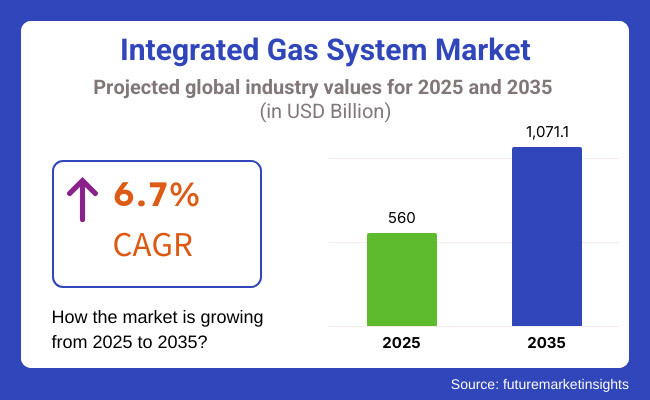

The Integrated Gas System Market is poised for substantial growth over the next decade, with its market value expected to rise from USD 560.0 billion in 2025 to USD 1,071.1 billion by 2035, reflecting a CAGR of 6.7%.

This expansion is driven by increasing demand for energy efficiency, growing adoption of natural gas as a cleaner alternative to conventional fossil fuels, and advancements in gas distribution and management technologies.

The integration of smart monitoring systems, automation, and digital control mechanisms within gas infrastructure is significantly improving efficiency, safety, and sustainability, further accelerating market growth.

The need for the integrated gas systems has grown rapidly among industrial, commercial, and residential areas, especially because of the low-carbon energy sources transition and the strict government policies that are compelling the use of cleaner fuels. The market is seeing the technological development of gas metering, real-time monitoring, and AI-led predictive maintenance, which, in turn, raise the production capacity and decrease the leakage risks.

The industrial sector, including power generation, manufacturing, and chemicals, remains the dominant consumer of integrated gas systems. The rise of hydrogen-based energy solutions, increased investment in liquefied natural gas (LNG) infrastructure, and the expansion of pipeline networks are key contributors to market growth.

Additionally, regulatory frameworks supporting carbon neutrality goals and smart grid initiatives are further fostering the adoption of advanced gas distribution systems.

Explore FMI!

Book a free demo

North America Integrated Gas System Market is expanding with the help of large investments in LNG export terminals, pipeline infrastructure, and smart gas distribution technologies. The USA and Canada focus on the decarbonisation of energy, using the new technologies of gas grids to enhance efficiency and decrease emissions. Significant actions taken are carbon capture and storage (CCS) incorporation within gas networks that are proposed to meet net-zero obligations.

Revenues, supported by hydrogen-based gas infrastructure, are the role of regulatory frameworks like the USA Inflation Reduction Act to be able to do that. The rise in renewable natural gas (RNG) and biogas integration backs sustainability objectives more. Nevertheless, the pipeline grid and other problems such as age, regulation, and security continue. The addressing of this issue by AI-driven gas monitoring, automation, and smart metering solutions is critical for market enlargement.

Europe's Integrated Gas System Market is on the edge of transformation due to the implementation of the strict decarbonisation policies and the climate neutrality target. The hydrogen gas network, along with the biome thane, and energy transition initiatives are the major areas of the investment from the government. The European Union's Fit for 55 policy and Repowered plan are dedicated to promoting the use of green hydrogen and synthetic gas for the reduction of the community's natural gas.

Germany, France, and the UK that have installed hydrogen-ready pipeline constructions and smart metering solutions in order to optimize the gas supply. In spite of the substantial political support, there are still challenges such as the high cost of escaping green gas, the hydrogen transport lines not being built yet, and the reliance on political issues for the availability of supply. The future growth hinges on the development of technologies like electrolysis, AI-driven gas grid optimization, and the enhancement of LNG storage which in turn will lead to the establishment of a strong and sustainable gas market.

Asia-Pacific topped the list of regions experiencing growth in integrated gas systems that are being developed owing to the energy demand surge, urbanization, and industrial development. China, India, and Japan are at the forefront of this trend through the construction of LNG terminals, smart gas metering systems, and the expansion of the related pipeline network. The policies of the government that push for the adoption of natural gas as a valuable alternative to coal expedite the boosting of infrastructure.

The China 14th Five-Year Plan and the Hindu National Gas Grid project are the principali driving factors behind the flourishing of the market. On the other hand, some internal problems like the supply chain constraints, the district's high dependence on LNG imports, and the missing out of infrastructure bottlenecks on efficiency have crept in. It utilizes AI in deployment and monitoring systems, advances gas storage techniques, and incorporates hydrogen and bio-LNG technologies as the solutions for space. Technological changes alongside policy-driven energy diversification will determine Asia-Pacific’s market route.

The cinnamon aldehyde market in the Middle East and North Africa (MENA)region is seeing a natural growth trajectory under the impact of the rising utilization of natural fragrances, the usage of organic preservatives, and the introduction of herbal medicines. The countries like Saudi Arabia, UAE, and South Africa are the beneficiaries of the success luxury fragrance and plant-based food ingredients markets, respectively.

The supply of Halal-certified or clean-label food& products that are sourced with natural ingredients is on the rise in addition to the elevated plant- contact and the driving force to the economy. The exact herbal medicine market saw the traditional industry increase and also contributed to GHG emission reduction by implementing better agricultural processes. The mix of non-toxic, plant-based ingredients being the new trend is likely to help the region become one of the major players in the global natural cinnamon aldehyde market.

Challenges

High Initial Capital Costs Associated with Gas Infrastructure Development

The progress of integrated gas systems necessitates a considerable monetary contribution resulting from the construction of pipelines, LNG terminals, storage facilities, and smart monitoring systems. An enormous initial capital expenditure act as a major barrier mainly for emerging markets and developing economies. The acquisition and upkeep of sophisticated gas distribution networks with real-time monitoring and automation are connected with a lot of costs.

Consequently, this makes it hard for small and mid-sized companies to gain access to the market. Continuation to hydrogen and renewable gas structure requires further funding in terms of the special pipelines, storage systems, and conversion technologies. Overcoming this obstacle thus necessitates government subsidies, public-private partnerships, and financial incentives, so as to globally speed up the modernization of gas infrastructure.

Regulatory and Environmental Constraints Affecting Gas Extraction and Distribution

Stringent environmental rules and guidelines are leaving a major mark on the gas sector's extraction, transportation, and distribution activities. As states around the globe push to hit carbon reduction goals, gas companies must adjust by deploying cleaner technologies and emissions control measures. The move away from fossil fuels, bans on new natural gas connections in certain areas, and rising carbon taxes are works against the traditional gas distribution.

The processes necessary for giving permits and compliance required for construction of LNG terminals, pipeline expansions, and gas storage projects are very often long and expensive, which obstructs the infrastructure growth. Besides, environmental problems arising from methane leaks, fracking, and groundwater contamination are causing a more stringent review of regulations. The sector has to support the development of the low-emission gas technologies, carbon capture systems, and other gas alternatives to help reduce these regulatory hurdles.

Gas Leakage and System Malfunction Safety Issues

Gas infrastructure is highly exposed to three main threats; work out, explosion, and malfunction which can also cause severe side effects for industries and consumers. In the long run, malfunctioning of pipelines due to such things as corrosion, valve failures, and loss of infrastructure often leads to dangerous gas leaks as a result causing environmental damage and public safety hazards. Moreover, the concentration of methane emissions emitted from the defective gas systems is the reason for climate change that directly influences regulators and environmental groups to be stricter.

Safety in gas transportation and distribution is guaranteed through regular investing that goes into leak detection, pressure monitoring, and advanced predictive maintenance technologies. Implementing such solutions as AI-based monitoring systems, IoT-powered sensors, and automating emergency response systems has become crucial for diminishing safety threats, strengthening gas grid immunity, as well as winning public confidence in integrated gas systems.

Opportunities

The Evolution of AI-Powered Gas Monitoring and Automated Distribution Systems

The application of artificial intelligence (AI) and machine learning is revolutionizing gas control by aide ring real-time monitoring, predictive inviting, and automated distribution. The technological solutions powered via artificial intelligence are capable of finding leaks, optimizing gas flow, and promoting operational efficiency therefore reducing costs and improving safety. Smart gas meters and IoT-based sensors enable remote monitoring and fault detection, which in turn decreases the time and cost of down time.

The digital twin technology is taking the gas infrastructure simulation and predictive maintenance strategies to the next level of sustainability. The joint deployment of AI and the fully automated gas distribution network will on the other hand, enjoy high energy efficiency, low emissions, and a good supply chain management that will consequently fast track the market to sustainability and growth heavers.

Hydrogen and Biogas Solutions Get a Boost from the Fight for Carbon Neutrality

The worldwide tilt towards renewable energy is the prime factor responsible for the investments directed towards the hydrogen and biogas structures. National and energy companies are constructing hydrogen-ready pipelines, electrolysers, and storage facilities to facilitate the green hydrogen blend into gas networks. Biomass and biome thane, produced from organic waste, are becoming increasingly popular as an environmentally friendly alternative to fuel gas.

Economic giants find solace in investing in hydrogen hubs, blending projects, and carbon-neutral gas production so as to meet the net-zero emissions targets. With the advancement of technology, the transportation, liquefaction, and conversion of hydrogen are further improved, making it necessary for renewable gas solutions to integrate into existing gas networks, which in turn, will lead to long-term growth in the market.

Transportation of LNG and CNG Rises as Governments Promote Less-Emissions Fuels

The increasing demand for the adoption of clean energy alternatives in transportation is the core force behind the rapidly rising of natural gas vehicles, compressed natural gas (CNG), and liquefied natural gas (LNG). Governments are now opting for LNG-fueled trucks, ferry boats, and public transport fleet vehicles over diesel and gasoline-powered models. LNG and CNG have lower carbon emissions, higher efficiency, and often lower costs compared to conventional fuels.

Global strategies for the implementation of fueling infrastructures like the LNG filling stations, shipping corridors, and hybrid fueling facilities are the other means that speed up the acceptance of gas-driven mobility solutions. Likewise, the define bio-LNG investments in centralized production capacities greatly foster the goal of a carbon-neutral transportation sector. Continue with your natural gas-powered vehicular way, and marine fuel substitutes that are in the limelight, the need for integrated gas distribution systems will just keep growing like powdery growth.

The integrated gas system market has experienced significant growth between 2020 and 2024, driven by increased industrial demand, advancements in gas processing technologies, and a growing focus on cleaner energy sources. The sector has benefited from enhanced gas infrastructure, automation in gas processing, and supportive regulatory frameworks aimed at reducing carbon emissions.

Looking ahead to the period from 2025 to 2035, the market is expected to undergo a transformation fueled by digitalization, increased investments in renewable gases, and stricter environmental mandates. Innovations such as AI-driven gas distribution, hydrogen integration, and smart metering will shape the future of integrated gas systems.

Comparative Market Analysis:

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments promoted natural gas as a transition fuel, with moderate emission control regulations. |

| Technological Advancements | Deployment of automated monitoring systems and enhanced gas separation techniques. |

| Industry-Specific Demand | Growth in industrial applications, including power generation and manufacturing. |

| Sustainability & Circular Economy | Initial carbon reduction initiatives and improved efficiency in gas processing. |

| Production & Supply Chain | Increased investments in LNG terminals and pipeline expansion projects. |

| Market Growth Drivers | Rising industrialization, energy transition policies, and increasing LNG adoption. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter environmental policies encouraging hydrogen blending and carbon capture technologies. |

| Technological Advancements | Integration of AI, IoT-based predictive maintenance, and renewable gas production enhancements. |

| Industry-Specific Demand | Expansion into green hydrogen production, fuel cells, and decentralized energy systems. |

| Sustainability & Circular Economy | Increased focus on carbon neutrality, circular gas economy, and sustainable gas recovery methods. |

| Production & Supply Chain | AI-driven logistics, decentralized gas grids, and localized energy generation. |

| Market Growth Drivers | Expansion of hydrogen economy, decarbonization initiatives, and the adoption of digital twin technology. |

The Integrated Gas System (IGS) sector in the United States is on the rise, thanks to developments in semiconductor fabrication, industrial automation, and clean energy projects. The government’s initiative to promote the creation of semiconductors locally and the need for hydrogen fuel has increased the demand for highly specialized gas delivery systems.

