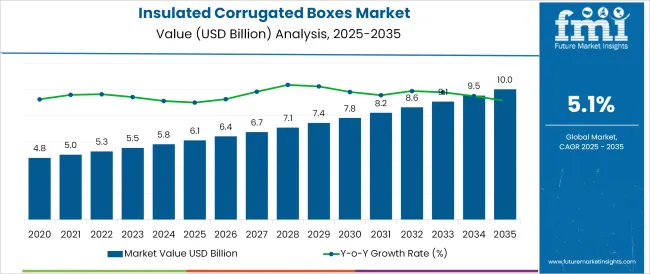

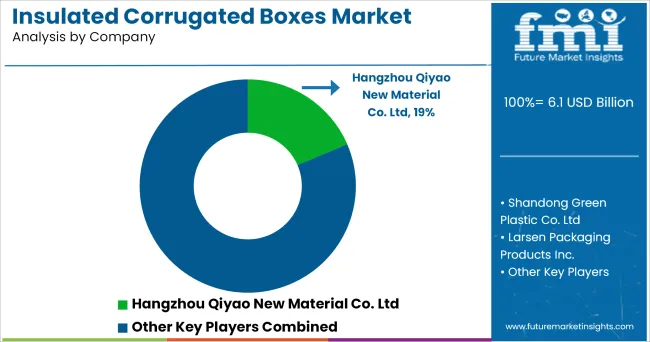

The Insulated Corrugated Boxes Market is estimated to be valued at USD 6.1 billion in 2025 and is projected to reach USD 10.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

The insulated corrugated boxes market is witnessing robust growth, underpinned by increasing demand for thermally secure, sustainable, and cost-efficient packaging across various temperature-sensitive industries. Rising global shipments of perishable goods, particularly in food and pharmaceutical sectors, have prompted logistics providers to adopt high-performance insulated packaging that minimizes spoilage while reducing dependency on synthetic coolants.

Innovations in multi-layer corrugated structures, biodegradable thermal liners, and phase change materials are enhancing packaging efficiency while complying with environmental mandates. Additionally, rising e-commerce penetration has amplified the need for lightweight, insulated packaging solutions capable of maintaining product integrity during long-haul transit.

Regulatory emphasis on cold chain compliance and green packaging frameworks is further catalyzing the adoption of recyclable, curbside-collectible corrugated insulation formats. The market outlook remains promising, with manufacturers focusing on material optimization, custom insulation technologies, and temperature assurance systems to serve evolving demands from food processors, healthcare logistics, and direct-to-consumer channels.

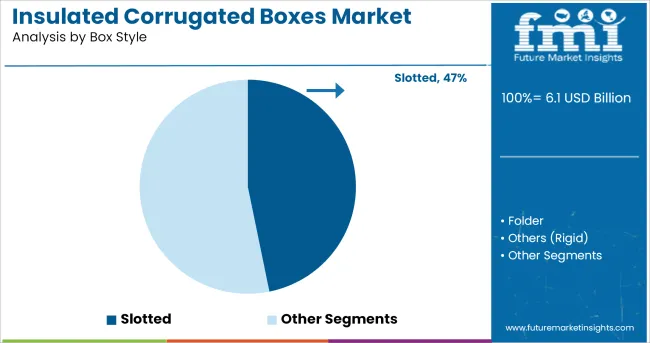

It is noted that the slotted box style accounts for 46.80% of total market revenue, making it the most preferred style in the insulated corrugated boxes segment. This dominance is driven by its cost-effectiveness, structural simplicity, and compatibility with automated packaging systems. Slotted boxes are known for their high material efficiency, as they require minimal die-cutting and generate lower production waste.

Additionally, their uniform flaps and customizable dimensions support a wide range of insulation inserts and refrigerants, enabling temperature-sensitive goods to be protected effectively during transport.

Their ability to fold flat also contributes to space savings in warehousing and return logistics. As demand increases for scalable, protective, and thermally insulated packaging in food and healthcare sectors, the slotted design continues to be selected for its adaptability and operational practicality across distribution networks.

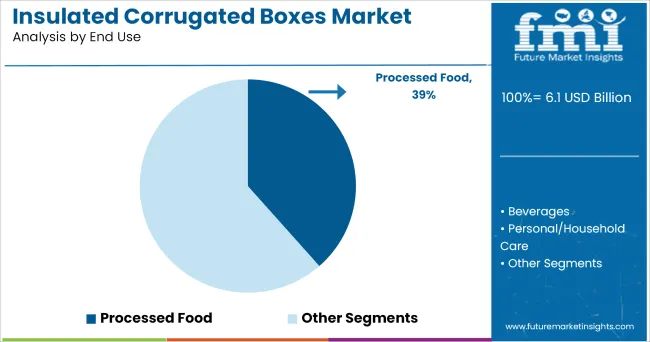

The processed food segment represents 38.50% of the insulated corrugated boxes market, establishing it as the leading end-use application. This position is attributed to the growing reliance on cold chain logistics to preserve the freshness, texture, and nutritional quality of processed food products during transit. Rising global consumption of frozen meals, ready-to-eat snacks, dairy alternatives, and meat products has intensified the need for packaging solutions that offer both insulation and structural durability.

The use of corrugated boxes with integrated thermal liners and moisture barriers enables processed food brands to meet stringent regulatory requirements while extending shelf life. Additionally, increased online food ordering and subscription-based meal kits have boosted demand for packaging that is both consumer-friendly and compliant with temperature assurance protocols.

The versatility, insulation performance, and recyclability of corrugated boxes make them the optimal solution for processed food logistics, thereby sustaining their market leadership in this end-use segment.

The rise of the e-commerce business has resulted in a massive demand for insulated corrugated cartons all over the world. The introduction of scale-open retail ecosystem platforms has also aided the e-commerce sector's growth. These platforms provide retailers with enticing options for expanding and growing their capabilities.

As a result, the success of online shopping platforms can also be attributed to initiatives like Amazon Prime Day, which was one of the largest shopping events in history in July 2020. This event fueled the need for corrugated boxes by resulting in massive product sales that necessitated vast numbers of corrugated boxes for packaging.

Furthermore, due to its great crush resistance and high structural strength, corrugated packaging has seen an increase in demand for manufactured products ranging from television sets and smartphones to edible goods such as chocolates. As a result, the expansion of the packaging sector is critical to the growth of the insulated corrugated boxes market.

A prominent trend in the insulated corrugated carton is a greater emphasis on product recycling and sustainable packaging. Traditionally, corrugated boxes accounted for a significant amount of garbage because they were discarded after use, which had a negative influence on the environment.

Manufacturers across industries have begun to use new technologies for crushing and compaction, which aid in the recycling of corrugated boxes, to reduce trash accumulation. This results in the production of fiber, which can be utilized for a variety of purposes.

The logistics of insulated corrugated boxes has a lot of potential in developing countries like Brazil, India, and China because of their high growth potential. These countries also have a large supply of raw materials. The manufacturing sector, which includes food and drinks, automobiles, electronics, and chemicals, has benefited from China and India's strong economic growth.

As a result, the increased use of packaging across a variety of food products, particularly meat, fish, and poultry products, is driving demand for insulated corrugated cartons in the above- mentioned developing countries, as well as providing opportunities for corrugated box manufacturers in these countries to offer more variety.

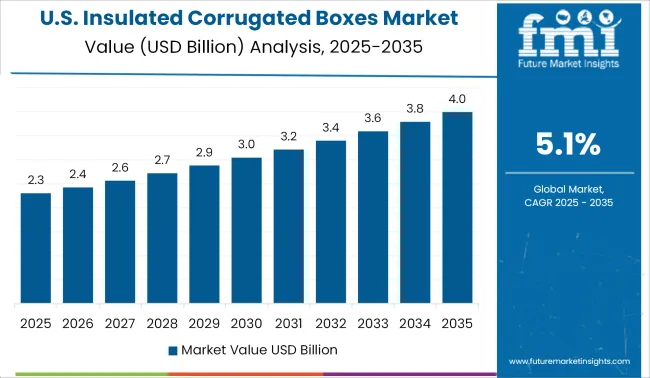

USA is considered as the lucrative market for insulated corrugated boxes market globally. The expansion of the insulated corrugated carton market in North America will be aided by increased trade between nations as a result of expanding globalization.

Its versatility allows it to be used in a wide range of industries, including food and beverage, cosmetics and personal care, pharmaceuticals, and chemicals. These boxes helps to keep internal contents from spoiling as a result of temperature fluctuations.

Furthermore, rising packaged edible product consumption will have a positive impact on market growth due to increased processed food exports in the region.

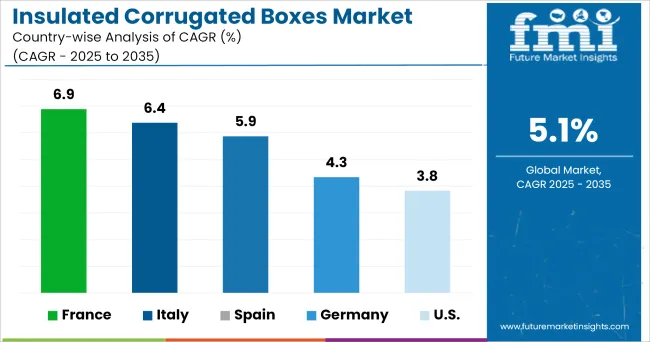

The expanding food & beverage and cosmetics & personal care industries are two significant reasons driving the insulated corrugated carton market in Europe. In European nations such as France, Germany, Russia, and the United Kingdom, increased consumption of ready meals and other convenience-oriented items is also pushing the insulated corrugated cartons industry.

Furthermore, the growing demand for packaged food as a result of the faster pace of life and changing lifestyles of people propels the industry forward. Over the projection period, key advantages such as increased shelf life of food products, ease of handling, and efficacy in the avoidance of material contamination will also fuel market expansion.

Some of the leading manufacturers and suppliers of insulated corrugated carton include

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global insulated corrugated boxes market is estimated to be valued at USD 6.1 billion in 2025.

The market size for the insulated corrugated boxes market is projected to reach USD 10.0 billion by 2035.

The insulated corrugated boxes market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in insulated corrugated boxes market are slotted, folder and others (rigid).

In terms of end use, processed food segment to command 38.5% share in the insulated corrugated boxes market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA