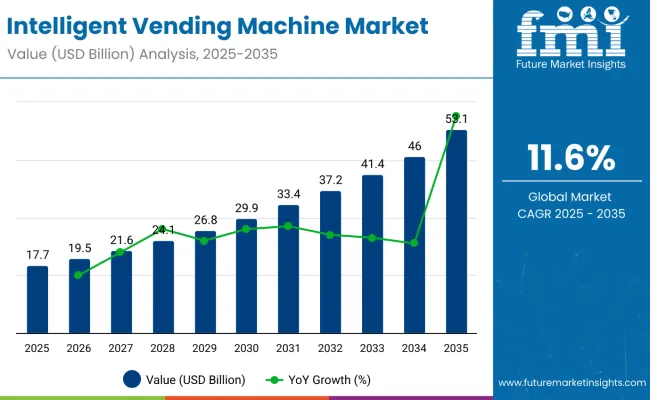

The global intelligent vending machine market was valued at USD 17.73 billion in 2025 and is projected to reach USD 53.15 billion by 2035. This growth is expected at a CAGR of approximately 11.6% during the forecast period. The expansion is driven by increasing consumer demand for convenience, technological advancements, and growing integration of artificial intelligence (AI) and the Internet of Things (IoT) in vending solutions.

Adoption of smart vending machines has been accelerated across retail, healthcare, hospitality, and transportation sectors. Key features such as cashless payments, real-time inventory tracking, and personalized user experiences are increasingly valued. The Asia Pacific region is expected to lead market growth, propelled by urbanization, rising middle-class populations, and improved digital infrastructure.

Recent innovations have further supported market momentum. In 2025, Coca-Cola and Fuji Electric introduced hydrogen-powered vending machines at the World Expo in Osaka, enhancing energy sustainability by eliminating reliance on traditional power sources.

Additionally, supermarkets like Asda in the UK have piloted free product vending machines, leveraging customer loyalty programs to boost engagement and sales as per The Verge, 2025 and The Sun, 2025. The integration of AI has gained traction with companies such as Sanden Vendo and Azkoyen Group deploying machines equipped with computer vision and predictive maintenance capabilities.

Leading manufacturers including Crane Co., Fuji Electric, and Sanden Holdings have invested heavily in R&D to enhance machine efficiency and user interface. Crane Co. CEO Mark Thompson stated in 2024, “Innovations in AI and IoT integration are revolutionizing the vending experience and optimizing operational workflows.”

North America and Europe demonstrate steady growth driven by automation adoption and consumer preference for healthy, customized offerings. The Asia Pacific region is forecasted to experience the fastest growth, supported by favorable government policies and a surge in digital technology adoption. The convergence of technological advancements and evolving consumer behavior is expected to sustain the market’s strong growth through 2035.

Leading companies in the intelligent vending machine market are increasingly adopting cutting-edge technologies to transform traditional vending into highly interactive and efficient retail solutions. By integrating artificial intelligence (AI), Internet of Things (IoT) connectivity, cashless payment options, and real-time data analytics, these companies aim to significantly enhance the user experience while optimizing inventory management and reducing operational costs.

The global trade of intelligent vending machines is shaped by a few key exporting and importing countries. Leading exporters like China, the United States, Germany, and Japan combine manufacturing scale with advanced technology to meet worldwide demand. On the other hand, major importing countries such as the United States, United Kingdom, France, Canada, and Australia drive growth through rapid urbanization and retail modernization. This dynamic trade environment reflects the increasing adoption of automated retail solutions to improve convenience and operational efficiency across markets.