In addition to that, the adoption of smart factory technology and IoT-based gas monitoring has been amplifying the market growth. Furthermore, the enforcement of safety rules by the OSHA and the EPA which forces companies to purchase new and high-tech gas handling systems is another reason which strengthens market growth. The aeronautics and pharmaceuticals industries, which require precise gas flow, are the other factors boosting the market rise. In the renewable energy sector, the rise in the need for hydrogen storage as well as the distribution sector will also move the IGS market in the USA forward.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.9% |

The market for Integrated Gas System in the United Kingdom is on an upward trend owing to the rise in demand from the semiconductor, pharmaceutical, and clean energy sectors. The Hydrogen Strategy of the UK government is the main driver of investment in gas-infrastructure hydrogen production and distribution. Apart from this, the progress of biotechnology and pharma R&D is creating a requirement for high-purity gas systems which are essential for laboratories and drug-making companies.

The move towards the mechanization of operations in industries is also a factor that is promoting the need for smart gas handling schemes. In compliance with toms and emissions directives, industry people are investing in more credible and eco-(efficient) gas delivery technologies. With the UP's semiconductor sector's expansion, which is fostered through government grants as well, the demand for advanced gas flow systems is also rising.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.5% |

The Integrated Gas System market in the EU is on a path of growth since it is impacted by the tight emission laws, the semiconductor sector's growth, and the hydrogen economy. The EU's goal of zero emissions is making the integrated gas solutions for hydrogen storage and fuel utilization more common. Semiconductor manufacturing bases in Germany and France are the main drivers for the demand of ultra-high purity gas systems.

Besides this, the medical and aerospace sectors require the gas control technologies which are the most advanced as they are needed for the high-quality manufacture of goods. Encouragement from the European Green Deal has further made it easier for the companies to take up energy-efficient and smart gas monitoring systems. The extension of AI-powered gas analytics and smart automation, which are the other drivers of the market, is also mentioned, as companies search for more efficient and safe methods of gas management.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.8% |

As a result of the progress made in semiconductor manufacturing, precise engineering, and F-Gas projects, Japan's Integrated Gas System market is currently growing. The world-leading position of the country in semiconductor production is necessitating high-purity gas management systems. Another factor promoting the growth is Japan's Hydrogen Society project, which demands gas storage and distribution infrastructure.

The market is also gaining from the high automation level in the manufacturing processes, mainly in the electronics, automotive, and aerospace fields. The adoption of smart, AI-powered gas control technologies are being pushed by the implementation of strict safety rules and the primary focus on energy efficiency. The gas system market in Japan is expected to be sustained with' increasing' industrial efficiency and emissions reduction schemes.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.4% |

South Korea’s Integrated Gas System market is expanding, driven by semiconductor manufacturing, hydrogen energy, and industrial automation. As home to Samsung and SK Hynix, the country’s chip production boom is fueling demand for ultra-precise gas systems. The South Korean government’s focus on hydrogen-powered transportation and energy storage is also increasing the need for advanced gas handling solutions.

The country’s smart manufacturing initiatives are further accelerating adoption in automated production facilities. Additionally, biotechnology and pharmaceutical industries are investing in high-purity gas solutions for R&D and drug manufacturing. Regulatory policies promoting sustainability are encouraging industries to adopt eco-friendly and energy-efficient gas delivery systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.7% |

Integrated gas systems' pneumatic valve sector holds the top position in the market with its superior features such as exact control, reliability, and efficiency. The valves are extensively employed in sectors like semiconductor manufacturing, chemical processing, and Industrial sectors that are shifting towards automation and fast actuation. In lithography, etching, and chemical vapor deposition (CVD) processes having pneumatic valves validates and provides gas discharges consistently avoiding the qualified manufacturer process fluctuation.

Because they can work in extremely difficult environments with the least human involvement they have become the mostly preferred means for these facilities. Also, the increased number of automated facilities in the industrial sector and the improving of smart valves are the other factors attributing to the growth of this region.

Though manual valves get competition from the automatic solutions, they still preserve a big share in places where precision control is not an issue. Manual valves generally find their application in maintenance, backup systems, and non-critical gas regulation processes.

Their simple design, affordable price, and user-friendliness are the key factors for their ubiquitous presence in various industries such as chemical vapor deposition and oxidation processes. Even though the industrial automation is cutting down the dependency on manual valves, they still find their use in conditions where safety and process adjustments require some kind of human involvement.

The lithography segment is one of the prime movers of the integrated gas system market, driven by the growth in semiconductor and microelectronics manufacturing. Gas flow management in lithography is essential for achieving precision in pattern transfer and, therefore, in the production of high-resolution semiconductors.

The demand for integrated gas systems in this segment is yet further pushed by technological developments in extreme ultraviolet (EUV) lithography-that requires ultrahigh purity gas to be used to perform better and thus enhance chip performance. The adoption of advanced gas control solutions in semiconductor manufacturers is on the rise due to the expansion of their production capacity to meet the increased requirement for high-performance computing and 5G technologies.

The etching segment is facing substantial adoption of integrated gas systems as it plays an important role in semiconductor production. The process of creating smaller and more intricate devices makes exact gas distribution in the etching processes imperative for achieving the nanometer range of accuracy.

Integrated gas systems organize gas mixtures, deliver uniform etching and in the end, minimize semiconductor wafer defects. The recent advanced node technologies and the growing activity in chip fabrication tanks will trigger the demand for etching applications with control solutions.

On the seal types, the W seal segment ranks first because it has much better leak-proof coordination leading to a higher level of gas cleanliness and thus safe semiconductor and industrial applications.

W seals are generally used in lithography, ionization, and oxidation processes where gas contamination-free is of utmost importance. The need for W seal technology is because of strict industry regulations and the requirement for ultra-hygienic gas systems in advanced manufacturing facilities.

The face seal segment has been enjoying the benefits of high-pressure sealing alone and very little gas escaping as the main driving force behind its growth. Semiconductor mastermaking processes mainly photoresist coatings and chemical vapor deposition are characterized by tricky sealing techniques to keep the process pure. The movement of the semiconductor industry to complicated and more performant chips is facilitated through the tools for solid gas sealing such as face seals.

The Integrated Gas System (IGS) Market is experiencing steady growth, driven by the rising demand for efficient gas distribution, automation in semiconductor manufacturing, and the increasing adoption of high-purity gas delivery systems in critical industries such as electronics, healthcare, and energy. Integrated gas systems are used to regulate, monitor, and distribute gases in industries where precise control is essential.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Parker Hannifin Corporation | 10-12% |

| Swagelok Company | 8-10% |

| Ichor Systems, Inc. | 6-8% |

| MKS Instruments, Inc. | 5-7% |

| Fujikin Incorporated | 4-6% |

| Other Companies (combined) | 60-70% |

| Company Name | Key Offerings/Activities |

|---|---|

| Parker Hannifin Corporation | Leading provider of advanced gas delivery systems with precision flow control and high-purity solutions for semiconductor and industrial applications. |

| Swagelok Company | Specializes in high-performance gas control valves, fittings, and modular gas distribution systems for high-tech industries. |

| Ichor Systems, Inc. | Designs and manufactures critical fluid and gas delivery subsystems used in semiconductor fabrication. |

| MKS Instruments, Inc. | Offers high-precision gas flow controllers, vacuum solutions, and integrated gas monitoring systems for electronics and pharmaceutical sectors. |

| Fujikin Incorporated | Develops innovative gas valves and control systems with a focus on high-purity gas handling for semiconductor and aerospace applications. |

Key Company Insights

Parker Hannifin Corporation

Parker Hannifin is a global leader in the market for precision gas delivery systems, which are used mainly in industries such as semiconductor manufacturing, biotechnology, and industrial gas control. The company is pioneering gas monitoring technology powered by AI, real-time leak detection devices, and gases flow technologies that are environmentally friendly. Its modular gas control units are flexible, reliable, and precise, which is why they are used primarily in high-performance applications across various industries.

Parker Hannifin as well as Prince are investing in cognitive automation and digital gas flow management, control systems for gas that are more secure, more efficient, and more sustainable. A large global company, the company strengthens its position in the market and its technological advances.

Swagelok Company

Swagelok is the maker of high-end solutions for gas handling such as precision valves, tubing, and regulators. The company focuses on safety, efficiency, and the use of corrosion-resistant materials to ensure proper gas distribution across the pharmaceutical, energy, and semiconductor sectors. It is introducing compact, modular gas systems to its portfolio that will further improve reliability and cut downtime.

Additionally, Swagelok is smart gas monitoring devices, allowing on-site IoT diagnostics for real-time gas flow optimization, thus leading to the measures of investment in wi-swap technology. Besides a strong emphasis on the customer and a quest for innovation, Swagelok is likely to be successful in the tech-growing market, thereby consolidating its status as a frontrunner in gas control solutions provision.

Ichor Systems, Inc.

Ichor Systems is a primary supplier of integrated gas and chemical delivery systems for semiconductor fabrication and electronics manufacturing. The company is known for its high-performance gas panels, fluid control units, and precision gas distribution modules, which ensure the optimal process efficiency. Ichor is boosting its OEM partnerships with major semiconductor manufacturers by getting their gas delivery solutions customized.

It is also putting funds in next-gen automation, AI-driven flow monitoring, and leak detection technologies to make gas flow safer and more efficient. Ichor, which is firmly positioned in the semiconductor supply chains, is unceasingly boosting its technological development.

MKS Instruments, Inc.

MKS Instruments is an eminent provider of precision gas flow controllers, vacuum solutions, and pressure measurement systems for electronics, aerospace, and pharmaceutical industries. The company is introducing new gas delivery systems to the semiconductor industry that are IoT connected, provide real-time diagnostics, and are AI-driven.

High-purity gas control and leak detection techniques that MKS Instruments focuses on not only bolsters process stability but also helps operational efficiency. The company is also centering its research shedding on gas monitoring solutions which are increasing in demand due to the rise of high-precision gas flow regulation needs in new manufacturing conditions. The firm continues to pursue groundbreaking technological innovations as it has a robust global presence.

Fujikin Incorporated

Fujikin is a renowned company that specializes in ultra-high-purity gas valve technology, mainly in the semiconductor, aerospace, and high-tech manufacturing industries. The company centers on tailor-made gas control systems, combining nano-flow gas control technology with the support of innovative microelectronics and chip fabrication.

Fujikin is ambitious in terms of enhancing gas flow accuracy, the reduction of contamination risks, and the reliability of operations. Fujikin is funding AI diagnostic programs and the introduction of digital gas monitoring, thereby giving better efficiency and sustainability. On the one hand, Fujikin attaches great importance to precision engineering through constantly improving innovation and diffusion of advanced manufacturing throughout the world.

The global Integrated Gas System market is projected to reach USD 560.0 million by the end of 2025.

The market is anticipated to grow at a CAGR of 6.7% over the forecast period.

By 2035, the Integrated Gas System market is expected to reach USD 1,071.1 million.

The semiconductor manufacturing segment is expected to dominate due to the increasing demand for high-purity gas delivery systems in chip fabrication and advanced electronic applications.

Key players in the Integrated Gas System market include Parker Hannifin Corporation, Ichor Systems, Applied Energy Systems, Fujikin Incorporated, and Swagelok Company.

Power Tool Gears Market - Growth & Demand 2025 to 2035

Surge Tanks Market Growth - Trends & Forecast 2025 to 2035

Radial Drilling Machine Market Growth & Demand 2025 to 2035

Motor Winding Repair Service Market Growth - Trends & Forecast 2025 to 2035

Industrial Linear Accelerator Market Growth & Demand 2025 to 2035

Vision Guided Robots Market - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.