The market for Global Instant Dry Yeast is in moderate consolidation, with international yeast producers at the forefront of large-scale production, while regional players and specialty brands cater to high-end and niche applications of yeast. Key worldwide companies Lesaffre, AB Mauri/Fleischmann's, and Angel Yeast have a 64.6% aggregate market share, boosted by large-scale production, advanced fermentation technologies, and extensive distribution networks.

Mid-sized yeast producers are Lallemand and Red Star Yeast with 21%, focusing mostly on customizing yeast solutions for bakery and food services. All these regional and niche players such as Pakmaya, Ohly (Kerry Group), Belga Brood, Pak Group (Instaferm), and Algist Bruggeman account for 14.4% in innovation in premium and specialty yeast products.

Nearly 80% of the market is dominated by the top five companies, affirming a moderately consolidated structure-a place where high-performance yeasts, sustainability, and new markets define competitive advantage.

Explore FMI!

Book a free demo

| Market Structure | Top Multinational Yeast Suppliers |

|---|---|

| Industry Share (%) | 64.6% |

| Key Companies | Lesaffre, AB Mauri/Fleischmann’s, Angel Yeast |

| Market Structure | Mid-Sized Regional Producers |

|---|---|

| Industry Share (%) | 21% |

| Key Companies | Lallemand Inc., Red Star Yeast |

| Market Structure | Specialty and Emerging Brands |

|---|---|

| Industry Share (%) | 14.4% |

| Key Companies | Pakmaya, Ohly (Kerry Group), Belga Brood, Pak Group (Instaferm), Algist Bruggeman |

There is moderate concentration of instant dry yeast market with top competing multinational yeast manufacturers competing in large scale manufacture while most regional players and specialty brands occupy space for premium and niche yeast applications.

Regular active dry yeast (51%) is the biggest part of the market, offering balanced fermentation and versatility for both commercial and home baking, as supplied by Lesaffre, AB Mauri, and Red Star Yeast. Premium active dry yeast (31%) is regularly gaining ground partly because of the rise in demand for high-performance and organic yeast solutions being marketed by Angel Yeast and Lallemand through enhanced fermentation strains for bakery and food processing industries. (18%) grows ubiquitously with Pak Group (Instaferm) and Ohly (Kerry Group) pursuing speedy yeast fermentation solutions, while quick baking applications are becoming popular entries in quick-growth rapid-rise instant dry yeast.

Bakery (42%) is the biggest segment of use as yeast plays a significant role in bread, pastries, and industrial baking, wherein Lesaffre and AB Mauri are the main suppliers of artisan and mass-produced bakery yeast. Food service/QSR (27%) is rising as restaurants, cafes, and quick service restaurant chains now introduce into their units high-efficiency yeast formulations with Angel Yeast and Lallemand treating commercial baking solutions. Food processing (18%) includes yeast propitious for seasoning, sauces, and fermentation of plant-derived meat products where Red Star Yeast and Ohly (Kerry Group) lead yeast extracts intended for food ingredients. Retail/household (13%) stays put in a stable position where brands such as Pakmaya and Algist Bruggeman specialize in home bakers and small-scale food enterprises.

There is a booming market for instant dry yeast right now due to rising commercial baking, food service, and functional foods use. Corporations have started focusing on high-performance yeast strains, clean-label solutions, and increased capacity development to match evolving industry needs.

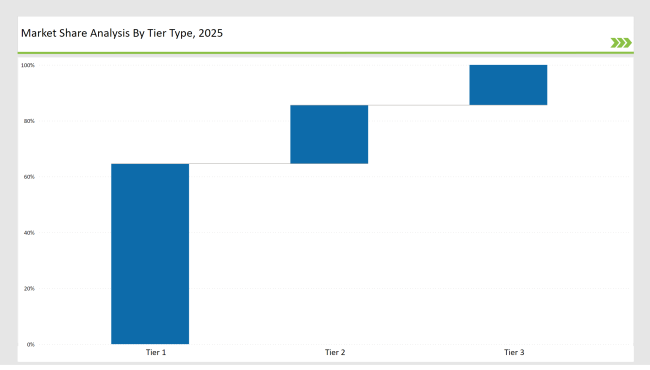

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 64.6% |

| Example of Key Players | Lesaffre, AB Mauri/Fleischmann’s, Angel Yeast |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 21% |

| Example of Key Players | Lallemand Inc., Red Star Yeast |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 14.4% |

| Example of Key Players | Pakmaya, Ohly (Kerry Group), Belga Brood, Pak Group (Instaferm), Algist Bruggeman |

| Brand | Key Focus |

|---|---|

| Lesaffre | Developed sustainable yeast fermentation processes for energy-efficient production. |

| AB Mauri | Expanded Fleischmann’s yeast supply chains, ensuring faster commercial distribution. |

| Angel Yeast | Strengthened functional yeast offerings, focusing on gut health-enhancing formulations. |

| Lallemand Inc. | Introduced rapid-rise yeast for QSR chains, ensuring faster dough fermentation. |

| Red Star Yeast | Launched longer-shelf-life instant dry yeast for commercial baking applications. |

| Pakmaya | Expanded organic and non-GMO yeast production, catering to clean-label baking. |

| Ohly (Kerry Group) | Developed new yeast-based seasonings for plant-based and processed food industries. |

| Belga Brood | Introduced artisan and gourmet yeast solutions, targeting premium retail baking. |

| Pak Group (Instaferm) | Focused on direct-to-consumer yeast sales via e-commerce platforms. |

| Algist Bruggeman | Launched high-performance yeast for sugar-rich doughs and industrial baking. |

Manufacturers will move from non-friendly production to eco-friendly yeast production able to optimize for low-energy fermentation and good water use. The sustainable yeast processing path is assumed to be developed and lead by Lesaffre and AB Mauri in the reduction of the carbon footprint for industrial yeast manufacturing. Growing demands for gut-health-enhancing and fortified yeasts will nourish developments from Angel Yeast and Ohly (Kerry Group) in probiotic and prebiotic yeast strains for functional food applications.

Lallemand and Red Star Yeast will promote rapid-rise yeast adoption as large-scale food service operations progressively move towards quick dough preparation along with fast-food companies. In response to market demand, Belga Brood and Pakmaya have expanded their premium yeast lines in response to busy consumers that are using slow-fermentation yeast for the artisan bread and gourmet baking. Stricter food safety, traceability, and labeling regulations are to be enforced by governments, necessitating higher compliance standards for Lesaffre and AB Mauri with clean-label and non-GMO certifications.

Key players include Lesaffre, AB Mauri, Angel Yeast, Lallemand Inc., and Red Star Yeast, controlling a major share of commercial and retail yeast production.

Instant dry yeast is widely used in bakery products, quick-service restaurants, food processing, and home baking applications.

Rapid-rise yeast ferments faster and requires no proofing, making it ideal for QSR chains and industrial baking.

Trends include high-speed fermentation, functional yeast for gut health, and sustainable yeast fermentation processes.

Fast-food chains use high-efficiency yeast for quick dough fermentation, ensuring rapid production in pizza and bread applications.

Supply chain disruptions, fluctuating raw material costs, and stricter food safety regulations impact yeast manufacturing and distribution.

Expect strong growth in functional yeasts, clean-label solutions, and high-performance yeast formulations, supporting sustainable food production.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.