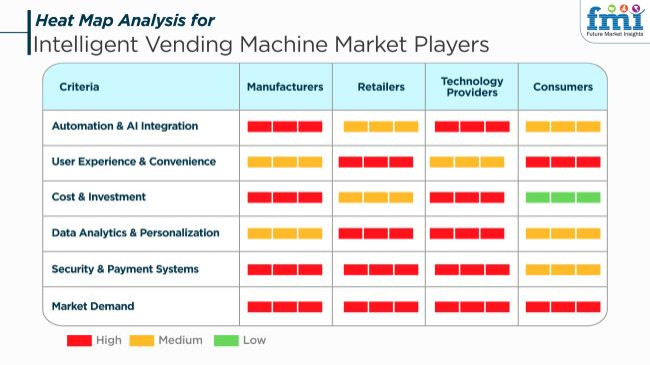

The intelligent vending machine market is expanding effectively in line with the use of the latest technology in AI, IoT, and cashless payments, which ensures a pleasant shopping experience. The manufacturers are mainly focusing on the automation of the process driven by AI and the smart inventory management system that will, in turn, lead to better operational efficiency.

The retailers are targeting customer experience, data analytics, and real-time monitoring for stock optimization and increased sales. Technology providers use cloud-based formulas, facial recognition, and NFC payment systems to ensure security and tailor the customer experience.

Consumers seek for the convenience of buying, not using cash, and a variety of products that vending machines offer, which leads to product innovations and interactive touchscreens. The key factors that they had for purchase included digital wallet integrations, machine learning for intelligent suggestions, energy efficiency, and the ability to manage it remotely.

The requirement for smart vending machines is anticipated to increase in the future because of companies incorporating smart retailing solutions across segments such as food & beverages, health care, and electronics and components.

Contracts & Deals Analysis

| Company | Contract Value (USD Million) |

|---|---|

| Crane Merchandising Systems | 30-40 |

| Fuji Electric Co., Ltd. | 50 |

| Azkoyen Group | 20-30 |

From 2020 to 2024, the intelligent vending machine market grew at a steady rate, fueled by the development of cashless payment systems, inventory management through artificial intelligence, and increasing consumer interest in contactless retailing. The use of IoT and intelligent sensors allowed vendors to track stocks and machine operations in real time, lowering costs of operation.

Increased demand for healthier snack choices and tailored product suggestions further revolutionized vending machines as smart retail outlets in the workplace, airports, and city transit centers. Supply chain disruptions and the cost of initial deployment hindered mass take-up, though. Between 2025 and 2035, the smart vending machine market is likely to grow further with consumer analytics powered by AI, facial recognition payments, and compatibility with digital wallets and cryptocurrencies.

The emergence of autonomous retail ecosystems will see vending machines transform into multi-purpose kiosks that provide fresh food, medicines, and even technology accessories. Sustainability will be a priority, with eco-friendly cooling technologies and recyclable packaging becoming common features. Improved connectivity via 5G and edge computing will further enhance machine responsiveness and customer interaction.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments also started enforcing compliance with cashless payment and food safety in vending machines. | Due to AI monitoring, it can be monitored for inventory, safety, and hygiene factors in real time. |

| Utilization of touchscreen interfaces and real-time monitoring by IoT. | Vending operations might also be enhanced by AI-driven personalized recommendations. |

| Transition from cash payment to digital payment methods such as mobile wallets and NFC. | Large-scale adoption of payments based on biometrics and blockchain in a safe and seamless experience. |

| Increased products ranging from snacks and beverages to pharmaceuticals, electronics, and fresh produce. | AI-based vending machines optimize stock based on user behavior, allowing hyper-personalized products. |

| Energy-efficient materials and recyclable packaging have become the latest trend. | The flooding of solar-powered and AI-enabled energy-optimized vending machines considerably reduces carbon footprint. |

| IoT sensors made it possible to track the inventory in real-time and enable predictive replenishment. | Demand forecasting-based AI reduced wastage and maximized efficiency in an autonomous supply chain management system. |

| Urbanization, demand for on-the-go products, and innovative technological advancement were all drivers of expansion. | Automated product dispensation along with real-time data analysis will ensure continued growth. |

The intelligent vending machine market is facing various kinds of risks which include cyber threats, regulatory compliance, supply chain interruptions, and market competition.

The main technological vulnerabilities are software bugs, IoT connectivity problems, and sensor issues. Intelligent vending machines have features including AI, screens without touching, and cashless payment systems, which expose them to mistakes, data errors, and connectivity disruptions that may influence consumer experience and sales. Firmware updates and AI-driven diagnostics are some precautions.

Supply chain disruptions are the main reason that machine production is affected. Thus, it also has an impact on the components, such as touchscreens, sensors, and digital payment processors, that will be used in product assembly. Global shortages in semiconductor and electronic parts could cause delays and lead to increased costs. Establishing manufacturing hubs in regions and varied supplier networks can control supply chains better.

Traditional vending machines, e-commerce, and self-checkout kiosks compete with intelligent vending machines, which puts pressure on the latter to give away unique features like AI-driven recommendations, personalized promotions, and seamless multi-payment options.

At the forefront are Tier 1 vendors, distinguished by their extensive global presence, substantial financial resources, and a broad portfolio of advanced vending solutions. These industry leaders have established strong brand recognition and consistently drive innovation. Companies such as Crane Co., Advantech Co. Ltd., and Azkoyen Group exemplify this tier.

Their dominance is attributed to continuous technological advancements, strategic acquisitions, and the ability to cater to diverse consumer demands across multiple regions. For instance, Crane Co. has expanded its influence through the development of cutting-edge vending technologies and strategic partnerships, solidifying its position as a key leader.

Tier 2 vendors are mid-sized companies with notable presence and regional influence. While they may not possess the extensive global reach of Tier 1 companies, they play a crucial role by addressing specific regional needs and niche markets. Companies like Sielaff GmbH & Co. KG and FAS International S.p.A. are prominent in this category.

Sielaff, for example, has a strong presence in the European industry, offering quality vending solutions tailored to local preferences. These vendors often focus on innovation within their specialties, contributing significantly to the market's diversity and resilience.

Tier 3 vendors consist of smaller, emerging companies and local manufacturers. These vendors typically operate within limited geographical areas and may offer specialized or customized vending solutions. While they hold a smaller share of the global industry, their flexibility and ability to provide tailored services make them vital players, especially in niche markets or regions with specific requirements.

Their contributions add to the market's overall dynamism and adaptability, ensuring that a wide range of consumer needs and preferences are met across different locales.

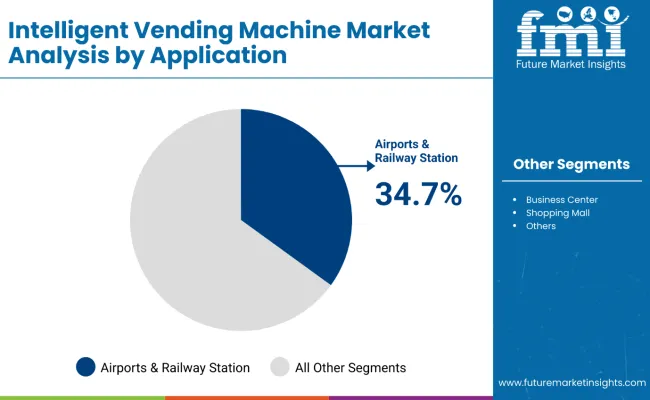

| Segment | Airports & Railways Stations (Application) |

|---|---|

| Value Share (2025) | 34.70% |

Airports and railway stations are emerging as key locations for fitting intelligent vending machines due to high passenger traffic and demand for rapid, automated selling. Due to the presence of millions of passengers daily traveling through these transport points, vending machines offer an ideal solution for distributing snacks, beverages, and common goods without manpower.

Rising deployment of touchless payment-enabled, facial recognition-enhanced, AI-driven inventory-managing smart vending machines is causing them to be the first choice in these facilities.

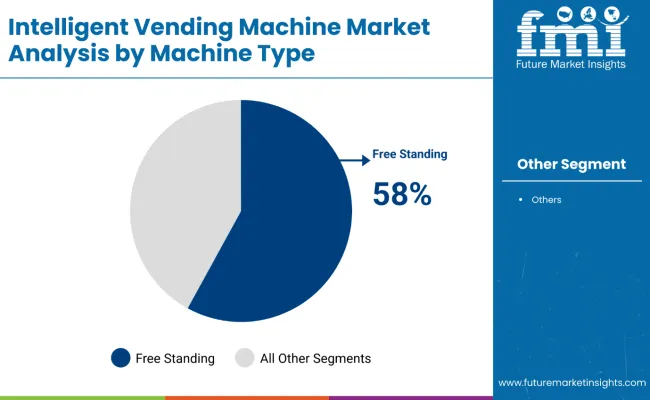

Free-standing intelligent vending machines are widely sold because they provide convenient and automated access to products without requiring staff. Their smart features, such as cashless payments, inventory tracking, and remote monitoring, improve user experience and make operations more efficient.

These machines can be placed in various locations like hospitals, offices, and public areas, offering round-the-clock availability. Additionally, they collect data that helps businesses optimize stock management and sales strategies, making them a popular choice in modern retail and service settings.

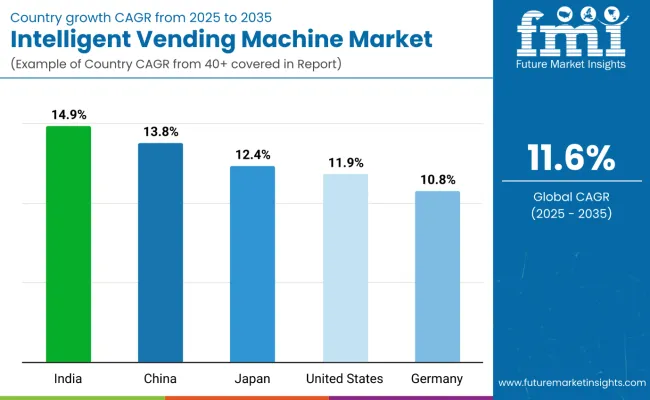

The section highlights the CAGRs of countries experiencing growth in the Intelligent Vending Machine market, along with the latest advancements contributing to overall development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 14.9% |

| China | 13.8% |

| Germany | 10.8% |

| Japan | 12.4% |

| United States | 11.9% |

India&rsquos growing focus on smart cities has created significant opportunities for the intelligent vending machine market. The Indian government&rsquos Smart Cities Mission aims to enhance urban infrastructure by integrating advanced technologies, including automated vending solutions, to improve convenience in public spaces. With urbanization accelerating, there is a rising demand for self-service vending machines that offer quick access to food, beverages, and essential products.

These machines are particularly beneficial in metro stations, airports, and office complexes where high foot traffic necessitates efficient retail solutions. The adoption of digital payments such as UPI has further accelerated this trend, making cashless transactions seamless for vending machine users.

The government installed automated vending kiosks in key railway stations across major cities, enabling travelers to purchase snacks and essential goods without human intervention. Over 500 vending machines have been deployed in metro stations across Delhi, Mumbai, and Bengaluru as part of the Smart Cities initiative, with plans to double this number in the next three years.

Such initiatives are driving the intelligent vending market in India, ensuring greater adoption in public infrastructure, commercial hubs, and urban neighborhoods. Intelligent Vending Machine market in India is projected to grow at a robust growth rate of 14.9% during 2025 to 2035.

The USA is at the forefront of adopting AI and IoT-enabled vending machines, transforming traditional vending operations into data-driven retail solutions. With increasing consumer demand for convenience, intelligent vending machines equipped with real-time inventory tracking and predictive analytics are becoming widespread.

These machines utilize IoT sensors to monitor stock levels, reducing the risk of product shortages and optimizing restocking schedules. AI-powered vending solutions also enable dynamic pricing, personalized recommendations, and facial recognition for seamless transactions, enhancing user experience.

The USA government has supported digital innovation by funding initiatives that promote AI-driven automation across industries, including retail. For instance, a recent federal program allocated USD 50 million for AI research in smart retail solutions, encouraging companies to integrate AI-driven vending technologies.

Additionally, major transit hubs such as New York&rsquos subway system have installed over 1,000 intelligent vending kiosks to cater to increasing demand. According to government reports, AI-powered vending machines have led to a 30% reduction in stock wastage and a 20% increase in efficiency in automated retail solutions. The USA Intelligent Vending Machine market grow at a CAGR of 11.9% throughout the forecast period.

