The insulated food delivery bags market is projected to experience steady growth from 2025 to 2035, driven by increasing demand for food delivery services, stringent food safety regulations, and advancements in thermal insulation technologies.

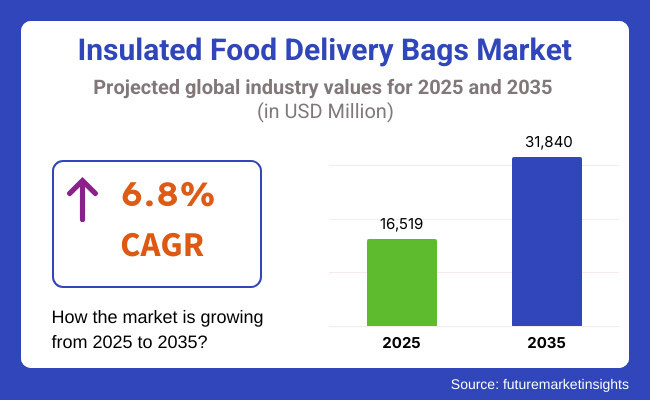

The market was valued at USD 16,519 million in 2025 and is anticipated to reach USD 31,840 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.8% during the forecast period.

Several key factors are contributing to the expansion of the insulated food delivery bags market. The surge in online food ordering, supported by the growth of food delivery platforms such as Uber Eats, Door Dash, and Zomato, has significantly increased the demand for high-quality insulated bags.

These bags help maintain optimal food temperatures, ensuring customer satisfaction and compliance with food safety standards. Additionally, the growing emphasis on sustainable and eco-friendly materials in packaging solutions is influencing market trends, with manufacturers investing in biodegradable and reusable insulation materials.

Despite the positive market outlook, challenges such as high production costs, stringent environmental regulations, and competition from alternative packaging solutions may impact market expansion.

However, technological advancements in insulation materials and increasing collaborations between food service providers and bag manufacturers are expected to open new growth avenues for market players.

The growth of the market can be attributed owing to innovations in thermal insulation, rising consumer preference for hot and fresh food delivery, along with strict regulations ensuring food safety during transportation. It ensures, that with the recent advancements in the areas of design of bags, sustainable materials and technologies, the insulated food delivery bags market will explode in the upcoming decade.

North America dominates the insulated food delivery bags market, owing to increasing online food delivery services in addition to high demand for temperature controlled packaging. The United States and Canada are among the major contributors, aided by the proliferation of food delivery services like Uber Eats, Door Dash and Grub hub. Growing focus on food quality & safety during transit augmenting demand for high-performance insulated delivery bags.

The region’s strict food safety laws motivate restaurants and delivery service providers to use long-lasting, reusable, and environmentally friendly insulated bag. But expensive materials and sustainability concerns continue to present obstacles. This has led to manufacturers devising effective, cost-efficient recyclable and biodegradable bag prospects in light of changing environmental paradigms.

Europe is expected to emerge as a prominent market for insulated food delivery bags, as countries like the UK, Germany, France, and Italy witness a growing prevalence of food delivery services. Strong emphasis on sustainability and environmentally friendly packaging solutions in the region has resulted in the increasing demand for reusable insulated delivery bags.

Increase in dark kitchens and cloud-based food services is massively boosting the market growth. But EU rules on packaging waste and carbon emissions are strict. To meet them, companies are seeking out materials like compostable insulation and lightweight, high-performance fabrics, which not only help them comply but also make the bag process more efficient and durable.

In addition, the insulated food delivery bags market will grow rapidly in the Asia-Pacific region, due to the rapid development of the online food delivery industry, rapid urbanization, and changing consumer lifestyles across the region. Food aggregators like Zomato, Swiggy, and Meituan are exploding in countries like China, India, Japan, and South Korea and are increasing the demand for insulated delivery solutions.

This is motivating manufacturers to re-shape advanced thermal insulation technologies for durable insulated bags with standing the seasonal peaks and a volume of policies. But in price-sensitive markets, cost limitations and the dominance of the single-use plastic bag challenge implementation. Answering these, the companies are concentrating on manufacturer lower price, re-useable, energy-efficient insulated bags to meet different consumer needs besides the promotion on sustainable practices.

Challenges

Durability and Temperature Retention Issues

A key challenge in the insulated food delivery bags market is maintaining product robustness alongside effectively retaining temperature over sustained periods. Duration of times often tough conditions, exposure to wet, and sudden climate situation can harm the insulation efficiency.

Thermal performance inconsistency could also create dissatisfaction among restaurant customers in food delivery services, especially when transporting hot and cold meals. Manufacturers also have to reengineer high-quality insulation materials focused multi-layered fabric designs and reinforced stitching for improved durability and performance to meet this challenge.

Opportunities

Growing Demand for Sustainable and Smart Delivery Solutions

Demand for sustainable insulated bag made from biodegradable, recyclable and reusable materials contributes to growth of the eco-friendly food delivery solution. Moreover, the implementation of smart temperature monitoring systems, RFID tracking, and IoT-enabled capabilities is a core avenue for progress in this domain.

This is in response to the demand of restaurants, cloud kitchens and online food delivery companies trying to deliver quality products through high performance, leak proof, lightweight insulated bags which are also in line with their sustainability goals. Air pollution is another area where countries can invest in eco-friendly materials, smart insulation with artificial intelligence (AI), and ergonomic designs of buildings will be trending in this market.

The insulated food delivery bags market witnessed significant growth from 2020 to 2024, driven by the increasing demand for online food delivery services, rising preference for takeaway meals, and growing consumer awareness regarding food quality preservation.

Despite this, market growth was constrained due to playability challenges such as materials, environmental packaging and durability concerns. In response, companies were able to meet industry demand by providing cutting-edge insulation techniques, waterproofing technologies, and customizable branding features.

Strategies for energy-efficient packaging should focus on advancements in AI-driven thermal regulation, lightweight nano-insulation materials, and reusable packaging innovations in the 2025 to 2035 market. The paradigm of temperature-controlled, intelligent insulating bags for a new generation of food circulation will be further brought about by the booming of drone food delivery systems and automatic delivery robots in the future.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Food safety compliance and hygiene regulations |

| Technological Advancements | Basic thermal insulation and waterproof layers |

| Industry Adoption | Expansion in food delivery platforms and cloud kitchens |

| Supply Chain and Sourcing | Dependence on synthetic and non-biodegradable materials |

| Market Competition | Presence of regional and global insulated bag manufacturers |

| Market Growth Drivers | Boom in online food delivery services and takeout culture |

| Sustainability and Energy Efficiency | Initial adoption of recyclable and reusable materials |

| Consumer Preferences | Demand for cost-effective, durable insulated bags |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter sustainability laws and carbon footprint reduction |

| Technological Advancements | AI-driven temperature control and RFID-enabled tracking |

| Industry Adoption | Integration with autonomous delivery vehicles and drones |

| Supply Chain and Sourcing | Shift toward biodegradable and compostable insulation materials |

| Market Competition | Emergence of smart and AI-enhanced delivery solutions |

| Market Growth Drivers | Demand for ultra-lightweight, high-performance insulated carriers |

| Sustainability and Energy Efficiency | Mainstream use of fully biodegradable, eco-friendly insulation |

| Consumer Preferences | Preference for smart, lightweight, and eco-conscious food carriers |

USA is a major market for insulated food delivery bags due to the growing food delivery industry, increasing consumer inclination towards takeout, and growing number of quick-service restaurants. Demand for high-quality insulated bags that keep food at the right temp while they travel has only surged from the rise of online food delivery companies, like Uber Eats and Door Dash. Further, the market trends are driven as per the evaluation of eco-friendly and reusable delivery bags.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.5% |

The increase in food delivery service adoption over the past few years, particularly in urban areas, has led to steady growth in the UK market. Cloud kitchens and meal delivery subscriptions raise demand for good and durable insulated bags. Increasing concern to minimize the environmental footprint is also a driving innovation in the segment.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.1% |

European Union Insulated food delivery bags market in the European Union is expected to grow massively attributing to the surging online food delivery services in Germany, France, Italy, and others. Sustainability regulations on packaging and transport solutions are driving the demand for recyclable and biodegradable insulated delivery bags. Moreover, the growing inclination towards grocery and meal kit deliveries is also aiding in market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.3% |

The demand for food delivery services in metropolitan areas has spurred growth in Japan's insulated lunch and food delivery bag market. The rising popularity of online bento delivery companies and the emergence of global food chains further encourage market growth. Also, the rise in utilization of premium delivery bags is due to the high-quality materials and advanced thermal insulation technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.2% |

The insulated food delivery bags market in South Korea is flourishing owing to the increasing demand for food delivery applications and rising number of cloud kitchens. Key factors driving the expansion of the market are India's advanced e-commerce ecosystem and a growing need for sustainable delivery solutions. As well as these, increasing environmental concerns have led to the creation of eco-friendly insulated bags that have been constructed using biodegradable materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.4% |

Owing to the increasing need for food delivery services, tripling of e-commerce, and growing emphasis on food safety and temperature retention, the insulated food delivery bags market is experiencing stable growth. Online food ordering, meal kit delivery, grocery transportation, and food safety and protection have been successfully hot business lately, creating a huge demand for high-performance insulated packaging solutions to protect the temperature of food and prevent contamination.

Driven by both sustainability considerations and changing regulations that shape the market, the manufacturers are shifting towards green materials alongside a preference for reusable containers and advanced insulation technologies. Furthermore, increasing integration of smart temperature monitoring systems is augmenting the efficiency of insulated food delivery solutions in numerous end-use industries, such as restaurants, cloud kitchens, supermarkets and logistics service providers.

While PET (Polyethylene Terephthalate) and fabric-based insulated food delivery bags hold the highest shares among the material types due to their durability, light weight, and effective insulation.

Polyethylene Terephthalate, using which, is well known for the properties like thermal efficiency and recyclability. PET-based insulated bags deliver moisture, structural stability, and cost-effectiveness making them the bag of choice for quick service restaurants (QSRs), food aggregators, and grocery delivery platforms. With temperature-controlled packaging being a key aspect of food safety guidelines, the use of insulated bags for hot and cold food transportation made of PET is also gaining traction.

With the rise of fabric-based insulated bags at the forefront, as they are reusable and eco-friendly. These bags are designed for multiple deliveries and long-term durability, made from 100% polyester, canvas, and nylon material. As the new sustainable delivery and reusable solution becomes more mainstream, insulated fabric bags are increasingly the solution of choice for not only meal deliveries but also bakery products, catering, etc.

Other materials such as polyethylene, polyurethane, and gel packs are used for specialized applications, including high-performance thermal insulation, cold chain logistics, and food delivery for medical purposes. Cutting edge in materials engineering and thermal technology promise significant innovation in the lightweight, flexile, energy-efficient, insulation solutions market.

By packaging type, the largest share will be held by boxes & containers, as they are versatile, stackable, and capable of maintaining the integrity of food over long-distance transit.

Boxes & containers are widely used for meal kit deliveries, catering services, and bulk food transportation providing protection against outside contaminants, temperature changes, and mechanical stress. Due to their stiff structure and heat resistance, they suit the long-haul and high-volume food distribution: specifically, airline catering, institutional food service, and high-end meal deliveries.

There is too good demand of bags & pouches mainly in quick service restaurant (QSR) and grocery delivery segments. These solutions offer low-weight, quick and inexpensive insulation, ideal for short-distance and temperature-sensitive perishable items food deliveries. Booming customizable and branded insulated bag to increase revenue generation in this segment. Moreover, the emergence of customizable and branded insulated bags is augmenting this segment growth as companies are constantly on the lookout to market and engage customers with bespoke offerings.

In addition, wraps are increasingly used in specialty food transportation, providing compact insulation for each food portion, beverage bottle, and small grocery item. Due to their encapsulated thermal protection, they offer an excellent solution for premium meal packaging, ready-to-eat food products, and organic food shipping.

Urbanization, the growing penetration of food delivery systems, and eco-friendly initiatives are all likely to pave new avenues for insulated food delivery packaging solutions over the coming years, further driving the demand for well-performing, sustainable and convenient solutions in the food delivery packaging landscape.

The demand of insulated food delivery bags is increasing steadily, fuelled by growing food delivery services, takeaway meals and temperature-sensitive packaging requirements. Keeping food quality, temperature, and freshness while on the go, these bags are crucial for the restaurant, cloud kitchen, and food delivery platforms. Beverages are pay more attention to manufacture of durability, thermal insulation efficiency, and eco-friendly materials for customers changing channel.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Grubhub Gear | 20-24% |

| Packir | 15-19% |

| Cambro Manufacturing | 12-16% |

| Delivery Bags USA | 10-14% |

| Other Companies (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Grubhub Gear | Specializes in premium insulated delivery bags designed for temperature retention and durability. |

| Packir | Develops customized insulated food delivery bags catering to restaurants and delivery fleets. |

| Cambro Manufacturing | Offers high-performance insulated transport bags and containers for commercial foodservice. |

| Delivery Bags USA | Provides lightweight, leak-proof, and eco-friendly delivery bags for efficient food transportation. |

Key Company Insights

Grubhub Gear (20-24%)

Grubhub Gear are the apex in the insulated food delivery bags market, providing delivery bags of high quality with greater thermal insulation. Customized branding, durable materials, ergonomic features for greater user convenience and improved food safety make the company products attractive.

Packir (15-19%)

Packir manufactures custom-designed food delivery bags for restaurants, third-party delivery services, and catering facilities. This advantage solidifies its competitive position with affordable high-performance insulated solutions.

Cambro Manufacturing (12-16%)

Cambro Manufacturing designs insulated transport solutions for commercial use, keeping food hot or cold for long periods of time. It is making a mark in the market with its commitment to quality, sustainability, and innovative insulation technology.

Delivery Bags USA (10-14%)

Delivery Bags USA specializes in lightweight, waterproof, eco-friendly insulated delivery bags, designed specifically for food delivery.

Key Players in the Open Ended Fund Market (30-40% Combined)

The global Insulated food delivery bags market consists of multidirectional players which are emerging as well as leading companies that are aiming towards updated insulation materials, extra sturdiness, and ecological-friendly packing solutions. Notable players include:

The overall market size for the insulated food delivery bags market was USD 16,519 million in 2025.

The insulated food delivery bags market is expected to reach USD 31,840 million in 2035.

The demand for insulated food delivery bags is expected to rise due to increasing demand for food delivery services, stringent food safety regulations, and advancements in thermal insulation technologies.

The top five countries driving the development of the insulated food delivery bags market are the USA, China, Germany, India, and the UK.

PET (Polyethylene Terephthalate) and fabric-based insulated food delivery bags are expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Insulated Products Market Size and Share Forecast Outlook 2025 to 2035

Insulated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Insulated Concrete Form (ICF) Market Size and Share Forecast Outlook 2025 to 2035

Insulated Bins Market Size and Share Forecast Outlook 2025 to 2035

Insulated Tumblers Market Size and Share Forecast Outlook 2025 to 2035

Insulated Corrugated Boxes Market Size and Share Forecast Outlook 2025 to 2035

Insulated Drum Covers Market Size and Share Forecast Outlook 2025 to 2035

Insulated Glass Market Growth – Trends & Forecast 2025 to 2035

Insulated Wires & Cables Market Growth – Trends & Forecast 2025 to 2035

Insulated Shipping Boxes Market Innovations & Growth 2025-2035

Insulated Coolers Market Insights - Growth & Forecast 2025 to 2035

Insulated Cup Sleeves Market Analysis – Size, Growth & Forecast 2025 to 2035

Insulated Gate Bipolar Transistors Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Leading Insulated Corrugated Boxes Manufacturers

Industry Share Analysis for Insulated Styrofoam Shipping Boxes Companies

Market Share Insights for Insulated Tumblers Providers

Insulated Styrofoam Shipping Boxes Market Growth & Forecast 2025 to 2035

Insulated Envelops Market

Insulated Thermal Box Liners Market

Insulated Bags Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA