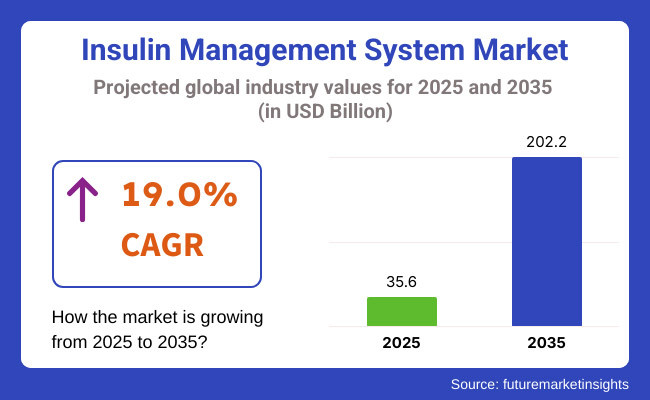

The market is expected to reach approximately USD 35.6 billion in 2025 and expand to around USD 202.2 billion by 2035, reflecting a compound annual growth rate (CAGR) of 19.0% over the forecast period.

Domination of the diabetic people around the globe are the leading factor for the market growth. People with diabetes have become more aware of the implications and the easy treatment of it through insulin management systems.

Research done by diabetes.org explains that about 283,000 Americans under the age of 20 have been diagnosed with diabetes that is nearly 0.35% of that population. The prevalence of type 1 diabetes among these youngsters fuels the adoption of advanced diabetes treatment technology such as insulin management systems that help the end user in controlling the glucose levels in blood.

The rising cases of type 1 and type 2 diabetes along with the advanced CSII technology delivering the expected amount of insulin to the patients are transforming the insulin management system market. Insulin management is nothing but the management of the right amount of insulin that enters the body to maintain the glucose level in the blood.

Insulin management system shows a promising market growth due high global prevalence and incidence, extensive research and advancement in technology for effective insulin delivery systems and support from government and health care centres in making insulin management systems available throughout the globe.

North American insulin management system market is greatly influenced by ongoing technological innovations and product developments. Firms are emphasizing user-friendly, autonomous, and effective insulin delivery equipment to improve diabetes care.

For example, Tandem Diabetes Care launched the Mobi system, the most compact fully automatic insulin delivery system with water resistance and Control-IQ technology, and the FDA approved Omnipod® 5 for Type 2 diabetes, making higher levels of advanced solutions accessible. These developments enhance patient compliance, ease, and overall efficacy of treatment, propelling the market to grow.

The other important consideration is the regulatory measures dealing with high insulin prices. The USA government has done a lot in terms of controlling the prices of insulin, for example, by suing big pharmacy benefit managers that have been sued for price gouging. The aim of these efforts is to make insulin more affordable and accessible, which translates to greater levels of adoption of insulin management systems. Consequently, price regulation efforts help the market grow through wider patient access.

Europe's high focus on patient-driven healthcare and self-management propel the insulin management system market. People managing their own conditions prompt the increase of the take-up rate for home-based insulin delivery systems within the European health policies.

Most healthcare systems facilitate self-injection, limiting hospital admissions, and, thus, increasing the demand for insulin pumps and pens that are easier to use and boost patient independence. Reimbursement policies complement this trend with innovations in insulin management devices that get approval for reimbursement, thus making them affordable.

Moreover, the increasing emphasis now emanating from the region for sustainable and environmentally safe medical solutions will affect the market. The European regulators insist that the manufacturers put their heads together and present some biodegradable and reusable devices for insulin delivery in a bid to reduce medical waste.

Accordingly, the producers are putting in place aspects of this green technology, namely reusable insulin pens and recyclable parts of pumps, that meet the sustainability objectives of the EU. The green philosophy makes its way into buying choices and drives up the uptake of eco-friendly insulin management solutions.

The rapid urbanization and lifestyle changes are leading to an escalation in the number of cases of obesity, inactive lifestyle, and Type 2 diabetes in Asia. With urban migration, people abandon their active lifestyles and adopt processed food.

This change in lifestyle is accelerating the demand for newer diabetes management solutions; hence, sophisticated insulin pumps and continuous glucose monitoring systems are being implemented. Investment in diabetes care infrastructure is sustained by governments and private healthcare providers, apart from pursuing aggressively insulin management technologies.

Local insulin management device makers are driving the expansion of the market in Asia. Domestic firms from China, India, and South Korea are producing insulin pumps and smart pens at competitive prices for the population of this region. Moreover, such manufacturers also create innovative localized offerings, diabetes management software adapted to local customs, having driven on further the market adoption process.

Challenges

Regulatory Complexities and Approval Delays Hindering Market Growth

The world's varying regulatory landscapes are providing enormous challenges in the insulin management system market. Prolonged approvals, especially for new insulin delivery devices in these major markets of Europe and Asia, account for the delays in launches.

Safety and efficacy requirements implemented today by authorities such as the European Medicines Agency (EMA)and Pharmaceuticals and Medical Devices Agency (PMDA) in Japan enormously complicate the expeditious launch of innovations by manufacturers. Changes in policies and varying reimbursement mechanisms become further hindrances toward global expansion.

Such regulatory underlying causes slow product availability and increase compliance costs, thus restricting additional players from entering the market. Consequently, extended timelines for product commercialization greatly hinder companies and interfere with their innovation cycles, thus limiting patient access to advanced technologies of insulin management.

Opportunities

Integration of Digital Health Ecosystems Creating Growth Opportunities

The convergence of digital health ecosystems is a large opportunity within the insulin management system market. Telemedicine and remote patient monitoring have increased, allowing healthcare professionals, caregivers, and patients to easily integrate insulin delivery systems with more comprehensive healthcare networks, where they can share information in real time.

The integration enhances customized treatment regimens and increases patient adherence to insulin therapy. Major healthcare players are partnering with software vendors to create smart platforms that synchronize insulin pumps, glucose meters, and mobile applications to deliver end-to-end diabetes care.

The rise of electronic health records (EHR) also integrates the ecosystem to support predictive analytics for enhanced disease control. As governments and private payers encourage digital health solutions, organizations that create end-to-end seamless connectivity and interoperability across healthcare networks will take the lead in the growing market for insulin management.

Trends

Expansion of Non-Invasive Insulin Delivery Methods

The insulin management system industry is shifting to non-invasive methods of delivery, since the researchers and firms work on alternatives to the usual injections and pumps. These are technologies like insulin patches, inhalable insulin, and oral insulin tablets. They aim to enhance patient comfort, reduce fear of the use of needles, and consequently, therapy compliance.

Microneedle patch and transdermal insulin systems recently broke into limelight because they have the potential for controlled release of insulin without injection. With the rising demand for painless and convenient solutions, non-invasive insulin delivery is in line for disruption in the marketplace and revolutionization in diabetes care.

Rise of Personalized and Adaptive Insulin Therapy

The insulin therapy becoming adaptive and personalized is dependent on sophisticated machine learning and real-time data analysis. Developers incorporate adaptive algorithms into the closed-loop systems and smart insulin pumps, thus enabling them to make insulin delivery adjustments using continuous glucose monitoring (CGM) information. These systems examine individual patients' patterns, habits, and glucose levels to deliver precise, tailored dosing of insulin.

This trend would readily assist the individuals with changing insulin requirements, for instance, those with Type 1 diabetes or active lifestyles. As the digital health solutions are being improved, the momentum towards a perfectly personalized insulin therapy will continue to dictate the direction of the future of diabetes management in terms of enhanced treatment efficacy and minimized complications.

Between 2020 and 2024, Over the past few years, developments in automated insulin delivery transformed the insulin management system market into incorporating smart insulin pumps and hybrid closed-loop systems. The technologies have demonstrated enhanced glucose control and lessened burden of constant monitoring for patients.

There was also an upward trend in digital health integration through pairing insulin devices with mobile apps and cloud-based platforms for distant monitoring by manufacturers. Some of the newer insulin delivery technologies have been cleared by regulatory agencies, enabling more treatment options.

In the forecast period 2025 to 2035, Governments and healthcare organizations have embarked on these price-reduction efforts to enhance accessibility. In addition, the introduction of biosimilar insulin has reduced the cost of treatments and enhanced competition in the market. Firms are creating automated, AI-based insulin delivery systems that can adjust doses in real-time.

Non-invasive delivery of insulin like wearable patches and oral insulin are being researched. Healthcare professionals are looking into deploying decentralized patient data management and interoperability solutions on the blockchain to support advanced personalized diabetes treatment.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Regulatory bodies are enacting regulations to guarantee the safety and effectiveness of insulin management systems, resulting in standardized practices and usage regulations. |

| Technological Advancements | The companies are launching more effective and convenient insulin delivery devices to improve patient compliance and increase uses in diverse healthcare environments. |

| Consumer Demand | Patients and clinicians are increasingly taking up sophisticated insulin management systems, propelling increased demand in the management of chronic diseases. |

| Market Growth Drivers | Increasing demand for diabetes and technological advancements in managing insulin are propelling a transition to cost-effective and effective solutions. |

| Sustainability | Producers are setting up environmentally friendly manufacturing practices and creating insulin management systems with lower environmental footprints. |

| Supply Chain Dynamics | Firms are lowering dependence on specialty suppliers by domesticating production in order to minimize supply chain disturbances encountered during worldwide occurrences. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | They constantly track regulations and make adjustments to maintain a balance between patient safety and technology advances, while imposing stricter quality evaluations to ensure product performance. Technological Development |

| Technological Advancements | They are also creating next-generation insulin management systems with enhanced biocompatibility, user-friendly designs, and AI-powered customized treatment solutions. |

| Consumer Demand | Consumers are demonstrating an increasing affinity for combined insulin management systems and patient-centricity, led by enhanced device technologies and a keen emphasis on patient safety and functional efficiency. |

| Market Growth Drivers | Healthcare professionals are investing in infrastructure development in growth markets, boosting healthcare spending, and riding on ongoing technological developments to improve procedural efficiency and patient outcomes. |

| Sustainability | They are embracing more sustainable manufacturing and distribution practices, employing recyclable materials and efficient energy processes to meet global environmental norms. |

| Supply Chain Dynamics | They are enhancing regional manufacturing capacities with technology improvements and strategic alliances, reducing dependence on imports and enhancing supply chain resiliency in general. |

Market Outlook

Led by the high prevalence of diabetes and good healthcare standards, the advancement seems to be rewarding for the USA insulin management system market. The various companies involved in such a process main on innovations: smart insulin pen, CGM systems, automated insulin pumps, etc. Favourable reimbursement policies alongside the increasing integration of digital diabetes management solutions are thereby further propelling the market to expand.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.6% |

Market Outlook

The Indian insulin management system market is also expanding fast with increasing access to advanced diabetes care and growing awareness of advanced diabetes management technologies. Bloomberg stated the government is making a transition bet by improving diabetes care and extending telemedicine service, thereby widening market growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 16.8% |

Market Outlook

China's insulin management system market is moving with strong momentum. It has a high diabetic population, rising investments in healthcare, and digital health technology adoption. The region's modernization of diabetes care, local companies creating insulin pumps, and the rising awareness towards smart diabetes management solutions among consumers have all spurred this market growth. Furthermore, the online healthcare platforms are facilitating the availability of insulin delivery devices.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 14.8% |

Market Outlook

Germany's insulin management system market prospers with robust government support, sophisticated medical research, and strong adoption levels of novel diabetes care technologies. The highly regulated healthcare infrastructure in the country guarantees extensive availability of insulin pumps, CGMs, and AI-driven insulin delivery systems. Pharmaceutical and medical technology firms are actively investing in cutting-edge diabetes management solutions, which further reinforces the market.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 10.0% |

Market Outlook

United Kingdom insulin management system market is growing due to rising cases of diabetes and NHS encouragement towards complex diabetes management. Public campaigns and governmental activities are supporting the digitalization of healthcare solutions, fueling growth for integrated insulin management systems. Access to newer treatments is enhanced through the support provided by NHS on financing insulin pumps and CGMs, getting more pervasive and spread throughout.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 11.8% |

External Insulin Pumps Leading the Market Due to Precision, Automation, and Patient Convenience

The development of external insulin pumps capable of providing accurate and continuous doses of insulin, thereby minimizing the risk for fluctuations, has positioned insulin management systems in the market as highly versatile.

The conventional means of delivery a needle and syringe are replaced by an advanced option: when combined with continuous glucose monitors it can be automated for insulin delivery according to glucose values in real-time. These devices provide type 1 diabetes patients and those undergoing intensive insulin therapy a convenience, precision, and potentially improved glycemic control.

Furthermore, there has been coverage and reimbursement extension by insurers as well as medical providers, adding to access these devices and leading to adoption. Companies are ongoing to add features to external insulin pumps using artificial intelligence-based insulin algorithms and smartphones, enhancing users' experience as well as clinical outcomes.

Because patients and health care providers lean more and more on these highly reliable and ease-of-use-friendly devices, the external insulin pumps segment is to continue as a leading segment within the insulin management system market.

Insulin Patches Gaining Traction Due to Non-Invasive Delivery and Ease of Use

Insulin patches are being hailed as a revolutionary leap forward in the management of insulin, given their non-invasive nature and ease of application, which has gained traction among manufacturers making anti-diabetic products. These patches eliminate the pain of injections involved with the traditional modes of insulin delivery and could thus improve compliance, especially in patients who are phobic towards needles.

Insulin patches ensure controlled and sustained insulin delivery and thus provide better glucose management and reduce the number of multiple daily injections involved through the use of transdermal technology techniques. Researchers are exploring their easy acceptance ever since the smart patches and microneedle-based patches that react according to glucose levels in real time were discovered.

Increased demand for discreet and wearable solutions for insulin delivery is the driving force behind further interest in the market along with the growing preferences for user-friendly diabetes management. Though still at nascent commercialization, continued advancements in stability of formulations alongside regulatory approvals are thus positioning insulin patches as a disruptive force-feeding multiples while becoming the forefront in the emerging segment of future insulin management.

Type 2 Diabetes Leading the Market Due to High Prevalence and Expanding Treatment Options

Insulin management system is driven mainly by the high prevalence of Type 2 diabetes and hence is the leading segment with respect to the disease indication. With lifestyle transformations, rising levels of obesity, and aging demography across the world, incidence of Type 2 diabetes grows, and a higher demand is created for the treatment based on insulin.

In contrast to Type 1 diabetes, for which insulin therapy is necessary from the start, numerous Type 2 diabetes patients eventually need insulin because of progressive beta-cell failure. Having several options for delivering insulin, such as pens, pumps, and intelligent insulin systems, has also benefited market growth.

Also, government programs, expanded insurance coverage, and innovation in automated insulin delivery are facilitating easier access for Type 2 diabetes patients towards effective insulin therapy. Owing to its prevalence and changing treatment processes, Type 2 diabetes will continue to be the dominant segment in the insulin management system market.

Gestational Diabetes Gaining Traction Due to Rising Maternal Health Awareness and Early Detection

Gestational diabetes is likely to be a budding field in insulin management as awareness on maternal health and early screening is growing. In connection with increasing obesity, sedentary lifestyle, and delayed pregnancy, cases of gestational diabetes are rising, calling for proper insulin management during pregnancy.

Unlike any other types of diabetes, gestational diabetes needs the tight glucose control in order to ensure both the health of mother and baby; consequently, the safe and efficient delivery systems for insulin will have greater demand. The use of insulin pens and pumps has become greater due to their convenience and dosing.

It helps prevent the risk of high blood sugar during pregnancy. Besides, there are several proactive treatments and screenings being stressed out by health professionals that are fueling the insulin treatment market in this category. During development of pregnancy-friendly insulin management options, the gestational diabetes segment is sure to pick up in the next few years.

The insulin management system market is very competitive, stimulated by increasing incidence of diabetes, innovations in smart insulin delivery devices, and increasing use of connected healthcare solutions. Businesses invest a lot in AI-based insulin management, automated dosing algorithms, and real-time glucose monitoring integrations to keep the competition going. Established companies, pharmaceutical companies, and digital health startups form the core of the market; these are all making contributions to the evolving landscape of insulin therapy solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Medtronic plc | 22-26% |

| Insulet Corporation | 18-22% |

| Tandem Diabetes Care | 10-14% |

| Eli Lilly and Company | 8-12% |

| Roche Diabetes Care | 5-9% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Medtronic plc | Market leader offering MiniMed insulin pumps with smart algorithms for automated insulin delivery. |

| Insulet Corporation | Develops Omnipod, a tubeless insulin pump system with app-based glucose management. |

| Tandem Diabetes Care | Specializes in touchscreen insulin pumps with AI-driven basal insulin adjustments. |

| Eli Lilly and Company | Provides connected insulin pen solutions with real-time dosing data tracking. |

| Roche Diabetes Care | Focuses on Accu-Chek insulin management systems with integrated CGM compatibility. |

Key Company Insights

Medtronic plc (22-26%)

The biggest player in the insulin management system market, Medtronic offers smart insulin pumps, hybrid closed-loop technology for precise glucose control.

Insulet Corporation (18-22%)

Insulet is a leader in tubeless insulin pump innovations, pioneering Omnipod, the discreet and convenient way to deliver insulin.

Tandem Diabetes Care (10-14%)

Tandem's role as a key innovator is integrating advanced insulin pump tech with customizable user controls.

Eli Lilly and Company (8-12%)

Digital insulin solutions leading competitor Eli Lilly connects insulin pens and has smart dose-tracking applications.

Roche Diabetes Care (5-9%)

Roche is integrated diabetes management solutions and further enhances insulin therapy with smart glucose monitoring and insulin delivery systems.

Other Key Players Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

Needle and syringe, Insulin Pen Injectors, Insulin jet injectors, External Insulin pumps, Implantable pumps, Insulin patches, Islet cell transplantation, Insulin inhalers.

Diabetes I, Diabetes II and Gestational Diabetes.

Rapid acting insulin, Short acting insulin, Intermidiate acting insulin, Pre-mixed insulin.

Speciality diabetic clinics, Home care setting, Non- Diabetic Clinics.

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for insulin management system market was USD 35.6 billion in 2025.

The insulin management system market is expected to reach USD 202.2 billion in 2035.

Increasing government initiatives and insurance coverage for advanced insulin therapies are expanding patient access, driving market growth.

The top key players that drives the development of insulin management system market are Medtronic plc, Insulet Corporation, Tandem Diabetes Care, Eli Lilly and Company, Roche Diabetes Care.

External Insulin pumps is expected to command significant share over the assessment period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA