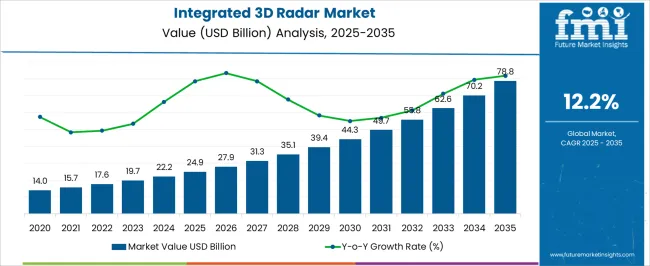

The Integrated 3D Radar Market is estimated to be valued at USD 24.9 billion in 2025 and is projected to reach USD 78.8 billion by 2035, registering a compound annual growth rate (CAGR) of 12.2% over the forecast period.

| Metric | Value |

|---|---|

| Integrated 3D Radar Market Estimated Value in (2025 E) | USD 24.9 billion |

| Integrated 3D Radar Market Forecast Value in (2035 F) | USD 78.8 billion |

| Forecast CAGR (2025 to 2035) | 12.2% |

The integrated 3D radar market is experiencing strong momentum as demand rises for advanced surveillance, navigation, and safety systems across both defense and civilian applications. Increasing emphasis on real time situational awareness and the need for multi dimensional target tracking are driving adoption.

Technological improvements in radar signal processing, digital beamforming, and sensor fusion are enhancing accuracy and reliability. Governments and industries are investing heavily in radar systems that can operate effectively in complex environments with minimal interference.

Integration with autonomous platforms, smart infrastructure, and intelligent transportation systems is further accelerating adoption. The outlook remains favorable as radar systems become increasingly vital in supporting security, transportation safety, and smart city development initiatives worldwide.

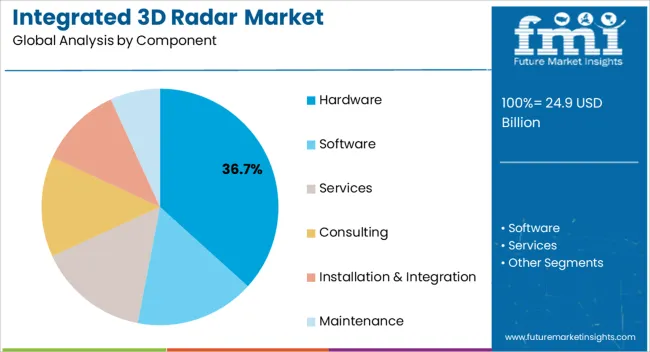

The hardware segment is projected to hold 36.70% of total market revenue by 2025 within the component category, making it the leading segment. Growth is supported by the critical role of antennas, transmitters, and receivers in ensuring system performance and reliability.

Hardware investments are being prioritized due to rising demand for high precision modules and compact radar units that can be deployed across diverse platforms. Advancements in semiconductor technology and cost efficient manufacturing processes are further strengthening adoption.

As organizations emphasize durable and scalable radar solutions, the hardware segment continues to dominate in terms of revenue contribution.

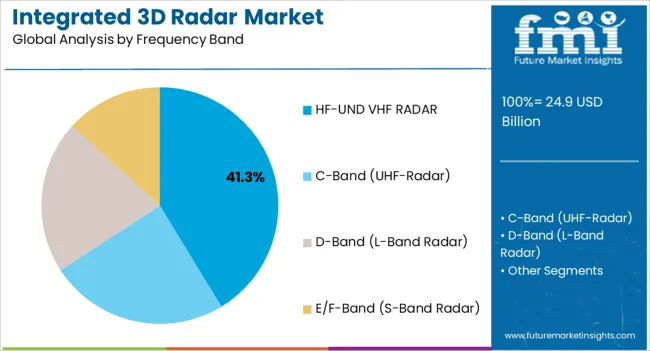

The HF and VHF radar segment is anticipated to represent 41.30% of the market within the frequency band category by 2025. This dominance is attributed to the ability of HF and VHF radars to provide long range detection and resilience in adverse weather conditions.

Their widespread adoption in both defense surveillance and large scale infrastructure monitoring underscores their strategic importance. Investments in improving bandwidth efficiency and integrating digital signal processing have reinforced their reliability.

As the need for long range monitoring and border security intensifies, HF and VHF radars remain the most deployed frequency band, securing their leadership position in the market.

Lately, the war between Russia and Ukraine has not stopped the sales of integrated 3D radar systems but pushed the sales of it. Regions in the neighborhood are spending more on their air security and monitoring systems, including integrated 3D radar systems.

The significant factors that help the integrated 3D radar market thrive are increasing military budgets worldwide, substantial private investment in the aviation industry, new flying zones opening up, and technological advancements integrating with radar systems.

As a threat to a nation's security is a huge concern for the government, military expenditure needs to cover each aspect that military forces ask for. An integrated 3D radar system is required in order to monitor the airspace, sea space, and land space in different formats. It gives information about the positioning, size, and speed of any object that is under surveillance.

This way, the security forces get a vivid idea about the object that enters the territory. For instance, Tata Power has signed a deal with the Indian government to provide 23 ship-borne 3D radar systems to the Indian Navy over the next ten years.

Another factor is the high consumption of integrated 3D radar systems in aviation industries, including airspaces and airports. The 3D radar system is used in air traffic management systems to ensure that the airspace is clear for the aircraft to fly. It also makes sure if the climate and air are suitable for flying or not.

Integration of advanced technologies like AI and machine learning along with these 3D radar systems is helping ATM systems forecast favorable conditions by going through different patterns and historical data. This integrated 3D radar helps in supporting infrastructure for detecting trespassing objects and ensures the passenger's safety.

Companies work in the direction of making these 3D radar systems in a way that they have long-lasting life. This is because these systems are mostly implemented in the remotest areas where maintenance is a near-impossible phenomenon. Vendors supplying huge batches of security and monitoring equipment to countries that are going through a civil war or rebellion are also fueling the sales of integrated 3D radar systems.

The only restraints that affect the market's growth are the high implementation cost, maintenance cost, and incompetent operators that need skillful workshops to learn about the frequent upgrades in the system. This also is not less in terms of cost. As Covid-19 has already broken the backbone of the aviation industry, aviation companies are not ready to spend massive capital on radar systems.

| Country | United States |

|---|---|

| Revenue Share % (2025) | 18.5% |

| Country | Germany |

|---|---|

| Revenue Share % (2025) | 12.4% |

| Country | Japan |

|---|---|

| Revenue Share % (2025) | 6.3% |

| Country | Australia |

|---|---|

| Revenue Share % (2025) | 2.4% |

| Country | North America |

|---|---|

| Revenue Share % (2025) | 30.6% |

| Country | Europe |

|---|---|

| Revenue Share % (2025) | 23.2% |

The integrated 3D radar market is divided into regions; North America, Latin America, Asia Pacific, Middle East and Africa (MEA), and Europe. The significant market is the United States, thriving at a CAGR of 11.3% between 2025 to 2035.

The region is expected to hold a market revenue of USD 78.8 billion by the end of 2035. The market held a leading share of 18.5% in 2025, while overall, North America held a share of 30.6% in 2025. The growth is attributed to government initiatives to enhance the security and safety of the borders of the region. Indian region grows at a substantial growth rate and is expected to hold USD 3 billion by the end of 2035 as it thrives on a robust CAGR of 14.4% between 2025 to 2035.

China also grows along with India, with the forecasted value of USD 4.4 billion (2035) at a CAGR of 10.4% between 2025 to 2035, while the United Kingdom has a revenue of USD 4 billion (2035) at a CAGR of 12.1%.

| Category | By Component Type |

|---|---|

| Leading Segment | Hardware |

| Market Share (2025) | 25.8% |

| Category | By Frequency Band Type |

|---|---|

| Leading Segment | D-Band (L Band Radar) |

| Market Share (2025) | 30.5% |

The integrated 3D radar market is categorized by Component, Frequency Band, Industry, and Platform. These categories are further divided into small segments that expand their channels in multiple market spaces. These segments perform differently in various markets as they have a stronghold in numerous regions.

According to a component category, the segments are; Hardware, Software, and Services, while the frequency band is divided into HF-UND VHF-RADAR, C-Band (UHF-Radar), D-Band (L-Band Radar), E/F- Band (S-Band Radar). The industry category is divided into automotive & public infrastructure, energy & utilities, and government, while the platform category is divided into airborne, ground, and naval.

By component, the FMI study finds that the hardware component has the highest sales potential through 2035. The application of hardware-integrated radar components is high and is likely to record a CAGR of 12.5% during the forecast period. The segment held a market share of 25.8 in 2025.

Consumer demand for hardware systems is attributed to their nature of working well without any outside source or software, easy implementation, and dynamic price range. In the forecast period, sales of hardware components of integrated 3D radar systems are estimated to grow excessively in order to provide better monitoring and scanning experience, security, and flexibility. This pushes the sales of integrated 3D radar systems in the new regions.

By frequency band, D-Band (L Band Radar) is the leading segment in the integrated 3D radar market and is expected to hold a significant portion in the forecast period. The segment is thriving at a robust CAGR of 12.9% between 2025 and 2035. The segment held a market share of 30.5% in 2025.

The factors behind the growth of this segment are the high consumption of it in military aircraft, civil airfields, and unmanned aerial vehicles (UAVs), fueling the sales of instant payment platforms.

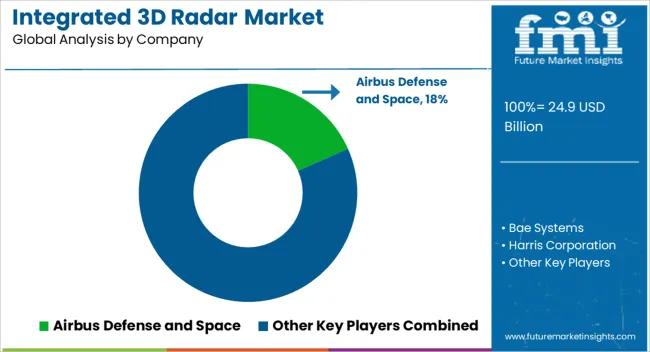

The competitive landscape of integrated 3D radar is diversified and makes the market more exclusive for new players. Vendors are trying to make their platforms more flexible for technological advancements while improving the bandwidth.

Companies also compete to get the government’s projects. The vendor companies also focus on mergers and collaborations to expand their distribution channels in new regions.

Market Developments

The global integrated 3D radar market is estimated to be valued at USD 24.9 billion in 2025.

The market size for the integrated 3D radar market is projected to reach USD 78.8 billion by 2035.

The integrated 3D radar market is expected to grow at a 12.2% CAGR between 2025 and 2035.

The key product types in integrated 3D radar market are hardware, software, services, consulting, installation & integration and maintenance.

In terms of frequency band, hf-und vhf radar segment to command 41.3% share in the integrated 3D radar market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA