Rica, and India have become possible destinations primarily because of their high technology medical centers and inexpensive procedures.

More American citizens are going to these areas for dental implants, cosmetic surgery, and orthopedic treatment, all with significant savings of thousands of dollars. Most of these settings also have bilingual providers and full-time international patient coordinators to help in making a seamless and comfortable experience. As medical tourism surely will become more comfy and approachable, the same trend is bound to grow further.

An increasing number of citizens from the United Kingdom, Germany, and France are traveling abroad for medical treatment concerning cosmetic surgery, dental services, and orthopedic procedures to Eastern Europe, Turkey, and Asia. The combination of cheaper prices, good standard of care in good medical centers, and low waiting times makes such places more appealing. The aforementioned government policies promoting cross-border healthcare in the EU are also easing the process of getting patients treated abroad.

Most European medical tourists are now leveraging digital health platforms to set up consultations with physicians prior to traveling, obtain remote diagnosis, and follow through on their post-surgery procedures. In the meantime, the private health care facilities in these countries are investing heavily in modern and new facilities while getting international accreditations in order to enhance patient confidence in medical tourism.

Thailand, India, Malaysia, and South Korea have emerged as shining examples of medical tourism that offer state-of-the-art healthcare at a minuscule fraction of the price. Patients from the Middle East, Africa, and the West flock to these countries to receive specialized treatments in cardiology, oncology, and infertility care, drawn by their famed hospitality in combination with quality medical treatments.

In addition, government bodies and private healthcare organizations regularly invest in the establishment of new-age hospitals with international accreditation and promote medical tourism campaigns to attract the greatest patient influx. Various facilities offer customized treatment packages, blending traditional and modern surgical procedures, and telemedicine enables convenient follow-up procedures even from afar. However, standardized variation in healthcare regulation across the region could aggravate issues with patient trust and market development.

Challenges

The Roadblocks Facing Inbound Medical Tourism Growth

One of the glaring problems facing medical tourism has to do with obtaining and guiding through the legal and regulatory environments of international healthcare. Differences in standards set for healthcare, licensing regulations, and malpractice laws may indeed pose threats to both patients and providers. Furthermore, the whole process of arranging travel permits, going through insurance, and planning post-procedure care can be burdened with complexities.

The language barriers and cultural differences are also some of the factors that affect the patient journey, sometimes with negative implications. For players in the medical tourism industry, the focus must then be on quality therapy and patient safety, given that any adverse outcome will wipe away any trust the industry has built. In many developing nations, lack of good transportation links and aftercare facilities can also create added logistical hurdles, making for a truly difficult decision for the patient in deciding to use such destinations for their health care needs.

Opportunities

Unlocking Opportunities in Inbound Medical Tourism Through Digital Health and Wellness

The speedy expansion of telemedicine and digital health solutions offers excellent opportunities for inbound medical tourism. Pre-operative evaluations and virtual consultations allow patients to be well-informed about their treatment before making travel arrangements, thus making it easier for foreign healthcare to get into the system and increasing the confidence level.

Apart from this, the development of specialized healthcare clusters and medical tourism centers that integrate wellness and rehabilitation facilities, give medical tourists a comprehensive experience. A cooperation between medical service providers, travel agencies, and insurance companies also makes the patients' journey more seamless and easy.

The governments of the most sought-after medical tourism destinations are actively marketing their health care services through campaigns targeted at consumers abroad. The hope is for those looking for affordable yet quality care. Other than that, the increasing interest in wellness tourism, such as medical spas and alternative medicine facilities, augments the arrival of more medical tourists.

Rising Trends in Specialized and Wellness-Integrated Medical Tourism

Specialty medical tourism continuously expands as people pursue specialized treatments like fertility treatments, cosmetic surgery, and new cancer treatments. In response, destination countries are offering specialized treatment packages to foreign patients, while new centers of excellence that specialize in healthcare services are being established on the basis of providing differentiation in an intensely competitive market.

The biggest levelers in enchaining trustworthiness are accreditation and quality assurance, which are being performed by bodies like JCI and NABH that certify the healthcare to international standards. An increasing number of patients along with fame are being attracted by hospitals and clinics with such accreditations.

Furthermore, medical tourism sites are made prettier by including wellness tourism. Now patients are provided with balanced destinations that merge health and wellness experiences, such as spa, holistic healing, and postoperative rehabilitation, particularly for patients seeking long-term recovery or prevention-driven care.

Revolutionizing Medical Tourism: The Role of AI and Blockchain Technology

Making the whole medical tourism experience much easier and more customized to the patients to whom it will cater, artificial intelligence presents to patients tailor-made treatment recommendations and cost analysis, as well as simultaneous language translation, making it possible for any patient anywhere in the world easily to reach informed decisions.

AI chatbots and virtual assistant applications are also making the service providers efficient by addressing queries and scheduling appointments, thereby giving time back to both patients and employees. Meanwhile, coming into play is blockchain technology, which guarantees that patient medical records are safely secured and transferred across borders.

The technology gives assurance of privacy and continuity in care for medical tourists, hence allowing them to share their medical history with global health care providers in a secure, tamper-proof manner. Together, these two technologies revolutionize the whole concept of medical tourism into an efficient, secure, and accessible avenue.

The inbound medical tourism market grew steadily from 2020 to 2024, propelled by the increased healthcare costs of developed nations, quality care in destination markets, and improved access to specialized care. Thailand, India, Mexico, and Turkey provided affordable options with the best medical facilities.

Patients were increasingly agitated about treatment abroad due to the telemedicine consultation and follow-up care that began. In spite of that, COVID-19 deemed itself as another challenge; fainting an already growing industry with yet other hurdles like variable legislations, consistency in insurance reimbursements, etc.

As we look to 2025 onwards, the industry will expand even more due to advanced globalization of healthcare, increased development of technology in medicine, and continuously streamlined cross-border regulatory environments. Greater investment in healthcare facilities and levels of accreditations will enhance patient confidence even further.

Breakthroughs in AI-based customized treatment plans and blockchain-protected medical records will further optimize and secure the field. Furthermore, green hospital initiatives and sustainable medical tourism will also be on the rise in light of increasing sustainability awareness, thereby carving other dimensions into the future of this industry.

Comparison Table

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Countries have varying regulations that impact accreditation and patient rights. |

| Technological Advancements | Telemedicine and AI-assisted diagnostics have grown, enabling remote consultations. |

| Consumer Demand | Patients increasingly prefer affordable, high-quality treatments abroad, especially for cosmetic surgery and elective procedures. |

| Market Growth Drivers | Cost-effectiveness, shorter waiting times, and the availability of specialized medical procedures have driven market growth. |

| Sustainability | Medical tourism has focused little on eco-friendly practices and carbon footprint reduction. |

| Supply Chain Dynamics | Geopolitical and pandemic-related disruptions have impacted travel and medical supply chains. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | International regulations will harmonize, facilitating seamless patient mobility and medical licensing. |

| Technological Advancements | AI-driven personalized treatments, blockchain for secure medical records, and robotics-assisted procedures will expand. |

| Consumer Demand | As global advancements in care continue, demand for complex procedures such as organ transplants and oncology treatments will rise. |

| Market Growth Drivers | Healthcare infrastructure will improve, governments will provide incentives, and global awareness of medical tourism benefits will increase. |

| Sustainability | Green medical tourism initiatives, sustainable healthcare infrastructure, and eco-conscious hospital operations will grow. |

| Supply Chain Dynamics | Localized procurement, strategic partnerships, and improved logistics will strengthen supply chain resilience. |

Market Outlook

Medical tourism in Hungary for dental procedures and cosmetic surgery has become increasingly popular in recent times. With high-quality and affordable medical services, it continues to be a viable option for patients from neighboring countries as well as Western Europe. The healthcare system in Hungary is on high grounds, and it is the qualified medical professionals providing motivation for further inflating the craze of medical tourism in this country.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Hungary | 8.8% |

Market Outlook

Singapore has carved a commendable niche for itself as a top-most medical tourism destination, providing higher standards of treatments and healthcare facilities. Its universal acceptance of quality care, stringent regulatory requirements, and emphasis on patient safety make it a favorite among international patients especially from Asia.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Singapore | 16.6% |

Market Outlook

India has emerged as a leading force in the field of medical tourism, providing a combination of treatments at a fraction of the expense of those incurred in the West. The availability of highly trained medical professionals and state-of-the-art health facilities, combined with the presence of alternative systems such as Ayurveda, draws patients from across the globe.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 17.4% |

Market Outlook

Colombia is emerging as one of the frontrunners in the ever-growing field of medical tourism, particularly in cosmetic and dental care procedures. Advanced medical facilities, excellent health personnel, and affordable costs have made North American patients, among others, prefer it.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Colombia | 4.7% |

Market Outlook

An established giant in the field of medical tourism, Thailand's world-class healthcare combined with friendly ambience draw many people. Modern medical centers, skilled medical personnel, and cheap health care have made it the darling of medical tourists.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Thailand | 18.6% |

Dental tourist destinations: High quality and low cost care for international patients

Dental tourism has become one of the major domains of inbound medical travel, and patients worldwide seek for quality care at lesser costs. Many nations, especially in Asia, Eastern Europe, and Latin America, are offering dental treatments for a tenth of the cost of Western nations. There are some treatments like implants, veneer, and crowns, or orthodontics that foreigners most demand.

All these give a little more glamour to dental tourism with the advancement of technology and internationally qualified clinics, and well-trained personnel. Shorter treatment times offered at some of these locations also allow patients to undertake procedures quickly.

Some go even one step further by weaving the dental visits into a vacation experience just for the fun of it. Governments in the most popular dental tourism destinations are already giving interested consideration to this market and, in view of attracting more patients, they are easing the visa regime and heavily investing in cutting-edge health care infrastructure.

Cosmetic Treatment: Increased Aesthetic Demand

Cosmetic surgery is becoming one of the most rapidly expanding components of medical tourism as individuals fly to a location where they are able to get top-of-the-line aesthetic treatments at a mere fraction of the price it would be in their home nation. Facelifts and rhinoplastics, breast implants, liposuction, and non-surgical interventions like Botox and fillers are conducting aesthetic surgeries increasingly in urban centers with brand-name surgeons, world-class hospitals, and rigorous standards of safety regulation.

Cost-cutting measures are among the most important reasons behind this trend, with patients usually saving as much as 70% when compared to prices charged in the West. In addition to price, several clinics offer customized treatment regimens, plush post-procedure recovery retreats that smooth out the process to near effortless, and cutting-edge techniques to ensure the work is painless. With a gradual acceptance of cosmetic enhancement in society and emerging techniques that are less invasive, aesthetic procedures abroad continue to rise.

We're moving on to holistic and preventive therapies now. Recently, wellness services have been increasingly combined with medical treatments and massages for rejuvenation, to the extent that they occupy a new niche in wellness tourism. People are demanding medical spas, detox therapies, weight-loss management, stress-relief therapies, etc.; alternative medicine is becoming popular with Ayurveda and TCM- alternative even mainstream forms of medical treatments.

Asian and European institutions are drawing upon their wealth of cultural heritage as well as having their cool natural healing climates to attract wellness-oriented medical tourists. Along with greater empowerment, more persons demand preventive medicine, treatments for longevity, and mental wellness retreats. In line with this development, both governments and private organizations are investing heavily in modern wellness centers to answer rising expectations.

Remedial Services: Bridging Gaps in Specialized Medical Care

More and more, people travel abroad for specialized care that is beyond reach or absent in their own homes. Among many of the therapeutic services that patients are seeking are postoperative rehabilitation, physical therapy, and disease management for chronic illnesses against a backdrop where specialized treatment in that regard has become an opportunity overseas. Multiple countries have branded themselves as specializing in those therapies, with state-of-the-art rehabilitation facilities and equipped with very qualified specialists.

Stroke patients, musculoskeletal diseases, and neurological illness patients currently recuperating from these illnesses have shifted towards medical tourism for lower quality but affordable treatment. The need for therapeutic treatment continues to grow exponentially as chronic conditions become more common and individuals age worldwide.

Currently, it is the fastest-growing industry in the entire round of medical tourism competition when people highly prefer low-cost, high-quality health care abroad. It attracts international patients seeking world-class treatment at lower costs through top hospitals with advanced facilities and specialized treatment centers. The competition in the market is based not only on the hospitals' international accreditation but also on their strategic alliances, offering much of which are customized services to make it less complicated for the patients as they seek care outside their country.

Market Share Analysis by Hospital

| Hospital Name | Estimated Market Share (%) |

|---|---|

| Bumrungrad International Hospital | 7.2% |

| Apollo Hospitals | 5.60% |

| Cleveland Clinic | 4.50% |

| Anadolu Medical Center | 3.40% |

| Other Hospitals (combined) | 79.3% |

| Hospital Name | Key Offerings/Activities |

|---|---|

| Bumrungrad International Hospital | Provides world-class facilities, employs cutting-edge medical technology, and offers specialist treatments. |

| Apollo Hospitals | Excel in cardiac care, oncology, and organ transplants at affordable prices. |

| Cleveland Clinic | Has high-level cardiac surgeries, orthopedic operations, and is specialized in neurology. |

| Anadolu Medical Center | Leverages cancer therapies, robotic surgery, and integrated medical care. |

Key Hospital Insights

Bumrungrad in Internationally accredited hospitals (7.2%)

Highly preferred among medical tourists, Bumrungrad brings together world-class health care and state-of-the-art technology. The hospital is famous for cosmetic surgery, cardiology, and body check-ups, attracting patients wanting high-quality treatment in a congenial and international accreditation environment from across the globe.

Apollo Hospitals (5.6%)

For best-in-class cardiac, orthopedic, and transplant procedures offered at reasonable costs, therefore Apollo Hospitals deservedly gained top choice rating among medical travellers. The hospital connects its vast network across India to foreign patients for quality medical care, advanced procedures, and personalized treatment.

Cleveland Clinic (4.5%)

Cleveland Clinic is highly reputed worldwide for unparalleled cardiovascular care, neurology, and orthopedic surgeries. People from all over the world flock to this hospital for delivering innovative and research-based treatments in highly advanced facilities giving patients access to the finest specialist medical care.

Anadolu Medical Center (3.4%)

In Turkey, Anadolu Medical Center has become an international trust for excellent cancer care, robotic surgery, and specialty care services. The Johns Hopkins Medicine affiliation further strengthens it by providing world-class medical expertise in a warm and state-of-the-art health environment.

Other Key Players (79.3% Combined)

Several other hospitals contribute significantly to the medical tourism market by offering specialized treatments and attracting international patients. Notable hospitals include:

The overall market size for inbound medical tourism market is expected to be USD 118.7 billion in 2025.

The inbound medical tourism market is expected to reach USD 424.9 billion in 2035.

The market in Malaysia is expected to grow at a CAGR of 19.0% during the forecasted period.

The global inbound medical tourism industry is projected to witness CAGR of 13.6% between 2025 and 2035.

Orthopedic Treatment by treatment type is expected to command significant share over the assessment period.

Dental treatment, Cosmetics Treatment, Cardiovascular Treatment, Orthopedic Treatment, Neurological Treatment, Cancer Treatment, Fertility Treatment and Other Treatments

Wellness Service and Therapeutic Service

Men, Women and Children

<15 Years, 15-30 Years, 31-45 Years, 46-60 Years, 60 Years & Above

Phone Booking, Online Booking, In Person Booking

Americas, Europe, Asia, Europe

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.