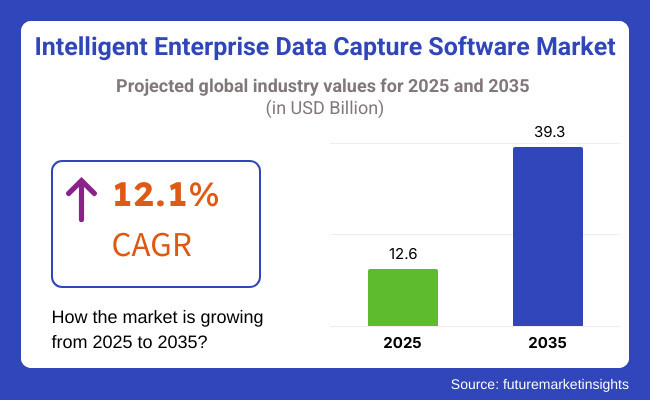

Intelligent enterprise data capture software market is likely to reach a valuation of USD 12.6 billion by 2025 and will be valued at USD 39.3 billion in 2035. By 2035, the fetching sales are growing with a CAGR of 12.1%.

Technology such as artificial intelligence (AI), machine learning (ML), optical character recognition (OCR), and natural language processing (NLP) allow for the acceleration and accuracy with which data is processed. This software communicates with enterprise software that ranges from enterprise resource planning (ERP) to customer relationship management (CRM). The process of applying this software is automated, and the human error in data entry during the manual entry of data in the system is reduced. So, the organization gets an opportunity to handle a huge amount of data, thus improving an organization's decision-making process, which eventually makes the organization more proficient.

With the constant growth in data, there is also a need for smart data capturing in the capture solutions. Today, establishments are investing their time in automating processes that cut down on manual data entry errors while improving the precision and productivity of the organization. These technologies (i.e., AI, ML, OCR, and NLP) are responsible for the creation of automated data extraction processes from diverse sources (such as invoices, emails, and scanned documents) and, later, Classification and Validation.

The growing focus of companies on digital transformation projects also fuels the demand for solutions for intelligent document processing. The need to manage large amounts of data quickly and accurately is projected to be the key driver for the market growth in the future.

Explore FMI!

Book a free demo

The market is the transformation of industries as the data-driven priority shift of organizations, and there is a lot of emphasis on having automatic, accurate, and efficient data management. Software developers are more inclined to develop state-of-the-art AI-oriented solutions that boost document processing, optical character recognition (OCR), and data extraction for enterprises. Corporate companies are attaching more importance to the provision of hassle-free association with the already installed enterprise resource planning (ERP) and customer relationship management (CRM) systems, which in turn would streamline operations to a smaller extent and help in better decision-making.

The providers of the cloud services are the ones who take the major part in giving the products of incrementing, the high-quality solutions which, by implication, will provide direct data processing and availability. The end-users of small and medium-sized companies and other types of organizations are demanding expense-efficient, intuitive solutions that could increase their productivity and still meet the necessary security standards.

Contracts and Deals Analysis

| Company | Contract Value (USA USD Million) |

|---|---|

| SpinSys-Diné | Approximately USD 35.13 |

| USA Department of Transportation (DOT) | Approximately USD 25.11 |

| Defense Information Systems Agency (DISA) | Approximately USD 18.05 |

| GEP SMART | Approximately USD 30.15 |

During 2020 to 2024, the world intelligent enterprise data capture software market expanded at a constant rate since automation was being brought more into play, and it was becoming essential to handle data in the right way. Merging of artificial intelligence and machine learning improved data processing, whereas digital transformation in key markets like Asia-Pacific fueled demand. Companies accorded high priority to intelligent capture solutions to enhance workflow effectiveness and regulatory compliance. Between 2025 and 2035, the market is poised for increased growth with breakthroughs in AI-powered automation, real-time analysis, and data protection. Heightened regulatory compliance and the need for smooth data unification will stimulate adoption in finance, healthcare, and manufacturing. Intelligent data capture will be imperative for operational efficiency and decision-making as organizations put digital transformation on the agenda.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Data privacy regulations such as GDPR and CCPA mandated stricter compliance for enterprise data capture. Organizations invested in secure data processing and storage solutions. | AI-driven data capture and processing increase regulatory scrutiny. Governments implement policies to ensure ethical AI use in enterprise data, emphasizing transparency, security, and compliance with evolving data privacy laws. |

| Cloud-based data capture solutions gained widespread adoption, improving accessibility and scalability. AI and OCR advancements enhanced document digitization and automated data extraction. | Quantum computing enhances real-time data processing capabilities. AI-driven automation in enterprise data workflows improves efficiency, accuracy, and compliance. Integration with IoT and edge computing optimizes intelligent data capture in real-time operations. |

| Businesses integrated AI-powered document recognition and workflow automation, improving operational efficiency. Digital transformation initiatives accelerated enterprise-wide adoption of data capture software. | Enterprises invest in autonomous AI-driven data capture ecosystems. Hyperautomation, combining AI, RPA, and ML, streamlines document processing, workflow automation, and decision-making. AI-generated insights optimize enterprise productivity. |

| Increased reliance on AI-enhanced data capture solutions in healthcare for patient record management and insurance claim processing. Financial institutions leveraged AI to automate document processing and fraud detection. | AI-powered intelligent data capture in healthcare enables real-time diagnostics and automated compliance monitoring. Financial institutions enhance cybersecurity and fraud prevention with predictive analytics and blockchain-integrated data capture solutions. |

| Intelligent data capture software improved supply chain visibility and manufacturing efficiency through automated data entry, inventory tracking, and predictive maintenance. | Machine learning-driven supply chain automation maximizes real-time monitoring, demand planning, and risk mitigation. Autonomous warehouses and forecasting analytics minimize operational waste and enhance logistics harmonization. |

| Uptake of AI-driven data capture solutions grew as companies transitioned to cloud-based digitalization. Automated processing of documents became a routine feature. | AI-powered data capture solutions are integrated with hybrid cloud infrastructures. Companies utilize decentralized AI for real-time document identification, fraud prevention, and data protection. Advanced NLP models facilitate conversational AI for enterprise document processing. |

| Companies used intelligent data capture to track and report ESG compliance. Automated data analytics facilitated corporate sustainability efforts. | AI-powered data capture enhances tracking of environmental, social, and governance (ESG) compliance. Businesses use intelligent document analytics for carbon footprint reporting, ethical supply chain management, and regulatory openness. |

| Growing demand for AI-fueled data capture solutions drove the need for reskilling the workforce. Organizations introduced specialized training programs to enhance AI and data processing capabilities. | AI-driven automation transforms job roles in data capture and document management. Workforce reskilling programs focus on AI-augmented data processing, cybersecurity, and ethical AI practices in enterprise automation. |

| Digital transformation, AI adoption, and increasing regulatory compliance fueled demand for intelligent enterprise data capture solutions. Organizations focused on operational efficiency and automation. | The market expands due to AI-powered enterprise automation, cloud-based data processing, and increased compliance requirements. Governments and industries invest in secure and intelligent data capture solutions to enhance business agility and decision-making capabilities. |

Global intelligent enterprise data capture software pricing strategies must be carefully tailored to customers with unique software demands and growth rates. The price structure must be well-planned to provide easy access to business sizes ranging from the smallest to the largest while at the same time being profitable to the software vendor.

Value-based pricing is a strategy worth considering, especially in sectors where automation is vital for productivity, such as finance, logistics, and healthcare. Acknowledging the value of reducing errors in manual processing, increasing compliance, and improving operational speed, companies are ready to pay extra money for sophisticated AI-based solutions.

Subscription-based pricing is the most common approach in the market, and it allows the client to choose the payment plan for completing the job, either monthly or yearly. It does not give providers a recurring revenue stream and allows clients to scale their operations based only on what they really need.

Lease pricing makes it possible for suppliers to set different prices based on the bundle of features provided. For example, a basic plan may consist of the OCR scanner function, while the premium plan would include AI automation, third-party app integration, and superior analytics. Such a strategy might help to serve both small and big enterprises.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 11.3% |

| Germany | 10.0% |

| China | 15.3% |

| India | 17.7% |

| Australia & New Zealand | 17.2% |

The United States dominates the market as a result of its cutting-edge AI infrastructure, in addition to substantial demand for enterprise automation and regulation-compliant data handling practices. BFSI, healthcare, IT & telecom, and retail verticals are big spenders on AI-driven document processing to enhance their operational efficiency and compliance. UiPath, OpenText, and Databricks are automation technology leaders with document processing processes using machine learning. The rise of big data analytics combined with high cloud adoption rates has made the switch to smart capture solutions a necessity for greater real-time processing and remote collaboration. The availability of a strong SaaS ecosystem, government initiatives to promote AI adoption, and compliance regulations for cybersecurity also create conditions that drive growth at an accelerated pace in the market. According to FMI, the USA market is expected to witness high growth at an 11.3% CAGR through 2035.

Drivers of Growth in the USA

| Key Drivers | Details |

|---|---|

| AI & Automation Leadership | Heavy investment in AI-powered document processing by USA companies is driving workflow automation. |

| Cloud-First Strategies | Firms are adopting cloud-based intelligent capture solutions for scalability and remote accessibility. |

| Regulatory Compliance | Data security regulations drive the demand for advanced document management solutions. |

The Intelligent Enterprise Data Capture Software Market in China is expanding at a rapid pace owing to the heavy government promotion of AI, automation, and industrial digitization. The "Made in China 2025" policy fosters smart manufacturing, accelerating logistics, fintech, and e-commerce implementation. Chinese technology leaders such as Alibaba, Tencent, and Huawei design AI-powered document processing solutions based on deep learning to support real-time analysis. Increased adoption of smart document processing by China's burgeoning e-commerce and finance sectors enhances the efficiency of fraud prevention and transaction verification. In addition, cloud data security and cybersecurity regulations require industries to invest in AI-driven enterprise data capture solutions. The growing adoption of 5G and IoT-based smart manufacturing drives even more demand for real-time automatic document handling.

China's Growth Drivers

| Key Drivers | Details |

|---|---|

| Industrial Digitalization | Smart factory and fintech expansion drive demand for intelligent document handling. |

| E-commerce & Fintech Growth | AI-driven automation supports secure transactions and efficient data management. |

| Cybersecurity Regulations | Stringent compliance needs fuel investment in safe, AI-based data capture solutions. |

The 4th industrial revolution and the accompanying era of digitalization have generated an extensive implementation of AI-powered document processing in manufacturing, automotive, and logistics. In Germany, enterprises leverage intelligent capture solutions to automate supply chains, boost operational efficiency, and enhance data assurance. The BFSI segment is also the strictest in terms of financial regulation, as it includes AI-based data capture software for secure transactions and anti-fraud programs. Companies such as SAP and Siemens are investing in AI-based workflow automation, which is gaining popularity in industrial and enterprise settings. FMI projects that the German market will grow at a 10.0% CAGR during the forecast period.

Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| Industry 4.0 Adoption | Industrial automation and supply chain management are optimized with AI-driven data capture solutions. |

| GDPR Compliance | Large data protection regulations drive business investment in secure data capture solutions. |

| BFSI Security Requirements | Banks and insurers ensure Compliance and fraud prevention through AI-driven document processing. |

India's intelligent enterprise data capture software market is booming primarily due to digital transformation initiatives, cloud adoption, and the gradual growth of small and medium businesses (SMEs). In India, various government initiatives like “Digital India” and “Make in India” have motivated organizations to embrace AI-based document processing in order to enhance operational efficiency and regulatory compliance. Industries heading the race for intelligent capture solutions include BFSI, healthcare, IT services, and e-commerce. Cloud-based automation is increasingly adopted by Indian enterprises, and thus, they look for cost-effective, scalable SaaS-based AI. Leading IT service providers like TCS, Infosys, and Wipro incorporate intelligent document processing into the enterprise process to help expand the market.

India Growth Drivers

| Key Drivers | Details |

|---|---|

| Digital India Initiative | Government-backed digitization drives enterprise automation requirements. |

| SME Cloud Adoption | Affordable, SaaS-based options spur AI-based document processing adoption. |

| BFSI & E-commerce Growth | Secure, AI-powered data capture solutions improve financial transactions and fraud detection. |

Growth in the market in Australia and New Zealand is being driven by increased investment in AI technologies, regulatory compliance initiatives, and an increase in the number of digital banks. Under prescribed Consumer Data Right (CDR) and Privacy Act laws, the banking sector is dependent on AI-led mechanization to ensure a protected advanced exchange. In the healthcare sector, AI-based document processing is used to process and manage patient information while ensuring compliance with data protection laws. All of this is concentrated in order to allow remote workers to use cloud-based intelligent capture technology to automate processes, as well as Australia's and New Zealand region's remote-working enterprises aiming towards business continuity. Moreover, the highly increased integration and adoption of AI-powered automation by retail, logistics, and government verticals will further drive the market growth.

Growth Drivers in Australia & New Zealand

| Key Drivers | Details |

|---|---|

| Financial Sector Compliance | Artificial intelligence-driven document processing ensures data privacy compliance. |

| Healthcare Digitalization | Intelligent capture software manages patient information on autopilot. |

| Cloud-Based Automation | Businesses invest in SaaS-based smart document processing technology. |

OCR is an important technology in the market due to its high accuracy and AI-enhanced features. Revolutionary companies like ABBYY have built AI-powered optical character recognition (OCR) solutions that enable enterprises to automatically extract data from their printed and handwritten documents to enable painless automation, reduce human error, and maximize workflow efficiency. For example, consider ABBYY’s FineReader. It implements Machine Learning to provide an accurate extraction of complex, unstructured, and multilingual texts.

Moreover, the integration of deep learning algorithms with NLP (natural language processing) has made OCR more robust and applicable to semi-structured and unstructured data. Other OCR solutions that are widely being adopted on scale and in real-time data capture, including cloud-based ones. For example, Scandit provides smart data capture software that enables devices to scan and recognize text, allowing for operational efficiency across industries.

Using machine learning and artificial intelligence for document classification and processing optimizes how different document types are captured, which is what Intelligent Document Recognition (IDR) is all about. Intelligent Document Processing IDR delivers more than traditional OCR functions: it learns the context, layout, and structure of a document so that data can be extracted accurately from complex and unstructured data sources. Fully Integrated document-centric solutions exist, such as Tungsten Automation (formerly Kofax), which provides IDE, IDP, and IDR all into one solution for enterprise systems for invoices, contracts, etc.

With the growing dependence on automation, compliance management, and fraud prevention by the BFSI industry, the Intelligent Enterprise Data Capture Software Market managed to overpower this segment. AI-enabled data capture is critical for financial institutions that handle massive volumes of unstructured data from loan applications, KYC documents, invoices, contracts, and even regulatory filings. Clearwater Analytics, for one, provides AI-enabled software to assist big investment firms, insurance companies, and hedge funds to manage assets and aggregate data.

Due to strict regulatory requirements such as GDPR, PCI-DSS, and AML compliance, the BFSI sector is being driven towards the implementation of secure and intelligent document processing technology to ensure data integrity and auditable documentation. Cloud-based intelligent capture solutions allow banks and insurance companies to improve remote data access and strengthen operational agility. The fraud detection and risk assessment features of the data capture software help financial institutions reduce safety threats. For instance, Quantexa applies AI to connect and interpret data across a range of domains for anti-fraud and compliance purposes. To address this, companies like IBM are bringing up intelligent capture solutions specifically tailored for the BFSI industry that enable organizations to solve their core info management challenges.

This is the Intelligent Enterprise Data Capture Software Market that encourages the presentation of new ideas in machine learning (ML), robotic process automation (RPA), artificial intelligence (AI), and optical character recognition (OCR). Data extraction, processing, and integration from various systems within the organization using automated solutions are the requirements of businesses nowadays.

The competitive players are UiPath, Blue Prism, Hyperscience, OpenText, and Nanonets. They are compared in terms of such features as accuracy and scalability, as well as whether they have cloud integration and the level of automation in different industries. UiPath and Blue Prism have offerings in document processing through RPA, whereas Hyperscience provides AI-powered automation through a human-in-the-loop approach. OpenText emphasizes deep ERP/CRM integration; Nanonets use low-code AI models that are adaptable to varied data capture.

The evolutionary direction for the SaaS business model and pay-per-use pricing will serve to attract small and medium businesses. Other new entrants and niche players complement this move by introducing unique products catered towards finance, healthcare, and legal services. To enhance market positioning, companies have entered strategic partnerships and collaborations with cloud providers, IT service firms, and automation platforms. The lively mergers and acquisitions, AI-driven innovations, and improvements in compliance will keep companies competing in this fast-growing market if they invest in their intelligent, adaptive, and scalable automation.

Market Share Analysis by Company

| Company Name | Estimated Share (%) |

|---|---|

| UiPath | 18-22% |

| Blue Prism | 14-18% |

| Hyperscience | 10-14% |

| OpenText | 8-12% |

| Nanonets | 6-10% |

| Other Companies (Combined) | 30-40% |

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| UiPath | AI-powered enterprise automation, integrating RPA with intelligent document processing for end-to-end workflow optimization. |

| Blue Prism | Intelligent automation solutions using AI and ML to enable enterprise-wide digital transformation. |

| Hyperscience | Machine learning-driven data extraction and document classification for financial services, healthcare, and government sectors. |

| OpenText | Cloud-based document capture and content management solutions with advanced AI and compliance automation. |

| Nanonets | No-code AI-powered OCR and document processing for small businesses and industry-specific automation. |

UiPath (18-22%)

A leader in enterprise automation, UiPath integrates RPA with AI-powered intelligent document processing to optimize workflow automation across industries.

Blue Prism (14-18%)

Blue Prism offers intelligent automation platforms with AI and ML capabilities, helping enterprises streamline business processes and drive digital transformation.

Hyperscience (10-14%)

Specializing in AI-driven document processing, Hyperscience enables automated data capture and classification for heavily regulated industries like finance and healthcare.

OpenText (8-12%)

A key player in enterprise content management, OpenText provides AI-enhanced document capture and compliance automation solutions for large organizations.

Nanonets (6-10%)

A rising player in AI-powered OCR, Nanonets focuses on no-code automation for small businesses and industry-specific document processing.

Other Key Players (30-40% Combined)

SAP SE's announcement in February 2025 regarding SAP Business Data Cloud is directed toward unifying SAP and third-party data across organizational boundaries for easy integration and management of data.

In September 2024, Intuit introduced a new customizable enterprise suite of financial products in the USA to knit together a series of offerings, including QuickBooks, in a drive to automate some vital financial processes and attract new customers seeking AI-based financial management solutions.

In August 2024, Capgemini agreed to acquire Syniti of enterprise data management software and services, strengthening Capgemini's expertise in data-driven digital transformation, particularly large-scale SAP transformations.

In May 2024, JBI Studios acquired Cody AI, an AI platform, and launched 'AI Suite' to develop next-generation enterprise AI solutions for the financial services sector, focused on fast-tracking AI capacities for enterprises and SMBs.

The market is projected to witness a CAGR of 12.1% between 2025 and 2035.

The market is predicted to reach USD 12.6 billion in 2025.

The market is anticipated to reach USD 39.3 billion by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 16.4% in the assessment period.

The key companies in the industry include ABBYY, Adobe, Ephesoft, Artsyl Technologies, CAPSYS Technologies, Oracle Corporation, SAP SE, Open Text Corporation, Hyland Software, Inc., and Nuance Communications.

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Residential VoIP Services Market Insights – Trends & Forecast 2025 to 2035

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Safety Mirrors Market - Growth & Forecast 2025 to 2035

Heat Interface Unit Market Analysis - Size, Demand & Forecast 2025 to 2035

Induction Motors Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.