China&rsquos rapid urbanization and widespread adoption of digital payments have significantly boosted the intelligent vending machine market. With a growing middle class and increased urban migration, the demand for convenient, self-service retail solutions has surged.

Intelligent vending machines are becoming a crucial part of China&rsquos smart retail ecosystem, offering cashless transactions via platforms like WeChat Pay and Alipay. These machines provide 24/7 accessibility in high-traffic areas, including metro stations, shopping malls, and office complexes.

The Chinese government has actively promoted smart retail through policies encouraging digital infrastructure development. In a recent government-backed initiative, over 10,000 AI-powered vending machines were deployed in public spaces across major cities like Beijing, Shanghai, and Shenzhen. Official statistics indicate that cashless vending transactions in China increased by 45% in the past year alone.

Furthermore, the government is investing in 5G-powered vending solutions to enhance machine connectivity and transaction speed, ensuring seamless user experiences. China is expected to make a profound impact on the intelligent Vending machine market significantly holds a dominant share of 59.4% in 2025.

The intelligent vending machine market is highly competitive with existing and new vendors vying with each other to enhance vending effectiveness and offer customers the optimal experience. Companies compete based on technology innovation in AI, IoT, and cashless payment, driving automation and self-service retail solutions

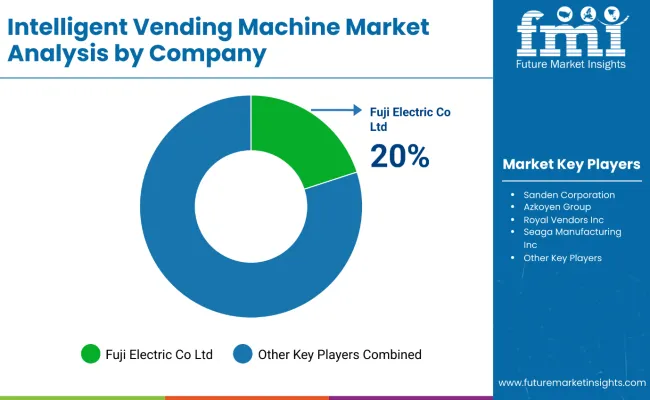

Key leaders Fuji Electric Co., Ltd., Sanden Corporation, and Crane Payment Innovations (CPI) have a good hold in the industry through their intelligent vending solutions. They prioritize innovation, strategic alliances, and automation to expand their business.

The increasing need for data-based vending and greater interaction with customers suits the R&D investment. Businesses are adopting cloud analytics, mobile payments, and touchless interfaces so that their operations stay ahead.

Market Share Analysis by Company

| Company Name | Estimated Share (%) |

|---|---|

| Fuji Electric Co., Ltd. | 20-25% |

| Sanden Corporation | 15-20% |

| Crane Payment Innovations (CPI) | 12-18% |

| Azkoyen Group | 8-12% |

| Seaga Manufacturing Inc. | 5-10% |

| Royal Vendors, Inc. | 4-8% |

| Other Players | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Fuji Electric Co., Ltd. | Advanced AI-driven vending machines that are energy-efficient. Customers can also do cashless payment. |

| Sanden Corporation | Smart vending solutions with IoT integration and user-friendly touchless interfaces. |

| Crane Payment Innovations (CPI) | Digital vending solutions with automatic tracking of inventory and cloud-based analytics. |

| Azkoyen Group | Customizable vending systems with multi-product dispensing and telemetry solutions. |

| Seaga Manufacturing Inc. | Small sized, high-tech vending machines for food, beverage, and retail applications. |

| Royal Vendors, Inc. | High-capacity beverage vending machines with smart monitoring systems. |

Other Key Players (25-35% Combined)

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 17.73 billion |

| Projected Industry Size (2035) | USD 53.15 billion |

| CAGR (2025 to 2035) | 11.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2019 to 2023 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion; Thousand units for machine volume |

| Types | Beverages, Snacks, Commodities, Others |

| Applications | Fast-Food Restaurants, Shopping Malls, Retail Stores, Public Transport, Airports, Hospitals, Hotels, Railway Stations, Schools, Business Centers |

| Technologies | Cashless Systems, Telemetry Systems, Voice Recognition |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa |

| Key Players | Fuji Electric Co., Ltd., Sanden Corporation, Crane Payment Innovations (CPI), Azkoyen Group, Seaga Manufacturing Inc., Royal Vendors, Inc., Westomatic Vending Services Ltd., FAS International S.p.A., Evoca Group, Jofemar Corporation |

| Additional Attributes | Growth driven by advancements in IoT connectivity, machine learning-enabled restocking, and integration with mobile payment ecosystems. Increased demand in high-traffic zones and tech-savvy urban regions is accelerating adoption. |

| Customization and Pricing | Customization and Pricing Available on Request |

The industry is segmented by type into beverages, snacks, commodities, and others.

The industry is segmented by application into fast-food restaurants, shopping malls, retail stores, public transport, airports, hospitals, hotels, railway stations, schools, and business centers.

The market is segmented by technology into cashless systems, telemetry systems, and voice recognition.

The market is segmented by region into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The industry is slated to reach USD 17.73 billion in 2025.

The industry is predicted to reach USD 53.15 billion by 2035.

India, slated to grow at 14.9% CAGR during the forecast period, is poised for the fastest growth.

Key companies include Canteen Vending Services, Inc., Crane Payment Innovations (CPI), Advantech Co. Ltd, Fuji Electric Co. Ltd., Bianchi Vending Group S.p.A, Cantaloupe Systems Inc., Intel Corporation, Glory Global Solutions Inc., Azkoyen Group, and Rhea Vendors Group.

Wall-mounted intelligent vending machines are widely used.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Application, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 8: Global Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 14: North America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 16: North America Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 20: Latin America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 22: Latin America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 24: Latin America Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 28: Western Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 30: Western Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 32: Western Europe Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 36: Eastern Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 38: Eastern Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 40: Eastern Europe Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Type, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Application, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 52: East Asia Market Volume (Units) Forecast by Type, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 54: East Asia Market Volume (Units) Forecast by Application, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 56: East Asia Market Volume (Units) Forecast by Technology, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Units) Forecast by Type, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Units) Forecast by Application, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Technology, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Units) Forecast by Technology, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Technology, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 10: Global Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 14: Global Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 18: Global Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 21: Global Market Attractiveness by Type, 2024 to 2034

Figure 22: Global Market Attractiveness by Application, 2024 to 2034

Figure 23: Global Market Attractiveness by Technology, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Type, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Technology, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 34: North America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 38: North America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 42: North America Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 45: North America Market Attractiveness by Type, 2024 to 2034

Figure 46: North America Market Attractiveness by Application, 2024 to 2034

Figure 47: North America Market Attractiveness by Technology, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Type, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Technology, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 58: Latin America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 62: Latin America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 66: Latin America Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Type, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Technology, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by Technology, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 82: Western Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 86: Western Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 90: Western Europe Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Type, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by Technology, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by Technology, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Type, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by Technology, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Type, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by Technology, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Type, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by Technology, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Type, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by Technology, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 154: East Asia Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 158: East Asia Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 162: East Asia Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Type, 2024 to 2034

Figure 166: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 167: East Asia Market Attractiveness by Technology, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Type, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by Technology, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Technology, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Technology, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Type, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by Technology, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fuel Vending Machines Market

Retail Vending Machine Market Analysis - Size, Share, and Forecast 2025 to 2035

Market Share Distribution Among Retail Vending Machine Suppliers

Medical Vending Machines Market

Intelligent Cash Deposit Machine Market

Hot Food Vending Machine Industry Analysis in USA & Canada - Size, Share, and Forecast 2025 to 2035

Refrigerated Vending Machine Market Size and Share Forecast Outlook 2025 to 2035

Sanitary Napkin Vending Machine Market Analysis - Trends, Growth & Forecast 2025 to 2035

USA Beauty and Personal Care (BPC) Retail Vending Machine Market Outlook 2025 to 2035

Intelligent Touch Screen Cash Register Market Size and Share Forecast Outlook 2025 to 2035

Vending Massage Chair Payment Solution Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Road Test Instruments Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Driving Technology Solution Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Intelligent Completion Market Size and Share Market Forecast and Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Rubber Tracks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA