The Intestinal Pseudo-Obstruction Treatment Market represents a steady rise from 2025 to 2035, due to increased awareness, evolving diagnostic techniques, and emerging treatment options. Intestinal pseudo-obstruction is a rare type of gastrointestinal disorder that resembles a mechanical blockage, but in the absence of an actual physical obstruction.

Improving knowledge about the disease; growing availability of pharmacological and surgical treatment options; and rising research activities related to neuromuscular disorders involving the gastrointestinal (GI) tract are some of the factors propelling the market.

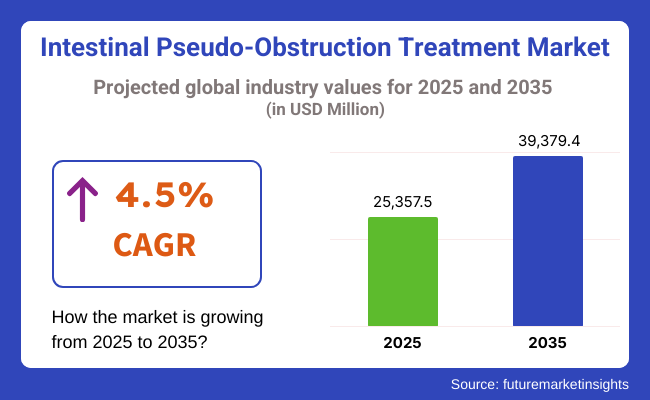

According to the report, the market accounted for USD 25,357.5 Million in 2025 and is expected to reach USD 39,379.4 Million by 2035, growing at a CAGR of 4.5% during the period. Prokinetics, parenteral nutrition support and even surgical options are being used that may be challenging or out of reach for healthcare providers like them that tried to improve patient outcomes.

The North America is dominating the Intestinal Pseudo-Obstruction Treatment Market with highest market share due to the presence of well-established healthcare infrastructure, increasing volume of diagnosed patients and well advanced research scenario in the field of gastrointestinal motility diseases.

The United States and Canada are major players, with the National Institutes of Health (NIH), for example, as well as the American Neurogastroenterology and Motility Society funding research and treatment breakthroughs. The surge in the use of new prokinetic agents, enteral and parenteral nutrition therapies, and neuromodulation therapies is also contributing to market growth.

Germany, the UK, and France have been key players for diagnosis, research, and adoption of IPO treatment in the European region. The European Society for Neurogastroenterology and Motility (ESNM) is going to advance diagnostic solutions and patient management.

It further aids in market growth, and initiatives by the government to promote fundings and common clinical trials for novel motility drugs are anticipated to facilitate market upsurge for rare disease treatments. Additionally, complex surgical services and enteral nutrition programs are improving outcomes in patients across the region.

The Asia-Pacific region is expected to witness the fastest growth over the forecast period owing to the increasing healthcare expenditure, rising awareness about rare gastrointestinal diseases and the development of advanced diagnostic technologies. Countries such as China, Japan, South Korea, and India are starting to focus on IPO management with increased interest in gastrointestinal motility disorders, neuromodulation therapies, and minimally invasive surgical procedures.

Japan has made significant advances in areas such as gastroenterology and motility research and is heavily investing in drug development as well as alternative therapies (such as stem cell transplantation and gut microbiome modulation). And this explains the strong growth in nutritional support programs seen in the regional IPO patients.

Challenge

Limited Awareness and Delayed Diagnosis

Low awareness and delayed diagnosis is one of the major challenges for the Intestinal Pseudo-Obstruction Treatment Market. Due to their symptoms overlapping with other gastroenterological (GI) disorders, IPO is often misdiagnosed, which can result in inappropriate treatments that ultimately contribute to worsening patient outcomes.

Moreover, the scarcity of motility testing centers and non-uniformity of diagnostic guidelines make early diagnosis even more difficult. In response to these hurdles, healthcare organizations are working to consumerize physician education programs, implement advanced diagnostics like antroduodenalmanometry and wireless motility capsules, and AI-powered gastrointestinal imaging.

Opportunity

Advancements in Pharmacological and Regenerative Medicine

Emerging specific pharmaceutical medicines and regenerative medicine modalities offer a vast market opportunity in IPO therapy. Diverse prokinetic agents, serotonin receptor agonists, and neuromodulation drugs are examined for enhancing intestinal motility and relieving IPO symptoms.

Moreover, stem cell therapy, gut microbiota-targeting treatments, and novel gene therapy methods are opening up prospects for long-term solutions to disease management. The companies developing next-gen GI drugs, personalized medicine, or AI-assisted diagnostic solutions will have an edge in the future IPO treatment paradigm.

Steady growth of IPO treatment market for intestinal pseudo-obstruction (IPO) from 2020 to 2024; Established market with gradual improvement towards diagnostic measurement/ imaging Quotient in addition to the rising awareness quotient & increase in prokinetic agent usage.

Improvements in gastrointestinal motility testing, MRI-based diagnostics, and manometry techniques all facilitated early detection. Therapeutic approaches centered on symptom control via prokinetic agents, analgesics, enteral/parenteral nutrition and decompression methods.

But despite these strides, major challenges including a lack of targeted therapies, a high rate of misdiagnosis and limited clinical research still persisted. In severe cases, surgical interventions and implantable gastric stimulators were used with differing levels of success and high risks of complications.

From 2025 to 2035, the IPO treatment space will change dramatically via gene therapies, microbiome-targeted interventions, and AI diagnostics.

Gene-editing strategies for hereditary motility disorders will seek corrections using approaches such as CRISPR, and microbiome-based therapies will exploit gut bacteria to restore gut motility. Early detection and the development of customized treatment strategies based on AI-driven predictive assessment will transform patient outcomes.

Long-term therapeutic solutions will come from regenerative medicine using stem cell therapy and bioengineered intestinal tissues. Moreover, non-invasively operating neurostimulation devices may evolve into a clinical solution to reduce reliance on symptom-directed therapies.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Diagnostic Advancements | MRI and motility testing improve early detection. |

| Therapeutic Innovations | Symptom-focused treatment with prokinetics and decompression. |

| Surgical vs. Non-Invasive Treatments | Surgical interventions for severe cases. |

| Personalized Medicine | Standardized symptom management protocols. |

| Research & Development | Limited focus on IPO-specific therapies. |

| Market Shift | 2025 to 2035 |

|---|---|

| Diagnostic Advancements | AI-powered diagnostics for real-time detection and monitoring. |

| Therapeutic Innovations | Gene therapy and microbiome-based interventions for root-cause treatment. |

| Surgical vs. Non-Invasive Treatments | Non-invasive neurostimulation and regenerative medicine. |

| Personalized Medicine | AI-driven personalized treatment planning. |

| Research & Development | Increased investment in targeted drug development and clinical trials. |

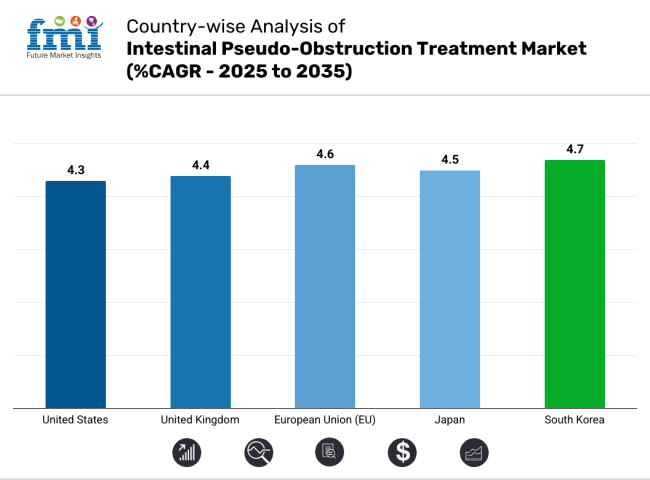

The United States Intestinal Pseudo-Obstruction Treatment Market is also driven by an increasing number of patients diagnosed with gastrointestinal motility disorders. The increased adoption of prokinetic agents, the improved drug development process, and increased research into treatments for neuromuscular dysfunction are the key drivers of this market. Innovative treatment solutions also benefit from a presence of leading pharmaceutical firms and an improved healthcare infrastructure.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.3% |

The UK market in the region is developing step by step and is accountable for the expanding occurrence of Chronic Intestinal Pseudo-Obstruction (CIPO), and better access to specific gastroenterology treatments. Government efforts to enhance the management of rare diseases, alongside rise in researches in gut microbiota and treatments for motility disorders are driving the market. Additionally, advances in minimally invasive diagnostic technologies contribute to the earlier detection and treatment.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.4% |

Growing cases of gastrointestinal motility disorders in Europe including Germany, France, and Italy region, is expected to propel the EU market growth. The well-established regulatory frameworks, increasing collaboration among research organization, and growing demand for novel drug therapies are a few factors responsible for the growth of the market. Increasing number of clinical trials for gut motility treatment and enteric nervous system disorders is also fuelling the growth of the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.6% |

Growing geriatric population, high awareness level towards gastrointestinal health and adoption of advanced prokinetic and neuromodulator therapy are some of the major factors propelling the growth of Intestinal Pseudo-Obstruction Treatment market in Japan. The federal government has made significant investments in research focused on gut motility disorders, and major pharmaceutical companies are now joining forces on improved treatment options. In addition, the market demand is also further contributed by the government aids for rare disease management, as well as for improved diagnosis.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

The market in South Korea is expected to grow as awareness for intestinal pseudo obstruction increases, coupled with rising availability of effective treatment options and advancement in the field of gastroenterology. More advanced imaging technologies and better patient management programs are improving early diagnosis in the country. Moreover, the promotion of research on digestive disorders by strong government initiatives is a key driver for the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.7% |

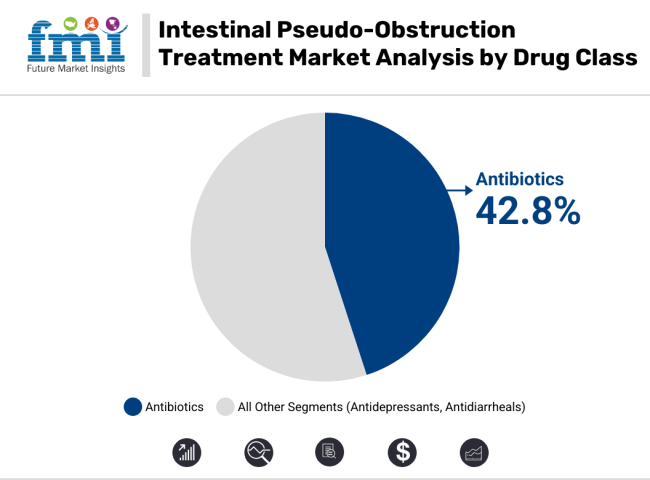

Antibiotics account for the largest share of the intestinal pseudo-obstruction treatment market, which is projected to reach ~USD 515 million by 2025, with a share of around 42.8% in 2025. These antibiotics control most of the complications of the condition, such as overgrowth of bacteria and the subsequent infection from growing that bacteria. Doctors also commonly prescribe antibiotics to patients with chronic intestinal dysmotility because bacteria may bloom and aggravate symptoms such as bloating, abdominal pain and malnutrition.

Growth in the demand for antibiotics is primarily driven by the increasing incidence of chronic intestinal disorders and the rising numbers of post-surgical pseudo-obstruction. Furthermore, emerging insights into the gut microbiome has highlighted the role of the gut flora in the pathophysiology of GI dysmotility, and thus the potential benefit of targeted antibiotic therapy. Children with severe classes of intestinal pseudo-obstruction may have prolonged hospitalizations, and antibiotics serve a key role in both inpatient and outpatient regimens.

(This is why the pharmaceutical companies are still persecuting new antibiotics that are broad-spectrum or target specific bacteria in order to kill off the bacterial pathogen but not the gut microbiota. As personalized medicine becomes more of a hot topic, the distribution of more targeted antibiotics targeted to individuals is also expected to complement its growth, thus driving this market.

However, things such as antibiotic resistance and longstanding veteran attachment require more research and development. Accordingly, a move toward next-generation (NGA) antibiotics that: boast improved safety profiles; have a longer duration of efficacy; and are associated with a reduced risk for the development of resistance is driving the research interest sector of the antibiotic market.

Ongoing innovations in drug formulation and improving awareness levels with respect to the cluster of ailments observed among healthcare professionals are projected to help the antibiotic type maintain lead in the intestinal pseudo-obstruction treatment market.

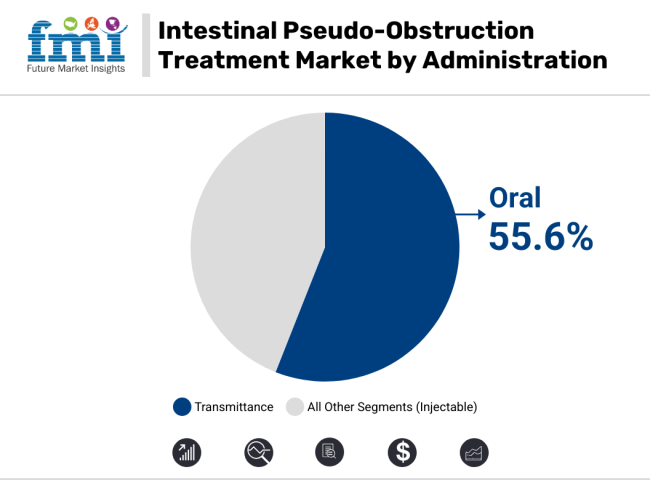

At present, an oral-based route of administration, dominates the intestinal pseudo-obstruction treatment market, in 2025 accounting for a 55.6% share. Moreover, it is due to the simplicity of the therapy, administration of the drug and high compliance of patients which drives oral drugs to dominate the market. Oral antibiotics (to kill colonic bacteria and reduce endotoxemia), antidepressants (to regulate intestinal motility), and antidiarrheals (to decrease diarrhea) are frequently prescribed by physicians in these patients.

The rising adoption of oral medication for various long-term chronic illnesses is because of the mechanism of action. Harms has found that the majority of patients with mild to moderate forms of intestinal pseudo-obstruction can be treated effectively based with the use of oral treatments that work without the need for a hospital setting. Moreover, with enhanced drug formulation techniques, the bioavailability and absorption when ingesting oral medications have proved more potent which leads to better therapeutic results.

Sustained-release and enteric-coated pharmaceutical formulations enhance the stability of the drug in the GI tract (gastrointestinal tract) owing to which these are widely used to treat gastrointestinal disorders. The increase of oral form prescription/OTC medications, along with the ease of access for patients, has also aided market growth due to more easily accessible treatment.

Furthermore, the low cost of oral medications relative to injectable therapies contributes to their overwhelming adoption. Oral drugs are also often preferred by healthcare systems and insurance providers because they are less expensive to manufacture and provide less of a healthcare burden to both the individual and the healthcare institutions.

Although oral administration is advantageous, oral therapies may not provide rapid symptom relief as injectable therapies may in some severe cases of intestinal pseudo-obstruction. Nonetheless, compared to the narrow range of patient population, and although there are newer formulations for intestinal pseudo obstruction, we furthermore forecast the oral administration segment to continue to have the largest share in terms of mode of drug delivery for the intestinal pseudo obstruction treatment due to growing preference for non-invasive treatment evolving with research & development of oral drugs.

The increase in Intestinal Pseudo-Obstruction Treatment Market is also positively influenced by rising incidence of gastrointestinal motility disorders and development of drugs for their treatment. Increasing demand for novel pharmacotherapy and therapeutic techniques, and diagnostic methods is driving the market.

Chronic intestinal pseudo-obstruction (CIPO) updates from the literature, development of prokinetic agents (eg, mitemcinal), anti-inflammatory drugs (eg, nitrofurantoin), regenerative therapies (eg, stem cell transplantation), and the focus of the condition by companies. The target groups in this market include large pharmaceutical companies, biotechnology companies, and dedicated healthcare companies working on innovative drug formulations and targeted therapies.

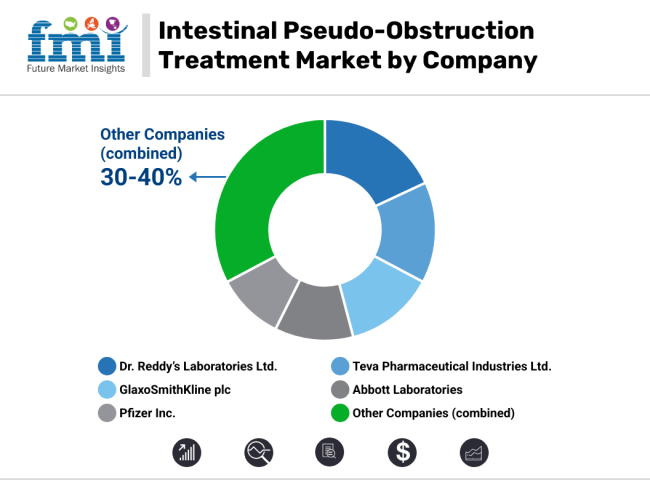

Market Share Analysis by Company

| Company Name | Key Offerings/Activities |

|---|---|

| Dr. Reddy’s Laboratories Ltd. | In 2024 , expanded its gastrointestinal drug portfolio with novel prokinetic therapies targeting motility disorders. |

| Teva Pharmaceutical Industries Ltd. | In 2025 , a next-generation opioid antagonist to manage intestinal motility dysfunction. |

| GlaxoSmithKline plc | In 2024 , launched an innovative anti-inflammatory treatment to reduce intestinal inflammation in pseudo-obstruction cases. |

| Abbott Laboratories | In 2025 , developed a combination therapy addressing both neural and muscular causes of intestinal pseudo-obstruction. |

| Pfizer Inc. | In 2024 , expanded clinical trials on regenerative stem cell-based treatments for gastrointestinal motility disorders. |

Key Company Insights

Dr. Reddy’s Laboratories Ltd. (18-22%)

Dr. Reddy’s leads the market with a diverse range of gastrointestinal medications.

Teva Pharmaceutical Industries Ltd. (14-18%)

Teva specializes in innovative motility disorder treatments, introduced aadvanced opioid antagonists to improve patient outcomes.

GlaxoSmithKline plc (12-16%)

GSK focuses on targeted anti-inflammatory treatments, reducing intestinal swelling and improving gut motility in pseudo-obstruction cases.

Abbott Laboratories (10-14%)

Abbott develops combination therapies tackling both neural and muscular dysfunction, enhancing treatment effectiveness for severe cases.

Pfizer Inc. (8-12%)

Pfizer advances regenerative medicine with stem cell-based therapies, pioneering novel approaches to chronic intestinal motility disorders.

Other Key Players (30-40% Combined)

Several pharmaceutical and biotech companies contribute to advancements in pseudo-obstruction treatment. These include:

The overall market size for the Intestinal Pseudo-Obstruction Treatment Market was USD 25,357.5 Million in 2025.

The Intestinal Pseudo-Obstruction Treatment Market is expected to reach USD 39,379.4 Million in 2035.

The demand is driven by increasing prevalence of gastrointestinal motility disorders, rising awareness and early diagnosis, advancements in pharmacological and surgical treatment options, and growing research into targeted therapies for chronic intestinal pseudo-obstruction (CIPO).

The top 5 countries driving market growth are the USA, UK, Europe, Japan and South Korea

The antibiotics segment is expected to command a significant share over the assessment period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA