In 2024, the worldwide internal gear pump market stood at USD 552 million, fueled by high demand in applications like chemicals, oil and gas, and food processing. The year witnessed greater use of internal gear pumps in precision applications, particularly in fluid handling processes where stable flow and high efficiency were needed. The manufacturers concentrated on enhancing pump designs to minimize cavitation and maximize durability, resulting in longer product lifetimes and reduced maintenance expenses.

Asia-Pacific, driven by China and India, saw massive investment in industrial automation, creating high demand for high-performance internal gear pumps. Europe and North America saw steady demand, supported by the growth in chemical processing and water treatment industries. Major industry players launched energy-efficient models in line with the global trend towards sustainability and stringent environmental regulations.

Looking forward to 2025 and beyond, the industry is anticipated to continue growing steadily and reach USD 0.575 billion by 2025 and USD 0.868 billion by 2035. Further industrialization and increased automation within the manufacturing and processing industries will remain the major drivers of growth. Furthermore, the industry will undergo a significant transformation in the upcoming decade due to innovative developments in smart pump technologies that incorporate real-time monitoring.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 0.575 Billion |

| Industry Value (2035F) | USD 0.868 Billion |

| CAGR (2025 to 2035) | 4.2% |

Explore FMI!

Book a free demo

Introduction

FMI conducted a detailed study of 450 industry stakeholders, including manufacturers, distributors, industrial operators, and regulators in key industries, including the USA, Western Europe, Japan, and South Korea, in Q4 2024. The study aimed to analyze emerging industry dynamics, key priorities, and global investment trends in gear pumps. The survey uncovered key insights regarding regulatory impact, technology adoption, material preferences, and industry challenges.

Global Trends

Regional Variance

High Variance in Adoption

73% of USA stakeholders considered automation a beneficial investment, whereas 35% of Japanese stakeholders preferred cost-effective, standalone models.

Material Preferences

Regional Preferences

Global

Regional Differences

Manufacturers

Distributors

End-User Industry

Global Alignment

Regional Investment Focus

USA

OSHA and NFPA regulations are a strong driver of safety technology adoption, according to 65% of respondents.

Western Europe

83% said that the EU Workplace Safety Directive was a strong sales driver for premium products.

Japan/South Korea

Just 35% felt regulations had a strong effect on purchasing decisions, as compliance was weaker.

Key Takeaways

Worldwide concerns about safety compliance, durability, and pressure on costs persist.

Adoption and pricing strategies vary widely

The global gear pump industry cannot be tackled using a “one-size-fits-all” approach. To ensure optimal industry penetration and sustainable growth, companies must tailor tactics to suit regional needs-IoT-oriented solutions in the USA; eco-friendly solutions in Europe; and cost-effective, small-footprint designs across Asia.

| Country | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States |

|

| United Kingdom |

|

| France |

|

| Germany |

|

| Italy |

|

| South Korea |

|

| Japan |

|

| China |

|

| Australia & New Zealand |

|

| India |

|

The gear pump industry in the United States will see 4.5% CAGR growth on the back of increasing demand from the oil & gas, chemical, and food & beverage industries. The Industrial Internet of Things (IIoT) is driving growth, with original equipment manufacturers embedding smart sensors for predictive maintenance. Regulatory systems like OSHA and EPA are encouraging the use of energy-efficient & low-emission gear pumps by the manufacturers.

Problems include semiconductor shortages and rising raw material prices, but opportunities in automation, hydrogen, and biofuels remain solid. Transferring well as domestic production that promotes innovation has also boosted growth.

The UK gear pump industry is projected to grow at a 3.8% CAGR, lower than the global average due to post-Brexit trade barriers and economic ambiguity. But demand from the pharmaceutical, water treatment, and industrial automation sectors is solid. The transition from CE marking to UKCA certification initially caused compliance issues, but the industry is now stabilizing.

Energy efficiency policies lead to the adoption of energy-efficient pumps. Although IoT adoption lags behind the USA and Germany, it is expected to drive industry growth in the coming years, with smart manufacturing and Industry 4.0 driving increased investments.

The demand for chemicals, cosmetics, and pharmaceuticals will be the key driver for the growth of France's gear pump industry, which is projected to grow at a 3.9% CAGR through 2023. Strict environmental regulations, such as ICPE laws, are driving manufacturers toward low-emission, energy-efficient pumps. The installation of gear pumps in explosive environments such as petrochemicals and power generation requires ATEX directive compliance.

Smart pumps with predictive maintenance are gaining ground here, but more slowly than in Germany. The supply chain is being disrupted by Asia, regulatory complexity in the EU, and potential battles for intellectual property in China, but there are also opportunities in some biotech, water purification, and alternative energy applications.

Germany, the industry with the highest revenues, continues to see growth of 4.6% CAGR. Strong demand for high-performance gear pumps thanks to strengths in industrial segments like automobiles, chemicals, and heavy equipment. Germany is at the forefront, with over 50% of manufacturers integrating IoT-enabled pumps for real-time monitoring and efficiency improvements.

Demand for green gear pumps gains momentum as the TA Luft regulations apply stringent emission controls. Biofuels and hydrogen usage are growth drivers for the renewable energy industry. Even though labour expenses and regulatory restrictions can impose barriers, Germany's focus on pursuing automated processes and a sustainable future ensures that they will thrive.

Projections indicate a CAGR of 3.7% for the Italian gear pump industry, with the food processing, textiles, and chemicals industries contributing the most. Italy is known for precision engineering and is a huge producer of custom-built and high-speed gear pumps. Moreover, compliance with IMQ Certification, CE Marking, and ISO Standards provides tremendous export potential.

Hybrid gear pumps are in vogue currently, as they are more cost-effective and energy-efficient. Economic instability and shifting industrial investments may dampen growth, but growing adoption of automated fluid-handling technologies and energy-efficient designs will underpin long-run demand.

In South Korea, the gear pump industry is anticipated to grow at a 4.0% CAGR, primarily driven by electronics, shipbuilding, and semiconductor production. If manufacturers need certifications for KOSHA and KC, they have to adhere to strict safety and performance controls. One of the key drivers has been smart factories and automation, with over 40% of the manufacturing base outfitted with IoT-ready gear pumps.

The government’s Green New Deal is pushing energy-efficient industrial equipment and driving growth for low-carbon gear pumps. High manufacturing costs and dependency on imported raw materials pose challenges, while advancements in robotics and automation provide ample growth prospects.

The gear pump industry in Japan will expand at a 3.6% CAGR, lower than the global average, as consumers prefer traditional machinery. Still, the automotive, robotics, and precision manufacturing industries are still key drivers of demand. The sector in Japan meet JIS, METI, and PSE standards to deliver high-quality products to our customers.

Due to the cost factor, 25% of industrial operators in Japan lack the implementation of smart pumps and are unavailable for IoT-based solutions. However, the significantly greater investments in wireless and compact fluid-handling solutions for space-limited facilities will present new avenues for growth.

Demand in China is expected to grow at the fastest pace among all leading industries, registering a 5.0% CAGR in the gear pump industry. Robust industrialization in the country, infrastructure development, and leadership in chemical processing and manufacturing generate demand. Product quality and safety are regulated by CCC certification and GB standards.

Demand for high-efficiency fluid-handling systems is being further accelerated by massive government investments in renewable energy and electric vehicles. China enjoys a comparative advantage in labour-intensive, low-cost production and demand-led growth, but it still suffers from higher labour costs, regulatory scrutiny, and supply chain disruptions. The industry is rapidly moving toward automated and intelligent fluid-handling systems.

Booming industrialization, urbanization, and infrastructure development are upholding the gear pump industry in India, which is anticipated to grow at a CAGR of 4.9% during 2025 to 2035. Oil & gas, water treatment, and food processing require more gear pumps. Granting BIS certification and compliance with CPCB environment norms is essential for entry into the industry.

Government initiatives such as “Make in India” as well as an investment in clean energy and smart manufacturing are driving growth. While price sensitivity remains prevalent, soaring demand for automated and high-efficiency fluid-handling products offers promising new opportunities. New investments overseas in the automotive, chemical and power industries would also complement the industry demand.

Steel pumps are the leaders in the global industry for gear pumps because of their excellent corrosion resistance, high strength, and capability to work with aggressive chemicals and extreme temperatures. The chemical, oil & gas, and food & beverage sectors extensively use these pumps due to their hygienic properties and resistance to harsh substances.

Cast iron pumps hold a significant industry share, especially in applications requiring rugged construction and cost-effectiveness. The industrial, mining, and marine sectors extensively use cast iron pumps. Their expansion is slower because of a move towards more superior materials with longer lives and better efficiency. The other type of pump encompasses hybrid and specialty materials, such as polymer-lined and ceramic-coated pumps, which are finding applications in niche industries for chemical resistance and lightweight solutions.

Heavy-duty pumps are a rapidly growing category due to their use in high-pressure applications in the oil & gas, shipping, and chemical industries. The demand for internal gear pumps in the heavy-duty segment held an overall market share of more than 32% in 2025. Demand for high-performance explosion-proof pumps is escalating in light of strict safety standards and growing industrial automation.

The largest sector is the chemical industry, led by demand for high-precision, corrosion-resistant pumps to deal with aggressive chemicals. Strict safety measures and emission regulations lead to the selection of heavy-duty stainless steel pumps. The marine industry is developing at a steady rate, and gear pumps play a crucial role in fuel transfer, lubrication, and ballast systems.

The use of internal gear pumps in marine industries contributed to more than 21% of the global market in 2025. The transition towards low-emission fuels such as LNG and biofuels is putting a demand on high-performance, corrosion-resistant pumps. The oil & gas industry continues to be a prime industry, with strong demand for heavy-duty, explosion-proof pumps for offshore drilling, refineries, and petrochemical processing. Expansion is driven by investments in hydrogen processing and biofuels.

The food & beverage industry is the most rapidly expanding segment, due to stringent hygiene regulations and the need for precision fluid transfer. Customers extensively use stainless steel, FDA-approved gear pumps, while the use of energy-efficient, CIP-compatible pumps is on the rise. Hydrogen fuel processing, battery production, and biofuels are increasingly using gear pumps, making this an emerging high-growth industry.

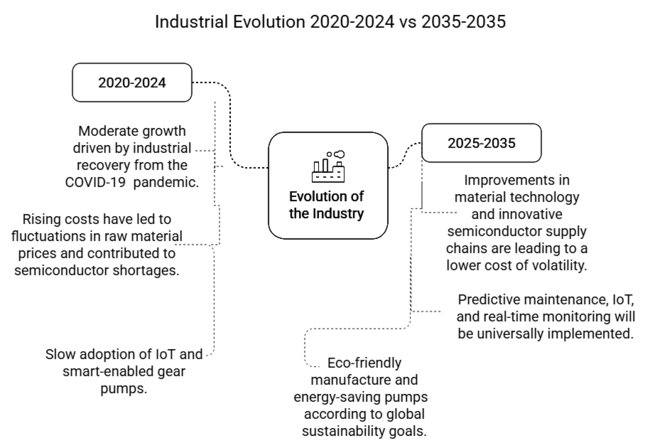

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Moderate growth driven by industrial recovery from the COVID-19 pandemic. | There is a positive matrix effect from automation, digitalization, and sustainability trends. |

| Supply chain shutdowns impacted raw material supply and production. | Localized manufacturing and strategic alliances lead to stable supply chains. |

| Rising costs have led to fluctuations in raw material prices and contributed to semiconductor shortages. | Improvements in material technology and innovative semiconductor supply chains are leading to a lower cost of volatility. |

| Slow adoption of IoT and smart-enabled gear pumps. | Predictive maintenance, IoT, and real-time monitoring will be universally implemented. |

| This growth is supported by the oil & gas, chemicals, and shipping sectors. | The food & beverage, pharmaceutical, and renewable energy sectors have boosted demand. |

| Tougher safety and emissions rules increased compliance costs. | Eco-friendly manufacture and energy-saving pumps according to global sustainability goals. |

| Traditional mechanical pumps dominate the industry. | There has been an increase in the adoption of hybrid and also smart gear pumps. |

The various players in the gear pump industry compete regarding price, technology, innovation, partnerships, and geography. Some are competing on the basis of cost leadership, while others are competing on the basis of high-performance, energy-efficient, and intelligent gear pumps. Key enablers include materials innovation, IoT-based monitoring, and predictive maintenance technology. Key players forge strategic partnerships with OEMs, industrial operators, and distributors to enhance their industry presence.

Common growth strategies include mergers, acquisitions, and the establishment or expansion of manufacturing facilities in rapidly growing regions like Asia-Pacific. In addition, organizations emphasize adherence to regulations (API, ATEX, FDA) and personalization for target industries to strengthen their industry sovereignty as well as address potential prospects in the industry.

Industry Share

Bosch Rexroth AG

Industry Share: ~20-25%

Bosch Rexroth is a global leader in hydraulic systems, investing heavily in innovation and energy-efficient solutions, securing a major share of the internal gear pump industry. Its huge R&D capabilities cater to several industries like automotive, manufacturing, and oil & gas.

Viking Pump, Inc.

Industry Share: ~15% and 20%

Viking Pump, whose prominent subsidiary is a brand under the parent IDEX Corporation, is an enterprise best known for their internal gear pumps that are durable and reliable. Headquartered in North America and Europe, the company focuses on tailored solutions for food & beverage, chemical processing, and other industries.

Tuthill Corporation

Industry Share: ~10-15%

Tuthill is an expert in high-performance internal gear pumps as a core technology, but the main applications are in the oil & gas and renewable energy spaces. It has been increasing its international presence through partnerships and technological modernisation.

PSG (Dover Corporation)

Industry Share: ~10-12%

Dover company PSG produces a wide range of internal gear pumps, including the Abaque and Blackmer brands. The company designs and manufactures solutions for demanding chemical, pharmaceutical, and wastewater treatment applications.

Colfax Corporation

Industry Share: ~8-10%

“Sourced through our Allweiler brand, Colfax manufactures high-tech internal gear pumps for industrial and marine applications. Their products have a strong focus on sustainability and energy efficiency.

Iwaki CO., Ltd.

Industry Share: ~5-8%

Specializing in precision-engineered internal gear pumps, IWAKI is a Japanese company that serves the chemical, pharmaceutical, and water treatment industries. IWAKI has been expanding its footprint in emerging industries.

Sumitomo Precision Products Co., Ltd.

Industry Share: ~5-7%

Sumitomo specializes in high-quality internal gear pumps for aerospace, automotive, and industrial applications. Keen focus of Sumitomo is on innovation and reliability to maintain a competitive advantage.

Bosch Rexroth AG announced a new series of its energy-efficient internal gear pumps designed to reduce carbon emissions in various industrial processes. The pumps use IoT-enabled sensors to enable predictive maintenance and real-time monitoring, which is in response to the growing need for smart manufacturing solutions.

Viking Pump, Inc. launched corrosion-resistant internal gear pumps for the chemical process industry to expand its product line. This innovation addresses the increased demand for durable and reliable pumping solutions in extreme conditions. Viking Pump further gained share in the industry by forming a partnership with a large European chemical manufacturer to co-engineer tailored pumping systems.

Tuthill Corporation One news snippet did involve the acquisition of a smaller pump manufacturer, one who works with renewable energy users. In March 2024, Industry Today reported Tuthill's key role in enhancing capacity to deliver sustainable pumping solutions for hydrogen production and biofuels. Tuthill predicts the acquisition will strengthen its presence in the renewable energy sector.

PSG, a division of Dover Corporation, focused on digital transformation by embedding advanced analytics and AI into its internal gear pumps. Announced in early 2024, this project provides customers the ability to maximize pumping potential while minimizing operational expenses. PSG also added to its in-region channel in Asia-Pacific to take advantage of the industrial areas’ growing sector.

Similarly, Colfax Corporation introduced a third-generation internal gear pump with energy-efficient performance and reduced noise levels. The pumps are aimed at marine applications and tap into an increasing interest in environmentally friendly solutions in the shipping sector. Colfax also collaborated with a leading shipbuilding entity to design exclusive pumping systems for next-generation vessels.

Iwaki CO., Ltd. made giant investments for R&D to manufacture internal gear pumps regarding pharmaceutical and food & beverage industries with improved sealing technologies. IWAKI also announced plans to build a new plant in India to support rising demand in the Asia-Pacific region.

In aerospace, Sumitomo Precision Products Co., Ltd. focused on innovation, launching internal gear pumps for lightweight designs. These pumps are purpose-built to deliver premium performance and safety, thereby enhancing Sumitomo's foothold in the aerospace space, as it were.

The adoption of Industry 4.0 and greener regulations will accelerate the demand for gear pumps that are intelligent, energy-saving, and environmentally friendly. As industrial operators demand real-time monitoring and efficiency in operations, investors must invest in IoT-based, predictive maintenance technologies.

Two key industries are Asia-Pacific and the Middle East, where industrialization and infrastructure investments are exploding. With governments around the world promoting environmentally friendly technologies, firms should also develop specialized gear pumps for emerging industries, like hydrogen fuel processing, biofuels, and cooling systems for electric vehicles.

TGTs will strengthen the competitive position and win new business as producers expect integrated, plug-and-play pump systems through strategic alliances with industrial automation companies. Even partnerships with OEMs can help pump vendors grow their business and become the preferred supplier of heavy machinery and process equipment manufacturers.

In addition, companies must navigate regional regulation schemes-adopting ATEX and CE marking in Europe, API certification in the US, and energy-saving designs in Asia-to gain traction in new industries.

Industries such as oil and gas, chemicals, marine, food processing, and industrial manufacturing utilize gear pumps.

Real-time device monitoring, predictive maintenance, and efficiency improvement are provided by IoT-based gear pumps.

The main issues are the plummeting raw material prices, regulatory compliance, and disruption in product sourcing.

Industrialization, infrastructure, and investment in the energy sector are driving growth.

Manufacturers are prioritizing energy-saving motors, low-emission components, and recyclables.

The industry is segmented into steel pumps, cast iron pumps, heavy-duty pumps and others.

The Industry is segmented into chemical industry, marine industry, oil & gas sector, food & beverage companies and other End-use Applications

It is fragmented North America, Latin America, Europe, East Asia, South Asia and Pacific, Middle East and Africa (MEA)

Immersion Heater Market Growth - Trends & Forecast 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Marine Cranes Market Growth - Trends & Forecast 2025 to 2035

Industrial Exhaust System Market Growth - Trends & Forecast 2025 to 2035

Hot Chamber Die Casting Machine Market Growth - Trends & Forecast 2025 to 2035

High Voltage Glass Insulator Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.